commentary Singapore

Commentary: Infant milk formula needs fair pricing and appropriate marketing

Providing more choices and ensuring the availability of accurate information is key to protecting the rights of consumers - in this case well-meaning parents who want the best for their young children - argues MP Sun Xueling.

Prices of formula milk sold at a supermarket in Singapore in 2017. (Photo: David Bottomley)

SINGAPORE: While we actively promote breastfeeding as the safest and most nutritious way to nourish young children, mothers do rely on infant formula at times to supplement. The latest national breast feeding survey in 2011 shows that 96.1 per cent of mothers breast feed their babies to some extent right after delivery but this number drops to 41.6 per cent six months after delivery, which indicates that many babies rely on infant milk formula either exclusively or partly for their nourishment.

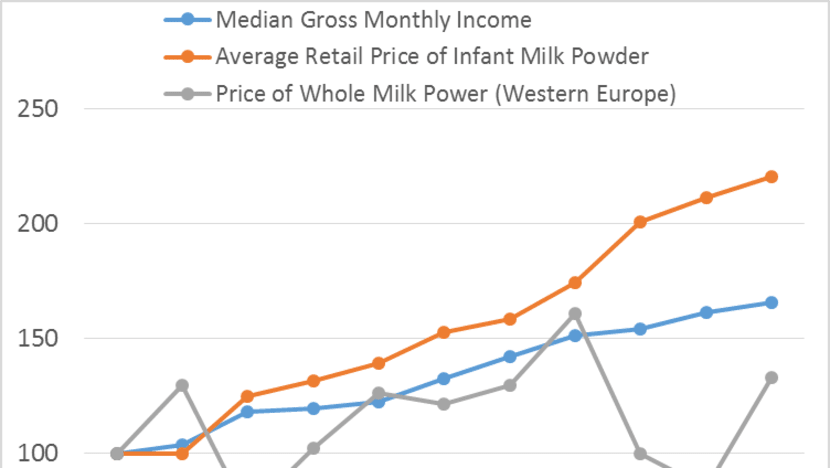

A standard can of 900 grams of infant formula purchased from a regular supermarket costs about S$56 on average, compared to S$25 in 2007. The price of infant formula has thus risen 120 per cent over 10 years, nearly twice as fast as nominal median incomes in Singapore, which rose 65.6 per cent over roughly the same period, placing a greater strain on household expenditures.

Based on an online survey I conducted over three days, which over 2,500 respondents completed, parents with children younger than a year old spend about S$191 per month on infant milk formula on average. This represents 15.4 per cent of household expenditure on food for young families.

Infant milk formula is thus not a small item of expenditure for young families.

IS THE PRICING OF INFANT MILK FORMULA FAIR?

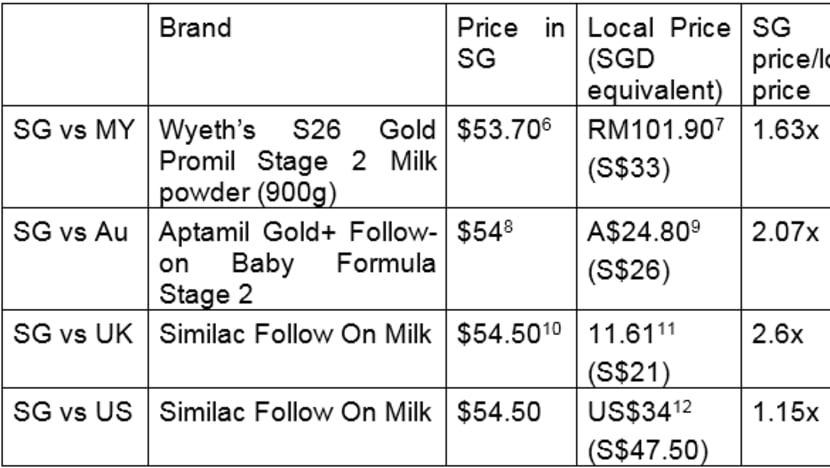

A check on prices for similar cans of infant formula in Malaysia, Australia, UK and the US shows that a similar can of infant formula in Singapore costs 1.63 times the cost in Malaysia, 2.07 times the cost in Australia, 2.6 times the cost in the UK and 1.15 times the cost in the US, based on prices on websites at point of checks.

While one may argue, for instance in the case of Malaysia, that business costs are generally higher in Singapore, regular milk sold in Singapore only costs 34 per cent more compared to Malaysia. Yet Wyeth’s S26 Stage 2 infant milk powder costs 63 per cent more in Singapore compared to Malaysia.

Why has the price of infant formula risen so much?

The explanation provided by major infant formula suppliers seems to point to efforts into research and development (R&D) for infant formula.

A check on a similar can of infant formula from Malaysia and from Singapore also shows slight differences in the ingredient mix.

Does the difference in the quantity of ingredients added to whole milk powder (for instance, cow’s milk) which then constitutes infant milk formula account for the higher prices of infant formula charged in Singapore?

Has the formulation been changing consistently over time to warrant the repeated price increases in Singapore?

And as to the R&D cited by major infant formula suppliers in Singapore, are the requirements of the Singapore market so different that R&D specific to Singapore is needed to warrant the sustained price increases in Singapore?

CONCENTRATED INFANT FORMULA MARKET IN SINGAPORE

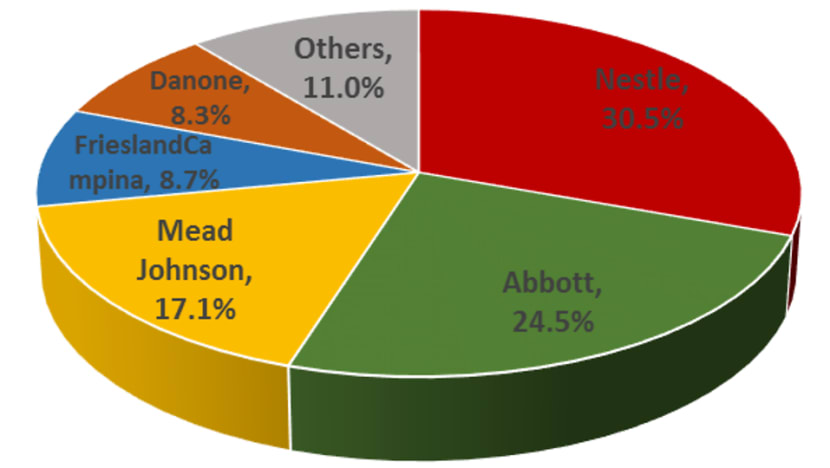

Infant formula worldwide is dominated by five suppliers - Nestle, Abbott Nutrition, Groupe Danone, Mead Johnson Nutrition and the Kraft Heinz Company, accounting for about 60 per cent of the global market .

The market is likely to be even more concentrated in Singapore, as based on my survey of 2,508 respondents conducted over three days, the top five suppliers in Singapore accounted for 89 per cent of the market. Other surveys suggest the market concentration in Singapore is even higher.

Interestingly, the other market that shows a high degree of concentration is the US, where the top four suppliers account for 92 per cent of the market in 2015. The US also shows high prices for infant milk formula.

The high price of infant milk formula in Singapore could thus be related to the large market share the major suppliers of infant milk formula have here.

To encourage more competition, Senior Minister of State Koh Poh Koon said in Parliament yesterday that the Government will simplify and streamline import requirements as well as remove unnecessary barriers to entry in order to bring in more options for parents without compromising food safety. Further, more infant formula options will be made available in hospitals.

With more choices of infant milk formula available to consumers, more sources of supply and hence greater competition in the market, prices over time should level out.

PARENTS’ MINDSETS ARE UNDERSTANDABLE

Parents want the best for their children. They are willing to spend on good-quality infant formula because infant formula constitutes the sole source of nutrients for their young child if breast milk is not available.

Further, infant formula is a short-term spending item. Young parents expect to spend on infant formula until their child becomes capable of consuming solid foods. As a result, they are willing to incur high expenses in the short term to buy good quality infant formula.

These pre-existing mindsets of parents, which are understandable, logical and well-meaning, create a conducive environment for suppliers of infant formula, who can use this to their advantage.

I look forward to the Competition Commission of Singapore’s findings later this week on the market structure of infant formula in Singapore and the behaviour of the market's main. This should shed light as to whether there is anti-competitive behaviour. We need to ensure that the interests of parents and, indirectly, the interests of young children are being taken care of and not taken advantage of.

ETHICAL MARKETING OF INFANT FORMULA IN SINGAPORE

A survey respondent left a comment on my Facebook, which is worth highlighting:

My boy of seven months is already drinking 250 millilitres and the price of FM (infant formula milk) is taking a toll on us. I believe that the brand of FM is priced not in terms of just the brand but the quality and research behind it. As a mother, I want to give my baby the best even if it’s taking a toll on us … Some say no money buy cheaper brand, it’s all the same … No! I will try to give my baby the best! And what’s good for his health!

Parents want the best for their child and they are afraid to short-change their child. Such mindsets open them up to being taken advantage of if they are not careful.

Any shopper to a supermarket in Singapore will observe that within an array of infant formula brands, certain brands aggressively market improvements in IQ that accompany the consumption of their infant milk powder. This improvement in IQ is purportedly a result of the addition of certain special ingredients in their infant milk formula.

The interesting use of mortar boards in advertising also sublimely reminds parents to purchase infant formula that helps their child get ahead academically.

As Senior Minister of State Koh Poh Koon shared in Parliament on May 8: “While some infant formula companies give the impression that their particular brand of milk or milk powder can do more for children, the scientific evidence for this is weak.”

It is thus timely that the Health Promotion Board’s Sale of Infant Food Ethics Committee is supporting an ongoing review to extend coverage of the code of ethics restricting advertising, marketing and promotion of infant formula to all infant formula for up to 12 months of age. The standards in Singapore should be in conformity to international standards on ethical marketing.

HELP FOR LOW-INCOME FAMILIES

In the meantime, help is needed for low-income families who may face difficulties purchasing infant milk formula for their young children. The S$1.5 million milk fund scheme launched by NTUC Fairprice and the five CDCs (Community Development Councils) in February, which will benefit up to 7,500 children from low-income families is timely.

With its disbursement in S$20 denominations to a total of S$200, the NTUC vouchers could potentially offset 40 per cent of the cost of a tin of milk powder with each purchase. And assuming a young child consumes about three tins a month, the vouchers will help a family for three to four months, a significant period in the development of a young child, before he or she can consume solids.

Parents want the best for their children. While we continue to advocate breastfeeding as the best form of nutrition for young children, infant formula acts as a supplement to breastfeeding in some cases, or as the sole source of nutrients in others.

Providing more options to parents and ensuring the availability of accurate information is thus key to ensuring fair pricing and appropriate marketing of infant milk formula. The rights of consumers, in this case well-meaning parents who want the best for their young children, should be protected.

Sun Xueling is a Member of Parliament for Pasir Ris-Punggol GRC.