analysis Asia

‘Strategic reset’: How China’s push to tighten assisted-driving rules could impact its auto industry

Even with stricter new regulation, Beijing will remain determined not to let recent setbacks derail its path to becoming a smart driving technology leader, experts said.

This audio is generated by an AI tool.

BEIJING: When Zhang Zhe, a 28-year-old Chinese bank manager, bought a Xiaomi SU7 electric vehicle equipped with smart technology in Beijing last October, he was eager to test out its autonomous driving features.

The vehicle was able to steer, accelerate and brake on its own, Zhang said, only needing a physical grip on the steering wheel to indicate that he was present.

“I have faith in the car,” Zhang said, adding that it could also follow traffic rules and avoided contact with other vehicles on the road.

But even with his years of experience behind the wheel, Zhang admitted he still felt a little uneasy.

“The functions work as designed (but) they just don’t feel natural,” he said.

Accelerating and braking could be abrupt and feel "overly mechanical" at times, he added.

The system would also hesitate to change lanes or take more cautious turns than a human driver would.

Smart driving assistance features in cars and new electric vehicles (NEVs) have been rapidly advancing and gaining popularity in China as automakers compete to launch new models equipped with state-of-the-art automated systems.

Companies like Chinese electric vehicle giant BYD, also the world’s largest EV maker, have accelerated the trend, observers say, rolling out technology like its “God’s Eye” assisted-driving system which allows for adaptive cruising and drivers to park or control their vehicles using their mobile phones.

But road accidents and fatal crashes involving self-driving cars have followed and many drivers like Zhang say they are still learning to trust and navigate these new smart safety systems.

A "STRATEGIC RESET"?

Officials have since moved to introduce new guidelines for smart driving technology, aimed at enhancing public safety and trust.

Also in the works are stricter regulations on remote software updates for assisted-driving systems, which would require regulatory approval for key updates impacting vehicle safety or performance.

Experts who spoke to CNA said they were expecting the new rules to be rigorous, claiming many Chinese automakers had been falling short of official standards.

“Right now, Chinese car manufacturers and driving software developers transmit and install updates on vehicles almost freely,” said Jia Yanbo, a Beijing-based expert with more than a decade of experience developing safety technology systems for vehicles.

“They collect data remotely, develop new functions that may not have been fully tested or validated on public roads and then push them to cars over the internet,” Jia added.

“Moving forward, authorities should review this carefully and require longer testing periods before such updates are rolled out.”

Others said the new rules could be a “strategic reset” for China’s smart tech ambitions, which in turn, could boost global consumer trust in Chinese-made smart vehicles.

A clear national guideline could “set the tone” for Chinese carmakers, said David Zhang, General Secretary of the International Intelligent Vehicle Engineering Association (IIVEA), who added that the new standards should require more efforts like added investment and testing.

Compliance would take time, Zhang added, as companies rush to meet the tougher new safety requirements.

This in turn, could hinder market growth until a wider regulatory picture is established.

"Like any product, (smart driving technology) must be learned and used properly," Zhang said.

"Misuse can have consequences."

L3 SELF-DRIVING VEHICLES

A notice issued on Jun 4 by China’s Ministry of Industry and Information Technology (MIIT) announced a public consultation as it welcomed feedback on smart driving technologies.

It followed an earlier advisory delivered by the ministry during a high-profile meeting between officials and nearly 60 automakers back in April, where measures like banning the use of misleading words in ads were discussed.

In its notice, MIIT said 55.3 per cent of all new smart passenger vehicles sold in China were equipped with Level 2 (L2) or higher driver-assistance systems.

According to official guidelines, L2 systems allow a car to control steering, acceleration and braking simultaneously but drivers are still required to be alert and engaged, monitoring road conditions at all times.

L3-ready vehicles are also being introduced, enabling hands-off driving under specific conditions, with the self-driving automated system assuming primary control while still expecting the driver to intervene when needed.

Levels 4 and 5, still in early testing stages, remain limited to small-scale robo-taxi and shuttle trials in cities like Beijing and Shenzhen - with regulators keeping mass deployment on hold until safety benchmarks and infrastructure catch up.

L4-ready vehicles are said to be capable of handle almost all driving within mapped areas, while L5-ready would see full automation in any setting, with no need for a driver at all.

Growing use of these systems has enhanced the driving experience but has also “led to a series of traffic accidents, drawing widespread public attention”, MIIT said.

The draft standards aim to tighten oversight, improve testing and safety benchmarks while pushing domestic carmakers toward faster upgrades, it added - all to ensure rapid innovation does not come at the expense of public trust and safety.

ROAD FATALITIES

Analysts believe that recent high-profile crashes involving smart driving vehicles prompted government action.

A fatal accident on Mar 29, involving Xiaomi’s best-selling SU7 electric sedan, drew widespread attention.

The vehicle, equipped with a smart driving automated system, had crashed into a concrete barrier while cruising along a highway in Tongling, a prefecture city in the southern Anhui province.

All three female university students on board were killed and families raised concern about potential system malfunction, resulting in the loss of control and jammed doors.

Responding to public questions, Xiaomi officials confirmed that the car had been in Navigation on Autopilot (NOA) mode, travelling at around 116kmh when it detected an obstacle.

Although the driver had taken control, the car collided with a cement barrier, they said.

The vehicle’s AEB (Automatic Emergency Braking) system “does not respond to common obstacles such as traffic cones, water barriers, rocks or animals”, officials added.

Another accident involving a smart driving car was recorded in December.

An Aito M7, a premium Huawei-backed EV, was travelling at 120kmh and had been in its smart assisted driving mode when it rear-ended a stationary truck.

Its driver, a former winner of an intelligent driving competition, was also injured in the crash.

Experts said the incidents highlighted broader issues within China’s fast-evolving intelligent driving landscape - showing a clear disconnect between drivers and smart driving technology.

“Not everyone (will) understand the technology in a systematic way,” said Jia, adding that implementing official guidelines would be good in helping drivers and the industry “know the limits”.

“The bottom line for smart driving technology is about safety,” he said.

Others said stringent law enforcement would be necessary.

Many drivers remain unaware of wider risks, said Guan Lipeng, co-founder of Geekcar.com, a Chinese automobile content platform.

“Standardised regulations that draw a clear line would force carmakers and marketers to confront safety concerns directly,” Guan said.

“It would also help raise overall safety standards across the industry.”

Tu Le, founder and managing director of Sino Auto Insights, a transportation innovation and management consultant firm, noted that “almost every major Chinese automaker now” had some form of smart driving function.

“The technology is being put in the hands of people who may not fully understand it, or are careless in how they use it,” Tu said, adding that many drivers gained a “false sense” of confidence after operating smart car systems for just a few minutes.

“The Chinese government does not care if fault lies with the driver or the system,” Tu said.

“The bottom line is that people are dying (and officials are) trying to get ahead as more of these systems hit the road.”

DANGEROUS “IMPATIENCE”

While Chinese automakers like BYD have been rapidly outpacing foreign rivals like Tesla, officials are threading a fine line between innovation and safety.

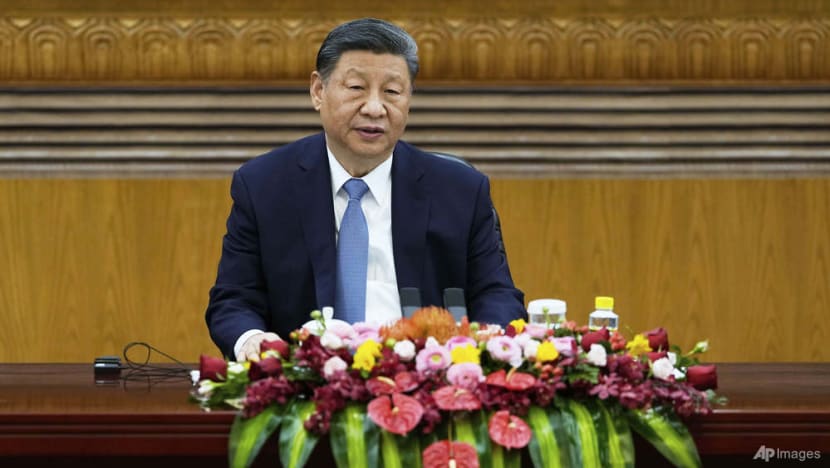

In unusually candid remarks made during a conference on Jul 14, Chinese President Xi Jinping questioned the rush by local authorities pouring resources into sectors such as NEVs and AI.

“Whenever a project is proposed, it always involves a few things: artificial intelligence, computing power, new energy vehicles,” Xi said in comments carried by state media outlets, also cautioning against “impatience for quick results”.

“Does every province in the country have to develop industries in these directions?”

His message was reinforced two days later by Chinese Premier Li Qiang during a state council meeting, where he called for tighter regulation of “irrational competition” in China’s NEV sector.

China's smart vehicle market remains fragmented, said Guan, noting that numerous smaller players had been producing smart driving technology to varying standards.

Without broad regulatory oversight, it would be difficult to enforce consistent benchmarks “not only for business performance but also for safety”, he added.

But at the same time, introducing overly stringent rules could jolt an industry unprepared to meet tougher requirements, Guan said.

The shock could destabilise the Chinese market, forcing smaller firms out of business if stricter rules significantly disrupted operations.

“It will result in a strategic reset of sorts,” said Guan.

“Right now, I’d estimate eight out of 10 players would fail to meet higher testing or validation standards.”

Others dismissed concerns that tighter oversight would stifle innovation, noting that China still remained far ahead of its global competitors like the US in rolling out smart driving vehicles and features.

“This isn’t about slowing the industry down relative to competitors,” said Tu.

“It’s about making sure unnecessary deaths and accidents don’t undermine public trust in a technology that’s now in almost every new vehicle.”

THE ROAD AHEAD

According to data released in June by the China Association of Automobile Manufacturers (CAAM), China exported 205,000 NEVs in June 2025, marking a 140 per cent jump from 2024.

Chinese developers and NEV brands like BYD and the state-owned Shanghai Automotive Industry Corporation (SAIC) have also been ramping up exports to international markets like Europe, Latin America and Southeast Asia.

The industry has become one of the key fronts in China’s broader technology war with the US, experts said, and Beijing will remain determined not to let recent setbacks derail its path to becoming a smart driving technology leader.

“China is set to continue its strong lead in the new energy smart car space, and for good reason,” said Zhang.

“Tighter regulations may make the curve harder to climb in the short term (but) once the industry steadies itself under the new guidelines, it will consolidate its lead.”

Exports of Chinese smart cars equipped with assisted driving technology are also likely to see a brief slowdown as cautious overseas buyers wait to see the impact of new guidelines, said experts, though they expect the effect to be short-lived.

“What matters most is meeting the destination countries’ requirements,” said Zhang.

“As long as those are met, sales won’t be an issue.”

Foreign importers may pause purchases of Chinese-made smart vehicles while they await clarity on the new guidelines, said Tu.

But this hesitation would likely be temporary and ultimately, serve as a “timely intervention”.

“If these guidelines give clarity, they’ll help reassure regulators overseas and accelerate adoption,” Tu said.

"Even if it slows things down, most car buyers see these features as important but not necessarily deal-breakers when deciding on a purchase," he added.