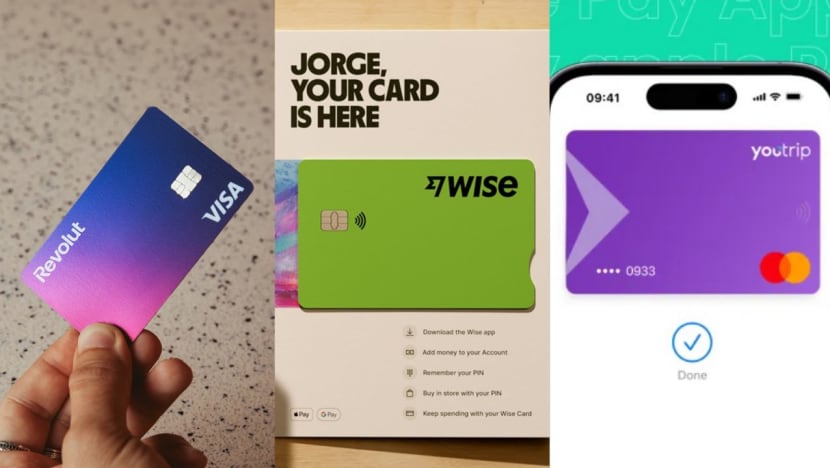

Revolut, Wise, YouTrip: What you need to know about multi-currency e-wallets in Singapore

What's the difference between Revolut, Wise and YouTrip? How do these multi-currency e-wallets secure their exchange rates, and are there risks in using them?

Multi-currency cards have grown in popularity in Singapore. (Photos: Revolut, Wise and YouTrip)

This audio is generated by an AI tool.

SINGAPORE: Multi-currency mobile wallets are increasingly popular with travellers, mainly due to their convenience and exchange rates which are usually better than those of traditional banks or moneychangers.

Besides less favourable exchange rates, consumers using credit cards overseas also have to pay a foreign transaction fee of around 2 to 3 per cent.

Revolut said its active users have almost doubled year-on-year since it launched in Singapore in 2019. YouTrip said one in five Singaporeans now use their service. Both companies declined to provide exact user numbers.

As Singapore gears up for the year-end travel period, CNA looks at three popular multi-currency wallets in Singapore: Revolut, Wise and YouTrip. How do these companies secure better exchange rates and how risky is it to leave your money with them?

HOW DO THE APPS WORK?

Revolut, Wise and YouTrip allow users to hold different currencies in their e-wallets. A user in Singapore might keep Singapore dollars in the wallet and exchange it for US dollars, for example.

The app will show you the exchange rate and relevant fees before you make the transaction, and both currencies will then be stored in the same wallet. Revolut and Wise charge a fee each time you convert a currency.

If a user runs out of US dollars for a transaction, other currencies in the wallet will be converted to US dollars to make payment.

Wise wallets can store 40 currencies, while Revolut and YouTrip can hold 33 and 10 currencies respectively. But users can spend in more than 150 currencies, with the conversion done on the spot instead.

All three apps have a wallet limit of S$5,000 because of regulations by the Monetary Authority of Singapore (MAS). That limit will be raised to S$20,000 by the end of this year.

Users can also send money to friends and withdraw money at overseas ATMs, with each company offering a different amount of free withdrawals before a fee applies.

YouTrip does not allow transfers out of the wallet to a bank account, but Wise and Revolut do.

FAVOURABLE EXCHANGE RATES

High transaction volumes and more efficient operations are among the reasons why multi-currency apps have an edge.

In an interview with CNA earlier this year, YouTrip CEO Caecilia Chu said the foreign exchange rates that the company offers have improved since they first launched around five years ago.

“When our volume goes up, we also get better FX (foreign exchange) rates, and over time we opened that up to our users,” she said.

Ms Ashley Thomas, head of strategy and operations at Revolut Singapore, said the company tries to be more efficient and offer the “best possible pricing” for users.

“Revolut's mobile-first platform means consumers benefit from lower fees as a result of the reduced costs of labour associated with physical operations,” she said.

Mr Tan Kiang Khiang, course chair for Singapore Polytechnic’s diploma in banking and finance, said this applies to the other digital-only companies as well.

“They have (a) leaner setup than traditional banks. Hence, their cost of operations is lower,” he said.

These companies may also maintain pools of currencies in different countries so that cross-border transactions would not require actual money transfers, where fees and exchange rates would apply, he said.

Dr Wang Xin, an assistant professor from Nanyang Technological University, said offering good exchange rates can be a marketing strategy to attract customers. “Those payment apps earn money from merchants and through investing customer funds, not the currency exchange fees.”

CAN BANKS COMPETE?

Banks can use some of these strategies, and local banks do have multi-currency accounts where foreign transaction fees don’t apply, but the exchange rates are still usually not as good.

For example on Friday (Nov 24), the exchange rate for Singapore dollars to Japanese yen on YouTrip was S$1 to 111.5 yen, which is close to the rate shown on Google. The rate offered by DBS was 110.34 yen.

“While banks can also access these (wholesale currency) markets, their higher overhead and diverse business interests may hinder their ability to negotiate favourable rates as effectively,” said Mr Lee Yen Teik, a senior lecturer of finance at the National University of Singapore (NUS).

“Even without explicit fees, banks may still apply markups to their exchange rates, effectively increasing the cost for customers.”

Banks may be slightly more secure than multi-currency apps, but the difference is minimal, experts said.

“Cybersecurity risks are inherent in digital services, even for well-established banks,” said Mr Tan of Singapore Polytechnic. Consumers should practise cyber hygiene and minimise the amount held in their wallets.

“If you were to use these money-changing apps and put money into the e-wallets, make sure that it is only enough for the purpose and do not over-commit and leave excess cash amount in the e-wallet,” he said.

Mr Lee of NUS said potential drawbacks for users could include reliance on technology, which could cause problems if connectivity is bad.

Physical moneychanger shops still have a role to play, though they need to embrace technology to stay relevant, he said.

“Traditional moneychangers endure by providing convenience for small cash transactions, personalised service through face-to-face interactions, and the tangible experience of exchanging physical currency notes.”