Luxury cars, rare art among prized assets kept in Singapore’s high-security storage facilities

One luxury car gallery said Singapore’s stable government and legislation gives its clients confidence in keeping their prized possessions here.

Items such as limited edition luxury cars are finding a home in Singapore as more people pick up alternative investments.

SINGAPORE: Super secure storage facilities are gaining popularity here as more wealthy individuals look to safeguard their prized possessions.

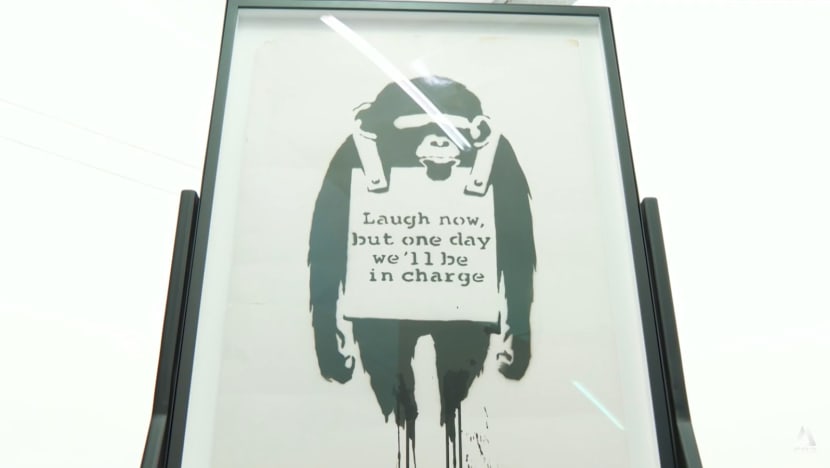

Items such as limited edition luxury cars and rare art pieces by artists such as Banksy, are finding a home in Singapore as more people pick up alternative investments.

At Wearnes Automotive in Leng Kee Road, super rare automobiles have found a temporary home in its exclusive gallery.

Among the cars parked inside is a Bugatti Divo, one of just 40 in the world.

It is currently valued at more than S$11 million (US$8.13 million), an increase of over 50 per cent in the last three years.

Such luxury cars, however, are not meant to be driven on Singapore’s roads.

Instead, they remain parked in a climate and humidity-controlled environment in the facility, where they are stored under a bonded agreement which lets them skip some 320 per cent of taxes in the form of additional registration fees.

MOST COLLECTORS FROM SOUTHEAST ASIA

Most of the luxury car collectors are foreigners from the Southeast Asian region, opting to park their prized assets in Singapore for the stability it offers.

Wearnes Automotive’s general manager Sebastian Tan told CNA: “We have a very stable government, you know, everything is very black and white.

“They (the clients) feel safe when they put their assets here in Singapore, because they are not afraid of the legislation changing and then their cars getting stuck."

The venue’s dual purpose as both a storage and gallery space, also lets it play the role of a broker.

Mr Tan said some clients will request help in sourcing for buyers on their behalf, as the company has a broad network of contacts, including people who use Singapore as a stopover given its location as a regional hub.

Such deals are done privately and in a safe environment as the company deals with them directly, he added.

While there are currently 40 cars in the gallery, Mr Tan expects the total to rise to more than 50 by the end of next year.

"People have started making reservations to ensure that they have slots when the car comes over,” he said.

“We do see that a lot of car makers towards the tail end of their production (are) trying to deliver cars that they should have been delivering 18 months ago.”

Mr Tan explained that the pandemic had scaled down the luxury car industry, as production stopped due to shortage of parts, “but things are starting to flow back”.

In preparation for the increased demand, Mr Tan brought in a car stacker to test if the capacity of the gallery can be doubled to 100 vehicles.

GROWING DEMAND FOR ART STORAGE

Another prized asset growing in popularity here are art pieces, with storage demand for them in Singapore growing by about 20 per cent annually.

Collectible art prices rose by 29 per cent last year, according to Knight Frank's Luxury Investment Index.

Among the artworks kept in private maximum-security vault Fine Art Storage Services is an original piece by renowned graffiti artist Banksy, worth a few million dollars.

"With the influx of ultra-high net worth individuals coming into Singapore to set up family offices and residences, art follows where the money goes. So that is driving the demand for storage,” the firm’s managing director Chaw Chong Foo told CNA.

He added that the rising popularity is also due to the Singapore government actively promoting art and culture in the country.

The storage facility, situated next to Changi Airport, holds thousands of art pieces, with their total value exceeding a billion dollars.

It has expanded beyond just art pieces, and now dedicates 30 per cent of its space to holding other assets like gold bars, wine and whisky.

At clients' requests, pieces of fine jewellery are also being kept in a safe room with dual-lock keys.

"You really need to know each individual client, because everyone requires different services and demand,” said Mr Chaw.

“It’s quite client-driven, but in terms of staffing, we have increased almost 5 to 10 per cent every year, and we are still looking for people right now."

With growing demand expected to fill his vaults within a year, Mr Chaw is already on the lookout to set up another facility in the next three to five years.