Elevating the consumer experience with smart nudges

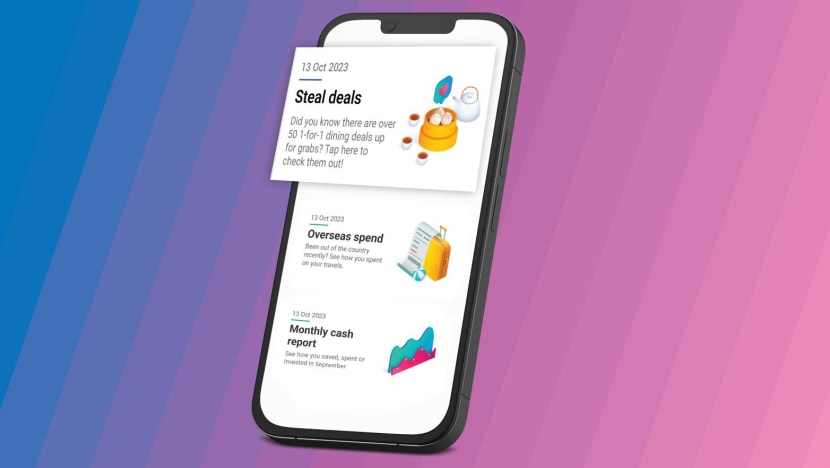

UOB’s TMRW mobile app harnesses the power of AI to deliver customised financial insights, expense tracking alerts and exclusive retail deals tailored to customers’ preferences.

A large number of UOB customers have benefitted from the hyper-personalised insights provided through the UOB TMRW app, says Ms Choo Wan Sim, head of UOB TMRW Digital (Singapore). Photos: UOB

This audio is generated by an AI tool.

From being functional tools that enable us to perform basic transactions like money transfers and credit card payments, banking apps have in recent years evolved to become more sophisticated, leveraging hyper-personalised insights to provide financial advice, expense tracking alerts and shopping deals that suit our needs and preferences.

These calls to action are made possible by the power of artificial intelligence (AI). Through its innovative UOB TMRW mobile app, UOB has deployed features such as timely insights cards to tailor customer experiences in the areas of wealth management, lifestyle, payments and financing. As of end-September, the bank delivered over 72.6 million of such AI-driven nudges to about 1.4 million Singapore customers.

According to Ms Choo Wan Sim, head of UOB TMRW Digital (Singapore), customers have responded positively by engaging with the insights cards served to them through the app. More than 50 per cent of customers who clicked on these notifications took steps to earn higher interest rates on their savings. Additionally, nearly 60 per cent of users benefitted from the exclusive retail offers suggested by the app.

USING AI FOR A PERSONAL TOUCH

According to UOB’s 2023 ASEAN Consumer Sentiment Study, close to four in five respondents in Singapore agreed that having their financial data on a single platform provides more personalised recommendations, while more than four in five said that data consolidation will help with financial planning.

Using data gleaned from customers’ past transactions and user input, UOB TMRW serves as a personal assistant that delivers valuable financial insights. Besides allowing customers to effortlessly monitor their cash inflows and outflows, its user-friendly dashboard helps them track their expenses by categories such as utilities, transportation, health and beauty.

What’s more, the bank curates rewards for customers via its Rewards+ programme based on individual information logged in the app. “Using our AI-powered merchant recommender engine model, UOB TMRW alerts customers to region-specific deals based on their spending patterns and travel locations,” said Ms Choo. “For instance, customers who are spending more on dining out may get timely prompts on one-for-one dining deals exclusive to UOB cardholders.”

For those seeking a more in-depth look into their finances, the bank’s proprietary UOB Portfolio Advisory Tools equips wealth management advisors with data-driven insights to provide comprehensive, personalised assessments to help customers make informed wealth-planning decisions. This is aided by the seamless integration of SGFinDex, which allows customers to gain a holistic view of their financial position, including deposits and investment portfolios across participating banks and government agencies.

UOB plans to enhance its recommender engine to better match customers’ unique goals and risk tolerances. For example, the engine will recommend suitable investment products based on customers’ wealth portfolios to help them grow their wealth while matching their risk profiles. It also aims to boost operational efficiency with the help of AI-assisted chatbots and robo-advisors to deliver automated financial services and 24/7 customer support.

SAFER BANKING IN A DIGITAL WORLD

With scams becoming more prevalent and elaborate, UOB remains committed to the safety and security of its customers. It employs real-time fraud monitoring systems to identify and block suspicious or fraudulent online transactions.

In September, the bank rolled out two anti-malware security features on UOB TMRW. The first restricts customers’ use of the app upon detection of any apps or tools that attempt to share their screens. This shields customers from unknowingly exposing their devices to scammers who seek to seize control and access sensitive banking information. The second restricts access to UOB TMRW upon detection of apps downloaded from third-party or unauthorised sites.

“As we continue to enhance our banking security against evolving scam tactics, these new security features on UOB TMRW are necessary to mitigate the risks and protect customers’ exposure to malware scams. We also urge customers to remain vigilant and stay updated on the latest scam threats and measures they can adopt to protect themselves,” said Ms Choo.

Discover the future of empowered banking with the UOB TMRW app.

Learn more about the future of finance at the Singapore FinTech Festival from Nov 15 to 17, 2023.