Prepaid losses for beauty consumers jump nearly six-fold in first half of 2025

Customers lost over S$108,000 - compared with S$19,000 in the first half of 2024 - after paying in advance for beauty services that were never delivered.

A woman undergoing a beauty treatment. (Image: iStock)

This audio is generated by an AI tool.

SINGAPORE: Beauty industry consumers lost over S$108,000 (US$83,842) in the first half of this year after paying in advance for services that were never delivered.

This represents a 464 per cent increase - or a near six-fold rise - from S$19,000 in prepayment losses during the same period last year, the Consumers Association of Singapore (CASE) said on Tuesday (Aug 5).

CASE noted that the beauty sector topped prepayment-related losses, with aggressive or misleading sales tactics being a key consumer complaint.

Such tactics accounted for about 28 per cent of all complaints during this period.

Many of these cases involved consumers being pressured into signing high-value packages under unclear or exaggerated promises, CASE said.

But there was a 19 per cent decrease in overall consumer complaints, with 6,253 cases lodged in the first half of 2025 compared with 7,721 in the corresponding period.

CASE noted that there were a few high-profile incidents in 2024, including the botched Sky Lantern Festival, which led to more than 400 complaints in the first half of last year.

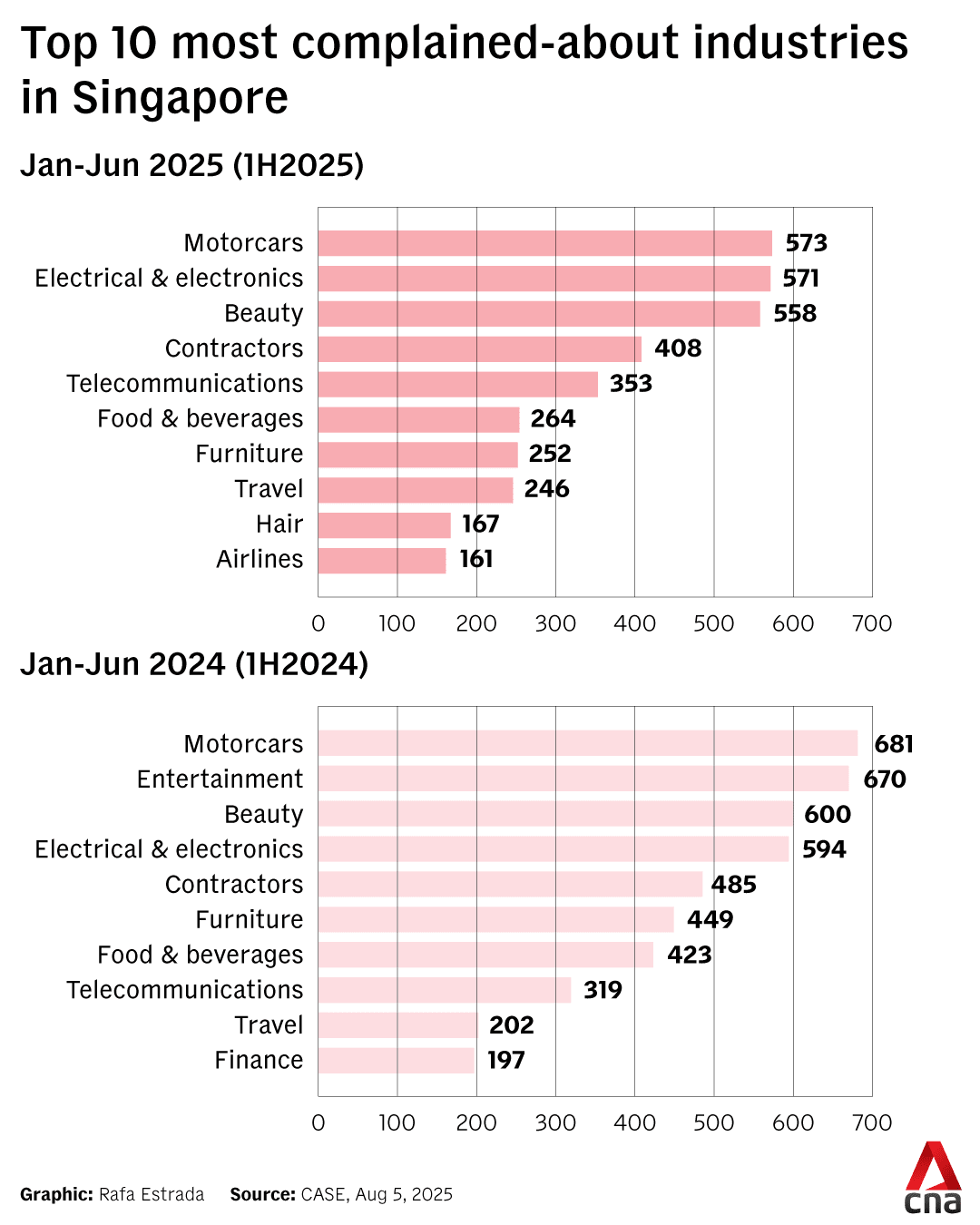

Cars, electrical and electronic products, beauty services, renovation contractors, and telecommunications made up the top five categories of consumer complaints in the first half of 2025.

BREAKDOWN OF COMPLAINTS

The motorcar industry remained the top complaint category with 573 cases in the first half of this year - a 16 per cent decrease from 681 complaints in in the corresponding period.

About 28 per cent of the complaints in 1H2025 involved vehicles that were either defective or did not conform to contract terms.

The electrical and electronics industry rose to become the second-highest complaint category, registering 571 cases. This represented a decrease of about 4 per cent from 1H2024.

Around 47 per cent of these complaints were related to defective products or those that failed to meet contract terms. They comprised both small electronic devices purchased online and larger household appliances bought from physical retail outlets like televisions and washing machines.

Telecommunications-related complaints also increased from 319 in 1H2024 to 353 in 1H2025. Of these, about 24 per cent were due to customer dissatisfaction with services they had paid for.

BEAUTY, CARS, E-COMMERCE

CASE noted that the beauty sector recorded the highest prepayment-related losses in the first half of 2025, despite a decline in complaint numbers from 600 in the corresponding period last year to 558.

It cited a high-profile case involving a contract worth over S$370,000, in which the consumer alleged that the business used aggressive, high-pressure sales tactics, made false promises, offered misleading discounts, and ultimately overcharged.

"Despite a slight drop in complaint numbers, the beauty industry remains a concern due to the sharp increase in prepayment-related losses," said CASE president Melvin Yong.

"CASE encourages consumers to patronise CaseTrust-accredited spas and beauty salons, which offer a five-day cooling-off period, refunds for unutilised packages, and stress-free treatments without sales pressure."

In 1H2025, complaints related to the motorcar industry fell by about 16 per cent, from 681 cases in 1H2024 to 573.

Complaints involving car-sharing services also dipped slightly from 109 to 97, though consumers continued to raise concerns about poor vehicle maintenance, billing issues, high insurance excess, and unreliable service.

There was a 42 per cent increase in complaints related to electric vehicles (EVs), rising from 33 in 1H2024 to 47 in 1H2025. Defective components, such as batteries, and problems related to EV charging were among the common complaints raised.

Said Mr Yong: "As more EVs take to Singapore’s roads, CASE expects to see EV-related complaints increase in tandem. Consumers seeking to purchase an EV should be mindful of issues related to charging and battery lifespan. Car-sharing services also remain a popular choice among consumers and there needs to be stronger standards for the shared mobility space.

"CASE is working with car-sharing operators to develop a CaseTrust accreditation scheme for the sector. This will allow consumers to patronise operators who have committed to consumer-friendly policies and provide an efficient dispute resolution mechanism."

Complaints related to e-commerce fell by 32 per cent in 1H2025, dropping from 2,611 cases in 1H2024 to 1,769.

This was largely due to an 85 per cent decline in entertainment-related complaints, which had spiked the previous year due to the failed Sky Lantern Festival.

However, CASE observed an increase in complaints against online travel agencies, with 139 cases reported.

Such complaints rose by around 40 per cent, it said.

They involved a range of issues, including misleading descriptions of hotel accommodations, website glitches that led to duplicate or inflated charges, and confirmed bookings that were not honoured.

Consumers had approached these agencies to book flights, hotels, and land tours, but encountered problems that disrupted their travel plans and caused financial stress.

“To better protect consumers and raise industry standards, CASE is looking to drive wider adoption of our CaseTrust scheme for e-businesses," said Mr Yong.

"As part of its review to enhance consumer protection in Singapore, the Consumer Protection Review Panel is looking at unfair practices commonly used by online merchants, with the aim of recommending enhancements to our consumer protection regime to better protect consumers in the age of e-commerce.”

With the continued rise in online transactions, Mr Yong also stressed the need to strengthen consumer protection in the e-commerce space.

They include mandating merchant verification, setting up escrow accounts for online transactions, and implementing a clear dispute resolution framework to help consumers seek recourse.

CASE also highlighted concerns over the increasing transaction values involved in disputes, noting that the cost of home renovation contracts often exceeds S$20,000.

It urged the government to review the current S$20,000 jurisdictional limit of the Small Claims Tribunals, in order to ensure consumers continue to have access to affordable dispute resolution options.