Time to level up: Navigating fitness, finance and your best lifestyle

SNACK by Income helps you focus on wholesome living while building your financial portfolio.

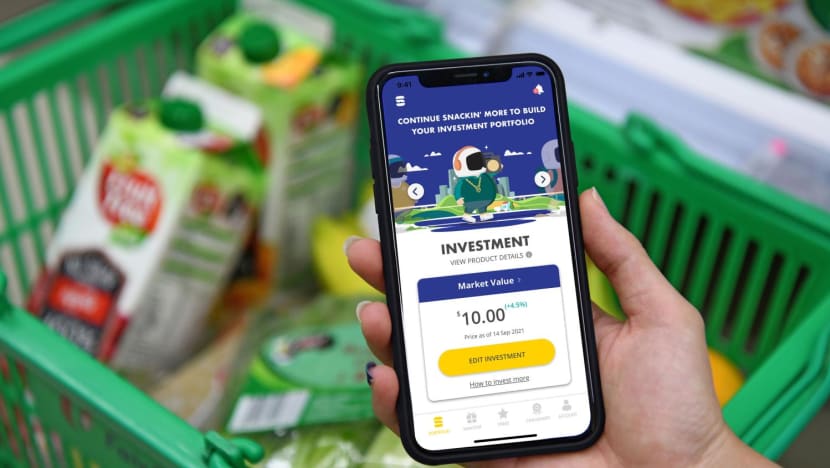

Boost both your investment and insurance portfolios while you carry out everyday activities, such as grocery shopping. Photos: SNACK by Income, Shutterstock

Amid heartfelt reunions and warm conversations this Chinese New Year, our hearts are full and our bellies fuller ... perhaps a little too full, on that latter point.

It may be a good time now to dust off those weights, dig out the gym attire and set in motion your strategy to achieving that toned bod before Christmas comes around.

Alas, time always seems to be the resource most scarce when you’re an adult. How does one juggle long-term goals like fitness and finance while still being able to make time for fun and play?

REDEFINING FINANCE AS PART OF YOUR LIFESTYLE

Fortunately, getting that extra bit out of life can be just a click away.

SNACK by Income is an easy-to-use mobile app that boasts an array of features aimed at adding incremental value to your financial portfolio in correlation with your lifestyle choices.

This one-stop digital finance lifestyle platform helps to beef up your investment portfolio and insurance coverage by automatically purchasing bite-sized investments and insurance policies as you go about your everyday routine. For example, you can buy insurance coverage from as low as S$0.30 when you take the train using an EZ-Link card linked to your SNACK app. This helps you build your insurance coverage incrementally, as you go about your daily activities without having to change your lifestyle.

What’s more, get rewarded with bonus insurance coverage if your biological age is younger than your actual age. SNACKFIT, a feature within the app, analyses your steps, active calories, resting heart rate, sleep hours and body mass index, and acknowledges your level of fitness with extra coverage. That’s great for anyone trying to live healthier and be a bit more active. As long as you’re giving it your best shot and tracking your activities on a Garmin or Fitbit (and soon Apple Health, Samsung Health and Google Fit), you’ll be able to reap gains that go beyond those gotten at the gym.

SNACK doesn’t just offer hacks to level up your life – there’re freebies to be had as well. Get free insurance coverage for every transaction made with a host of SNACKUP brands such as UOB, foodpanda and Fave when you link your Visa card to the app. Yes, you get rewarded just for carrying on with your daily activities, like ordering food delivery and grocery shopping.

MAKING INVESTMENT A PART OF EVERYDAY LIFE

Now that you’ve gotten your insurance settled, it’s time to look into diversifying and boosting your portfolio. It’s not as arduous as it sounds if you use SNACK Investment – a micro investment-linked plan with bite-sized premiums.

The process is simple. Choose the amount you wish to invest – as low as just S$1 per transaction – each time you complete a lifestyle activity. Accumulated investments go towards purchasing units of the Asian Income Fund at the start of each week, the distributions from which are automatically reinvested as you earn them.

As you invest regularly and over a prolonged period, you will naturally reap the benefits of compounding and dollar cost averaging to steadily grow your wealth.

Fortunately, you don’t have to mull over whether to ‘replace’ your existing financial strategies when considering whether to get started with SNACK. Because of its low barrier to entry and its focus on building up micro-investments over time, SNACK is a natural complement to other investment platforms that most financially savvy Singaporeans would be accustomed to.

Perhaps the best part? The platform even affords users the ability to withdraw investments at any time for added flexibility and control over their financial portfolio.

All in all, SNACK gives you the freedom to enhance both your investment and insurance portfolios while you simply carry out activities that you already do on a daily basis. It’s a great lifestyle companion app that seamlessly builds up your investment and protection – and it’s all possible just by living life the way you know best.

Get investment credits worth 20 per cent of every dollar invested, up to S$500, from Feb 28 till Apr 30, 2022.

Promotional terms and conditions apply: bit.ly/si-mp-tncs

Important Notes: bit.ly/si-in

Protected up to specified limits by SDIC.

This advertisement has not been reviewed by the Monetary Authority of Singapore.