How the Johor-Singapore Special Economic Zone is shaping up to be different from past collaborations

Interest in the Johor-Singapore Special Economic Zone has been high amid geopolitical uncertainties and businesses that have already set up shop in the area have seen early gains, but more improvements are needed for the business ecosystem to really take off and realise its potential.

The greater potential for the special economic zone is not just about Singapore businesses going to Johor, but it is about both sides working together to attract new investment projects globally, Singapore Prime Minister Lawrence Wong said. (Illustration: CNA/Nurjannah Suhaimi)

This audio is generated by an AI tool.

After decades of cross-border cooperation, Singapore and Malaysia in January inked an agreement to embark on their most ambitious joint project yet – the Johor-Singapore Special Economic Zone (JS-SEZ).

Its aim is simple: leverage the unique strengths of both countries to attract fresh investment into Singapore and Malaysia.

The zone promises to fuse Singapore’s strengths in research and development with Malaysia’s industrial muscle and land space – if certain cross-border challenges can be resolved.

Singapore's Ministry of Trade and Industry (MTI) told CNA TODAY that businesses based here may tap the economic zone to expand their downstream capabilities, or twin their operations in Johor with their headquarters back home.

Its target is also to facilitate the expansion of 50 projects and create 20,000 skilled jobs in five years.

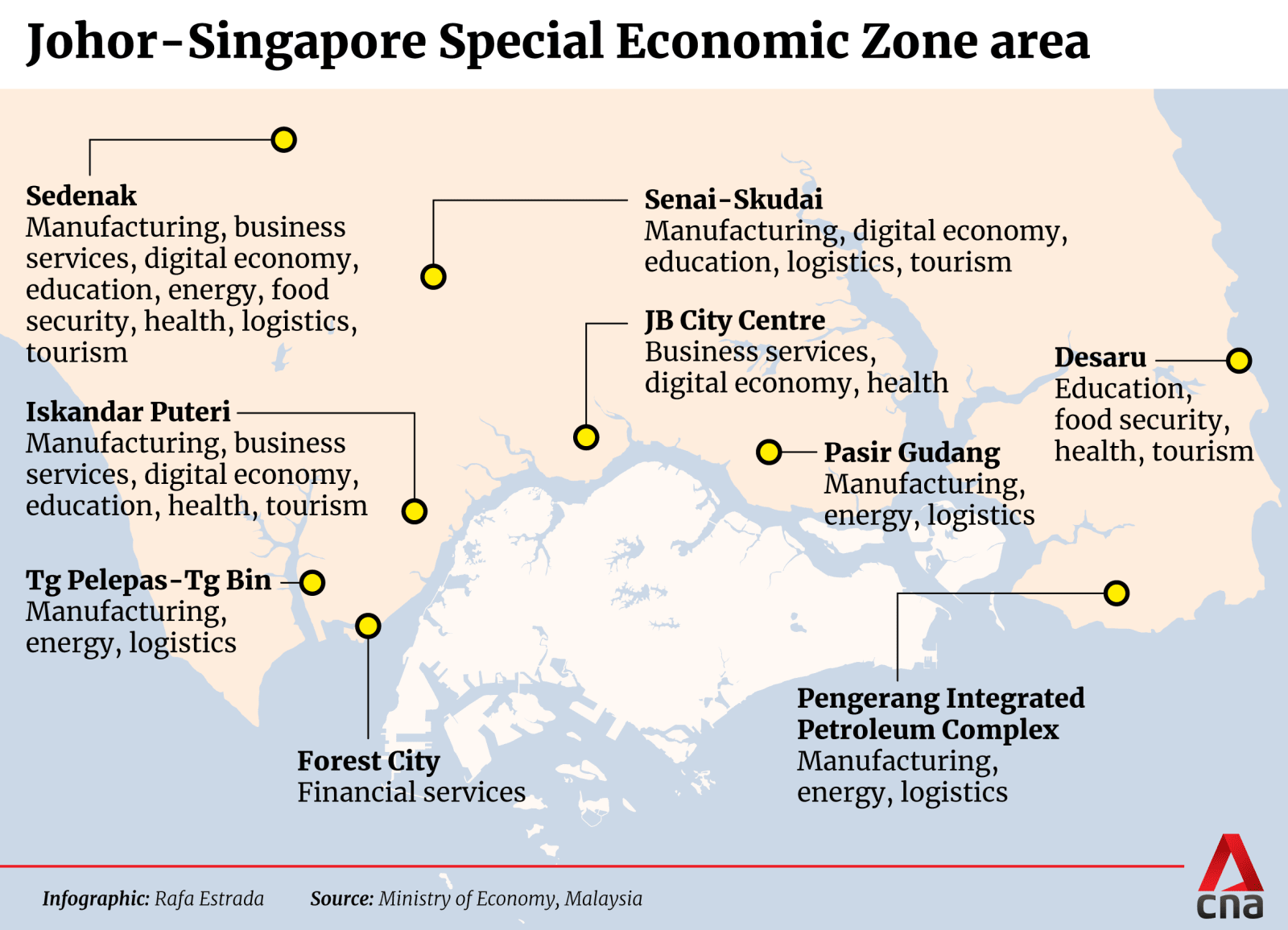

So far, interest in the JS-SEZ – which comprises nine “flagship areas” covering economic sectors ranging from manufacturing and digital economy to health and tourism – has been promising.

In recent months, trade associations such as the Singapore Business Federation (SBF) and the Singapore Manufacturing Federation (SMF) have organised a few missions to Johor for its members to explore new opportunities.

More than 180 Singapore companies took part in the business mission organised by SBF in February, while SMF has brought representatives from about 150 firms across the border so far this year alone.

Additionally, the joint JS-SEZ project office that was formed by MTI, Singapore's Economic Development Board (EDB) and trade agency Enterprise Singapore has received more than 140 enquiries from domestic and foreign companies so far, MTI said.

Its Malaysian equivalent, Invest Malaysia Facilitation Centre Johor (IMFC-J), has also received more than 300 investor enquiries, with 100 focused on the Forest City Special Financial Zone alone, it told CNA TODAY. It is a one-stop centre that fast-tracks investor journeys within the special economic zone, which is led by Malaysia's state and federal government agencies.

Dulling this early enthusiasm, however, is the lack of clarity regarding the zone’s regulations and incentives.

In CNA TODAY’s conversations with businesses that either have an eye on expanding to Johor or are already situated there, most said they are awaiting further announcements to see if their companies would qualify for special privileges within the zone.

The Malaysian Investment Development Authority (MIDA) has already published its tax incentive package for businesses looking to enter the zone. However, a minimum capital investment of RM500 million (US$118 million) is required for projects in various sectors to be eligible – a tough ask for many small- and medium-sized enterprises (SMEs).

Singapore, for its part, has delivered on initiatives such as streamlined procedures at customs for land intermodal transshipment and passport-free QR-code clearance, but it has yet to reveal much about tax incentives specific to the economic zone for businesses.

Mr Ang Yuit, president of the Association of Small & Medium Enterprises (ASME), said that as a result, the economic zone in its present form does not have "immediate resonance with Singapore firms, apart from providing a baseline confidence of what both governments' directions are”.

Speaking at a media gathering on May 20, he also said that some existing Singapore businesses in Johor Bahru have faced administrative and regulatory issues such as contrasting instructions from Malaysia’s federal and state governments on taxable items.

“This indicates that firms must be prepared for hiccups and the need for alignment along the JS-SEZ journey," Mr Ang added.

Many businesses have thus chosen to take a wait-and-see approach before committing to operations in the area. They are hopeful, though, that the governments will announce more schemes beneficial to SMEs in time to come.

Taking a wider view, Singapore Prime Minister Lawrence Wong said in January that the greater potential for the economic zone is “not just about Singapore businesses going to Johor, but it is about both sides working together to attract new investment projects globally”.

The signs are slightly more optimistic on that front.

Mr Ben Neumann, leader of Singapore business at global mobility advisory firm Vialto Partners, said his firm is seeing more interest coming from large multinational corporations and SMEs enquiring about the special economic zone, more so than big-size Singaporean and Malaysian companies.

Indeed, industry players believe that the unfolding trade war between the United States and its major trading partners positions the JS-SEZ favourably to investors who are looking to put their money in stabler regions.

It may still be early days, but capital across the globe is keenly monitoring what was billed as a “game changer” by Malaysia's former economy minister Rafizi Ramli.

CNA TODAY takes a closer look at how the JS-SEZ is shaping up and what stumbling blocks it may have to overcome.

EARLY GAINS FOR BUSINESSES

Just five months after the bilateral agreement was formalised, SMEs with existing operations in the areas outlined in the JS-SEZ told CNA TODAY that opportunities for business partnerships have already grown.

One such company is Singapore-based green energy firm GoRental SG, which provides solar-powered energy packs to help reduce the carbon footprint of large-scale events.

In 2020, the company established solar facilities in one of the zone's flagship areas.

GoRental’s managing director Colin Peh said his firm has seen a 30 per cent increase in the number of collaborations with Malaysian firms since January.

While government agencies in Malaysia used to indicate a preference for working with firms based in the country, that mindset has since shifted considerably to one that is more responsive and amenable to cross-border collaborations, he added.

“The entry point is a lot more open because the governments have paved the way,” Mr Peh said. “So when I talk to Malaysian companies to work together, there’s an openness to it. That has become a norm in that whole zone.”

One tangible benefit his firm has gained from this willingness to collaborate is in his search for skilled workers.

Earlier this year, Mr Peh’s team sought MIDA’s help to find engineers to work on GoRental’s solar facilities.

They were given access to a pool of suitable candidates and pointed to relevant grants to help with hiring costs.

A Malaysian construction firm Southrise, which has operations in Senai, Johor, has similarly seen a 15 to 20 per cent increase in tenders commissioned to it since January. Its administrative manager Cassie Tiong attributed the rise to the increased interest in the special economic zone.

Banks have also taken steps to promote the project and have indicated their willingness to lend to smaller firms within the zone.

United Overseas Bank in February launched a Green Lane with Invest Johor to fast-track investments into the zone.

Three months later, Maybank announced that it had partnered with ASME to facilitate Singapore-based SME financing and access to the zone as well. The Malaysian bank also facilitated S$709.6 million (US$545 million) in client investments to the economic zone last week – from Thomson Medical Group, Centurion Corporation, as well as Alpine Renewables and Edible Oils.

Though the zone is still very much in its infancy, larger firms that have taken the leap to expand into Johor have also benefited from being part of it at the moment.

Singapore-based agricultural-technology firm Archisen recently completed its development of a 52,000 sq ft smart indoor vertical farm located in Iskandar Puteri, a joint venture with Malaysia’s state-owned agri-food company FarmByte.

Archisen's chief executive officer Vincent Wei said his firm, which offers an end-to-end solution to design, build and operate urban farms, has seen an uptick in interest from collaborators and clients who are keen to work with the company in the economic zone.

Mr Wei said that Johor has, for many years, been known for having lower costs of production.

“What was lacking is the security and the know-how of getting business approvals and permits,” he added.

“Furthermore, there will also be a series of tax incentives, which are in the process of being implemented – so that further attracts companies’ interests.”

Data centres aplenty have also entered Johor in recent years.

Princeton Digital Group, a Singapore-based internet infrastructure firm, officially launched its data centre campus in Sedenak Tech Park in July last year.

Its chief technology officer Asher Ling said although it was still too early to provide an update on the benefits to his company from being a part of the zone, it is optimistic about the potential to deliver long-term advances to the industry, particularly in terms of regulatory efficiency, improved cross-border connectivity and access to skilled talent.

In essence, while the benefits of Johor’s comparatively lower costs for labour and land are not new, the formalisation of the economic zone signals a new level of political will that attracts investment from both regional and global players, businesses said.

Mr Marcus Sia, managing director of advanced manufacturing firm Applied Total Control Treatment, said that Singapore’s appeal as a hub by itself is no longer what it used to be, owing to its reputation as an expensive city.

However, the symbiotic nature of the JS-SEZ acts as a counter to that reputation.

“Whatever we can offer, many other countries can also offer today ... In business, people want choices, so you need to know how to position yourself,” he said.

Since 2017, Mr Sia’s firm has had operations in the Senai town of Johor, now a part of the zone.

Owing to the appeal of the zone, his company, which primarily focuses on manufacturing for the aerospace and semiconductor industries, now sees positive interest from “seven out of 10” clients that they approach, Mr Sia said.

HURDLES AND LINGERING DOUBTS

Despite the early gains for some businesses, trade associations from both countries agreed that there is still much to be done.

Industry players in Singapore told CNA in January that they were concerned about several issues, including a lack of skilled labour in Johor and congestion along the Causeway – and some of these concerns remain.

Mr Sebastian Tan, group managing director at media production firm Shooting Gallery Asia, is resuming its Malaysian operations in Medini Johor – which is part of the Iskandar Puteri flagship area – after previously being based in Kuala Lumpur.

He said that the “energy and vibrancy” generated by the JS-SEZ announcement convinced him to kickstart his business there, where he plans to bring in “big names” from the media industry to work on future cross-border projects such as films and television commercials.

However, the biggest hurdle to a successful launch is the commute between Johor and Singapore, including the movement of equipment between the two states, he figured.

“If you want to bring international talent in, the moving of people and equipment between the two borders is a major hindrance,” he said.

“If these ‘big names’ get stuck in traffic for four, five hours, they would say, ‘Don’t waste my time’. And never come back again.”

By the end of 2026, the Rapid Transit System (RTS) Link project linking Singapore’s Woodlands North station to Johor’s Bukit Chagar station is expected to begin service and it is expected to ease congestion at the Causeway, but Mr Tan said he was not sure if it would completely alleviate these concerns, since high-skilled foreign workers would still prefer to travel in the comfort of a private vehicle.

Another primary concern for businesses seeking to expand their operations in the special economic zone is the availability of skilled workers.

SMF’s president Lennon Tan said that it would not be an issue to find non-skilled workers in Johor, but skilled ones are very often already working in Singapore.

Due to skilled workers being in short supply in Johor, there is a consensus that firms would have to pay “at least two-thirds” of Singapore’s rates to employ them.

Because of this, and that smaller companies with fewer resources would not be able to qualify for MIDA’s tax incentives, SMEs should not fall into the mistaken belief that they would pay merely “one-third price” if they set up shop in the economic zone, Mr Tan added, referring to the Malaysian ringgit being roughly a third of the value of the Singapore dollar.

Over in Malaysia, Mr Soh Thian Lai, president of the Federation of Malaysian Manufacturers (FMM), told CNA TODAY that its members' primary concern revolves around “skills mismatch and talent leakage”.

He said the emphasis on high-impact sectors in the zone presents “a challenge in terms of domestic talent readiness” in Malaysia.

This emphasis refers to the strategic focus on attracting innovation-driven sectors such as artificial intelligence and advanced engineering – areas that have been highlighted by both governments as part of their push for high-value economic activities.

“There is a limited pipeline of skilled professionals in these fields and continued outflow of talent from Johor to Singapore due to wage imbalances,” Mr Soh added.

“Without proactive upskilling and retention mechanisms, the JS-SEZ may struggle to scale up or localise operations anchored in Johor.”

Mr Soh also took issue with what he termed a “significant gap” in the engagement with SMEs for the zone, seeing that they form the “backbone of the nation’s industrial base”.

The current framework of the economic zone, he noted, appears to prioritise large-scale foreign investment, with limited dedicated mechanisms or incentives targeted at the participation and growth of Malaysian SMEs.

“This oversight risks marginalising a crucial segment of the Malaysian economy, potentially hindering opportunities for technology transfer, skills upgrading within domestic firms, and the establishment of robust domestic supply linkages.”

WHY OPTIMISM STILL RUNS HIGH

Despite these teething pains, many believe the special economic zone has a fighting chance, in part due to lessons learnt from past attempts at cross-border collaborations.

In 2006, Malaysia launched Iskandar Malaysia, formerly known as the Southern Johor Economic Region, where large areas in Johor were made available for the development of key sectors such as logistics, tourism and finance.

Long before that, the Singapore-Johor-Riau Islands (Sijori) Growth Triangle was launched in 1990 together with Indonesia to capitalise on the three areas’ comparative advantages.

Dr Francis Hutchinson, a senior fellow at the ISEAS-Yusof Ishak Institute, noted in a commentary for ISEAS' publication Fulcrum that Sijori’s legacy lives on – stemming from the moment when international firms began to see the benefits of pairing operations in Singapore with factories in Johor and Batam three decades ago.

However, changing international economic conditions and domestic political priorities meant that both of those initiatives failed to sustain their momentum.

This time around, however, the international geopolitical landscape, which has become more volatile than ever since US President Donald Trump’s return to the White House, may serve as a driver of the JS-SEZ’s success rather than a hindrance.

Mr Chua Hak Bin, an economist at Maybank, said that the JS-SEZ could act as a “strategic hedge” against targeted tariffs introduced by Mr Trump.

It could also leverage the “China plus one” shifts in the supply chain, he added, referring to the business strategy where companies diversify their manufacturing beyond China to reduce risk and dependence on a single market, often driven by factors such as geopolitical tensions and trade wars.

Indeed, Mr Sia, the managing director of Applied Total Control Treatment, said it is for this reason that manufacturers such as his firm have benefitted from the Trump administration’s antagonistic relationship with China.

“Before Trump took office in 2016, many of our potential customers would not entertain any quotations from us because Singapore’s prices would not be competitive. Prices in China are a lot lower than what we are able to offer,” he divulged.

“After Trump was re-elected in 2024, supply chains are expediting their restructuring activities, so people are looking to move away from China completely. This is an opportunity for us and that’s why we’re looking to expand our manufacturing plant in Malaysia.”

Mr Chua said that the JS-SEZ stands apart from past initiatives such as Iskandar Malaysia by being a “truly bilateral effort”, a view echoed by trade associations from both countries.

Mr Tan from SMF believes that both governments are “putting in a lot more resources and conviction” this time, while Mr Soh from FMM said that the groundwork laid by both countries “reflects strong political will and sets a positive trajectory” for the economic zone's long-term success.

Furthermore, the zone builds on an already strong foundation of economic ties between Johor and Singapore, particularly in sectors such as electronics, logistics and precision engineering, Mr Soh said.

This optimism extends to those in the services and consumer sectors as well.

Malaysian food-and-beverage (F&B) entrepreneur Ewearn Tan took the plunge in February by renting two stalls at a food court in R&F Mall, just several minutes from the border, because she noticed gradually increasing footfall there.

Singapore retail outfit Perky Lash also expanded its operations overseas for the first time to the JB City Centre in March last year. Like Ms Tan, its founder Jasmin Tay said she is hopeful that overall spending in the area would increase as investments pour into Johor.

Then there is the royalty factor as well. Businesses noted that it is advantageous that Johor ruler Sultan Ibrahim Sultan Iskandar, who is also Malaysia's king, is supportive of the special economic zone, too.

CRUCIAL NEXT STEPS NEEDED

However, for all the optimism and interest that the JS-SEZ have garnered, businesses said the zone must do more to address on-the-ground needs, especially if it is to succeed beyond the initial buzz.

Managing director Steven Chiang from Alpine Renewables and Edible Oils said an express lane for business stakeholders and workers in the economic zone is at the top of his wishlist, because it would go a long way in avoiding lengthy delays at immigration checkpoints.

An executive from Singapore-based nuts and bolts manufacturer Chin Yuan Metal, which has operations in Johor, agreed, adding that execution must match intent for the economic zone.

“There is a need to further expedite customs clearance for both goods and people,” its operations director Nathaniel Lin said. “Critical for our competitiveness is obtaining timely approvals for import tariff exemptions.”

Beyond mobility, the issue of incentives looms large.

Mr Peh of GoRental noted that Enterprise Singapore has a Market Readiness Assistance grant to help companies expand into new markets overseas that is capped at S$100,000, but he wishes to see more incentives soon for Singaporean businesses to move into the economic zone.

Other businesses pointed to structural challenges such as labour quotas.

Mr Sky Chong, managing director of precision machining firm New Way Synergies, spoke of the difficulty of adhering to the resident-to-foreigner hiring ratios in Singapore and Malaysia.

Special passes or hiring flexibilities, he argued, would help fast-growing cross-border firms scale up more sustainably.

Manufacturing players also highlighted the infrastructure and policy risks.

Mr Sia from Applied Total Control Treatment said that he had experienced electricity and water outages at least once or twice a year in his manufacturing plant in Penang – a situation he hopes will not be repeated in Johor.

On that front, he believes that steps to prevent such outages, which can be costly for businesses such as his, will be taken.

Mr Lin of Chin Yuan Metal called for more clarity in Malaysia’s licensing and legal requirements, noting that “greater streamlining and simplification ... would significantly benefit manufacturers like ourselves”.

Current tax incentives by MIDA could also be refined to incorporate a graduated income tax benefit system, Mr Chiang from Alpine Renewables and Edible Oils suggested.

Right now, investments above RM500 million qualify for a 5 per cent tax rate. He proposed extending a 10 per cent rate to investments between RM200 million and RM500 million.

Preferential personal income tax rates for expatriate employees of companies based in the economic zone may also help attract top-tier talent, he added.

Finally, Mr Yap Wee Kee, a partner at professional services firm KPMG in Singapore, noted that a recurring concern for Singapore-based businesses is the clarity and consistency of the onboarding and implementation process for the JS-SEZ.

To alleviate this, he suggested the development of an online “step-by-step onboarding guide” that clearly outlines key application procedures, critical milestones and expected outcomes.

“This will enable firms to plan their market entry and expansion strategies with greater confidence,” he said.

Most businesses interviewed said that they are “cautiously optimistic” as they wait for improvements.

Ultimately, the success of this special economic zone would be measured by the scale of foreign direct investment, growth in Johor’s gross domestic product, job creation, population increase and wage gains compared to the rest of Malaysia, Dr Chua the economist said.

“Realising this potential will depend on strong policy coordination, effective execution and continued investor interest.”

%20(5).jpg?itok=zM0TDBYg)