With China's Gen Z consumers craving value over status, luxury brands and global markets brace for impact

Amid slower economic growth, young consumers in China are changing their spending habits, with implications that go beyond the Chinese economy.

Chinese customers shop at a mall in Beijing on Jul 2, 2024. (Photo: AP/Vincent Thian)

This audio is generated by an AI tool.

Rather than chasing fast fashion trends and expensive Western luxury brands, Ms Mi Gao, a graduate student from Zhuhai city in China’s southern Guangdong province, opts for style and practicality when buying clothes and accessories.

The 25-year-old is part of a new generation of frugal Gen Z consumers in China, born after 2000, who experts say have been greatly reevaluating their spending habits and purchases, becoming more rational and discerning with their choices as they grapple with a multitude of issues like high youth unemployment rates amid growing economic uncertainty.

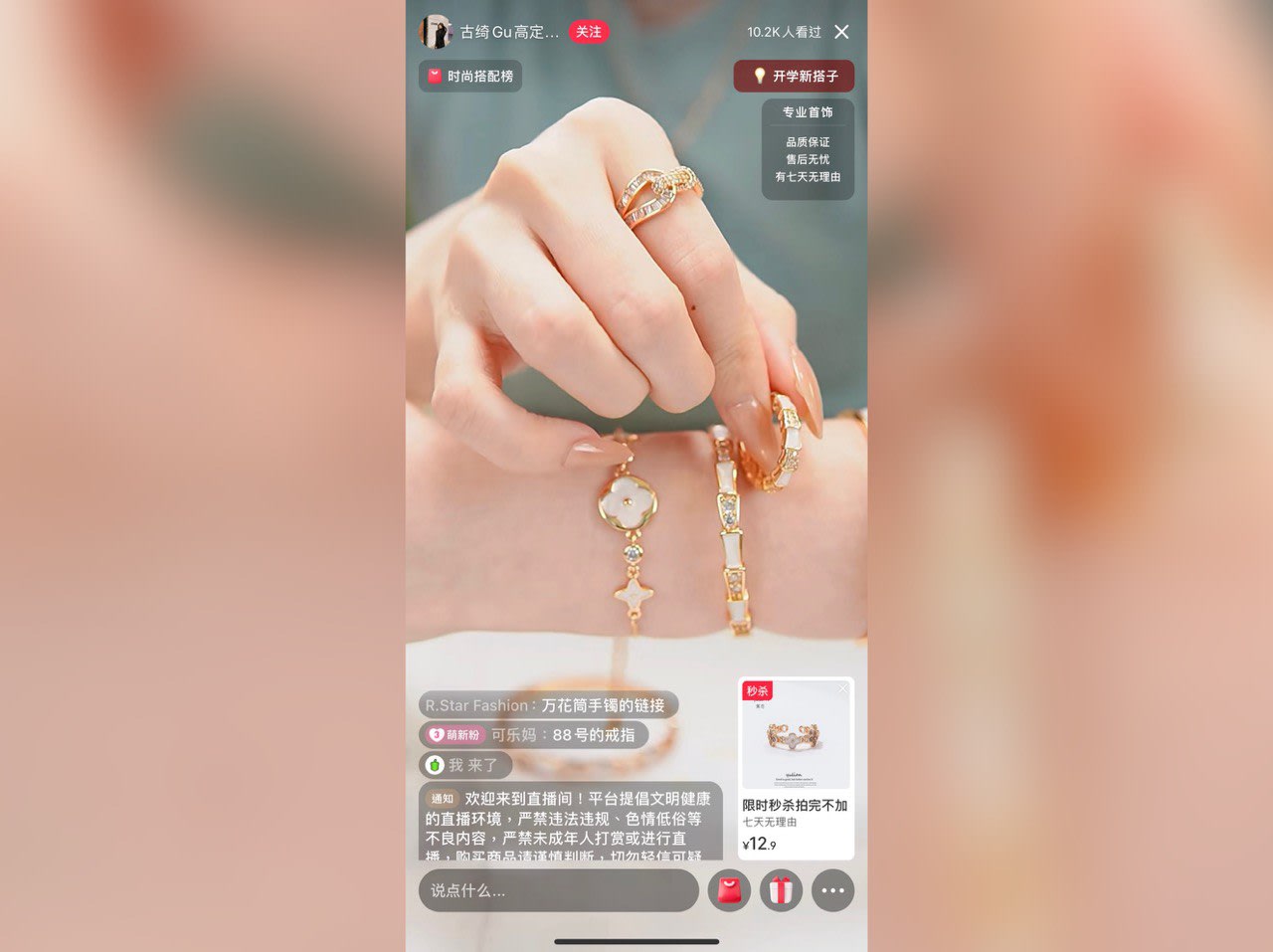

Like her peers, Ms Mi is always on the hunt for the best deals and discounts. She regularly turns to livestream auctions hosted on popular domestic apps like Douyin and Xiaohongshu, where hosts and sellers plug everything from clothes and accessories to tech gadgets while fielding rapid-fire questions live from thousands of viewers and potential buyers.

The avid online shopper shared with CNA her love of fashion and how she scours popular online e-commerce platforms like Taobao and Douyin, TikTok in China, for inspiration.

Cost is a big priority for her whenever she shops online and so is “practicality,” she said.

The last time she visited a physical shopping mall, she recalls, had been months ago in June, and it was only because she “urgently needed” a pair of sandals at the time.

“About 80 per cent of my purchases are made online,” Ms Mi said. “What I care about most is whether something is suitable for me…The price advantage determines (where) I make my purchase.”

For daily household items and necessities like laundry detergent and napkins, Ms Mi uses Pinduoduo, a popular Chinese budget app.

She spends the most time on Xiaohongshu and Douyin and recently discovered 1688, another popular shopping website run by the Alibaba Group and famed for its affordability.

“I quickly get tired of my jewellery, and this platform offers wholesale prices. For clothes, I use Taobao and Douyin.”

RECKLESS SPENDING IS OUT, BUDGETING IS IN

Raised during an era of rapid economic expansion and rising standards of living, China’s youth have adopted more rational and thrifty approaches to spending - a stark contrast to their parents and grandparents.

Today, online shopping trumps offline sales. Social media platforms have played a pivotal role in shaping spending habits and of young Chinese consumers.

On Xiaohongshu, which sees an estimated 450 million registered users, Gen Z shoppers are prioritising value and low costs, buys that reflect their choices and identities and better cater to their personal needs.

A versatile and affordable military cargo jacket would go down better with young shoppers, as compared to high-end luxury items like purses, shoes and handbags, experts say.

Many are increasingly turning to discounters - where products are sold at lower prices than traditional retailers - a trend that underscores a growing preference for value over brand names, noted Ms Stephanie Cheung, director of research firm Vermilion Asia.

It marks a departure from traditional shopping habits where status symbols and premium brands dominate.

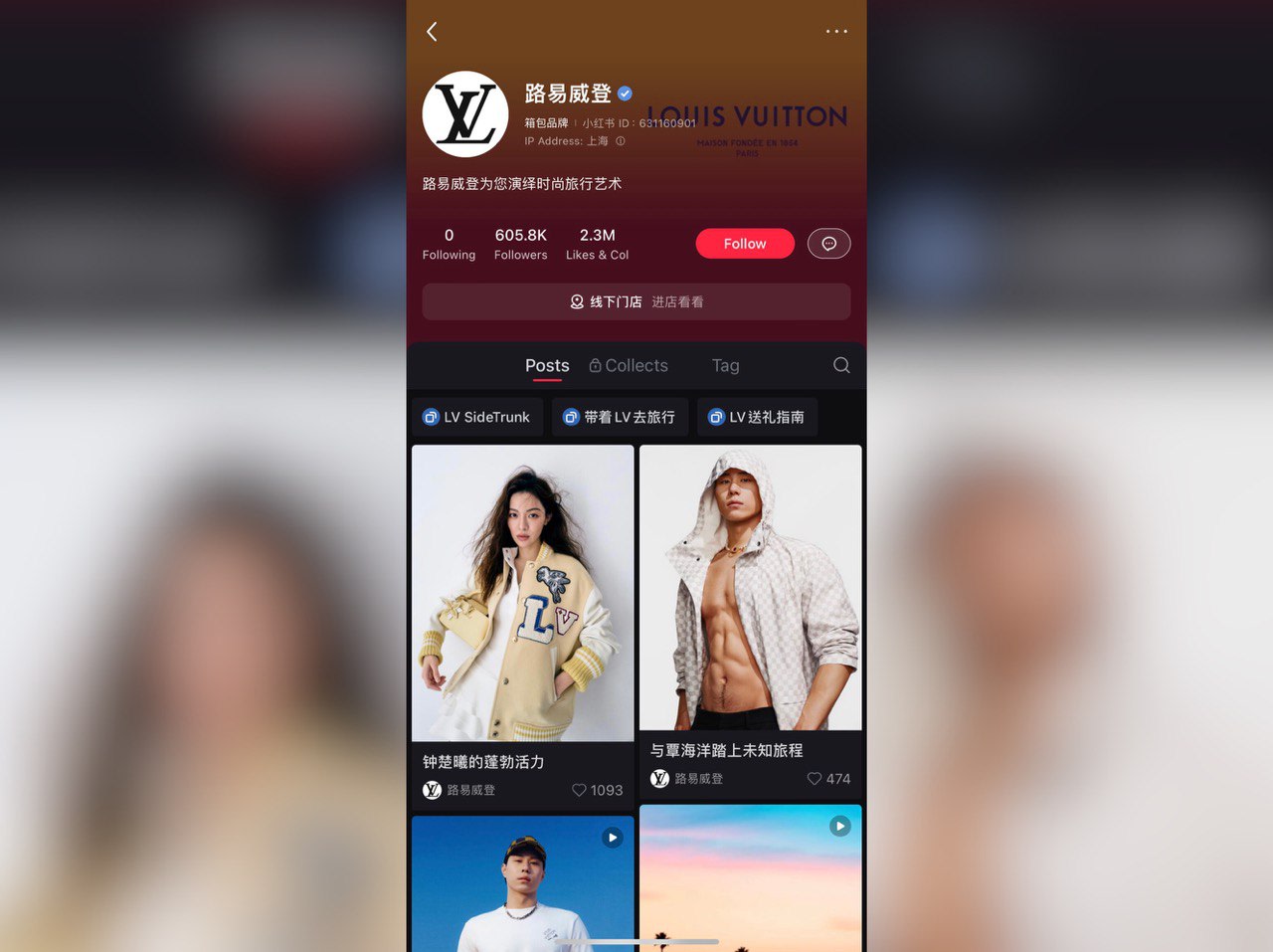

Even big names like high-end French luxury brands Louis Vuitton and Lanvin are heavily investing in influencer marketing on the popular platform, using official accounts and collaborations with bloggers to reach lucrative young audiences.

“China's social media is well-established – people can quickly get information and compare prices and product quality,” she said, noting an 84 per cent increase in beauty and skincare content on Xiaohongshu and a 120 per cent rise in fashion-related posts in the first half of 2024 – as compared to 2023.

This rapid shift towards slower, more rational consumption and practicality - is a sign of a maturing economy, analysts said, and also signals an important transition for China from its booming years, when luxury and status were prioritised.

"A lot of young Chinese consumers buy online and even when it comes down to offline shopping, they go to discounters because they believe the quality is at least on par with the big brands - if not better,” said Mr Jason Yu, managing director of consultancy firm Kantar Worldpanel.

Heavy discounts did not sit well with Chinese consumers in the past, who would perceive cheap products to be of lower quality and standards,” Mr Yu added. “But today, shopping discounts are certainly very acceptable."

However, the shift does not mean Chinese consumers were lowering their shopping standards and sacrificing quality, he said, adding that on the contrary, Chinese consumers still want quality.

“They are just becoming more rational and selective with their purchases. People (now) want to invest and spend more on experiences rather than physical products ... so an experience-driven economy still does relatively better as compared with the physical product-driven economy."

LUXURY BRANDS FEEL THE STING

China has grown exponentially over the years to become one of the world’s largest luxury markets. But the boom came to an end in 2022 due to the impact of Covid-19, analysts say – resulting in “a double-digit decline in annual growth”.

It enjoyed a slight increase in 2023, but a new report released on Mar 8 by Singapore-based consultancy firm Bain & Company projected that the Chinese luxury market would continue to experience mid-single-digit growth in 2024.

And the switch to rational consumer spending could continue to spell disaster for global luxury brands.

The decline in Chinese spending is also being felt in high-end boutiques.

“Some of them actually went bankrupt in the past 12 to 18 months,” said Mr Yu of Kantar Worldpanel.

Gourmet supermarket chains like City Shop in Shanghai, selling only pricy imported products, is one example. City Shop’s closure in April was reported widely by Chinese media outlets, citing operational difficulties and failure of a self-rescue attempt.

Announcing its July earnings, LVMH, the world's largest luxury conglomerate which owns brands like Louis Vuitton and Dior, reported a 13 per cent drop in sales across Asia – with the exception of Japan – during the first half of the year.

Luxury goods are also being heavily discounted, with some items marked down by as much as 50 per cent, according to a Jul 16 article by the Financial Times. Brands like Versace, Burberry, Marc Jacobs and Bottega Veneta – have all turned to selling their goods on Chinese e-commerce sites to win back buyers.

“Some luxury brands, for instance, open pop-up shops in Wuxi. They do not necessarily need to open a permanent store there, because they are not quite sure whether the consumption power will be able to sustain it,” said Mr Yu.

This could signal a slow “end” to China’s luxury market, says Mr Xu Tianchen, senior economist at the Economist Intelligence Unit. “It will not disappear but it won't have a lot of space to grow,” he said. “It could be stagnant for a couple of years, or just record very slow growth.”

“CAUTIOUS” APPROACH IN BOOSTING CONSUMPTION

Since 2021, China’s government has introduced a series of policies aimed at redistributing income and wealth, often framed under the banner of "common prosperity,” says Mr Xu.

This has led to crackdowns on high-paying industries like tutoring, the financial sector, and the tech industry.

“While these measures were intended to address income inequality, the consequences have been more negative than positive, with the economy taking a considerable hit.”

However, there seems to be a shift in the government’s approach. Mr Xu observed that policies from the recent Third Plenum could suggest a move towards promoting urbanisation and encouraging migrant workers to settle in cities, secure regular jobs, and perhaps even purchase homes.

The idea is to boost income growth among the lower-income groups, rather than focusing solely on curbing the income of the wealthy. This approach, while promising, is unlikely to yield immediate results, and may take five to 10 years to materialise - if it succeeds at all, Mr Xu adds.

Mr Yu noted that "the government is very clear that they do want to drive domestic consumption, and today's situation is not ideal for them".

"They want to actually deepen the reform, complete a number of tasks in terms of improving the quality of the Chinese economy, not just the quantity."

Amid these policy shifts, Chinese households, particularly in the country’s largest cities, are exhibiting a marked caution in their spending. One of the key reasons for this is the rapid decline in housing prices in these urban centres.

According to EIU's Mr Xu, previously resilient housing markets began to falter in mid-2023, following the trajectory of smaller cities that saw price drops in 2021 and 2022. This decline has triggered a negative wealth effect, where individuals’ spending is influenced not just by their income but also by their perceived wealth.

The crackdown on well-paid jobs in major Chinese cities has also contributed to this caution. For instance, salaries in investment banking have plummeted to as low as half of what they once were, leading to reduced consumer spending. This trend is further evidenced by a 7 per cent drop in China’s personal income tax revenue this year.

“If you see a very significant drop in personal income tax paid, then that should suggest that all those like good jobs may have diminished significantly. So that's probably explaining why consumption has been more cautious.”

Kantar Worldpanel's Mr Yu believes there are a lot of “big motivations” behind driving consumption, although those are “grand strategies to translate into tangible policy, and will take some time”.

"NEW REALITY"

This changing consumer behaviour has also forced Western brands to reassess their strategies to stay relevant in China as competition with local brands intensifies.

Chinese sportswear giant ANTA, which started as a small shoe manufacturer in Jinjiang in Fujian province, offers a wide range of products, including basketball shoes and apparel - is now diversifying its offerings with a "pyramid" approach, Mr Yu said, catering to different consumer needs by featuring luxury, premium as well as value-for-money product lines.

“A lot of Western brands really cannot compete on cost as compared with the local brands so they have to really think about what their unique propositions are - to make sure that they are able to actually continue to tap on their brand strengths in China," said Mr Yu.

“They are increasingly accepting this is the new reality... Either that, or they continue to invest in innovation to make sure that their brand experience is something that cannot be replicated easily by a Chinese follower."

The rise of rational spending among many young Chinese also has global implications, experts add, particularly in the travel and international luxury markets.

For instance, as the Japanese yen weakened, Japan became a popular destination for Chinese tourists, noted Ms Cheung. Chinese consumers, driven by their newfound rationality, find shopping in Japan more “cost-effective”.

But this cautious spending behaviour also means that Chinese tourists are spending less overseas, which is having a direct impact on the economies of major tourist destinations.

EIU’s Mr Xu said Thailand, for example, saw Chinese tourist arrivals at just over 70 per cent of pre-pandemic levels, contributing to its slower economic growth this year. Hong Kong, similarly, has not experienced a significant influx of Chinese luxury spending, resulting in a less robust economic performance.

"In general, I would say, this consumption slowdown makes people more cautious about their spending, and consequently they will also maybe slash their spending overseas."

Additionally, the slowdown in Chinese demand is affecting Southeast Asian economies that are heavily reliant on exports to China.

"I think ultimately that will pass on to these Southeast Asian economies, which are more or less export-driven, but they are not exporting enough goods to China because China doesn't have very strong demands. That will be a drag to these countries for sure."