Growing comfort with debt as more young Singaporeans use 'buy now, pay later' service for daily spending

While some view "buy now, pay later" services as a way to finance large purchases such as renovations or weddings, others are increasingly using them for smaller, everyday items, which experts say could lead to excessive spending and spiralling debt if these expenses are not well-managed and closely tracked.

(Illustration: CNA/Nurjannah Suhaimi)

This audio is generated by an AI tool.

Sitting in her cosy resale flat, Clare Chen, 36, shudders at the memory of the “dark times” she endured last year while trying to meet the substantial costs of renovating and furnishing her recently acquired home.

During that financially draining period, she was relying heavily on a “buy now, pay later” (BNPL) service to ease the immediate strain of these big-ticket purchases.

Having spent most of her savings on the renovations, Ms Chen struggled to afford items such as a television, washer, dryer, bed and oven with her salary as a communications manager.

She found that using BNPL to spread the payments over 12 months without interest fees made these expenses manageable.

Still, even this option ended up taking a heavy toll. From July to September last year, she was paying S$4,200 a month for nine concurrent BNPL instalments, which was about 90 per cent of her take-home salary.

“With my savings drained, I was actually pretty desperate back then. To manage, I cut out all non-essential spending. I also stopped dining out and meeting friends,” she said.

Other consumers are using BNPL for smaller purchases in a trend that worries experts who are concerned over the erosion of good spending habits and financial discipline.

Ms Sandra, a 23-year-old student, began using BNPL in November 2023 to take advantage of platform-exclusive vouchers and purchase items at discounted prices.

For instance, one voucher gave her S$10 off her next purchase paid with BNPL, which incentivised her to continue using the service.

But soon Ms Sandra was relying on BNPL for most of her food and transport expenses, maxing out the monthly limit of S$500 set by the BNPL provider.

Ms Sandra, who withheld her full name to keep her spending habits secret from her parents, said that at first, she had a spending limit of S$300 per month, which she had to pay off at the beginning of the next month.

“Because I spent regularly and always paid on time, my limit increased to S$500 after a month or two. Around that time, I also started an internship, so I started spending even more,” she said.

“The convenience of BNPL made it easy to justify spending on food deliveries and rides. I thought it wasn’t a big deal since I was earning money from my internship.”

By June last year, Ms Sandra realised she was consistently maxing out the S$500 limit – about half of her internship salary – every month, mainly on food and private-hire rides.

Ms Chen and Ms Sandra’s experiences highlight not only the rise of BNPL as a payment method but also a broader mindset shift in how younger people approach spending.

The practice of spreading out payments – once reserved for big-ticket items and familiar to older generations through paying credit card instalments – has now expanded to include smaller, everyday expenses.

Experts CNA TODAY spoke to said the rising preference for instalment-based payments marks a shift toward stretching one’s salary rather than strictly living within one’s means.

Younger generations like Gen Zers and lower-income groups are more inclined to adopt BNPL services, they added.

Statistics bear this out: Payment processing firm Worldpay’s 2024 report showed that 77 per cent of Gen Zers in Singapore used BNPL, the highest percentage among all age groups.

It was 47 per cent for millennials, 28 per cent for Gen X, and just 13 per cent for baby boomers.

Market research firm Euromonitor International reached similar findings. Its senior analyst June Lau said BNPL’s primary target groups are students and recent graduates with annual incomes under S$30,000 (US$21,970).

BNPL offers an easily accessible source of credit for younger consumers who may not have credit cards yet, she added.

On the trend of using credit to stretch one’s income, Mr Bryan Tay, Singapore country manager at loan matching platform Lendela, said younger demographics, particularly Gen Z and younger millennials aged 28 to 35, see credit as a way to cope with cost-of-living pressures.

This trend is also seen in markets such as Hong Kong and Australia, he added.

BNPL aside, Lendela's data showed a rise in borrowing among middle-class millennials earning between S$48,000 and S$84,000 annually. Their share of total applications increased by 18 per cent between 2022 and 2024. Meanwhile, the share of applications from millennials earning over S$84,000 saw a 30 per cent rise during the same period.

These were primarily driven by cost-of-living-related expenses, such as household expenses and credit card debt.

“This may suggest a growing comfort with leveraging credit as a financial tool, but it also reflects the challenges younger Singaporeans face in managing finances amidst stubborn inflation, stagnating wage growth, and rising costs for families,” he said.

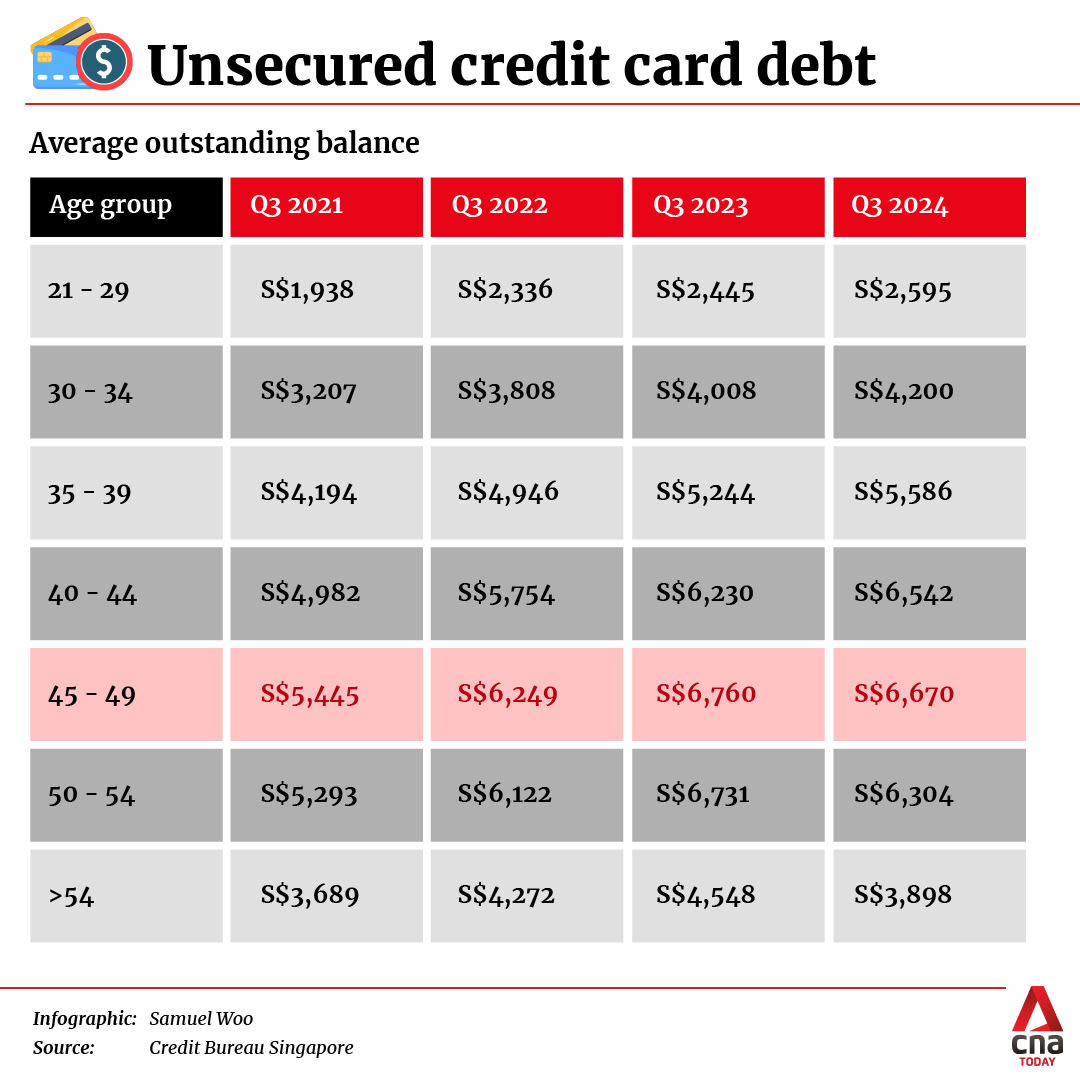

With credit cards, Singapore users in their forties and fifties often rack up the highest amount of debt, according to Credit Bureau Singapore. In its latest quarterly report on consumers’ credit behaviour, those aged 45 to 49 had the highest outstanding balances at S$6,670, consistent with previous years. This relates to unsecured credit, and does not include home or car loans, for example.

General manager Tan Huey Min from social service agency Credit Counselling Singapore said that credit cards have become a way of life over the past 20 to 30 years, and that their convenience has grown even more in the last decade as the push for a cashless society has intensified.

“As society evolves, younger people are more exposed to credit than older generations, like those in their sixties or seventies, who might only have encountered it later in life.”

Professor Jan Ondrus from Essec Business School's Asia-Pacific campus agreed, saying that the younger generation's comfort with digital platforms and preference for convenience and instant gratification "really sets them apart".

"Unlike older generations, who often see debt as something to avoid except for major purchases, younger consumers are drawn to BNPL’s ease of use and tailored features that appeal specifically to them."

However, this shift also raises concerns that BNPL risks becoming another debt trap and contributing to rising credit card debt for those who link BNPL repayments to their credit card, particularly among young adults.

Ms Tan said that buying on credit is not inherently bad – it is about knowing how to use it wisely.

BNPL AND CREDIT CARDS: WHAT’S THE DIFFERENCE?

BNPL allows consumers to split payments for goods or services into smaller instalments over a fixed period, typically without incurring interest if payments are made on time.

This payment option has gained popularity in the last few years in Singapore and across Asia Pacific.

Currently, the four accredited providers of BNPL services here are Atome, SeaMoney, Grab and ABNK.

All BNPL providers here operate under a code of conduct introduced in 2022, which emphasises consumer protection measures such as creditworthiness checks, transparent fees and caps on late payment charges.

The code of conduct was developed by a working group led by the Singapore FinTech Association (SFA).

A key point is a S$2,000 cap on outstanding payments that customers can have with each BNPL provider. This cap can be increased only after further creditworthiness assessments are conducted by the provider.

BNPL platforms also generate revenue differently from banks and credit card services.

BNPL providers get most of their revenue from merchant fees, said Associate Professor Pearpilai Jutasompakorn from the Singapore Institute of Technology (SIT).

“BNPL providers charge merchants a fee, usually (between 2 per cent and 8 per cent), for offering their service. Merchants are often willing to pay these fees because BNPL could increase sales and average transaction values,” she told CNA TODAY.

“And if a consumer misses a repayment, BNPL providers often charge a late fee. While these fees are not the primary revenue source, they contribute to the overall business model.”

Assoc Prof Jutasompakorn, a programme leader at SIT’s business, communication and design cluster, added that BNPL could encourage higher spending and attract customers who might not have made a purchase otherwise by enabling them to split payments into smaller, more manageable amounts.

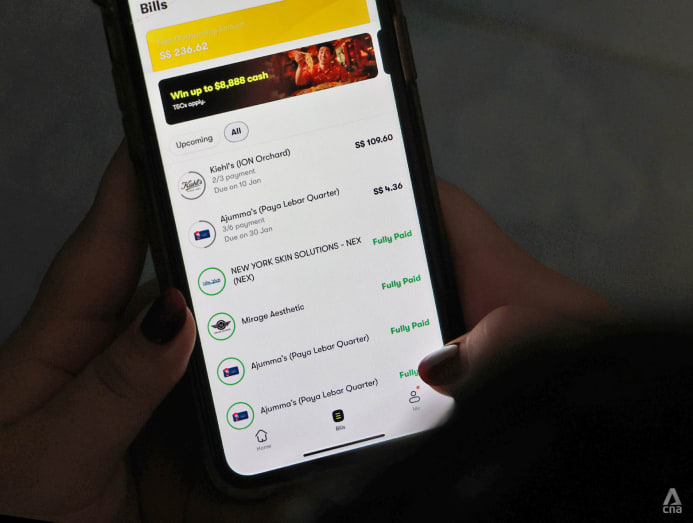

Some consumers link their credit cards, if they have one, to BNPL accounts for automatic repayment deductions, essentially making use of two credit facilities simultaneously.

But the BNPL code of conduct has strict guidelines that prevent the accumulation of outstanding balances.

Similarly, credit card limits are regulated by the Monetary Authority of Singapore's (MAS) rules on the balance-to-income ratio, which cap unsecured credit facilities at 12 times an individual's monthly income.

While eligibility criteria apply to obtaining credit cards, such as a minimum level of income, there are typically no such requirements with using BNPL services.

Generally, once a BNPL user has an overdue bill, their account will be immediately suspended, limiting the risk of snowballing debt. Only after the user has settled all outstanding bills can they continue using the service.

An SFA spokesperson highlighted that all code-compliant BNPL firms are required to ensure that customers failing to pay on time are not able to use their BNPL services to make any additional purchases.

"In other words, a customer with overdue payments to a BNPL firm will not be able to make any further BNPL transactions through his or her account with that firm until all overdue payments have been fully settled," said the spokesperson.

"However, the late payment will be reported to the credit bureau by provider A. This information will then be made known to other BNPL providers, who will decide whether to extend their services to the customer."

In Singapore, global information services firm Experian has been appointed to operate the credit bureau for BNPL services.

STEADY CONSUMER DEMAND IN SINGAPORE

An Atome Singapore spokesperson told CNA TODAY that since launching in 2020, the firm now has more than 1.3 million registered users in Singapore, with 75 per cent of users aged between 21 and 45.

Grab and SeaMoney, the digital financing service firm behind SPayLater, noted similar trends. While they were unable to disclose exact figures, both firms reported consistent growth in users over the years.

Grab’s PayLater was launched in 2019, while SPayLater in 2021.

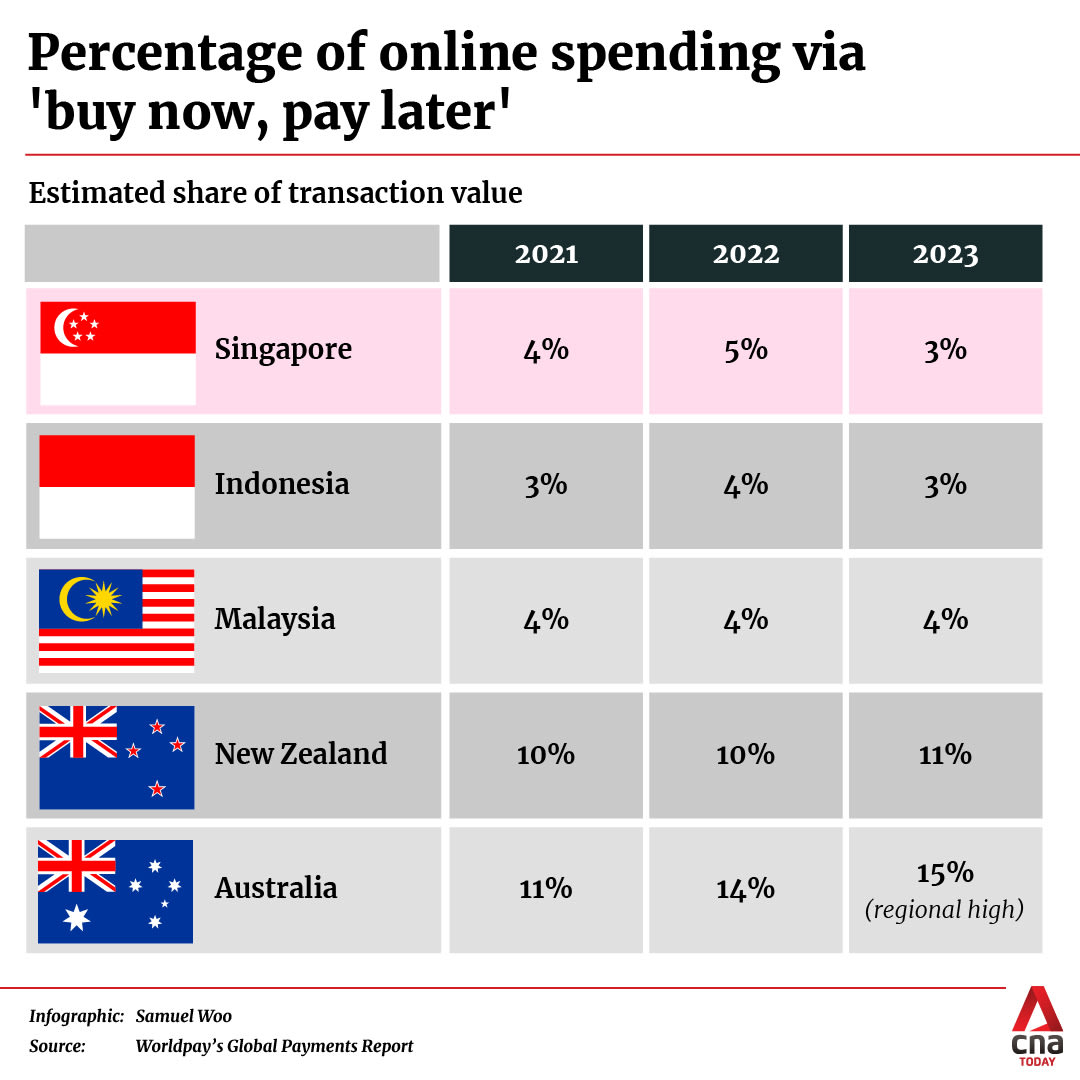

Worldpay reported that in 2023, BNPL accounted for 3 per cent of Singapore’s e-commerce transactions, a figure projected to remain steady until 2027. This marks a slight decrease from the 4 per cent and 5 per cent recorded in 2021 and 2022, respectively.

Even so, Mr Phil Pomford, general manager for Worldpay’s global enterprise e-commerce team in the Asia Pacific, said consumer demand for BNPL in Singapore remains steady despite some challenges, such as looming regulation and souring investor sentiment.

Dr Aurobindo Ghosh, assistant professor of finance at Singapore Management University (SMU), said higher interest rates over the past couple of years added to the costs borne by BNPL firms, as they absorb these rates using their revenue and bear the risk of non-payment by clients. This squeezes their profit margins.

Meanwhile, the codification of conduct by the Singapore Fintech Association and industry players leaves less room for smaller or new BNPL companies to manoeuvre.

And because BNPL players do not have a secured clientele like banks do, customer acquisition is costly, they have little data to mitigate credit risk and have to compete on pricing.

But Dr Ghosh agrees that demand remains strong. Although Worldpay's report noted a drop in the proportion of BNPL as a payment method for online transactions in Singapore, this is not necessarily due to a decline in user interest, he said.

"This is a supply-driven issue rather than a demand-driven one. Young adults, for example, still face limited access to cash, and the zero-interest feature of BNPL remains highly attractive."

The trend extends beyond Singapore, and its popularity here mirrors regional trends, as seen in Worldpay’s report.

In 2023, BNPL represented 4 per cent of online spending across the Asia Pacific, up from 1 per cent in 2021. Australia leads the region, with 15 per cent of online spending attributed to BNPL, followed by New Zealand at 11 per cent.

Two years earlier, BNPL made up 11 per cent of online spending in Australia, and 10 per cent in New Zealand.

As for Singapore’s immediate neighbours Malaysia and Indonesia, they see similar adoption rates, with BNPL contributing 4 per cent and 3 per cent of transactions respectively, unchanged from 2021.

THE ALLURE OF SPREADING OUT PAYMENTS

Although BNPL's share of the payment ecosystem remains small, the easy access to credit it offers to consumers aged 18 and above has sparked conversations on its impact on financial management.

Data from Atome, SeaMoney, and Grab shows that BNPL services are frequently used for beauty products and services, lifestyle expenses such as travel, education and healthcare, as well as electronic items such as mobile phones, laptops, gaming consoles and home appliances.

Fashion-focused e-commerce platform Zalora reports that BNPL is making luxury goods more accessible, with millennials and Gen Zers increasingly using it to finance their purchases.

Ms Tina Aw, a 23-year-old student, uses BNPL several times a year for purchases that normally require a few hundred dollars upfront, such as skincare items costing S$200 to S$300 or facial packages.

“In the beginning, I mostly used BNPL because there were vouchers. But I soon realised that BNPL helps keep expenses more manageable since I am a student with no credit card.”

Ms Aw, who currently has two ongoing payments with a BNPL platform, added that she was cautious about accumulating debt because she has heard stories of people her age overspending with BNPL.

“So, for instance, I made a big purchase of S$300 on skincare and opted for a three-month instalment with BNPL. I pay off the first instalment, and if possible, I’ll try to pay off everything by the second instalment.”

Software quality engineer June Aw (not related to Ms Tina Aw), uses BNPL weekly to enjoy discounts on her favourite fashion and beauty brands.

The 28-year-old's purchases range from S$30 to S$1,500, including items like yoga packages, cosmetics and clothing.

“BNPL has been great for managing my credit expenses. I have a credit card that requires a minimum spend of S$500 a month to earn cashback.

“Some months, I may not meet that target, but a BNPL repayment for a purchase I made one or two months ago helps me stay on track,” she said.

Considering she has several credit cards and uses BNPL regularly, Ms June Aw said she acknowledges that having easy access to credit can lead to overspending if expenses are not managed well.

“It’s all about self-control and buying what you can afford. I can afford the upfront payment for some hefty purchases. It’s just that I prefer to split the payments to get more value out of it,” she said.

Like Ms Chen, who furnished her home with BNPL instalments, Mr Darius Ng is also using BNPL to fund his furniture and wedding expenses.

The 32-year-old senior project and events executive said he uses BNPL mainly to avoid running out of cash, as he did not find paying for big purchases all at once to be practical.

Although Mr Ng finds BNPL a convenient way to spread out his payments and he always makes sure to pay on time, he thinks the service has influenced his spending habits for the worse.

“The ability to pay over time reduces the fear of how costly big-ticket items are, so I might have bought more than I actually need for my house and wedding,” he said.

“It can be risky for individuals who don’t manage their finances well. As a regular user, I keep notes and use an expense-tracking app to monitor my spending, too.”

Meanwhile, special needs educator Nurin Insyirah Yusran, 24, said she plans to stop using BNPL once she has achieved more financial stability.

She has just started working full-time and uses BNPL for cosmetics and electronic gadgets, making it easier to manage payments of a few hundred dollars.

“BNPL makes spending easier. It’s like I’m spending invisible money, so it's quite scary, and if you are not aware of your expenses, you can easily overspend, especially those with a shopping addiction.”

HOW TO PREVENT ACCUMULATING DEBT

Default rates and late repayments are generally low here, based on what the major BNPL providers here told CNA TODAY.

Atome said that the most common reasons for late payments on its platform are invalid or expired credit and debit cards, and failure to add a debit or credit card or payment account for auto deduction.

Still, experts interviewed by CNA TODAY cautioned over the pitfalls of these services, stressing the need for financial literacy and responsible spending to avoid accumulating too much debt.

SMU's Dr Ghosh said he is concerned that young adults may become accustomed to borrowing early in life.

This means they may develop a habit of accumulating debt, potentially extending to credit card debt as they grow older and gain greater access to unsecured credit, he added.

“My main advice is to get sound financial literacy, understand needs and wants, budget and track expenditure. This will automatically make people aware if or when they need to finance their expenses using BNPL,” Dr Ghosh said.

He also advised consumers to follow a 50-30-20 strategy of spending: 50 per cent on essentials, 30 per cent on discretionary items and 20 per cent on savings.

“And most definitely, try to avoid financing too many short-term consumption discretionary or luxury goods with BNPL, even bubble tea.”

The golden rule is never to borrow more than you can pay back, said Mr Aaron Chwee, OCBC’s head of wealth advisory.

“BNPL may give the illusion that the purchased item is affordable because you can repay it in smaller amounts over time … Even so, this will impact your monthly cash flow, hinder your financial goals, and cause a debt trap.”

Mr Chwee also advised users to be mindful of interest rate charges and late fees that may be applied to the borrowed amount.

Mr Steward Thum, financial services associate director at wealth management firm PhillipCapital, said BNPL can be a smart option if it frees up cash for high-priority expenses or investments that generate higher returns.

“For example, you may earn interest on the amount that can be deferred and kept in your savings account for a few months, making financial sense in certain situations,” he said.

“However, the savings from ‘paying later’ vanishes if it leads to spending beyond your means or purchasing items you do not truly need.”

Mr Thum also advised users, regardless of whether they have credit cards, to use BNPL services with financial discipline and awareness of potential risks.

Users without credit cards should set a clear budget, track their instalments and avoid using BNPL for impulse purchases.

For users with credit cards, Mr Thum emphasised the importance of avoiding the simultaneous use of BNPL and credit cards, which could lead to unmanageable financial obligations.

Credit cards often come with hefty interest rates applying to balances not paid on time.

In response to CNA TODAY’s queries, the Monetary Authority of Singapore (MAS) said that BNPL transactions remain as a small fraction of consumer payments.

In the second half of 2023, the total value of BNPL transactions was about 1 per cent of the combined value of credit card and debit card payments here.

The authority said that although it does not regulate BNPL firms, those operating in Singapore have committed to the BNPL code of conduct, developed under its guidance and administered by the industry.

“Under this code, BNPL firms commit to safeguards, including to suspend the accounts of BNPL users who have defaulted on their repayments, not to compound interest or fees, and not to pursue bankruptcy proceedings against customers who have outstanding payments,” MAS said.

“BNPL firms are also not allowed to extend more than S$2,000 in credit to a customer unless they perform an additional credit assessment. These measures limit any debt build-up and mitigate the risk of consumer over-indebtedness from BNPL use.”

BUY NOW, REGRET LATER?

Ms Sandra, the 23-year-old student who spent S$500 a month using BNPL, is now well aware of the danger of one’s finances easily getting out of hand.

Reflecting on her expenses last year, she recalled how certain circumstances would prompt her to use the service in the name of convenience.

“My internship required long commutes, up to four hours every day (using public transport). So, I often felt too tired to cook or buy food from nearby hawker centres.

“Ordering food online and hailing a ride became a habit, and I stopped considering more practical or cost-effective options like buying groceries,” she said.

Ms Sandra said it finally hit her last August that she should assess her finances after a serious discussion with friends on managing money as they navigate adulthood.

“After calculating my total spending for the first eight months of the year, I realised my BNPL expenses amounted to about S$3,700.”

With hindsight, Ms Sandra lamented that the money could have been used more wisely, such as on groceries and driving lessons. She has since stopped using BNPL.

As for Ms Chen, who allocated 90 per cent of her take-home pay to BNPL repayments last year, she said she realised how BNPL could adversely affect her if she were not careful or disciplined enough.

“I was living pay cheque to pay cheque for three to four months, but it stopped me from spending unnecessarily. I knew exactly how much I had left to spend for the month and I really stuck to it.”

Asked if she had any advice for first-time BNPL users, she cautioned against allocating more than 50 per cent of one’s monthly salary to BNPL instalments “unless you’re prepared for some tough times”.

“And if you can’t afford something, don’t buy it. Don’t spend money you don’t have unless it’s truly necessary.”

Editor's note: This article previously stated that Lendela's data recorded an 18 per cent rise in loan applications from middle-class millennials earning S$48,000 to S$84,000 from 2022 to 2024, with a 30 per cent jump among those earning over S$84,000. That is incorrect. The figures referred to the share of applications, not the absolute number of applications. We apologise for the error.

The article was also amended following a clarification from the Singapore FinTech Association after publication on the BNPL safeguards for instances of overdue payment.