Metis Global Singapore: Democratising the power of trusts

Trusts are now more accessible than ever, enabling individuals from varying financial backgrounds to leverage their benefits.

Offering benefits such as enhanced privacy and a seamless transfer of wealth, trusts are now gaining traction among individuals from diverse means. Photos: iStock

In the dynamic arena of estate planning, trusts have undergone a significant transformation. Previously considered the exclusive domain of the affluent, trusts are now gaining traction among individuals from various economic backgrounds. Offering streamlined asset management, enhanced privacy and a seamless transfer of wealth, trusts are becoming an increasingly popular instrument that empowers families to secure their financial legacies.

High initial setup costs and the need for substantial assets are factors that have deterred many people from establishing a trust, according to Mr Alex Ng, deputy CEO of Metis Global Singapore (Metis SG). “In Singapore, setting up a trust usually starts from a few thousand dollars and can exceed S$20,000. What's more, settlors often need to set aside assets worth hundreds of thousands, or even millions,” he said.

Recognising these challenges, Metis SG aims to democratise the landscape by making trusts more accessible. By reducing the financial barriers to entry, the company hopes to extend the advantages of trusts to a broader population.

THE DIFFERENCE BETWEEN WILLS AND TRUSTS

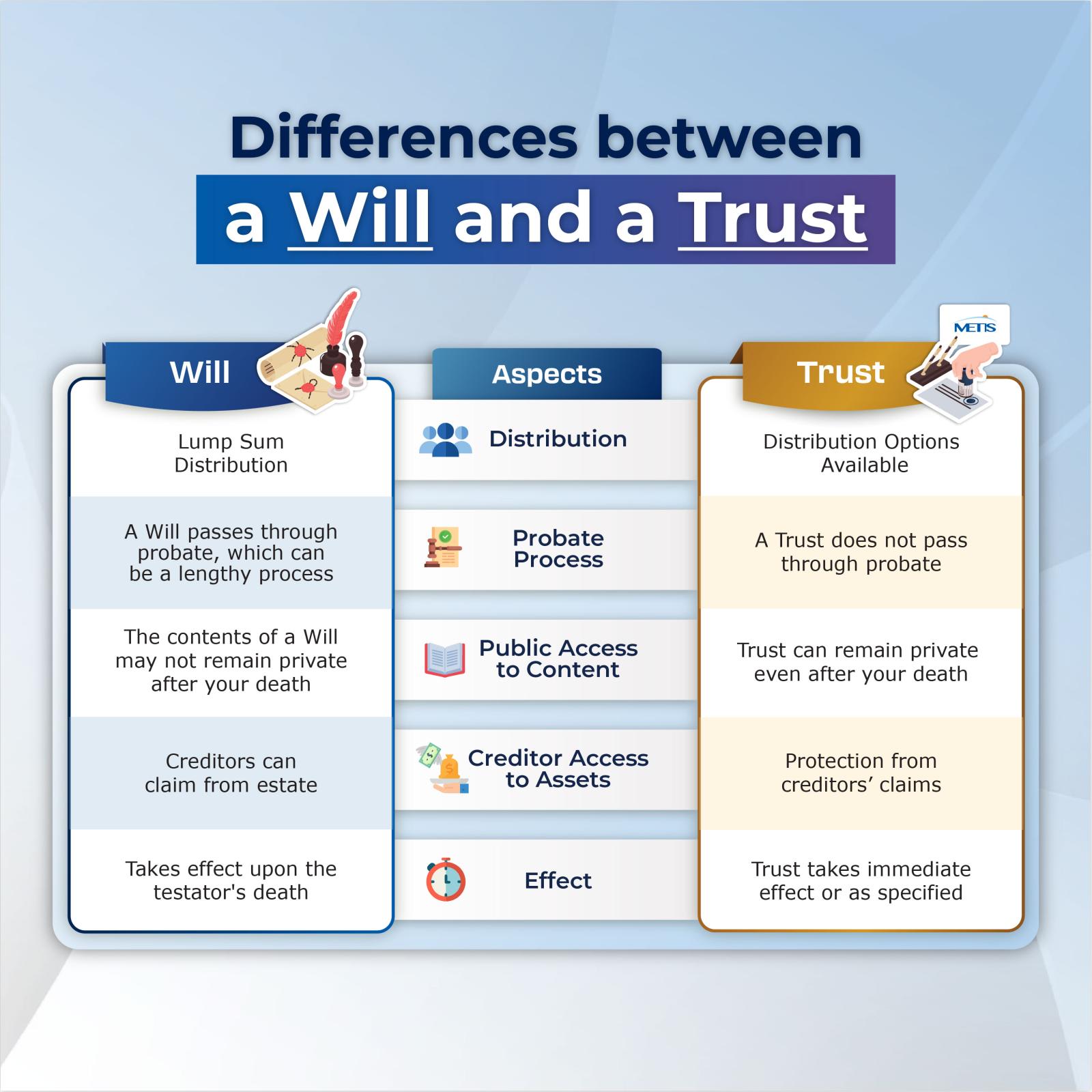

Understanding the differences between wills and trusts is crucial for effective estate planning.

A will is a legal document that sets out the wishes of the testator – the individual making the will – for the distribution of their estate, which usually includes all their assets.

In contrast, a trust is a legal arrangement in which the individual initiating the trust – known as the settlor – transfers assets to an appointed trustee, such as Metis SG. The trustee will then manage and distribute the assets to the settlor's beneficiaries in accordance with the terms of the trust and the governing law of the trust.

Wills, which are generally easier to create and modify compared to trusts, typically cover assets that individuals want to retain control of and have access to during their lifetime, including real estate, vehicles and bank accounts. It is usually inexpensive to make a will, and its contents can be easily amended during the testator’s lifetime, as long as they are mentally competent.

With a will, however, beneficiaries may not be able to immediately benefit from the deceased's estate. Before the estate can be distributed, the executor of the will has to make an application to the court for a grant of probate. This process can take months, or even years, if the application is contested. Trusts, on the other hand, do not need to pass through probate, accelerating asset distribution to beneficiaries.

Moreover, trusts may be used to safeguard the settlor's assets against creditors. Under an irrevocable trust, assets do not form a part of the settlor’s legal estate.

A trust also offers the advantage of preserving privacy, even after the settlor’s death, as the terms of the trust are not publicly disclosed. “Trusts provide confidentiality even among beneficiaries,” said Mr Ng. “Unlike wills, where the inheritance amounts for each beneficiary are usually disclosed, trusts help maintain privacy, reducing the likelihood of conflicts.”

A LIFELINE FOR FAMILIES WITH VULNERABLE BENEFICIARIES

Trusts are a useful financial planning tool for anyone with dependents, but they are especially valuable for those with vulnerable beneficiaries.

Vulnerable beneficiaries do not only include children who are minors or individuals with special needs, but also individuals who may not be capable of proper financial management. In these situations, beneficiaries are likely unable to manage the large sums of monies that are bequeathed to them under a will.

By setting up a trust, the settlor can specify the circumstances under which a distribution is to be made, for instance, when the settlor's children reach a certain age. The settlor can also opt to distribute the assets in a series of regular payouts, rather than as a lump sum. “This allows the settlor to have peace of mind, knowing that the assets allocated will sustain their loved ones throughout their lives,” added Mr Ng.

CHOOSING THE RIGHT TRUST PLAN

Metis SG offers two trust plans, SapphirePRO and CitrinePRO, which are designed to meet a variety of client needs.

For those looking to build up their wealth through monthly contributions, SapphirePRO is a sound choice. This plan allows up to two settlors to commit to a contribution term ranging from five to 30 years, with a minimum monthly contribution of S$500.

“This is an affordable plan for young parents who wish to accumulate assets for their children while balancing other financial commitments,” said Mr Ng.

Individuals looking to safeguard a substantial sum of money can consider CitrinePRO. This single-contribution trust plan accommodates up to two settlors and has a minimum contribution amount of S$30,000.

Both plans are reserved-power trusts where the settlor retains the power of investment. “To prevent the value of the trust assets from being eroded by inflation, settlors can select up to five mutual funds to invest in,” explained Mr Ng.

Apart from cash assets, Metis SG's clients can choose to assign insurance policies or nominate their Central Provident Fund (CPF) monies into their trust. This feature is particularly beneficial for settlors with vulnerable beneficiaries as they can opt to distribute the monies in a series of regular payouts.

The democratisation of trusts opens up new avenues of financial planning. As these instruments become increasingly accessible, their potential for safeguarding assets and facilitating long-term plans will gain greater prominence.

Said Mr Ng: “A trust symbolises a timeless act of love and responsibility towards your loved ones as it evinces your intention to protect and care for them even when you are no longer around. This is the very essence of estate and legacy planning.”

Learn more about trust plans at Metis Global Singapore or call 6204 1313 to speak to a trust relationship manager. You may also find out more on Metis Global Singapore’s LinkedIn page.