Temasek's net portfolio value grows by S$7 billion to S$389 billion, boosted by US and India investments

The state investor posted an annual shareholder return of 1.6 per cent, after last year's negative 5.07 per cent.

Temasek's senior management at a press conference on Jul 9, 2024. (Photo: Temasek)

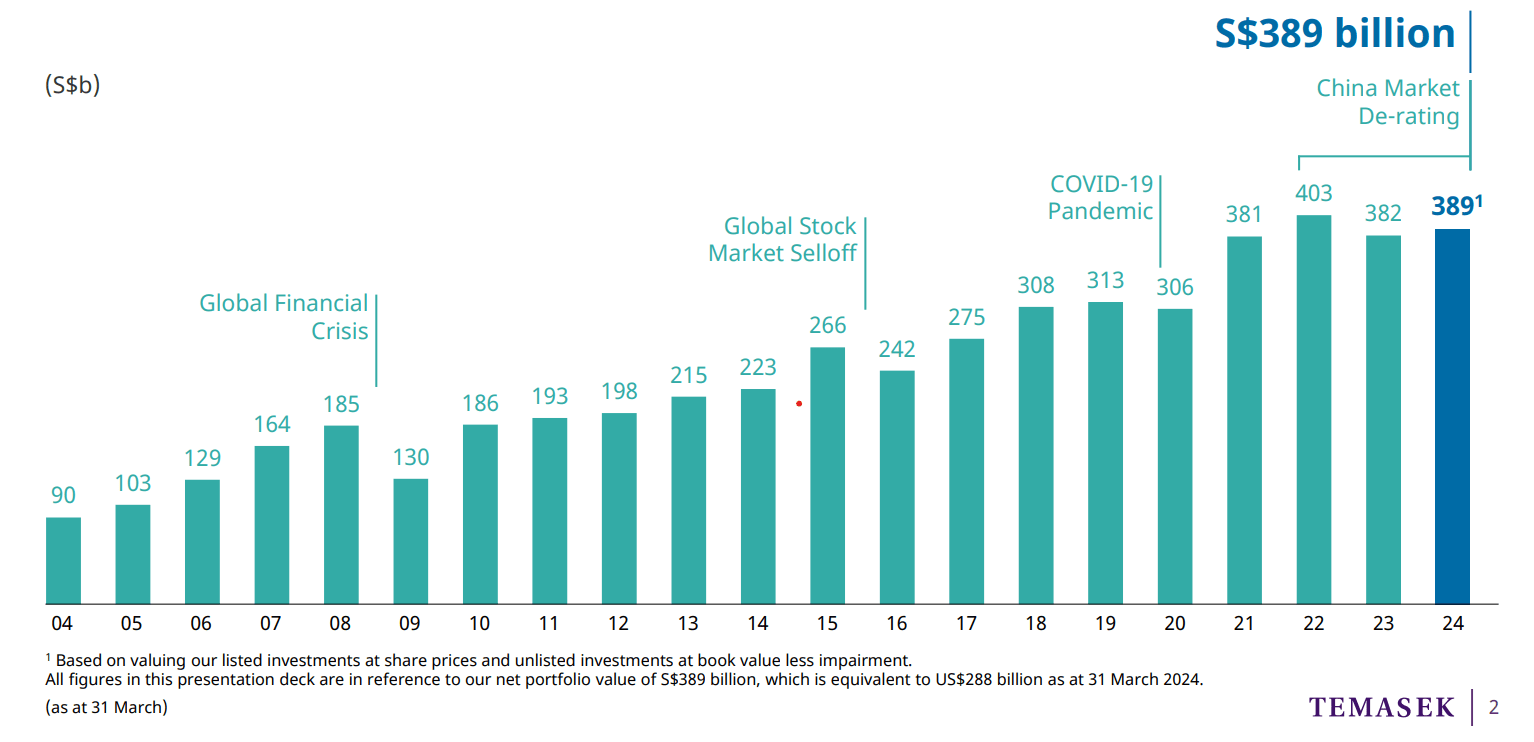

SINGAPORE: Temasek Holdings reported a S$7 billion (US$5.2 billion) increase in its net portfolio, with investment returns from the US and India providing a boost and offsetting China's underperformance.

The state investor's net portfolio was valued at S$389 billion as of Mar 31, up from S$382 billion a year ago, according to its latest annual review released on Tuesday (Jul 9).

It posted a positive annual shareholder return of 1.6 per cent after last year's negative 5.07 per cent, which was its worst since 2016.

Temasek is one of the three entities that have part of its returns tapped every year for the government’s annual Budget.

The government can spend up to half of the long-term expected investment returns generated by Temasek, as well as by sovereign wealth fund GIC and the Monetary Authority of Singapore, based on the Net Investment Returns Contribution framework.

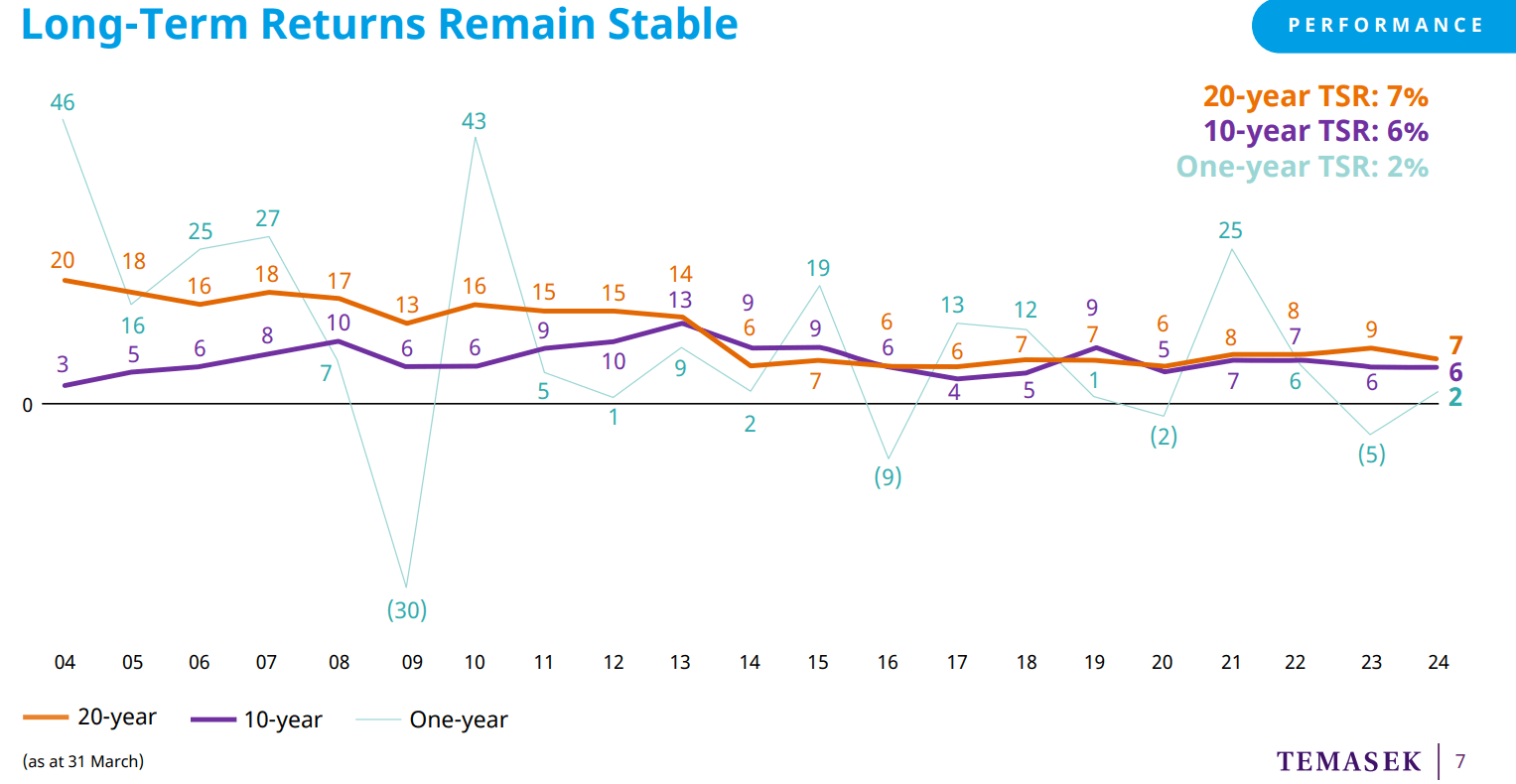

"As our investments are primarily in equities, we're not immune to year-to-year market volatility," said Ms Connie Chan, head of financial services at Temasek International.

She added that the longer-term total shareholder return tends to be more resilient.

The 10-year total shareholder return was 6 per cent, same as the previous year's. The 20-year return was 7 per cent, down from 9 per cent – this dip was because the latest figure excludes 2004, which was a post-SARS recovery year.

Temasek also refined its methodology for calculating its mark-to-market net portfolio value to be more in line with its peers, using market multiples of comparable public companies and other approaches to assess the fair value of its unlisted assets.

Based on that methodology, its mark-to-market portfolio would be valued at S$420 billion, and the previous year's portfolio would stand at S$411 billion.

It usually uses the book value of its unlisted investments and takes impairment into account. Unlisted assets have grown to make up 52 per cent of the portfolio.

"CAUTIOUS BUT STEADY"

The state investor had a net divestment of S$7 billion for the year ending Mar 31. It invested S$26 billion, but divested S$33 billion.

Around S$10 billion of the divestment was due to the repayment of bonds from Singapore Airlines and the redemption of preferential shares by Pavilion Energy.

Temasek said it maintained a "cautious but steady" investment pace, driven by expectations of a US recession until the Federal Reserve pivoted from its tight monetary policy and the slower-than-expected pace of post-COVID recovery in China.

It invested in sectors such as technology, financial services, sustainability, consumer and healthcare.

Since 2016, Temasek has invested with four structural trends in mind, which helps the company construct a more resilient and forward-looking portfolio, said Ms Chan.

"Digitisation and sustainable living have a pervasive impact across sectors and business models. The future of consumption and longer lifespans reflect shifts in consumption patterns and address the needs of a growing and ageing population," she said.

These investments made up 39 per cent of Temasek's portfolio, up from 13 per cent in 2016, when these trends were first identified.

Transportation and industrials, as well as financial services, remain the two largest sectors in the portfolio.

GEOGRAPHICAL OUTLOOK

The Americas made up 22 per cent of Temasek's portfolio, second only to Singapore, which stood at 27 per cent.

The figures are roughly similar to the previous year's, when Americas was 21 per cent and Singapore was 28 per cent.

Its China investments fell from 22 per cent of the portfolio to 19 per cent. China boosted the company's portfolio returns from 2004 to 2014, but the market's performance dipped in the next decade.

Deputy CEO Chia Song Hwee said structural challenges remain in China, despite the government's pro-growth stance. Temasek focuses on businesses that serve a domestic market, such as biotech, import substitution, electrification and electric vehicle value chain.

"Some of these businesses have export potential, but given the geopolitical risk, we are really focusing on companies that only solely rely on (the) domestic market and less reliant on exporting to other countries," he said.

"We've also been stepping up our investments in India, as we see more opportunities in consumer, healthcare and financial services," said Ms Chan.

Related:

Globally, geopolitical tensions remain a concern and inflation is sticky, though it is coming down from elevated levels.

The US will continue to be the largest destination of capital, especially in artificial intelligence enablers and adopters. Removing the so-called Magnificent Seven, which refers to seven tech stocks that are dominant in the market, the S&P equal weight index is trading below long-term averages, said chief financial officer Png Chin Yee.

"There are pockets of opportunities that we continue to see in the US market," she said.

Europe's economy is recovering, but two risks include less supportive fiscal impulse and political shifts in the region. Temasek opened an office in Paris in April.

Asked about the impact of the recent French elections, Ms Png told CNA that the office helps to establish a presence for investing throughout the continent.

"Typically when we invest in Europe, we would invest in global companies which may not just serve the European market, but serves the global market," she said, adding that the focus in Europe is also on sustainability and the green transition.

FTX EFFECTS

In a separate interview with CNA, Mr Chia declined to comment on whether Temasek would receive any payouts from cryptocurrency company FTX, which has recovered up to US$16 billion to pay its customers.

He said legal proceedings are still ongoing, but that Temasek would continue investing in tech.

"The FTX issue was quite clear - it's a situation relating to fraud, not a company that did not perform in terms of market opportunity," he said.

Ms Png said tech is an important sector because Temasek needs to stay informed about innovations happening around the world.

"That's why we invest in innovation, one for the returns they generate but two, to understand what the impact is for our portfolio," she said, adding that early stage investments are capped at 6 per cent of the total portfolio.

"That will help ... us manage the risk, that, together with the way we phase in investments in this space as well," she said. "Typically, we will go in with a smaller check size and when we see traction in the business model, then we can look to double down."