Having the resources for a strong economy and society 'not a fairy tale', requires prudence: Lawrence Wong

Singapore must maintain its commitment to set aside enough not just for the current generation, but also for the future, said the Deputy Prime Minister in his closing speech for the debate on the 2024 Budget.

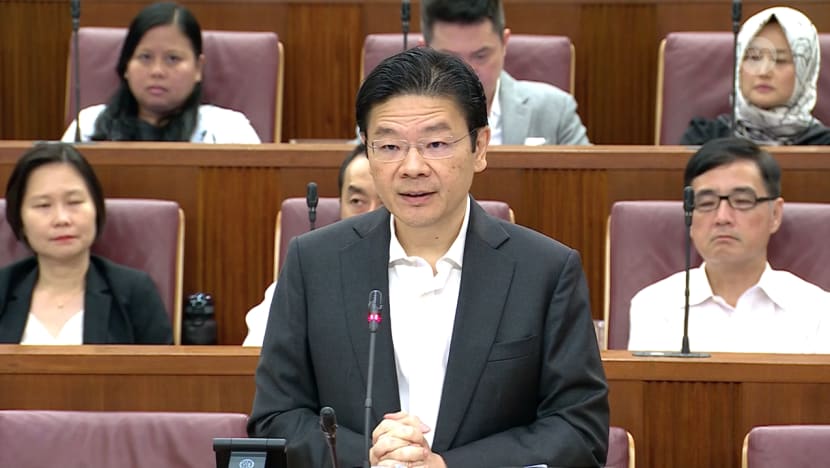

Deputy Prime Minister and Finance Minister Lawrence Wong delivers his closing speech for the Budget 2024 debate in parliament on Feb 28, 2024.

This audio is generated by an AI tool.

SINGAPORE: Having the resources to pursue a strong economy and society is “not a fairy tale”, but Singapore’s reality, which requires a focus on prudence, Finance Minister Lawrence Wong said on Wednesday (Feb 28) in his round-up speech on the Budget debate.

He directed some of his comments toward opposition Members of Parliament (MPs), who may take a “different view of fiscal management”.

“We must continue to plan ahead, do our sums carefully and be upfront with Singaporeans on the cost of various proposals,” said Mr Wong, who is also Deputy Prime Minister.

“This approach of looking and planning ahead is a hallmark of our fiscal policy.”

According to Mr Wong, the opposition wants the government to use more of the reserves for current spending, such as through using revenue from land sales, waiving land costs for public flats and increasing the percentage of the Net Investment Returns Contribution (NIRC).

“What will this mean? Basically, we will end up with less for ourselves in the future, and we will also leave less behind for our children and the next generation,” he said.

Earlier this month, parliament debated a motion calling for a review of Singapore’s Budget and reserve accumulation policies. The motion was brought by Non-Constituency MPs Leong Mun Wai and Hazel Poa from the Progress Singapore Party.

Prime Minister Lee Hsien Loong challenged the opposition to campaign on this issue at the next General Election. An amended motion to ensure the government stays “fiscally responsible and sustainable” was eventually passed.

On Wednesday, Mr Wong said many governments in advanced economies do not have enough money to fund their policies and have to raise taxes. “Their fiscal systems are at risk of breaking,” he said.

Having a version of an independent Budget office – which the Workers’ Party (WP) has proposed – did not help, said Mr Wong.

“No political party in these countries is prepared to dish out the hard truths, so their policy debates are dominated by what some commentators call fiscal fantasies,” he said.

Examples include overly optimistic forecasting assumptions and the idea that all the funds can be raised from the rich with close to zero consequences for the rest of the population. They may also kick the fiscal can down the road indefinitely, he added.

“Let's not indulge in fantasy thinking. Not in this House, not in Singapore,” he said, adding that Singapore is in a unique and privileged position of being able to use savings from the past, rather than having to pay for debts accumulated by previous governments.

“We must maintain our commitment to set aside enough not just for ourselves, but also for the future. So I call on everyone in this House, let's commit to upholding these values.

“Fiscal responsibility, discipline, ensure that our fiscal system meets the needs and aspirations of both current and future generations of Singaporeans,” Mr Wong said.

He repeated Mr Lee’s challenge to make drawing more from Singapore’s reserves an election issue.

“The PAP will join issue with you, we will present our case to Singaporeans, and ultimately, Singaporeans can decide what is the best fiscal approach to take Singapore forward.”

Workers' Party MPs and Progress Singapore Party NCMPs did not respond directly to the challenge.

USING SINGAPORE'S RESERVES

Leader of the Opposition Pritam Singh (WP-Aljunied) raised clarifications after Mr Wong’s speech, and argued that calling for more information from the government is part of how the opposition tries to understand fiscal prudence for Singapore.

“I would be cautious to suggest that the opposition essentially just wants to dig into the reserves, because we do think about the financial prudence question quite carefully,” said Mr Singh.

In response, Mr Wong noted that WP previously objected to the GST increase, calling for Singapore to dig into its reserves to meet its needs.

But now, WP has accepted the GST increase to 7 per cent, he said, asking if Mr Singh’s party will also accept the increase to 9 per cent as reality.

The Deputy Prime Minister also asked if this would mean that WP’s proposals to use more of Singapore’s reserves “are therefore no longer relevant”, and that the party is “fully consistent” with the People’s Action Party (PAP) in terms of the use of the reserves.

Mr Singh said the opposition makes proposals based on the information available to them at the time. It has no insight into how the government spends money to fund policy objectives, so it cannot make any promises on committing to raising revenues.

“I think the vision or whatever is before the Workers’ Party … (is) we’ll have to work with the information that we have. We are not in government. And if it means that we have to look at all options, we will look at all options.”

Mr Wong said under former WP chief Low Thia Khiang, it was very clear that both the ruling party and WP held the same ethos of fiscal responsibility.

“It seemed to me that this had changed under Mr Pritam Singh,” he said.

He said WP is free to change its position but the PAP would not shift from fundamental principles even if policies changed.

“This must never be compromised. This must never change. These principles were put in place by our founding leaders. They have continued under successive leaders of the PAP and they will certainly continue under my watch,” said Mr Wong.

Mr Singh said he has heard such statements before in this House.

“I do agree with the Finance Minister. Policies change. A PAP government yesterday would return the money that it has used from the reserves as a matter of principle. But today a PAP government may not return the money it uses from the reserves. That's my response.”

NO NEED TO RAISE GST FURTHER UNTIL 2030

In response to a question by Ms Poa, Mr Wong said there will be no need to increase Singapore's Goods and Services Tax (GST) further, at least until 2030.

GST increased by 1 percentage point per year in 2023 and 2024, bringing the rate to 9 per cent presently.

"We have closed the funding gap up to 2030," he said.

The Ministry of Finance published a paper in 2023 stating that government spending stood at around 18 per cent of GDP, and is expected to increase and potentially exceed 20 per cent of GDP by the financial year 2030.

Singapore's revenue was around 18.5 per cent of GDP and would not be enough to cover the expected increase in government spending. The GST increase announced in Budget 2022 is meant to help pay for expenses in the coming years.

Mr Wong said there would be updates on a rolling basis, from time to time.

"Post-2030, we'll have to see what the picture is. And beyond that, we'll have to see if indeed there is a funding gap, if there are increased expenditures and whether or not additional revenues or tax changes are needed," he said.

"But as of now, up to 2030, we are in a sound position."