analysis Asia

Malaysia’s privatisation of airport operator with BlackRock entity faces a bumpy ride, but likely to go ahead

Observers say Prime Minister Anwar Ibrahim is unlikely to cave in to demands to remove an entity partner with ties to Israel from the deal. But larger questions loom on the economics and whether the move will give Kuala Lumpur International Airport a lift in international rankings.

This audio is generated by an AI tool.

KUALA LUMPUR: Criticism and questions continue to dog Malaysia’s plan to privatise its national airport operator Malaysia Airports Holdings Bhd (MAHB), but analysts say there’s unlikely to be any U-turning on the move.

“This train has left the station and the time to back out is no longer an option because a formal offer has been made (on the proposed privatisation),” said a Finance Ministry official involved in the proposed transaction.

The official added that the international reputation of two of Malaysia’s largest state-controlled funds driving the deal, sovereign wealth fund Khazanah Nasional and the Employees Provident Fund, were at stake.

The involvement of the world’s largest asset manager, New York-based BlackRock Inc, in the multi-billion-dollar privatisation of the airport operator has turned the proposed transaction into a hot political potato for Prime Minister Anwar Ibrahim because of the US company’s links to Israel.

In mid-May, Khazanah and EPF announced they had formed a consortium with BlackRock-linked Global Infrastructure Partners (GIP) and the Abu Dhabi Investment Authority to take publicly listed MAHB private with an offer of RM11 (US$2.30) a share.

BlackRock holds significant investments in Israel and was also a big investor in companies that arm the Israeli defence forces. It announced in January it would buy GIP for US$12.5 billion in an acquisition that is expected to be completed in the third quarter of this year.

Under the multi-stage corporate transaction to privatise MAHB, the four entities will form a special purpose vehicle, Gateway Development Alliance Sdn Bhd. Khazanah and EPF will have a 70 per cent interest in the consortium, with the foreign parties owning the remainder.

Related:

With a share base of 1.66 billion units, the deal values MAHB at RM18.26 billion (US$3.9 billion). And with roughly 40 per cent of MAHB shares currently held by the public, according to advisory firm CGS International, it would cost the new consortium roughly RM7.3 billion (US$1.55 billion) to take the company private.

The deal, estimated to take place in the fourth quarter of the year, must secure regulatory approval in Malaysia and other jurisdictions, such as Türkiye.

WHAT IS THE PLAN?

But it isn’t just politics that is stoking public consternation over the proposed privatisation of MAHB, which stands as the Anwar administration’s most audacious corporate exercise since coming to power in November 2022.

Aviation experts and bankers are also questioning the economics of the privatisation plan.

“I still can’t understand the rationale behind the privatisation because it is not going to guarantee results. There is a general view in the industry that there is no clear plan apart from this being very transaction-driven,” said Mr Shukor Yusof, a senior aviation analyst and founder of Singapore-based Endau Analytics.

He added the management models of top airports, such as Singapore’s Changi and South Korea’s Incheon International, are options Malaysia should consider. Aviation analysts noted that both these airports are successful because they are not only functional but also serve as attractions.

The wider investing community appears to concur.

Typically, the value of shares in a company targeted for a privatisation and takeover creeps up to the target price of the proposed transaction.

But that has not been the case for MAHB. On Friday, shares of MAHB were trading at RM9.87 per share, a sharp discount to the RM11 offer price in the privatisation deal.

“Markets don’t lie and the share price is suggesting that there are a lot of concerns whether the deal will go through,” said a chief executive of a foreign bank based in Malaysia.

GIP “FITS THE BILL”, SAYS KHAZANAH

The government’s defence of the proposed MAHB privatisation has been less than robust.

Mr Anwar has accused the opposition of throwing baseless allegations. “There is nothing positive from them, only inciting hatred and envy,” he was quoted as saying by Malaysia's domestic media.

Debate over the MAHB deal is expected to get heated again at the next Parliament sitting that begins on June 24.

In a written response to CNA, Khazanah, which is often compared to its Singapore peer Temasek Holdings, defended the proposed privatisation plan, noting that the BlackRock-tied GIP was picked after a robust review of potential technical partners, including global airport operators.

“We were looking for a partner that has a strong track record of value creation and one that goes beyond what current airport managers are doing and can achieve…GIP fits the bill and like most private equity funds, they will eventually exit after creating value, just as they have been doing with their other airports,” said a spokesperson from Khazanah.

GIP does come with serious credentials.

Ranked as one of the leading infrastructure managers in the world, GIP has a 17-year track record and currently has US$112 billion in assets under management. Apart from managing ports and airports, GIP also has extensive investments in renewable energy and oil and gas projects across the globe.

But critics of the privatisation plan noted that the airports under GIP’s management do not rank highly in international rankings such as Skytrax.

The London Gatwick Airport, in which the fund has a 49.99 per cent interest, is ranked 48th in Skytrax’s 2024 ranking, while the Sydney Airport, of which GIP owns 37 per cent, was in 55th place. By contrast, Singapore’s Changi was ranked second, after the Doha Airport, and South Korea’s Incheon was ranked third.

Unlike the standalone airports GIP currently manages, MAHB has 39 airports in its stable, all of them in Malaysia with the exception of the Sabiha Gokcen Airport in Istanbul.

FINANCIAL MUSCLE NEEDED FOR UPGRADES

The airports in Malaysia are in need of upgrades.

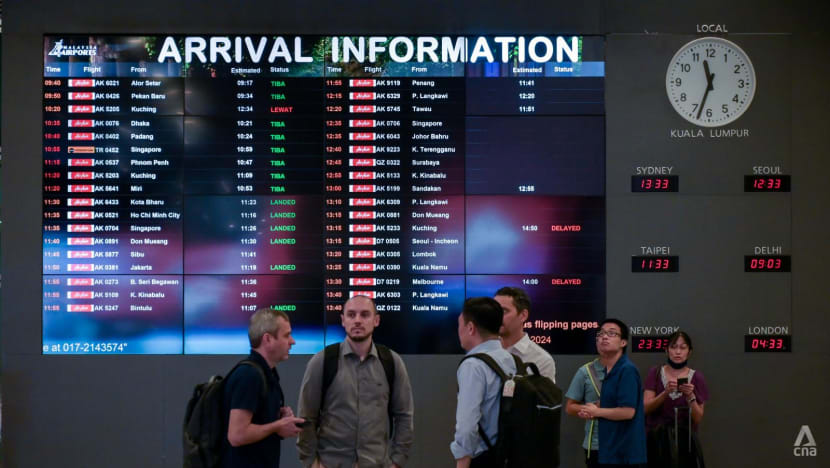

The Kuala Lumpur International Airport (KLIA), widely seen MAHB’s prized asset, was 71st in the Skytrax 2024 airport rankings. It suffered an embarrassing technical outage that left passengers stranded in 2019 and, in 2023, the airport management was forced to suspend its aged aerotrain network that is now being replaced.

Proponents of the privatisation plan noted that GIP would lend much-needed financial muscle and technical expertise to get MAHB back on course to compete with other international rivals.

The move by the Anwar administration in March to replace the operating and land lease agreement of the previous 25-year concession with a fresh 45-year term that will only expire in 2069 will also allow for better financial planning and airport expansion programmes, government officials said.

But there is concern that BlackRock’s participation could create other complications, particularly over the future prospects of the Sabiha Gokcen Airport in Istanbul.

Türkiye suspended all trade with Israel last month over what President Recep Tayyip Erdogan said was a “worsening humanitarian tragedy” by the Israeli offensive in Gaza.

Some bankers have speculated that unless ties between the two countries return to normal, MAHB could find itself in an awkward position when the concession for the Sabiha Gokcen Airport expires in 2023.

CGS International noted in a report to clients in late February that MAHB could opt to brighten its chance for an extension by bringing a new Turkish investor as a partner in Sabiha Gokcen, where it now has a 100 per cent interest.

Khazanah declined to comment on the prospects for the Istanbul airport.