Singapore's tax revenue up 13.1% following economic recovery after end of COVID-19 pandemic

SINGAPORE: A total of S$68.6 billion (US$50.3 billion) in tax revenue was collected for the 2022/23 financial year in Singapore, a 13.1 per cent increase from the previous year.

The S$7.9 billion increase reflected the country's economic recovery following the end of the COVID-19 pandemic, the Inland Revenue Authority of Singapore (IRAS) said on Wednesday (Sep 6).

The arrears rate for income tax, Goods and Services Tax (GST) and property tax, meanwhile, fell to S$363.1 million, or 0.59 per cent – compared with 0.64 per cent in the preceding financial year.

"Taxes collected are used to support Singapore's economic and social programmes to achieve quality growth and an inclusive society," IRAS said in a media release.

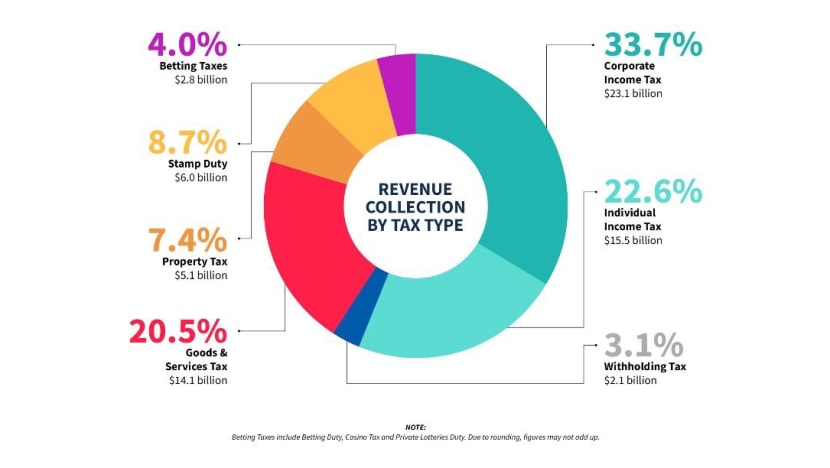

Tax revenue collection rose across most tax types.

"Of the S$7.9 billion increase in collection, corporate income tax accounted for S$4.9 billion on the back of buoyant corporate earnings," IRAS said.

"GST rose by S$1.5 billion due to higher consumption and a rebound in international arrivals, while individual income tax increased by S$1.3 billion on account of higher personal incomes."

Stamp duty collection dipped, however, decreasing by S$800 million – or 12 per cent – due to a lower volume of transactions compared to the year before.

S$4.6 BILLION DISBURSED

In the last financial year, IRAS disbursed a total of S$4.6 billion in grants to more than 120,000 enterprises to support local hiring and wage growth for Singaporeans, the authority said.

These grants come under schemes like the Jobs Growth Incentive (JGI), Progressive Wage Credit Scheme (PWCS), Senior Employment Credit (SEC) and Small Business Recovery Grant (SBRG).

Of this sum, S$2.7 billion went to more than 68,000 businesses with local hiring under the JGI. This will help to create good and long-term jobs for Singaporeans, IRAS said.

Under the enhanced PWCS, S$1 billion went to providing transitional wage support for more than 70,000 employers, with higher government co-funding for lower-wage workers.

Under the SEC, S$319 million was channelled to more than 95,000 employers who hired Singaporean workers. This helped them to adjust to cost increases arising from the higher retirement and re-employment ages, IRAS said.

S$136 million under the SBRG was disbursed to support more than 41,000 small businesses that were impacted by COVID-19 restrictions. These businesses received one-off cash payouts in June 2022.

Corporate income tax made up the largest share of IRAS' revenue collection, accounting for S$23.1 billion, or 33.7 per cent.

It was followed by individual income tax at S$15.5 billion, or 22.6 per cent. IRAS said that 83 per cent of this figure came from taxpayers with annual incomes exceeding S$150,000.

GST accounted for S$14.1 billion – 20.5 per cent – and stamp duty accounted for S$6 billion, or 8.7 per cent.

Property tax (S$5.1 billion), betting taxes (S$2.8 billion) and withholding tax (S$2.1 billion) accounted for the remaining tax revenue.

IRAS added that it audited and investigated 9,019 cases in the 2022/23 financial year and recovered about S$499 million in taxes and penalties.