DINKs are lagging behind parents when it comes to retirement planning. Is this a worrying trend?

Couples who have "dual income, no kids", or DINKs, tend to put retirement planning on the back burner until they are in their 40s compared to couples with children who usually start thinking about retirement in their 20s or 30s, financial experts said.

Couples who have dual income and no children tend to seek retirement planning advice in their early 40s, whereas those with children tend to do so earlier, a recent survey found. (Photo: iStock)

This audio is generated by an AI tool.

Four times a year, Ms Tania Ong and her husband, both 34, go overseas for holidays in the region, always choosing to fly on Singapore Airlines over budget airlines.

She estimated that they spend more than S$12,000 a year on such trips.

The capital markets broker also treats herself to weekly massages and spends a few hundred dollars a month on the couple's two dogs, which includes pricier grooming services at home and organic kibbles.

Ms Ong knows that her choices are usually a little on the extravagant side, but the couple believe that they can afford to splurge more on themselves, given that they have decided not to have children.

“We definitely can spend more than couples who have children, because we don’t have to pay for enrichment classes (for the children), which can be costly,” she said.

Ms Ong married her self-employed husband in the finance industry three years ago after 10 years of dating.

She hopes to retire at 50, but is unsure if her goal is attainable since it hinges on several uncertainties such as the price at which she can sell her three-room Housing and Development Board flat where she lives and her future property investment choices.

“It’s uncertain whether my retirement plans can materialise in 20 years."

A survey by Singapore bank OCBC last November points to Ms Ong's retirement outlook as rather typical.

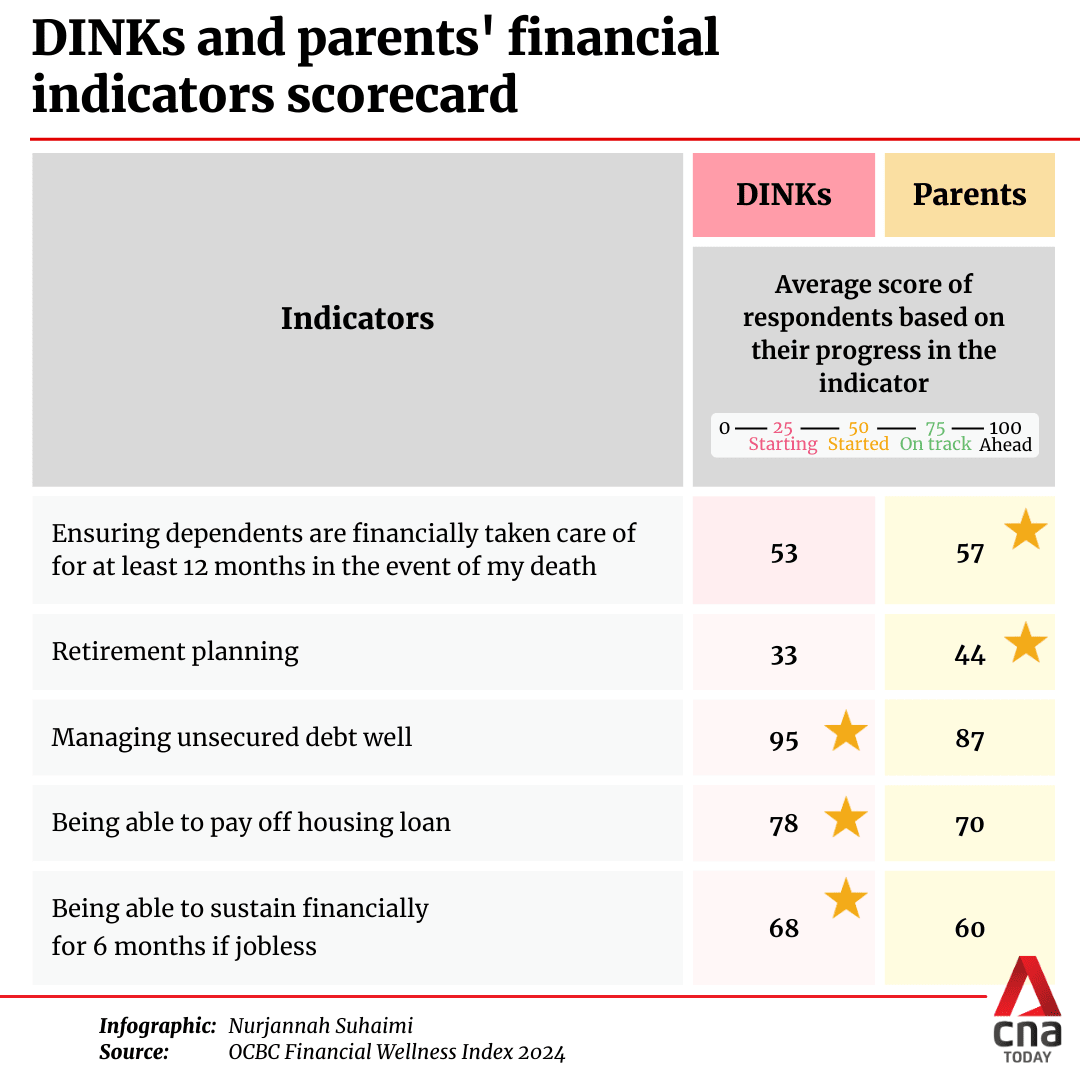

It found that retirement planning is one of several financial wellness indicators where working couples without children, commonly referred to as dual-income couples with no kids (DINKs), are falling behind those who have children.

On a scale of 100, where zero means they have not started planning at all and 100 means that they are ahead in their planning, DINK couples scored an average of 33, compared with 44 for couples with children.

The survey was done with 2,000 people aged 21 to 65 and it looked at a total of 24 financial wellness indicators.

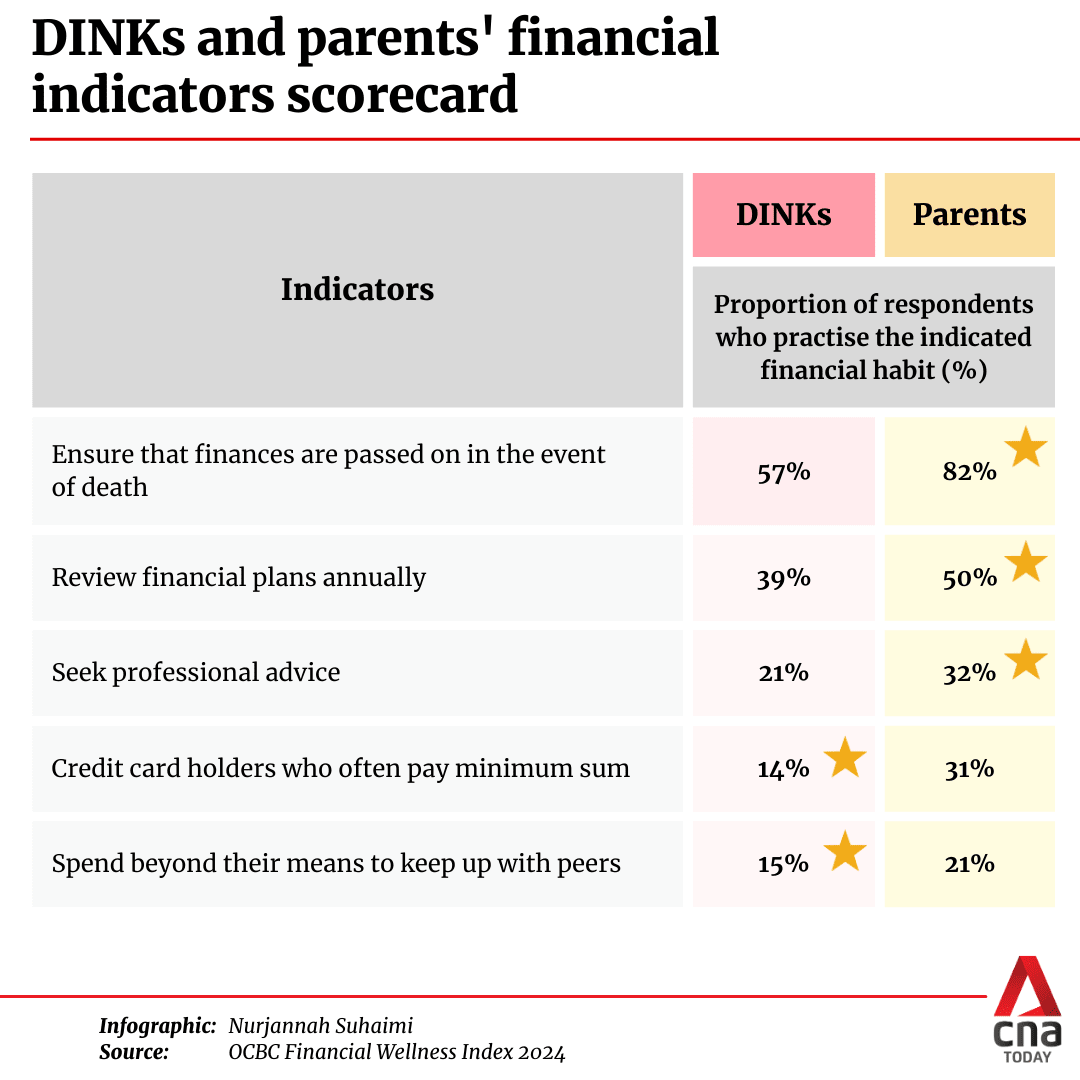

DINK couples fared poorer than couples with children in eight areas, including seeking professional advice and when it came to reviewing their finances yearly.

However, the OCBC study found that DINK couples are faring better than couples with children in most of the remaining financial areas, such as being more on top of their loans and having less tendency to spend beyond their means to keep up with peers.

DINK couples are also better able to tide over rainy days such as joblessness or a medical emergency, the study found.

CNA TODAY spoke to several working couples with no children who said that they have not started planning for their retirement because they still have a "long runway".

Most of them said that they are savouring their prime years of their 30s and 40s, focusing on leisure activities and enjoying life before they eventually turn their attention to retirement savings.

"PRETTY LONG" UNTIL RETIREMENT

Communications professional Siti, who is 31, and her husband who is a 33-year-old engineer, said that they are taking the opportunity to spend more on themselves before having children.

This includes getting pricier household appliances such as picking items from reputable brands and high-end models that sometimes costs a few hundred dollars more than a basic option, and they would go out for fancy meals twice a month.

The couple, who got married in 2020, also contribute to their parents' holidays, including one to the Middle East.

“We’ve not started on retirement planning because we want to breathe and enjoy life a little after COVID-19,” Ms Siti said, declining to give her full name.

She and a few individuals who spoke to CNA TODAY did not want their full names published because they do not want others to know the details of their personal financial plans and situation.

Ms Siti also expects that as a couple, their income will continue to grow as they climb the corporate ladder, making them confident that they will be able to meet any future financial needs including having children and getting ready for retirement.

For Mr Yan and his wife, both 35, they said that they have a “pretty long” runway to prepare themselves for retirement.

Mr Yan, who also did not want to make public his full name, works in sales and his wife works in a bank.

When it comes to meals, holidays and hobbies, the couple does not think too hard before forking out the money to pay for what they want, as long as it is within their means.

Their decision not to have children, coupled with their passive income from leasing their property, have given them an added sense of financial security, Mr Yan said.

“I guess for now, our priority is to grow our net worth as much as possible by working hard and investing rather than having an actual end-goal in mind,” he added.

"CAREFREE SPENDER"

Ms Jeanette Wong, 32, describes herself as a “carefree spender” who does not budget her spending in advance.

Instead, she does not hesitate to spend on having good experiences such as shelling out a few hundred dollars on special occasions to have an omakase meal, where the chef decides on the menu for the customer who usually pays a three-figure sum for the set, or even on big-ticket items such as going on holidays with her family to destinations in Scandinavia, Switzerland and the United States.

“I think it comes down to having no kids. You're freer, right? So you want to try more things and typically, in Singapore, trying more things means spending more money,” the strategic planner in a startup said. Ms Wong has been married for six years to her 35-year-old business analyst husband.

For Mrs Liew, 52, an educator who did not want her full name disclosed, retirement has always been at the back of her mind.

In the early years of marriage, she and her husband, who works in the banking sector, could not resist travelling across globe.

Heading to at least two countries a year, the couple would spend up to S$20,000 as a household, which included one trip within Asia and one beyond the continent.

Mrs Liew fondly recounted her most memorable trip so far: Sipping wine with a view of the Matterhorn mountain in Zermatt, Switzerland.

She said that if they accumulate enough "miles" from their credit card spending, they may fly business class for their travel, but would usually fly economy class and stay in three- or four-star hotels.

Although she and her husband’s wants have changed over the years, their desire to travel, even in their older years, remains.

This prompted her to more proactively prepare for retirement some years ago. When she turned 44, she began putting aside 30 per cent of her income into savings and stocks.

“Spending on holidays is a way to reward ourselves. Of course, I wish I could have saved more in the past, but ultimately, I have no regrets I spent on travel,” Mrs Liew added.

BALANCE BETWEEN INDULGENCE AND SAVINGS

Even as they admitted to being able to spend more than what they would if they had children, the couples with no children who spoke to CNA TODAY reiterated that they never splurge irresponsibly, regardless of whether they have their retirement plans figured out or not.

Many of them said that they still set aside some money for savings, while others such as Ms Wong have already begun planning her retirement planning from before marriage by parking some money in endowment plans and other investments.

Mr Yan has a different approach to ensure that he does not overspend: “I don't own a credit card and I try not to let my bank balance drop below a certain level.

“I would say my mentality is more towards not compromising so much on my comfortable lifestyle but nothing too extravagant like buying a Rolex (watch).”

Mr Christopher Gee, deputy director at the Institute of Policy Studies, said that generally speaking, it is already concerning for someone not to make financial plans for their retirement.

“And particularly so for those who do not have kids, who may not have the familial support from children to take care of them at their old age,” he added. Mr Gee is also senior research fellow and heads the governance and economy department at the institute.

TEND TO INVEST MORE AGGRESSIVELY

That said, it is not all doom and gloom for couples without children who have not started on their retirement planning, financial experts said.

Mr Loh Yong Cheng, team lead of the advisory team at wealth advisory firm Providend, said it is not surprising that DINK clients tend to seek retirement planning advice only in their early 40s, whereas couples with kids tend to do so soon after they have children, which for most is before their 40s.

Younger couples in their 20s and 30s who have no children tend to be more focused on their freedom to do whatever they want without the added responsibility of raising children and they tend to indulge in travelling and other activities they enjoy, Mr Loh said.

It is only when they reach their 40s that such couples are more forward-thinking, turning their focus to retirement.

“In your 40s and 50s, you are more vulnerable in life and career opportunities than your younger counterparts. If something happens in your industry, you might need to take a pay cut,” Mr Loh said.

“Most people will enter a 'countdown mode' where they worry about how much time they have left at the peak of their career.”

Mr Loh mentioned two advantages that DINK couples have when it comes to retirement planning:

- The flexibility to adjust their lifestyles to save more due to having fewer dependents

- The ability to invest aggressively over a shorter time frame

Ms Karen Tang, a certified financial planner for more than 20 years, observed that DINK couples are more open to investing aggressively and have higher risk appetites compared to couples with children who prioritise hard assets such as real estate that provide long-term security but may not provide higher returns.

That said, couples with no children should not take such advantages or their existing savings for granted and unduly delay their retirement planning either. They should sit down to really take stock of their current finances.

This is because people in general, whether they have children or not, tend to just have a rough estimation of their finances instead of having a clear understanding of their financial state and whether they are on track to meeting their retirement needs.

This causes situations where couples with no children overestimate how much they have for retirement when they eventually consult a financial adviser, Ms Tang added.

As a rule of thumb, those who are planning for retirement should save what they expect to spend and then some, with any buffer money used to counter inflation and pay for emergencies.

Regardless of their marital or parental status, people should start planning their long-term financial and retirement plans early and review them regularly to account for changes in life circumstances.

“A stitch in time saves nine. By not planning on a timely basis, you may miss potential for growth or certain opportunities to take steps to turn your financial plan around,” Ms Tang said.