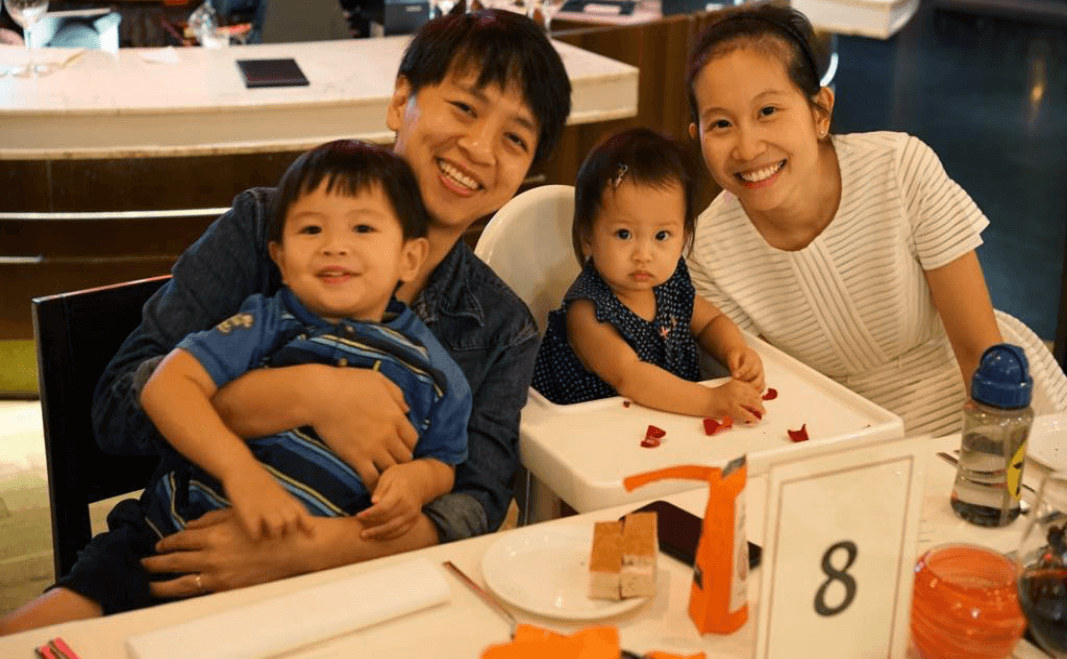

W hile Jordan and Huilin Lim, both 33, were open to having kids, they did not expect to conceive their first child right after marriage. Within a month of tying the knot in late 2015, Huilin became pregnant with their baby boy Josiah. The couple were overjoyed at the prospect of having their son. But they also had pressing financial concerns at the back of their minds. For one, their $357,600 housing mortgage was a huge financial commitment. The new home had to be renovated too, adding to the mounting costs.

Huilin also made the decision to stop working after Josiah was born, leading to a single-income household. “It’s important for me to have more interaction with my children during their formative years,” she explains. To make ends meet and prepare for having a second child, the Lims made certain lifestyle sacrifices like cutting back on travel plans and expensive holidays. In 2018, the Lims welcomed their second bundle of joy − a daughter named Naomi. After her arrival, the couple were again concerned about childcare costs. “We were planning for me to start a full-time master’s course, meaning that both kids had to attend preschool. Our concern was that preschool costs would be too expensive,” says Huilin.

For each child, we received a one-time $3,000 pay-out and a $3,000 Matching Grant. Every dollar you put inside the account, the government will match it up to $3,000."

Jordan, on government financial support that helped.Tapping On Financial Support

Once they had their little ones, the Lims were relieved to discover that raising kids didn’t actually need to cost an arm and a leg. After researching the various modes of financial support, they were able to plan ahead for a secure family future. As Jordan explains, the Child Development Account First Step they received in their Child Development Account (a special savings account to help with educational and healthcare expenses) resulted in substantial savings. “For each child, we received a one-time $3,000 pay-out and a $3,000 Matching Grant. Every dollar you put inside the account, the government will match it up to $3,000,” he elaborates.

Josiah and Naomi were also accepted into My First Skool this year, a government-funded childcare centre and preschool. Prior to this, Josiah attended a private preschool, costing the Lims $1,500 a month. Fees are now a lot more affordable for the Lims − less than half the cost of private school. “There is an ECDA preschool subsidy for mums who are studying or not working too,” adds Huilin. “We submit an application which the government evaluates on a case-by case-basis. We received an additional $320 off monthly preschool fees, because I’m both a non-working mum and a full-time student.”

The couple were also grateful that pre- and post-delivery medical bills were extremely affordable. They opted for public healthcare, with Huilin delivering both children at Singapore General Hospital.

The couple were also grateful that pre- and post-delivery medical bills were extremely affordable. They opted for public healthcare, with Huilin delivering both children at Singapore General Hospital. “My pregnancies were considered low-risk, so we didn’t see an appointed gynaecologist,” she says. “The cost of check-ups and delivery were therefore very low. Healthcare standards are excellent too. There were no long waiting times for appointments, and you don’t feel second-class when going the public route.” And when Naomi was hospitalised for a viral infection late last year, Jordan’s workplace insurance covered the expenses. “The bill actually came up to around $1,200, but because of my company insurance, it was reduced to only $400,” he recalls.

Fulfilling Personal Dreams

Though being a homemaker is a full-time role in itself, Huilin did not give up on her other pursuits. With enough financial support, she is now pursuing a full-time master’s course in translation and interpretation at Nanyang Technological University. The course involves night classes three times a week, as well as a full-day class on Saturdays. “I’ve been looking forward to the course for some time − the intricacies of language have fascinated me from a young age,” she says. “Getting a formal degree in translation is helpful if I want to pursue future jobs in this area too.” She does acknowledge feeling some initial guilt at pursuing a full-time course, given that it means spending less time with her little ones. “But being away from me helps them become more independent, otherwise they will always be sticking to me,” laughs Huilin. “Since Naomi started attending childcare, she is interacting much more with others too!”

For the first two years of your child’s life, government subsidies are really helpful in offsetting expenses. There will also be support from family and friends, so parents don’t have to worry.”

JORDAN LIM, DAD OF Josiah AND NAOMIFamily And Friends To The Rescue

With Huilin starting her course in January this year, the couple’s parents also provided invaluable help. “On Saturdays when I’m working and Huilin is at school, my parents help to look after our kids,” says Jordan. “Her parents frequently bring over groceries and meals for us too.” Aside from parental assistance, Huilin is part of a mum’s support group that communicates via WhatsApp and meets every alternate Thursday. “We exchange lots of practical advice, and it was very helpful for me as a new mum when I needed tips on breastfeeding or other child-rearing issues,” she says. Looking back, the Lims realised that many of their initial concerns were unfounded. Even though their first child was unplanned, there was much support in place to ensure their needs were not lacking.

“For the first two years of your child’s life, government subsidies are really helpful in offsetting expenses. There will also be support from family and friends, so parents don’t have to worry,” assures Jordan. “Kids add much joy to a marriage too − don’t wait too long to have them!”