Budget 2023: Higher additional registration fees, cap on rebates for luxury car owners

Car buyers will have to pay ARF of 320 per cent on the portion of their vehicle's open market value over S$80,000, up from 220 per cent.

A car at a traffic junction in Singapore. (File photo: iStock/kurmyshov)

SINGAPORE: Owners of high-end cars are set to pay more for their vehicles with adjustments to the additional registration fee (ARF) rates, announced Finance Minister Lawrence Wong on Tuesday (Feb 14) in his Budget speech.

These ARF rates will be adjusted to “better differentiate between the higher-end cars”.

Buyers of cars with an open market value (OMV) of more than S$40,000 will pay higher marginal ARF rates than they do today, said Mr Wong in Parliament.

Taxes on properties, luxury cars and cigarettes are set to rise, and are expected to generate about S$800 million per year in revenue, announced Finance Minister Lawrence Wong in his Budget speech on Tuesday (Feb 14). Michelle Teo reports.

The ARF is a tax imposed when you register a vehicle, and is calculated based on a percentage of your vehicle’s OMV.

The OMV is the cost of a vehicle imported into Singapore. It is assessed by Singapore Customs, taking into account the purchase price, freight, insurance and all other sale and delivery charges for importing the vehicle to the country.

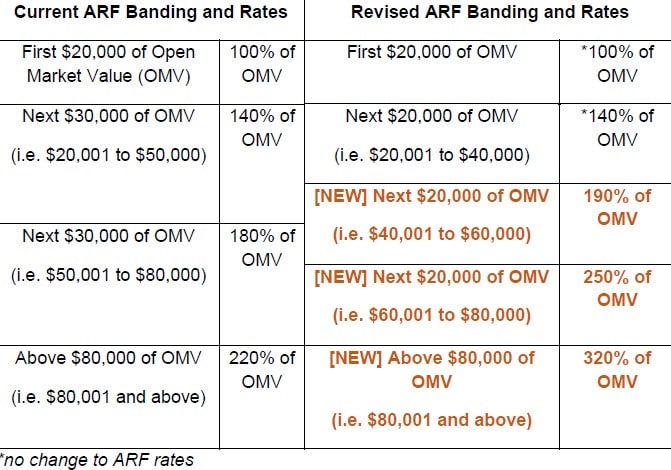

REVISED ADDITIONAL REGISTRATION FEES

The highest tier for ARF banding, which involves vehicles with an OMV of above S$80,000, will see revised ARF rates of 320 per cent. This is up from 220 per cent today, according to a news release from the Land Transport Authority (LTA).

For vehicles with an OMV above S$40,000 to S$60,000, the revised ARF rates will be 190 per cent. And vehicles with an OMV above S$60,000 to S$80,000 will be charged an ARF rate of 250 per cent.

CAP FOR PREFERENTIAL ADDITIONAL REGISTRATION FEE REBATES

The Government will also cap the preferential ARF (PARF) rebates at S$60,000 to “avoid providing excessive rebates to more expensive cars when they are deregistered”, added Mr Wong.

PARF rebates are currently sized as a percentage of the payable ARF.

For example, a vehicle with an OMV of S$100,000 will pay S$200,000 in ARF under the revised structure. If it is deregistered between nine and 10 years of age, it will qualify for a rebate of 50 per cent of ARF paid, which works out to S$100,000.

Under the revised PARF cap, the vehicle will now only qualify for a rebate of S$60,000.

The new ARF structure and the preferential ARF cap will apply to all cars registered with a Certificate of Entitlement (COE) obtained from the next round of COE bidding in February 2023, said LTA.

For cars that do not need to bid for COEs, such as taxis, the revised ARF structure will apply for those registered on or after Feb 15, 2023, the authority added.

For these same cars, the preferential ARF cap will apply to those that are registered on or after Feb 15, 2023, which are subsequently deregistered within the preferential ARF eligibility period.

“These changes are expected to affect the top one-third of cars by OMV,” said Mr Wong.

“The ARF change is expected to generate about S$200 million in additional revenue per year, but the actual amount will depend on the state of the vehicle market.”

Buyers of cars with an OMV of S$40,000 or less, including almost all Category A cars and many 7-seater cars, will be unaffected, added LTA.

Editor's note: This article has been amended to accurately reflect that the rate of 320 per cent applies to the part of OMV above S$80,000, and not the whole OMV. We apologise for the error.