Why Singapore is sitting out the fight for medical tourists in Southeast Asia

Private hospitals and clinics in Singapore are working to stay relevant by expanding across Asia and targeting tourists with deep pockets looking for specialised healthcare services.

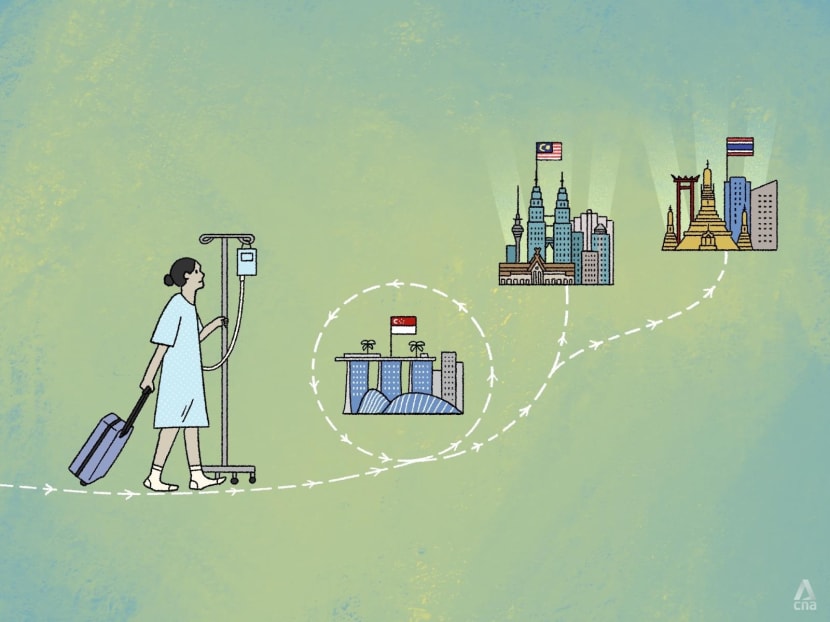

Thailand and Malaysia are more appealing than Singapore to medical tourists who are looking for less costly healthcare treatments. (Illustration: CNA/Nurjannah Suhaimi)

This audio is generated by an AI tool.

Increasingly, a group of well-heeled tourists are choosing to head to Malaysia or Thailand over Singapore.

They are not drawn to these countries simply because of the shopping or food scenes, but rather, for their cost-effective medical services.

Even though Singapore continues to be named among Asia's top destinations for medical tourists, it lags behind Thailand, which has long been a popular destination for these tourists in Asia, and Malaysia, which has boosted its medical tourism industry in the past few years.

Others such as Vietnam are also eyeing a slice of the lucrative medical tourism pie, which market research and advisory firm DataHorizzon Research estimates will be worth US$79.4 billion (S$108.5 billion) globally by 2032.

Medical tourists typically travel overseas for services that are not available, too expensive or not of their desired standard in their home country. These can range from simple procedures such as health check-ups to complex treatments such as for cancer or knee stem cell therapy.

In Singapore, medical tourists are mostly from Indonesia, whereas in Thailand, they are typically from the Middle East.

Malaysia, which positions itself as a halal medical care centre for Muslims, draws most of its medical tourists from Indonesia, China and India.

Malaysia is the only country among the three that has a government agency, the Malaysia Healthcare Travel Council (MHTC), backed by its health ministry, that manages the flow of medical tourists.

Singapore does not have a similar coordinating government body overseeing medical tourists, who are typically patients of private healthcare chains.

Thailand does not have one either, but it has made strides to woo such tourists. Last June, the country introduced a new visa category that allows medical tourists to enter Thailand multiple times for up to 180 days.

About 2.86 million medical tourists visited Thailand in 2023, spending US$850 million. RHB bank reported that the number of medical tourists who visited the country in 2024 is expected to be 3.07 million, a roughly 7.3 per cent increase.

Close behind, Malaysia saw growth of about 26 per cent in medical tourists: About 1.26 million such tourists visited the country between January and November last year, up from about a million in 2023.

In contrast, Singapore shifted away from focusing on medical tourism in the 2010s in the midst of scrutiny that public resources were being disproportionately diverted to serve this patient segment.

Since 2015, it has stopped reporting data on the number of incoming medical tourists and their medical spending, but several market watchers have estimated that the country's medical revenue last year was between S$200 and S$300 million.

Mr Tay Wee Kuang, a senior analyst from financial service firm CGS International, said that the figure could be as high as S$1 billion, based on reported revenue from listed firms IHH Healthcare and Raffles Medical Group.

Both are listed companies that run several hospitals and healthcare facilities in Singapore and around the world. IHH Healthcare has Gleneagles, Mount Elizabeth and Parkway as service providers under its wing, while Raffles Medical Group has a hospital and several clinics under its name.

They and most other private healthcare providers told CNA TODAY that roughly 20 to 30 per cent of their patients are medical tourists. This figure is either slowing in growth or has stagnated over the past five years, they added.

Industry players and analysts said that Singapore’s strong dollar has made medical services costlier for tourists.

This difference is especially pronounced when compared to neighbouring Malaysia and Thailand, where certain services are available at a third of the price.

With medical tourism gaining ground worldwide and analysts foreseeing that it will continue to be a fast-growing sector, is Singapore missing out on a lucrative business?

INITIAL PUSH FOR MEDICAL TOURISM IN SINGAPORE

In 2003, Singapore launched SingaporeMedicine, a multi-agency, government-industry partnership to promote the country as a leading medical hub in Asia and as a world-class destination for advanced patient care.

Led by the Ministry of Health (MOH), SingaporeMedicine was to help achieve a target of serving a million foreign patients yearly by 2012. The target was set by the Economic Review Committee led by then Deputy Prime Minister Lee Hsien Loong.

During SingaporeMedicine’s launch in October 2003, Acting Health Minister Khaw Boon Wan acknowledged concerns at the time that a large volume of medical tourists could push up healthcare costs, because private and public hospitals might fight over medical workers.

Even so, as Singapore improved its expertise, medical resources and air travel network, it solidified its position as a medical hub that was convenient for tourists to visit.

However, concerns about the usage of resources for this sector continued to grow as restructured hospitals faced shortages of beds in 2013.

In a particularly stark example, Changi General Hospital had to set up a tent to house patients during “unexpected surges in demand” in 2013, MOH said a year later. The ministry did not explain why there were surges or if medical tourism was a reason for the bed crunch.

In 2014, Mr Inderjit Singh, then Member of Parliament for Ang Mo Kio GRC, said in a Facebook post: ”I was shocked to discover last year that all our government restructured hospitals are involved in promoting medical tourism around the region. Shouldn’t the services … be for Singaporeans and residents first?”

From 2015 onwards, the Singapore Tourism Board (STB) stopped reporting the number of medical tourists and tourism receipts generated by medical services in its annual data. MOH also clamped down on medical tourism in public hospitals in 2018.

The next year, in response to a parliamentary question about medical tourism receipts from 2015 to 2018, Mr Chan Chun Sing, then minister for trade and industry, confirmed that medical tourism was no longer a part of the country’s tourism strategy.

Most recently on Oct 31, 2023, Health Minister Ong Ye Kung reiterated the negative aspects of medical tourism.

He drew upon a hypothetical example of a country that funds heavy healthcare subsidies through medical tourism. As a result of this policy, he said: “Many top doctors and healthcare professionals preferred to work in the medical tourism sector as that was where the financial rewards were better.

“Citizens began to notice the disparity in service levels between what they were experiencing and what the medical tourists experienced, and were not happy.”

In response to CNA TODAY’s latest queries, the Ministry of Trade and Industry (MTI) said: “Although the market size is predicted to increase, (medical tourism) must be balanced against limited resources.”

MOH told CNA TODAY that between 2019 and 2023, public and private hospitals saw about 18,000 foreign patients a year on average, or about 2 per cent of all inpatients and day-surgery patients.

"Over the last three years, foreign patients who travelled to Singapore to seek medical treatment made up less than 1 per cent of all patients on average, out of the total inpatient and day-surgery attendances at our public healthcare institutions," MOH said, adding that Singaporeans remain the majority of patients treated in public healthcare institutions.

"The priority of our public healthcare institutions is to serve Singaporeans’ healthcare needs, especially given our limited healthcare manpower resources and capacity, and risks of escalating healthcare costs."

COMPETITIVE MEDICAL FEES

Beyond the Singapore government’s decision not to focus on medical tourism, the strengthening Singapore dollar has made it more expensive for tourists to visit for treatments.

Analysts from DBS bank said last July that Thailand’s medical tourism industry grew at a compound annual growth rate of 5.1 per cent between 2019 and 2023. In comparison, Singapore's grew at a rate of 0.4 per cent during the same period.

Dr Beng Teck Liang, chief executive officer (CEO) of Singapore Medical Group Limited, said that about a third of the patients seen by the private healthcare group’s specialised clinics in the past five years were medical tourists, most of whom were from China, India and Southeast Asia.

Rising costs in hospital inpatient fees, medication and accommodation in the last few years has made Singapore less attractive to many medical tourists, he added.

Budget Direct Insurance, quoting figures within the past five years, stated on its website that a knee replacement surgery in Singapore could cost about S$22,000. In Malaysia, the same surgery would cost S$10,000.

Dr Ong Sea Hing, a consultant at private cardiology practice The Cardio Clinic, said that some of his patients have chosen to buy medication from other countries because it is cheaper.

In response to queries, MHTC, the council that manages medical tourism in Malaysia, told CNA TODAY that the country is hoping to draw more medical tourists by enhancing its integrated healthcare offerings, including traditional and complementary medicine such as Traditional Chinese Medicine, as well as enhancing its wellness programmes.

Dr Melvin Heng, group CEO of private healthcare provider Thomson Medical Group, said that the efforts of the council, including extending visa-free travel agreements with countries such as China, have bolstered medical tourism for the group's healthcare facilities in Malaysia.

Without providing figures, he said that TMC Life Sciences, which is part of Thomson Medical Group, has seen “a steady increase in international patients year-on-year”.

He pointed out that another growing medical tourism destination is Vietnam, because the country has continued to pump investments into enhancing its healthcare infrastructure and obtaining international accreditations for medical institutions.

Thomson Medical Group acquired FV Hospital in Ho Chi Minh, which has also seen a “steady stream of medical tourists each year” for its premium healthcare services, Dr Heng added.

Dr Beng of Singapore Medical Group observed that Thailand and South Korea have become more attractive because of advancements in areas such as wellness services or stem cell treatments, noting that in these countries, “guidelines and regulations are less strict compared to Singapore”.

Beyond easing visas and making continued investment into its medical tourism industry, Thailand has 60 medical institutions accredited by the Joint Commission International (JCI), an international not-for-profit healthcare accreditation body.

In comparison, Singapore and Malaysia have around a dozen JCI-accredited medical institutions each.

The marketing executive who lives in Singapore travelled to Bangkok two months ago to have a "Movita Joy" surgery, which uses a fairly new breast implant technology.

“The surgery is still very new, so not many people are certified to do it. Even among those certified, they may have just done a few procedures,” she said, adding that she still wanted to get this particular kind of surgery because it would involve a smaller incision.

She had enquired at first with clinics in Malaysia and Singapore, but each of them told her that they had performed the procedure fewer than 10 times. The clinic in Bangkok, however, had posted more than 50 reviews related to the surgery on its social media account.

“The doctor teleconferences you to see if you’re suitable before you fly to Thailand," Ms Lee said.

"Within seven days, you get one physical consultation, go for the operation, rest and do some shopping and sightseeing if you’re feeling better. Then, you do a check-up to be certified that you can fly back home."

The clinic also video-calls overseas patients every two to three months to ensure that the healing process is smooth. A consultant who can speak English accompanies foreign English-speaking patients throughout their medical treatment so that nothing is lost in translation.

In total, Ms Lee spent about S$10,000 – nearly a third of the roughly S$29,000 figure she was quoted by a clinic in Singapore.

As for 44-year-old Singaporean Serene Soh, the cost savings were worth the hassle of crossing the boarder for a comprehensive health screening in Johor Bahru, Malaysia.

After recommendations by friends and her clients, the financial planner decided to get a full-body check-up last October at Gleneagles Hospital Johor for around RM$1,700 (S$510).

For the same comprehensive test in Singapore, she would have had to pay around S$1,000, she told CNA TODAY.

“Everything was done within the day – from the blood work to the ultrasound scans," she said, adding that she received the results within the same day.

Singapore was the fourth-largest source of medical tourists for Malaysia in 2024, MHTC said.

Several private hospitals there are making it easier for their patients to travel across the Causeway.

Beyond having facilities in nearby Johor Bahru, several hospitals across Malaysia are also Medisave-approved facilities. This is the mandatory Medisave account for Singaporeans under Singapore's Central Provident Fund, which allows account holders to use their savings for selected health expenses.

Ms Chin Wei Jia, group CEO of HMI Medical, said: “This accreditation enables patients to use their Medisave funds for eligible treatments, further enhancing accessibility to our comprehensive healthcare services.”

HMI Medical has several clinics in Singapore and hospitals around Asia, including two hospitals in Malaysia, namely the Regency Specialist Hospital in Johor and the Mahkota Medical Centre in Melaka.

To meet the growing demand for advanced medical care, Regency is undergoing a major expansion that will more than double its capacity, from 218 beds to 500 beds, Ms Chin added.

IS SINGAPORE LOSING OUT?

Temasek Polytechnic senior lecturer Benjamin Cassim, who teaches its diploma course in hospitality and tourism management, noted that medical tourists are often frequent visitors depending on the number of medical services they are seeking, and they often travel with family members.

This means that each medical tourist can bring in quite a substantial amount of tourism dollars.

“Generally, people who travel overseas for medical treatment fall into the middle-income to upper-income levels of the social strata," he added. "There is, therefore, a propensity to spend more on a per capita basis when travelling overseas for medical tourism purposes."

Still, he does not believe that Singapore is missing out entirely. As regional populations are becoming more aware of the importance of staying healthy into old age, his view was that medical tourism on the whole could decline over time.

Furthermore, Ms Selena Ling, the chief economist and head of global markets research and strategy at OCBC bank, said that the constraints in Singapore's hospital capacity and supply of specialists mean that it has to be more selective about the clients it accepts.

It therefore makes sense for Singapore to carve out a niche as being the destination for critical and complex medical care.

Indeed, doctors and hospitals interviewed by CNA TODAY said that medical tourists to Singapore these days are typically seeking more specialised treatments and complex procedures.

Dr Peter Chow, CEO of IHH Healthcare Singapore, said that the procedures include neurosurgery, spine surgery, heart-related specialist care, critical care and proton therapy, which is used in cancer treatments.

“Such a shift should not be viewed as a decline, but rather as an exciting opportunity for us to set ourselves apart by moving into even more highly specialised advanced care that other regional operators are unable to offer,” he added.

Similarly, Dr Heng of Thomson Medical Group said that the group has long attracted medical tourists seeking fertility services, so it has expanded its medical specialities in recent years to offer a range of more complex procedures such as cataract removal and minimally invasive orthopaedic procedures such as knee and even spine operations.

Dr Beng, Singapore Medical Group's CEO, agreed that this shift is not necessarily a loss to Singapore.

“Complex medical cases are typically higher in value and skills requirements and may take longer treatment periods," he said.

"This potentially translates to a considerable amount of spending injected into our economy.”

NEW FOCUS ON WELLNESS TOURISM

In response to queries, STB told CNA TODAY that medical tourism is not part of its growth strategy.

Rather, it has identified wellness as a key trend to drive tourists to Singapore, noting that the global wellness economy was worth US$6.3 trillion in 2023, 25 per cent higher than in 2019.

The wellness economy is projected to reach US$8.99 trillion in 2028, it added.

“In light of this global trend, we believe that Singapore is well-positioned to establish itself as a leading urban wellness haven that prioritises holistic well-being and offers accessible and ‘must-do’ experiences to rejuvenate residents and visitors.

“Thus, we have developed various strategies and initiatives to realise our wellness ambition, leveraging Singapore’s existing strengths in accessibility, technology and as a strong business hub that caters to leisure and corporate travellers.”

Wellness tourism covers a broad spectrum of experiences and activities involving a tourist’s physical, emotional and mental well-being.

Mr Cassim of Temasek Polytechnic said that such activities may include spa treatments and experiences, healthy life-extension programmes, as well as mind- and body-boosting retreats.

The motivations for tourists to travel to Singapore would be different as well: Medical tourists are likely to travel to receive treatment if they are sick, while wellness tourists are driven by their aspiration to lead a healthy lifestyle and boost their well-being, he said.

“Wellness tourism cannot replace medical tourism, but it provides a complementary offering that can diversify Singapore’s tourism portfolio and further enhance the city’s global reputation for health and well-being care,” Mr Cassim added.

STB said that it is growing the wellness offerings in Singapore and these can be enjoyed both by residents and international travellers.

For example, it supported wellness event Glow Festival, a 16-day festival held last July at Marina Bay Sands resort that offered workout classes, meditation classes and wellness talks, among other things.

It also pointed to several new wellness offerings here, Hideaway at New Bahru on Kim Yam Road, which offers a massage and bathhouse, and a water-based flotation therapy space at Dempsey Village.

Last July, STB launched a tender for a wellness attraction at Marina South Coastal Site. The tender was supposed to close on Oct 4 last year, but it has been extended to April 17, 2025.

Mr Tay the research analyst was not so sure that Singapore can compete with other established players in this scene, such as Thailand, known for its plentiful beach resorts with spas, yoga studios and other wellness activities.

“Thailand has positioned itself well in this field. Tourists can go there and get a medical procedure done, then spend some time rejuvenating with their established wellness activities and facilities surrounded by nature," he said.

“Adding in the cost factor, Singapore will need to focus on the niche segment of tourists who are willing to pay a premium.”

To pull off the wellness strategy well, Mr Cassim said that curating personalised relaxation and rejuvenation experiences will be critical.

This means that stakeholders in the tourism industry must aim to complement each other, to curate end-to-end wellness visitor experiences that last throughout a tourist's trip in Singapore.

"Singapore’s ongoing focus on high-quality, unique wellness offerings will ensure that it remains a competitive player in the global wellness tourism market," he added.