The Big Read in short: What ails the car-sharing industry and is regulation the answer?

In Singapore, car-sharing has seen steady growth only in recent years, especially after the Covid-19 pandemic subsided and COE prices continued to soar.

SINGAPORE — When Certificate of Entitlement (COE) prices hit six figures last year, Mr Muhammad Aiman had no choice but to turn to car-sharing after scrapping his vehicle at end of the COE's 10-year validity.

Now, the 43-year-old security supervisor relies on the service almost every day to ferry his family around. With no COE to pay for, the point A-to-B car-sharing is exactly what he needs.

Even though Singapore’s public transport system is known to be efficient and covers almost every part of the island, Mr Muhammad Aiman, a father of three who wanted to be known only by his first name, sees a car as a necessity, not a luxury.

Given his heavy dependence on car-sharing services, he was most affected by the recent glitch in the BlueSG app, which saw many users experiencing difficulties in ending their rentals and chalking up exorbitant rental fees.

“The recent (disruption) has been very disappointing. It's been almost a month, and the issue is still not resolved,” he told TODAY.

Still, having enjoyed the benefits of car-sharing, Mr Muhammad Aiman expects to continue using the service owing to his needs and responsibilities as a family man.

Given the current situation, is car-sharing, which started here in 1997 and but expanded rapidly only in recent years, a boon or bane for land-scarce Singapore which has a zero-car population growth policy to manage traffic congestion?

WHY IT MATTERS

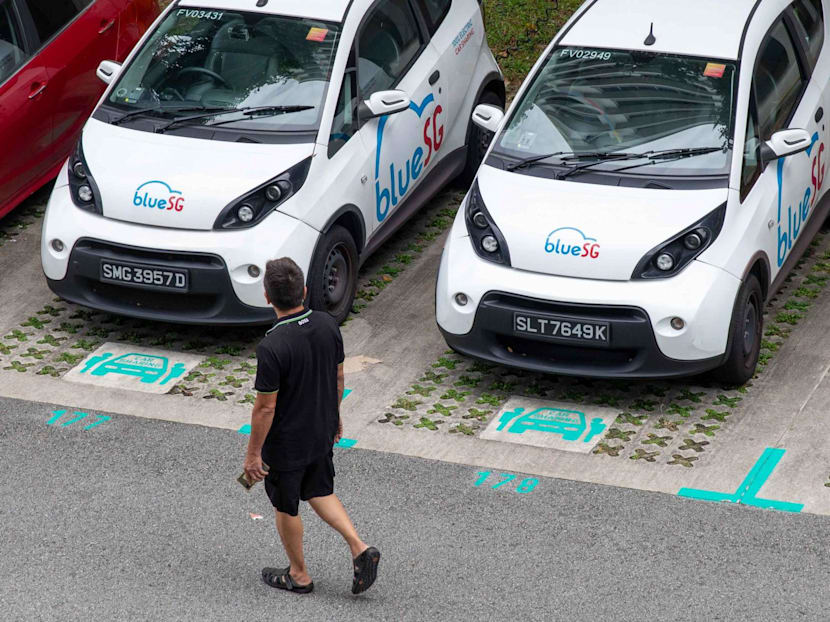

Today, the car-sharing landscape in Singapore is driven by various major players such as Tribecar, BlueSG, and GetGo, along with smaller outfits like Shariot, Car Lite and Drive Lah.

Technological advancements, particularly the use of mobile app-based platforms and connected car systems, have played a crucial role in the growth of car-sharing services in Singapore, transport analysts told TODAY.

According to global data gathering platform Statista, revenue in Singapore’s car-sharing market is projected to reach S$245 million this year.

With the annual growth rate estimated at 6.23 per cent, this means the market volume could grow to S$311 million in 2028.

However, rapid growth and higher usage have led to a sharp rise in consumer complaints against the car-sharing companies.

Numerous accounts circulate about users being slapped with costly bills, often exceeding thousands of dollars, from the operators, occasionally following minor incidents.

An incident reported in November involved a user being billed S$9,200 for a low-speed collision that led to two damaged vehicle plates.

The Consumers Association of Singapore (Case) received 127 complaints related to the car-sharing industry last year, up from 48 in 2020.

Case President Melvin Yong told TODAY these generally involved:

- Disputes over excess charges or unauthorised charges due to alleged pre-existing defects in shared cars

- Challenges in cancelling subscriptions after auto-renewal

- Poor customer support and dispute resolution process

THE BIG PICTURE

The quality of customer service is a common concern raised by users TODAY spoke to. Other uses have taken to online forums to discuss the high insurance excess they are liable for, ranging from S$1,000 to S$10,000.

Insurance excess refers to the amount of money that an individual must pay out of their pocket before their insurance coverage kicks in to cover the remaining costs of repairs due to accidents.

Crane operator Padma Shanmugam, 45, told TODAY that he was frustrated with the response time of car-sharing firms, as it could take hours before a customer service officer answered his call.

“I had a problem once where I was in a rush, but I couldn’t start the car. And my rental was ongoing. In the end, I had to call customer service, and it took hours to end my rental because I couldn’t stop it on my end."

Database administrator Gary Real, 57, had the same gripe, albeit with a different company. “Sometimes, the vehicles I booked have software issues, but there's no customer service attending to your calls," he said.

A financial analyst, who wanted to be known only as Jim, stopped using a car-sharing service in mid-2023 after getting billed an invoice of S$2,900 over a minor collision.

Stressing that the company needed to improve its customer support, Mr Jim said he had sent an appeal to the company but received no response, so he had to foot the bill in the end.

Leftover trash and pre-existing defects are also part and parcel of the car-sharing experience. However, consumers like Mr Jerrold Koh have come to accept that there might be a lack of user effort in maintaining cleanliness, but said he has not experienced any major issues so far.

A logistics driver, who wishes to be known only as Hafiz, said that despite the known problems plaguing the service, he is not deterred from using it.

The 42-year-old said his primary concerns when using a shared car are avoiding unnecessary trouble.

“Report any minor dents or scratches, no matter how many pictures you have to take, because it safeguards us from getting blamed for the things we didn't do,” he said, adding that it would be best to keep the photos for at least a year from the rental date in case any disputes arise.

In response to these concerns, GetGo and Tribecar said they provide a 24/7 live chat and hotline for accident cases and vehicle maintenance issues.

BlueSG, which also offers the same round-the-clock customer support, acknowledges recent service lapses and is currently in the midst of expanding its customer service team.

The firms told TODAY that insurers determine liability, as they have a better understanding of how to investigate accidents.

Transport analyst Terence Fan from the Singapore Management University (SMU) noted that car-sharing rates are typically lower than traditional car rental rates, as operators anticipate multiple users.

However, operators cannot guarantee constant car utilisation. They also do not have the luxury of surveying costs at different workshops before opting for the most cost-efficient one and may thus charge a standard, higher rate for repairs instead.

THE BOTTOM LINE

Amid rising complaints, Mr Yong of Case wrote in a commentary on the consumer watchdog's website in August calling for three major changes to be implemented to improve the car-sharing experience for users.

These comprise a mandatory maintenance regime, transparency on terms and conditions, and a clear dispute resolution process.

Calls for regulation can also be seen online whenever disgruntled users post about their negative car-sharing experiences.

One comment on online forum Reddit said: "The model is (based on) economy of scale. More cars on the road means higher revenue.

"They don’t have to maintain the vehicle to a certain standard, (as long as) can turn on the engine (it) means (the car is) fine and because downtime means money lost... The Government should really regulate car sharing."

Motoring writer Ben Chia also suggested in a TODAY commentary that while most car-sharing companies claim to have a regular maintenance schedule for their fleets, the enforcement of an industry-wide practice is necessary to ensure consistency.

Asked about the need for regulation of the industry to minimise these complaints, Mr Saktiandi Supaat, chairperson of the Government Parliamentary Committee for Transport, expressed caution with this approach.

With car-sharing having an important role in Singapore’s push towards a car-lite society, he said that there has to be a fine balance between having regulation and legislation and ensuring a more competitive car-sharing sector.

“Once you start regulating, there will be cost issues as costs might go up. Meanwhile, issues such as safety and technology glitches would need to be addressed on the legislative side.

“We do not want to be a system where everything needs to be regulated or legislated,” said the Bishan-Toa Payoh Member of Parliament.

Associate Professor Walter Theseira from the Singapore University of Social Sciences agreed that it is worth looking into whether the industry should implement a code of practice or set of industry standards for consumer protection.

“However, the industry cost structure, prices, and competitiveness may be affected if some consumer protection issues are addressed,” he said, echoing Mr Saktiandi’s sentiments.

In response to TODAY’s queries, including on whether there is a need to regulate the car-sharing firms in some form, the Ministry of Transport and Land Transport Authority said in a joint statement that they are working with operators to improve infrastructure, such as the availability of parking lots, to support users of car-sharing services.

The authorities noted that as with all fleet operators, car-sharing operators are responsible for ensuring that only vehicles meeting roadworthiness standards are deployed on the roads.

“The majority of vehicles used by car-sharing services are registered as self-drive private hire cars, and are subject to similar inspection regimes as private vehicles," they said.

“As private companies, car-sharing operators have to ensure that the quality of their platform and service standards are attractive to customers.”

CLARIFICATION: This article has been updated to reflect that it is accident liability and not insurance excess charges that is determined by insurers.