Big Read

Once seen as cheap knockoffs, Chinese brands are losing their stigma and winning over Singapore consumers

In the past, Chinese brands were often passed over by consumers who viewed them as cheap and of poor quality. Today, they’re increasingly gaining favour, in particular, with younger consumers for being innovative, aesthetically pleasing and value for money.

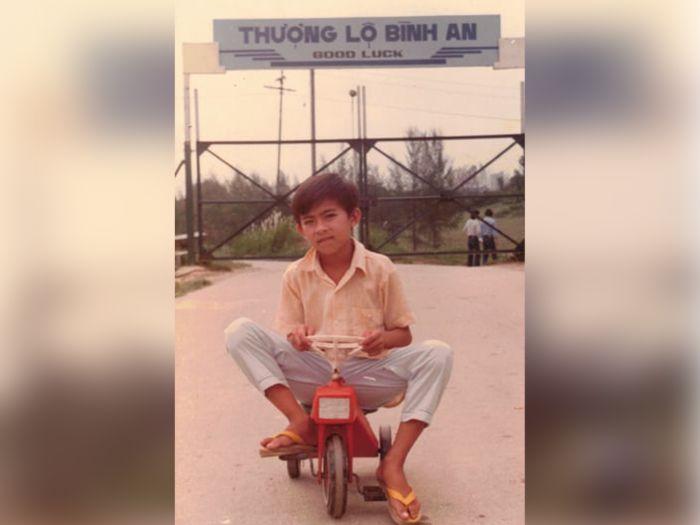

Up Close

Visual Stories

Ground Up

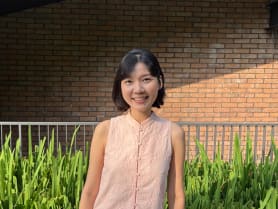

'Too hot to think': Rising heat leaves Singapore students cranky and distracted

Several studies found that rising temperatures reduce educational outcomes and children's cognitive ability. To deal with this heat, students and schools are doing what they can to stay chill.

Voices

Adulting

The secret to standing out on LinkedIn is not trying too hard. Here's how

How can one get through the noise and clutter on LinkedIn and get noticed professionally, if one is averse to posting there in the first place?