Behind the scenes of DBS’ anti-scam efforts

In the ongoing fight against scammers, DBS leverages behavioural science and the latest technologies to safeguard customers and their finances.

In 2023, 92 per cent of scam losses in Singapore were attributed to schemes involving social engineering and deception. Photos: Shutterstock

This audio is generated by an AI tool.

Scammers are employing increasingly elaborate tactics to exploit victims, moving beyond quick schemes to more complex methods that rely on building trust with their targets.

Common schemes involve scammers posing as an old friend reconnecting after many years or offering remote job opportunities with promises of high salaries. They also convincingly impersonate credible institutions like banks, government agencies or law enforcement, knowing that people are more likely to comply when they believe the instructions come from a figure of authority.

“Scammers no longer only rely on phishing for banking IDs, passwords or one-time passwords like they once did,” said Assistant Superintendent of Police (ASP) Lynn Tan, a senior investigation officer with the Singapore Police Force (SPF). “They now use social engineering to manipulate individuals into initiating bank transfers or installing malware that grants scammers remote access to their devices to complete the transfers.”

Social engineering involves manipulating victims into divulging confidential information or taking actions that compromise their security, typically by exploiting emotions and trust.

SOCIAL ENGINEERING FOR PROFIT

In the first half of 2024, 86 per cent of reported scams involved self-initiated transfers, making them particularly hard to detect. “When victims are groomed into parting with their money, they often do so repeatedly and delay making police reports when the promised returns do not materialise, clinging to the false hope that they will eventually recover their funds,” explained ASP Tan.

Authorised scams are particularly challenging to detect and prevent because traditional security measures are designed to identify unauthorised access or suspicious transactions – not those initiated by the account holder.

This is where the DBS Behavioural Science Team steps in. “Our work involves researching and analysing scam tactics to understand how scammers exploit human biases and vulnerabilities, and developing targeted communication strategies to counter that,” said Mr Kim Jung Kyun, a behavioural scientist at DBS. “It’s similar to the role of a data scientist, but instead of interpreting raw data, we analyse data with a focus on the psychological factors and mechanisms at play.”

The team also looks for key moments to introduce cognitive breaks – intentional pauses in the customer journey designed to shift the customer from a “hot” state, where impulsive decisions are more likely, to a “cold” state of calm reflection. These breaks give customers a chance to reconsider their actions and reflect on the legitimacy of the transaction.

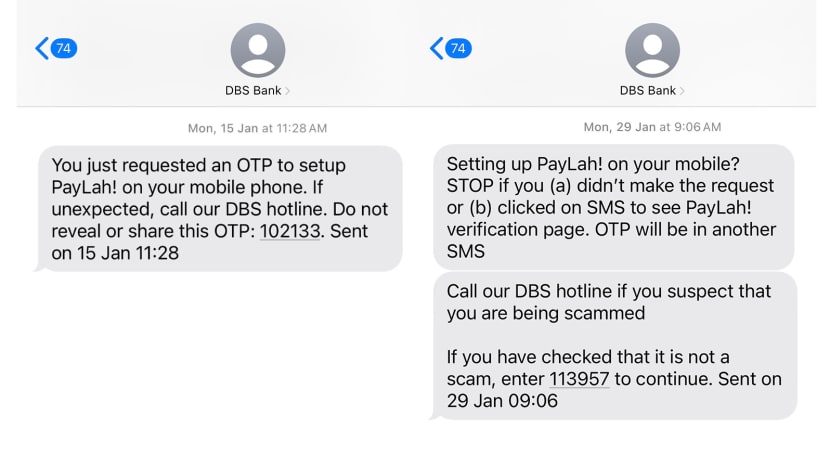

For example, the team introduced a capitalised “STOP” in the text message sent when PayLah! is set up on a mobile device, urging the customer to review their transaction if they didn’t initiate the request. Additionally, the message is split into two parts – a deliberate temporal break between the first and second SMS that acts as a cognitive pause, giving customers a moment to reconsider their action before the one-time password arrives.

According to Mr Kim, cognitive breaks have proven to be an effective way of mitigating fraud risk. “We continuously evaluate the effectiveness of our solutions and refine them based on feedback and performance metrics,” he said.

DBS has also introduced additional safeguards, including transaction delays and differentiated notifications, for transfers that exhibit high-risk characteristics.

Another tool that functions as a cognitive break is digiVault. It requires customers to unlock their funds by visiting a bank or ATM, giving them a moment to reconsider their transaction.

In October, digiVault was further enhanced for DBS and POSB customers, who can now conveniently lock funds in their existing accounts through the digibank app or digibot, the DBS chatbot. Funds can be unlocked at more than 1,200 DBS and POSB ATMs across the island, as well as bank branches.

DBS and POSB customers can continue earning the same interest on their locked savings and fixed deposits. Since the launch of digiVault close to a year ago, DBS has seen a 15 per cent monthly increase in the number of customers locking their funds.

REFINING SCAM PREVENTION WITH NEW TECHNOLOGIES

Scammers today are leveraging advanced technologies like artificial intelligence (AI)-powered chatbots and deepfake videos to create convincing fake identities and spread misinformation across social media and messaging platforms. AI tools like ChatGPT enable scammers to craft flawless messages, eliminating the poor grammar that was once the telltale sign of a scam.

However, these same technologies can also be harnessed to combat fraud. As part of its multi-layered defence strategy, DBS is utilising AI and machine learning (ML) to protect customers’ accounts.

Powered by regularly updated and refined AL/ML systems, DBS’ fraud surveillance systems scan millions of transactions daily to identify suspicious activity. Once an anomaly is detected, it is immediately flagged for further investigation by DBS’ anti-scam team.

Compared to traditional fraud prevention methods that rely on predefined rules and human calibration, AI/ML systems offer greater speed and scalability in threat detection. These systems process data in real-time and adapt to evolving fraud tactics, making them ideal for handling large transaction volumes and staying ahead of new threats.

By integrating ML with existing controls, DBS is able to create a more robust and adaptive approach to identifying suspicious activities.

A SHARED RESPONSIBILITY

Ultimately, the best way to stay safe from scams is to avoid falling for them in the first place. While tech-based controls provide valuable safeguards, customers must remain proactive in recognising and responding to potential threats.

By practising good cybersecurity habits and staying informed about common scams and social engineering tactics, customers can take the critical first steps in securing their safety online.

Learn more about the tools and teams DBS has put in place to protect you from scams. In addition, create your own cognitive break today by locking up funds you don’t need in the near future in digiVault. Get more tips on how to stay scam-savvy with DBS.