Tiger Brokers celebrates a decade of excellence and innovates towards greater growth

Tiger Brokers celebrates its 10th anniversary at Jewel Cloud9 Piazza. Photos: Tiger Brokers (Singapore)

As it commemorates its 10th anniversary, the online broker remains committed to innovation, consistently refreshing its product lineup to meet the evolving needs of its clients.

Homegrown brokerage firm Tiger Brokers has made significant strides in innovation within the financial sector. With one in three people in Singapore having used Tiger Trade, CEO Ian Leong attributes this success to the company’s dedication to revolutionising trading and investment services.

“Since establishing our base in Singapore, we’ve seen a compound growth rate of 539 per cent in local account openings while customer assets have increased for five consecutive quarters,” he shared.

This year marks Tiger Brokers’ 10th anniversary, highlighted by milestones such as the introduction of TradingFront in 2021, a platform for financial advisors to seamlessly manage investments for clients, and the launch of Tiger Fund Management in 2023, which focuses on wealth management.

Tiger Brokers has also expanded its extensive global investment services to Hong Kong, Australia, New Zealand and the United States. While growth abroad continues, Mr Leong is confident of the untapped potential in Singapore – home to more than half of its monthly trading clients and a market of around 2 million investors.

He said: “We’re excited to continue growing in this market and help it flourish through partnerships with the Singapore Exchange to revitalise and enhance accessibility in Singapore’s trading environment.”

HONING A COMPETITIVE EDGE THROUGH INNOVATION

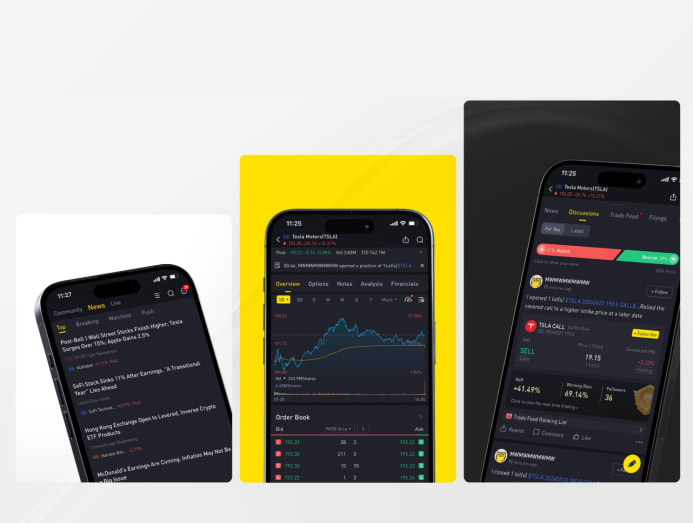

In the last year, Tiger Brokers has launched several groundbreaking offerings tailored to the personal finance habits and needs of its Singaporean audience.

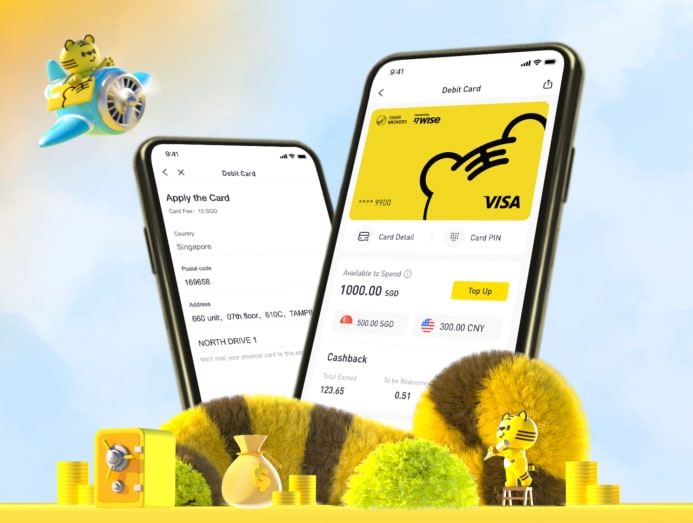

It is the first fintech broker in Singapore to offer a debit card that enables users to instantly earn fractional shares* as they spend. More than 10,000 users have signed up for the Tiger BOSS debit card as of July 2024.

It is also the first to offer contra trading facilities via its Cash Boost account, which empowers clients to trade without needing to deposit the full amount upfront*. “This enables clients to maximise the utilisation of capital while seizing market entry opportunities,” explained Mr Leong.

Furthermore, clients can now link their CDP securities account with Cash Boost and enjoy lower fees compared to other traditional brokers.

As a technology-driven company, Tiger Brokers dedicates 50 per cent of its staff to research and development. Since 2021, the company has boosted operational efficiency and enhanced service standards through advanced backend capabilities and cutting-edge technology.

TigerGPT, an AI-powered chatbot developed by Tiger Brokers to help customers cut through market complexity, received the Singapore Business Review Technology Excellence Award this year. Since its launch, it has facilitated over 400,000 conversations with more than 70,000 engaged users.

ANTICIPATING CUSTOMER NEEDS IN AN EVOLVING INVESTMENT LANDSCAPE

TigerGPT exemplifies the company’s forward-thinking strategy. Mr Leong shared: “We continuously seek tech-driven solutions to anticipate and meet our clients’ future needs.”

The company is taking a proactive approach in addressing global trends shaping the future of investment management. According to Mr Leong, the rise of generative AI is one such trend. “Investors are starting to allocate more into AI-related companies, and they may prefer US equity going forward, as most AI-related companies are listed in the US,” he said.

To meet this demand, Tiger Brokers introduced 24-hour trading for over 9,000 US stocks and exchange traded funds, enhancing flexibility and opportunities for retail and institutional investors.

Another critical trend is the need for robust risk management, given the increasing weight of technology stocks in major market indexes. “High valuations and rapid innovation cycles in tech result in significant price swings, making the market more sensitive to shifts in tech performance,” Mr Leong shared, predicting a shift towards more stable assets such as bonds and money market funds.

In response to Singapore investors’ demand for user-friendly investment management products and one-stop asset allocation solutions, Tiger Brokers has launched a series of wealth management products, including Tiger Vault, US treasuries as well as structured products that are typically available only through banks.

Mr Leong said Tiger Brokers remains dedicated to strategically anticipating its customers’ needs and being at the forefront of financial advancement: “We want to grow into a comprehensive financial institution serving retail, institutional and corporate clients.”

Visit the Tiger Brokers website and learn more about Cash Boost Account and its fees. Download the Tiger Trade app from the App Store or Google Play to begin your investing journey.

*This article is not intended as financial advice. Investments carry risks. Cash Boost Account lets you make purchases using a credit limit, which means you could spend beyond your current funds and potentially incur losses greater than your account balance. Please make decisions based on your own risk tolerance.

Tiger Brokers (Singapore) has partnered with Wise to provide card issuance and account issuing services. Wise is the trading name of Wise Asia-Pacific, which is a company incorporated under the laws of Singapore with unique entity number 201422384R. Wise Asia-Pacific is regulated as a major payment institution by MAS. Licence: PS20200413. Terms and conditions apply.

This advertisement has not been reviewed by the Monetary Authority of Singapore.