More investment funds flowing into private healthcare, pet care but with strings attached

While it brings opportunities for growth, innovation and efficiency in the healthcare sector, an injection of private capital can also pose potential challenges for those involved in balancing profit goals with patient care.

(Illustration: CNA/ Nurjannah Suhaimi)

This audio is generated by an AI tool.

As a senior doctor at a privately owned healthcare facility some years back, one of Dr Sandra’s biggest stressors was attending financial meetings with management.

Sandra is not her real name, but she spoke on condition of anonymity as it could jeopardise her professional relationships in the healthcare industry.

At these quarterly meetings, she often heard comments such as: “Doctor, you have many patients, so why aren’t more undergoing surgery?”

Such a line of questioning made her feel as though she was being judged more on revenue generation than on the quality of patient care.

Dr Sandra would respond that not all cases required surgery — some patients only needed biopsies and did not require admission.

But the managers were more focused on the numbers: They had projected ever-rising revenues, which to Dr Sandra was "impossible".

“Realistically, after reaching a sustainable workload, there's a limit to how much more can be done within the available hours each day,” she told CNA TODAY.

During her years at the facility, Dr Sandra consistently shared with the management her insights on how patients in her care should be treated.

“But I noticed a disconnect between the medical and financial directions of the organisation, which made it hard to navigate. By the end of my contract, after discussing with senior colleagues, I finally found the courage to start my own practice.”

In interviews with several healthcare professionals, including veterinarians, CNA TODAY found that private investment in healthcare can significantly transform a clinic's operations, leading to a shift in priorities.

Be it from private equity firms or privately owned companies, private investment can be a double-edged sword: While it brings opportunities for growth, innovation, and efficiency in the healthcare sector, it also poses potential challenges for those involved in balancing profit goals with patient care.

Healthcare and pet care are hot sectors for private capital. In the United States, private equity investments in the healthcare sector have grown dramatically over the past two decades, skyrocketing from US$5 billion in 2000 to about US$206 billion in 2021.

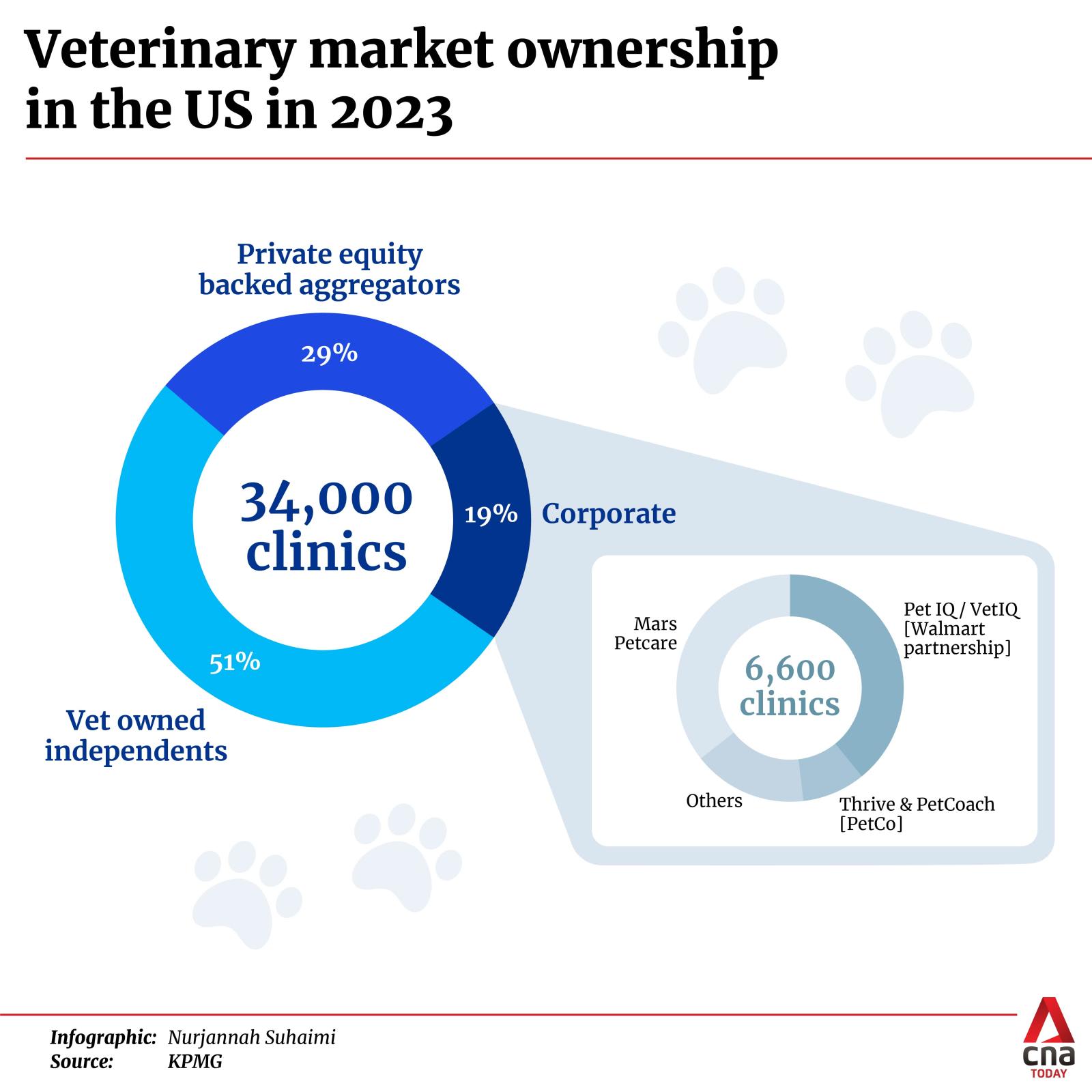

While veterinarians in the US still own a majority, or 51 per cent, of the roughly 34,000 vet clinics, private equity firms have rapidly increased their presence in recent years.

These firms, which focused on acquiring companies, optimising their operations, and selling them a few years later for a profit, now own 29 per cent of the vet market, while corporations hold 19 per cent.

Closer to home, private equity investors are increasingly targeting Southeast Asia's healthcare sector, especially in Singapore, amid growing demand for better healthcare driven by greying communities.

While the benefits of private equity investment in healthcare for humans and animals, such as improvements in operational performance and innovation, are widely acknowledged, concerns abound, too.

Critics argue that a focus on profitability could drive up patient costs, shift priorities away from quality care, and lead to an increase in unnecessary procedures or services designed to maximise revenue.

In fact, as the infusion of private capital continues to grow in Singapore, some healthcare practitioners and vets have voiced concerns over cost management and the quality of patient care — issues that have plagued private-equity-driven healthcare facilities in the US.

GROWING INVESTORS’ INTEREST

Generally, private equity firms operate by raising capital from investors and then using that capital to invest in and acquire companies. Their goal is to generate higher returns for investors, often by scaling up the companies they invested in, enhancing their performance, increasing profitability, or a combination of these strategies.

They often take control of the companies they buy, and may own them for a period of up to 10 years before selling or exiting the investment.

Experts told CNA TODAY that investors are attracted to Singapore’s healthcare sector due to its efficiency and strong branding, viewing these factors as scalable advantages for regional growth and profitability.

According to data from Bain & Company, a management consulting firm, healthcare was Southeast Asia's second-largest sector for private equity investments by value in 2023, while leading the market in buyouts.

Within the region, Singapore accounted for the bulk of private equity investment deal values in 2023, with healthcare being one of the top five sectors drawing in capital.

Ms Jacqueline Lee, senior consultant for Asia Pacific at executive search firm FP Global, told CNA TODAY that healthcare investments rose by 24 per cent in deal value from 2019 to 2023, and nearly half of the top 10 largest investments and exits last year were healthcare-related.

She highlighted SeaTown Holdings’ S$150 million investment to establish Foundation Healthcare Holdings, which led to a 40 per cent increase in specialists within nine months.

The investment in the multi-specialty private healthcare group was made via SeaTown’s private equity fund.

In the last few years, other high-profile deals reported include Templewater, a Hong Kong-based private equity firm, acquiring oncology and cardiology private clinic groups OncoCare Medical and Novena Heart Centre in Singapore in 2023.

In 2022, Fullerton Health finalised a merger led by private equity firm RRJ Capital, resulting in RRJ becoming the majority shareholder and gaining effective control of the healthcare company. The same year, independent private equity firm Sylvan Group acquired four Singapore healthcare companies, including pharmaceutical company Juniper Biologics, orthopaedic services provider Artemis Health Ventures, and radiology and imaging services firm DX Imaging.

Pet care has also been seeing strong demand from private equity firms and large corporations globally.

Dr Teo Boon Han, president of the Singapore Veterinary Association (SVA), noted that several veterinary clinics here are now owned by private equity investors.

While the exact number is difficult to determine as deals are not always publicised, he believes such private investments will continue, just like in the US and the United Kingdom.

Candy-maker Mars, though not a private equity firm, is the largest consolidator of pet care businesses in the US and has expanded into Singapore through several acquisitions.

Here, the company acquired the Veterinary Emergency & Specialty (VES) Hospital in 2020, Mount Pleasant Veterinary Group in 2021, and Gentle Oak Veterinary Clinic in 2022.

In 2023, Mars added Hillside Veterinary Surgery to its Singapore portfolio.

WHAT HAPPENS AFTER A TAKEOVER

In Western markets such as the US, the balance between profitability and patient care quality has emerged as a key issue in the debate on the merits of a private equity-driven healthcare sector.

In the context of Singapore’s healthcare sector, experts told CNA TODAY that while private equity firms generally aim to preserve the core mission of serving society, the operational changes they introduce can sometimes lead to tension.

Mr Mridul Karkara, a partner in life sciences and healthcare at consulting firm YCP, said when private equity steps in, the goal is often to standardise processes, optimise costs and make data-driven decisions.

As a result, treatment protocols and product choices may be guided by broader data trends and proven efficiencies rather than individual doctors' preferences.

“When this happens, it is an uncomfortable change for certain doctors who have been so used to running a department or a practice in a very individualised way,” he said.

Based on developments in the US, some healthcare practitioners, such as Dr Tan Yia Swam, have reservations about how the sector will evolve alongside the growing involvement of private equity.

Dr Tan, a general surgeon who owns her private practice Breast Friend Surgery, thinks it is likely that “we will head down the same way” as the US.

Drawing on real-life situations faced by her peers in both privately owned and private equity-backed clinics, she said: “In the afternoons, I'm typically free to manage my time as I please. But if I become an employee of a larger organisation, my performance will be scrutinised.

“I could be questioned why I have no appointments in the afternoon, which limits my flexibility and autonomy.”

Dr Tan, also a former Nominated Member of Parliament, added that if she were to sell her practice to a private equity firm, she might receive some cash upfront from the acquisition, but she would likely have to work much harder to meet the financial targets set by investors.

“For instance, when treating a patient with a certain medical condition, I could previously focus on a patient-centric approach, looking at options like surgery versus observation.

“But with financial targets in mind, some doctors might feel inclined to overprescribe treatments,” she said.

Dr Angela Yang, a partner at recruitment firm Page Executive, said private equity’s focus on profits is a common concern, as it may lead to cost-cutting measures that impact patient care.

Another worry is the increased pressure on staff to meet profitability goals, leading to higher turnover rates.

“Employees who feel the environment has become more profit-driven may choose to leave. This can lead to burnout and further impact patient care, making it difficult to balance efficiency with staff well-being,” she said.

Dr Yang, who specialises in C-suite and executive-level hiring in healthcare and life sciences across Asia, added that private equity firms typically operate on a shorter investment timeline, often seeking an exit after a few years.

“This can lead to frequent management changes or shifts in strategy, creating instability, especially in a field like healthcare, where long-term planning is essential.”

Echoing a similar view, an ex-employee of a private clinic who only wanted to be known as Chelsea, told CNA TODAY that when her previous workplace was acquired, there were changes made by the management that made her feel insecure about her job.

“I couldn’t focus on my work for months because plans kept changing," said Ms Chelsea, who spoke on condition of anonymity.

"The management wanted to move staff around. Ultimately, I decided it was better to find another job elsewhere.”

But some experts noted that the impact of private equity taking over a clinic hinges largely on the firm's strategies, as well as the doctors' resilience to external pressures.

Adjunct Associate Professor Jeremy Lim said doctors must be able to withstand undue pressures, such as being urged to prescribe more expensive drugs when cheaper alternatives would suffice.

“At the organisational level, it’s crucial to have leadership that prioritises clinical care over financial concerns.”

Dr Lim, who is from the Saw Swee Hock School of Public Health at the National University of Singapore (NUS), said it is “naive” to believe there are no external pressures as “we are all subject to them”.

“In the public sector, while money may not be the top priority, there’s still pressure regarding time. A doctor who sees only five patients in a clinic session will be questioned by administrators, especially when others are seeing 15 patients, for example," he noted.

“Whether it's about waiting times, productivity, or financial returns, we all face external scrutiny and pressure. And these need to be balanced by strong clinical governance, both individually and collectively."

Another doctor, who wanted to be known only as Tom, who works at a clinic owned by a private equity firm, believes that it is a misconception that these investment firms influence how patients are treated at clinics, as it ultimately depends on the professionalism and ethics of each practitioner.

He also rejected the idea that a profit-driven culture took over his workplace after the acquisition, pointing out that many healthcare professionals prioritise ethical standards in patient care.

But Dr Tom noted that problems often arise when companies are run by a management team that is not familiar with the intricacies of healthcare.

This results in non-medical executives imposing policies that do not align with best medical practices, treating healthcare like a business, when it is different from other industries and requires a more nuanced approach, he said.

At Companion Animal Surgery, which was acquired in 2019, Dr Alan de Asis said the impact has been minimal, as the private equity firm's business model allows practices to operate as they always have, since the existing approach is already effective.

Dr de Asis said being part of a larger corporation offers several advantages, such as increased resources. But one key area to adapt to was budgetary oversight, which required his team to be more mindful of expenses and strategically prioritise investments.

While several clinics may receive private equity offers, some doctors believe there is value in maintaining independence.

Dr Patrick Maguire, co-founder of Beecroft Animal Specialist & Emergency Hospital, said being an independent operator allows him to invest in equipment, training and facilities that directly benefit patients — even if they do not always add to the bottom line.

"I relish the freedom to invest in what I feel is right, to make medical and business decisions based on patient care rather than live under the gun of corporate financial metrics, such as increasing the average patient charge or hitting a target number of injections, therapies or surgeries per month."

IS PRIVATE EQUITY DRIVING UP COSTS?

Research in the US has shown that private equity investment is often linked to rising costs for both payers (such as insurance companies) and patients.

With increasing investor interest in Singapore, could the city-state be in for a similar prognosis? Unlikely, experts told CNA TODAY, given the nation’s healthcare sector operates differently from that of the US.

Ms Lee of FP Global noted that while healthcare in Singapore is primarily funded by government expenditures, it falls short of meeting consumer needs for quality, such as reducing long wait times in polyclinics and public hospitals.

"There is a need for private equity investment to help bridge this gap," she added.

Professor Alan Wong, who specialises in health and social sciences at the Singapore Institute of Technology, said private healthcare is expensive, but providers typically target those who can afford these services.

As more private equity players enter the market, competition among private providers will increase, he noted, so private equity leaders must weigh the risk of raising costs when acquiring clinics.

They will likely choose to either maintain prices or adjust the range of services offered, he said.

Similarly, YCP’s Mr Karkara said the surge in demand across primary and acute care is driving costs higher, not necessarily due to private equity firms and profit-driven entities, but because of the healthcare system’s capacity limitations.

“Ideally, if we could boost supply through increased primary care facilities, preventive health programmes, and incentives for early care, then this could alleviate the pressure on acute and tertiary care, reducing the need for higher pricing.”

What about the management pressures and financial targets that doctors and staff at private equity-backed clinics may grapple with to earn more profit?

Dr Lim of NUS said in the private healthcare market, doctors cannot charge whatever they want because there are market prices.

“Doctors take an oath to serve their patients and are regulated by the Singapore Medical Council. This creates a balance of market reality, profit motives and clinical governance, ensuring that doctors can make money without acting unethically.”

However, Dr Lim cautioned that problems arise when this balance is disrupted — which can also happen in for-profit clinics, not just private equity-acquired ones.

“But this can be balanced by doctors and health professionals within the system. It's important for them to stand up to CEOs and say, ‘This might improve profits, but it's unethical. I can't recommend treatments a patient doesn't need’,” he said.

Even so, some independent clinics CNA TODAY spoke to admitted that they do feel the pressure of having to compete against clinics owned by private equity and larger corporations.

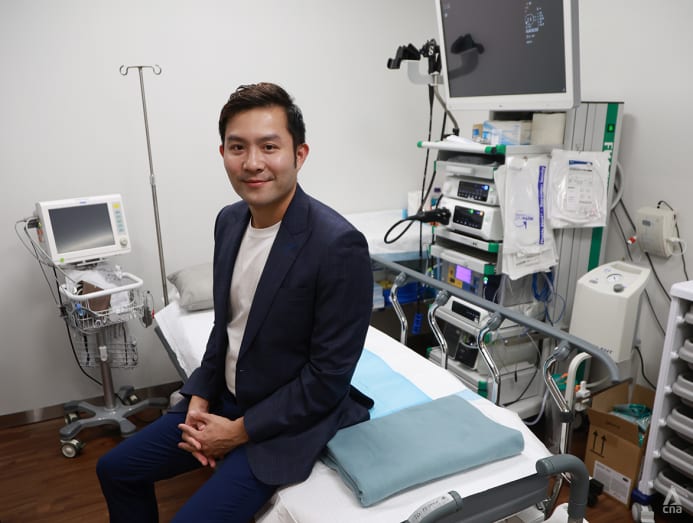

Mr Don Poh, chief executive officer at Curasia Endoscopy, an independent practice providing endoscopy, said the growing influence of private equity in healthcare has increased pressure on facilities such as his, particularly by raising manpower and medication costs.

Still, he said the business remains manageable, thanks to mitigation strategies like establishing Curasia Endoscopy’s facility outside traditional hospital systems to avoid high rental costs.

This allows them to offer above-market remuneration packages to attract talent, he said.

In veterinary care, Dr Brian Loon, a principal veterinary surgeon at Amber Vet, agreed that competition has gotten stiffer and his team must carefully manage rising costs and not fully pass them on to customers.

“As an independent practice, we can’t access the lower supplier prices that larger groups get through bulk purchasing without compromising the quality of the medications we procure, which inevitably makes our prices higher," he said.

On the other hand, some vets, such as Dr Arman Chen, veterinary surgeon and practice manager at Gaia Veterinary Centre, said his biggest challenge is not competition from corporations — it is the shortage of manpower, which is an industry-wide problem.

“This has always been the most pressing issue. Even if corporates didn’t exist, the problem would still be the same for us.”

Dr Teo of SVA said the bigger issue for him is not so much the ownership structure or the role of private equity in Singapore's veterinary sector, but how these developments will impact veterinary professionals and pet owners in the long run.

“In human healthcare, there is a public health service to balance private sector activities, along with high insurance uptake and significant government subsidies.

“These are all absent in veterinary care here.”

ADVANTAGES OF PRIVATE EQUITY

CNA TODAY reached out to five private equity firms with known investments in Singapore and Southeast Asia for their response. Most did not respond, while some declined participation.

Experts said despite the downsides, private equity also offers advantages beyond capital.

For example, they could implement a centralised ordering system across a company that has been acquired, potentially resulting in lower prices for consumables due to bulk purchasing. The company could also gain better access to human resources and marketing services.

Ms Chin Wei Jia, group chief executive officer of private healthcare provider HMI Medical, told CNA TODAY that investments from its private capital partners, including private equity, have driven the company's growth both organically and through acquisitions.

"When speaking with potential investors, we were clear on our criteria. We wanted a partner who truly believes in our mission and vision to support us on our growth journey.

"We wanted a partner with relevant experience in working with quality healthcare providers... (and) a partner who was able to provide us with capital solutions in a timely manner that were aligned with our overall business requirements."

In recent years, HMI, a family-led business, has averaged two to three acquisitions and partnerships annually. Recent examples include The Harley Street and Vascular Centre, MHC Asia Group, and Advanced Urology Associates.

YCP’s Mr Karkara said private equity firms also bring expertise from other markets, management discipline, and evidence-based decision-making and treatment protocols.

“This adds significant value beyond funding alone. Of course, financial pressures can sometimes lead to suboptimal outcomes, but these issues are recognised and can be managed.”

Mr Karkara added that the advantage for Asian markets, including Singapore, is that they are entering this private equity phase with the benefit of insights gained from challenges already encountered in Western healthcare systems.

“These become ‘known problems’. Consultants like us in private equity take these factors into account. When we recommend changes and support execution, we recognise potential pitfalls and work to prevent them,” he said.

Dr Lim of NUS said it is not unreasonable to want hospitals to be more operationally efficient. In fact, it is the right approach.

The challenge arises when there is insufficient time to make these improvements properly after a healthcare facility is acquired by a private equity.

“For instance, if I’m given 10 years to turn around a hospital, we can implement changes, bring in new systems, adopt technology, without negatively risking patient care.

“But if I only have 12 months, I might have to make quick cuts, like reducing staff or shortening shift hours. This kind of ‘squeeze’ compromises patient care.”

In response to CNA TODAY's queries about private investment into healthcare, the Ministry of Health (MOH) said Singapore’s healthcare system differs significantly from that of countries like the United States, as it has a significant public sector presence, especially in the hospital and specialist space.

To help consumers make informed healthcare choices, it publishes the bill sizes and fees of public healthcare institutions, along with fee benchmarks for common surgeries in private hospitals and by private doctors.

"There is also a mandatory requirement for all healthcare providers, private or public, to provide financial counselling to their patients," MOH said.

It added: "MOH also exercises governance over national financing schemes, including MediShield Life and MediSave claims made by private healthcare providers, to ensure claims are appropriate and do not unnecessarily raise healthcare costs and premiums."

Furthermore, all healthcare providers, regardless of ownership or profit model, must meet stringent licensing requirements, undergo regular audits and follow comprehensive patient care standards.

"MOH will continue to regularly review and update our policies and regulations to address emerging trends in the healthcare sector so that Singaporeans can continue to have access to affordable and good-quality healthcare," the ministry said.

Dr Tom pointed out that private healthcare, which caters to a different demographic — primarily those willing to pay more than public healthcare patients — can only be sustained with sufficient investment, which is increasingly coming from private equity firms.

“It's important that not everyone floods into public hospitals, demanding immediate care and overburdening the system.”

Dr Tom also pointed out that doctors have only two pathways to choose, public or private. And those who have worked in public hospitals may eventually choose to work in the private sector, where they can earn more.

“Their income comes from investors, patients, and sometimes international patients, who also contribute to the country by paying taxes. These taxes, in turn, help support public hospitals," he noted.

“It's a symbiotic ecosystem. If one system falters, the other will also suffer.”