Bargain telco prices set to disappear, but consumers may still win as Singapore telcos consolidate

Analysts say the next phase will be shaped less by cheap data and more by innovation, service quality and new digital offerings.

In Singapore, it remains to be seen how the three telecommunications players still in the game – with Simba replacing M1 as one of the trio – will reshape the telco market here in the coming months. (Illustration: CNA/Nurjannah Suhaimi)

This audio is generated by an AI tool.

The moment that analysts have predicted for years has finally arrived: Singapore's telco landscape has come full circle, at least in numbers.

Simba's acquisition of M1 – if approved by the authorities – will leave the market with just three mobile network operators (MNOs), the same number it had pre-2020.

The surprise move was swiftly followed by StarHub's complete takeover of MyRepublic's broadband business a day later, rounding off 48 hours of quickfire consolidations.

Some consumers are worried, recalling the days when Singapore's telco scene was ruled by Singtel, StarHub and M1, and data plans were more expensive.

A few gigabytes cost a premium, and users rationed their mobile data carefully. It was common for people to keep their 3G and 4G networks switched off unless absolutely necessary.

Intuitively, it feels entirely possible that the days of pricey, restrictive plans might return. But experts say that apart from the numbers, nothing is quite the same this time round.

Singapore's fourth MNO Simba, formerly TPG, formally entered the fray in 2020 hailing from Australia without any strings attached to state-owned investment company Temasek Holdings, unlike its other three rivals.

The new kid on the block generated headlines that year when it announced a SIM-only plan that gave customers 50 gigabytes (GB) of data, 300 minutes of local talk time and 30 local SMS for S$10.

To compare prices at the time, Singtel offered a SIM-only 20GB plan with 150 minutes of talk time and 500 SMS for S$25.

M1 offered a 30GB plan with 1,000 minutes of talk time and 1,000 SMS for S$25, while StarHub offered a SIM-only plan with 5GB of data and 100 minutes of talk time for the same price.

Since then, the telcos have been falling over themselves to slash prices, sparking what many analysts called a brutal price war. Singaporeans saw their phone bills shrink even as their usage ballooned.

Add to the mix a slew of mobile virtual network operators (MVNOs), such as MyRepublic and redONE, and the nation with 8,231,200 mobile subscriptions in December 2020 had itself a crowded market, competing in what essentially was a race to the bottom.

In response to CNA TODAY's queries, Singtel Singapore's chief executive Ng Tian Chong said this intense competition "impacted the industry’s ability and willingness to continue important forward investments in newer network technologies around networks, infrastructure, cybersecurity and artificial intelligence."

That the telco landscape is going back to the way it was with just three MNOs is thus unsurprising to the experts who spoke to CNA TODAY.

Maybank analyst Hussaini Saifee noted that most markets in Asia have consolidated to the "sweet spot" of three MNOs from four or five previously.

"Singapore was the only exception to witness consolidation – but that is happening now," he said.

Mr Manoj Menon, founder of research and technology advisory firm Twimbit, observed likewise: "If you look at Indonesia now, consolidation has happened and they have three big players – and they're a big country with 300 million people."

Indonesia's telecommunications industry is dominated by three major carriers – Telkomsel, Indosat Ooredoo Hutchison and XL Axiata – which cover about 98 per cent of the total market share.

"India as well has three big players. It's three for every major market,” Mr Menon said.

In Singapore, it remains to be seen how the three players still in the game – with Simba replacing M1 as one of the trio – will reshape the telco market here in the coming months.

Could this be the end of the cheap data era? Is more consolidation coming? And what took so long for these consolidations to happen in the first place?

WHY THE CONSOLIDATIONS NOW?

Simba's entrance into the market was preceded by a call for proposals for a fourth MNO put out by the Infocomm Media Development Authority (IMDA) in 2016.

The authority said the move would "enhance innovation and competition in the mobile market", and looking back, that goal was certainly achieved.

The wave of MVNOs that rode Simba's tide, some of which were owned by the MNOs themselves, pushed prices lower and contributed to a steep decline in the incumbents' average revenue per user (ARPU) – a key metric in the telephony business that shows how much each subscriber pays to the telcos.

Data from Maybank IBG Research shows that there has been a steady decline in ARPUs for both Singtel and StarHub since 2018. In just five years, telcos have seen ARPUs drop by 30 per cent.

Mr Menon of Twimbit described these figures as "atrociously low" for a developed market.

"That's why consolidation had to happen, because they (the major telcos) have not been able to do anything else to increase their average revenue per user," he said.

ARPU is not the only figure that has been declining.

Maybank's Mr Saifee noted that StarHub's return on invested capital (ROIC) dropped from nearly 20 per cent in the 2016-2017 period to less than 10 per cent today. Other incumbents, he added, have suffered similarly.

ROIC is crucial in the telco business because it shows whether massive capital investments in spectrum, networks and infrastructure are generating returns that exceed the cost of capital. This ultimately determines long-term competitiveness and shareholder value.

Sustaining decent returns requires a degree of "competitive rationality", with consolidation being one way to achieve it, Mr Saifee said.

So what took them so long? Analysts had long warned that Singapore's telco market was too small and saturated to sustain four network operators, let alone a swarm of virtual players.

Hence, when Keppel-owned M1 and StarHub combined to win one of two licences to operate a nationwide 5G network, the expectation was that this partnership would evolve into a merger.

Unexpectedly, it was Tuas – the Australian-listed company that owns Simba – that pulled the trigger and submitted a bid for M1, which Keppel accepted. StarHub CEO Nikhil Eapen kept mum about whether his company, too, had bid for M1 when asked by reporters at a media briefing on Aug 14.

Dr Yao Jingxian, deputy head and senior lecturer of the marketing programme at the Singapore University of Social Sciences (SUSS), said that the pressure to merge did not happen overnight.

"When a new player enters the Singapore market, the number of subscribers each brand has will fluctuate over several years.

"Only when a new market structure stabilises would brands consider mergers and acquisitions for profits and long-term development."

The COVID-19 pandemic also slowed things down, Dr Yao added. With businesses prioritising stability, motivations for mergers and acquisitions were put on hold.

Furthermore, selling a brand’s core business is far from a straightforward process – in this case, Keppel selling M1's telco operations.

Dr Yao said: "They will first need to clarify the new portfolios and strategic priorities after the sale. Hence, the implementation of consolidation takes time as both parties decide on their future business plans."

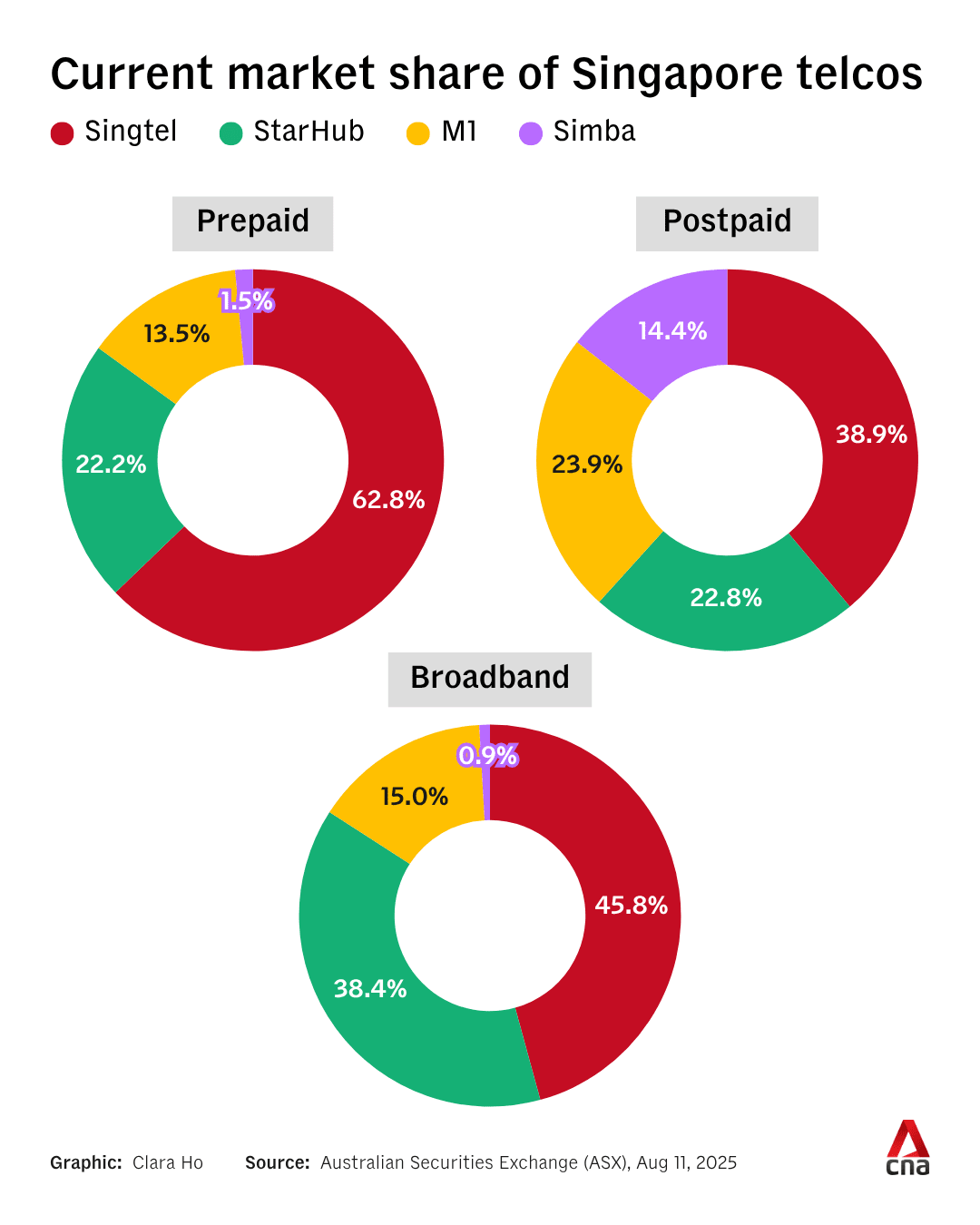

A filing on the Australian Securities Exchange by Tuas last week showed that Simba has the smallest market share in Singapore across prepaid, postpaid and broadband categories.

But its acquisition of M1 will catapult it to No 2 in the postpaid game – just 0.6 percentage point behind market leader Singtel.

Tech industry observer Oo Gin Lee said that this makes the youngest telco here "very threatening".

"In Singapore, postpaid comprises 75 per cent of total lines. So even though Simba and M1 have a smaller market share for the prepaid category, they're still number two overall in the mobile market," he said.

Simba's broadband base is small at about 14,000 subscribers, but it will also take over M1's 223,000 fibre-broadband customers.

Mr Menon said that this instantly makes Simba "a serious fixed-line competitor and positions it as a converged telco".

Mr Oo said that competition in the broadband segment has not been as intense as in the mobile segment, in part because most fibre plans are still tied to two-year contracts, while the mobile market has shifted towards no-contract offerings.

"While Simba is still early in the broadband game here, its legacy as TPG – a disruptive broadband player in Australia – means that the industry is looking at the potential moves it might make to grow market share for broadband in Singapore," he added.

WHAT TO EXPECT IN THE SHORT TERM

Even if the number of MNOs reverts to three, analysts do not expect swift, sudden price hikes in the short term.

Firstly, competition remains intense, and any player who decides to move with a significant increase in pricing risks losing market share, Dr Yao of SUSS said. This is especially so for Simba.

"The recent acquisition might put them under the spotlight, so the brand may refrain from drawing public attention to swift pricing changes and creating a negative, manipulative brand image," he added.

Mr Oo is even more optimistic, saying that there is "no way" the market will return to the old status quo.

"It was the same problem before – the three big guns didn’t fight enough to bring prices down. That’s why IMDA stepped in to introduce a fourth player," he said.

Dr Yao also noted that IMDA's Code of Practice for Competition in the Provision of Telecom & Media Services prevents unfair pricing in several ways.

It has set out provisions that require fair, reasonable and non-discriminatory pricing by dominant entities, and bans anti-competitive agreements such as price-fixing. It also protects end-users from unfair charges or sudden price hikes.

IMDA earlier said that its approval of the Simba-M1 deal would hinge on ensuring competition was not significantly reduced, and that the transaction would benefit consumers while supporting sustainable growth.

Responding to CNA TODAY's queries on how it would ascertain that, IMDA said: "Telcos proposing market consolidations have to demonstrate that consumers' interests are safeguarded and that the outcomes would overall benefit the market and Singapore."

Furthermore, Simba has established itself as a genuine competitor. Mr Oo views Simba – listed on the Australian Securities Exchange – as a maverick in the market, with no government links and a need to prove itself to investors. The firm's decisions are purely commercially driven, he said.

"I'd be extremely surprised if the new trio of MNOs tried to form a cartel of sorts. What is the point of spending so much to build a network from scratch, only to make a deal with the other telcos? It has to show growth to its stakeholders," he added.

With Simba's acquisition of M1, Mr Oo believes that competition will intensify rather than subside.

"They (the telcos) will become even more competitive on all fronts, whether that means offering more value for the same price or lowering their prices."

In the battle to garner more market share in the interim, while the industry awaits IMDA's approval of the merger, more consolidations might even be possible.

Mr Eapen, StarHub's CEO, said on Aug 14 that the company would "continue to put pressure on the market and be aggressive". This includes its own MVNO, Eight, which the company described as "a leader in the market with very compelling offers for people seeking those lower prices".

StarHub did not rule out more acquisitions of its own either.

"We have a strong cash flow, low leverage and a big war chest. We can apply that towards domestic consolidation and we would also apply that to scaling the enterprise business, where we have a very good track record," Mr Eapen added.

"We'll continue to do acquisitions. But we will (only) do acquisitions that are needle-moving in size, that are value-creating and financially accretive.

"We are also open to further small-scale consolidations in the domestic consumer space."

WHAT LIES FURTHER AHEAD

Although price hikes in the short term are unlikely, Mr Saifee of Maybank said that price points of the telcos' offerings "should start moving up, as with almost all the markets in Asia".

Agreeing, Mr Rodney Kinchington, the managing director of Asia-Pacific, Japan and Greater China at global telecom operator BT International, noted that in other markets where consolidation has taken place, there is often a slowdown in aggressive discounting and fewer deep-discount plans.

However, Mr Saifee believes there should not be much pushback to price increases.

This is because compared to markets such as Australia, Hong Kong, Japan, South Korea and Taiwan – which have ARPUs in the range of US$20 (S$25.70) to US$25 – Singapore's ARPU is on the lower side at US$18, Mr Saifee said.

Even if moderately higher prices come to be, Mr Menon said these consolidations will be, on the whole, beneficial for consumers.

"Companies (need) to be healthy, too, so they can create value and better services."

And as telcos adapt to the shifting industry dynamics, technological or product innovations that benefit from larger scales can be expected, Dr Yao said.

That could mean denser 5G coverage, private 5G networks or new bundle offerings that tie mobile plans to streaming subscriptions, gaming passes or digital vouchers.

In response to CNA TODAY's queries, Circles.Life's vice-president of corporate marketing Fabian Sossa said he shares this view, arguing that consolidation would reset the industry's focus on customer experience and innovation.

The company highlighted its own recent launches such as CirclesAI, which gives customers free, unlimited access to artificial intelligence tools such as ChatGPT and Perplexity.

It also has a gaming platform within its mobile application that allows users to play games, create avatars and solve riddles.

Circles.Life, which entered Singapore's market in 2016, is technically an MVNO as it leases network capacity from M1.

The company prefers to be seen as a "digital telco", though, distinguishing itself from price-led virtual operators by running on its own digital operating platform that manages customer onboarding, billing and service – the same system it now licenses to other telcos abroad.

Looking ahead, Mr Sossa said Circles.Life is building new AI-driven features, product partnerships and personalised services to stay ahead of the curve.

Over at StarHub, the telco has already announced its intention to offer streaming of football content from the Premier League to existing MyRepublic broadband subscribers.

In the longer term, consolidation may also accelerate the shift towards what is known as Network as a Service, or NaaS.

Instead of enterprises having to buy and maintain their own networking hardware, they would be able to "subscribe" to telcos' connectivity and network functions on demand, much like how companies already consume cloud computing today.

"Industry analysts estimate this could be an opportunity worth US$100 billion to US$300 billion," Mr Kinchington from BT International said, referring to innovations such as network application programming interfaces (APIs) and edge services.

For corporate clients, that could mean secure cloud connectivity, programmable bandwidth and intent-based networking that can be scaled up or down instantly, without the capital expense of building and running it themselves.

In the end, Singapore's telcos face a challenge that goes beyond price.

"In a country where we pride ourselves on service – from Singapore Airlines to government services – it is time our telcos up their game,” Mr Menon said.

"Can we be that benchmark for an exceptional experience?"

He pointed to South Korea, where telco SK Telecom boasts consistently high net promoter scores. The score, which tracks customer loyalty and satisfaction, is a measure of just how far telcos can go when they make service a priority.

It retained the top spot in the mobile communications category on the country's National Customer Satisfaction Index for 25 years until 2022.

To get there, telcos must move up the value chain and deliver "serious innovation", from AI-driven customer service that anticipates billing problems before they occur, to hyper-personalised apps and niche offerings for gamers, TikTok users or heavy travellers, Mr Menon said.

The price wars may have defined the past decade, but the next will be marked by whether Singapore's telcos can make the leap from cheap data to world-class service – and prove, as Mr Menon put it, that an "exceptional experience" can be their new competitive edge.