When Ms Nancy Lim dabbled in stocks in her 20s and 30s, she learned some tough lessons. Like many novice investors, she lacked a deep understanding of the companies she invested in, leading to less-than-ideal outcomes for her savings. “You can’t pick stocks the way you pick groceries,” she said. “It was an unpleasant experience.”

The 55-year-old human resource director now takes a more diversified approach to investing and prioritises relevant insurance coverage as she steps into her “young senior” years. One of her recent decisions was investing in an investment-linked insurance policy (ILP) from Income Insurance.

This policy combines flexible investment with robust insurance protection – a balance that meets her evolving needs.

UNDERSTANDING ILPs AND THEIR EVOLUTION

ILPs combine insurance and investment into a single solution, offering a dual-purpose tool for wealth accumulation and life insurance coverage. Whether you are a young professional starting out or approaching retirement, ILPs could be a viable financial planning solution suited to your needs.

While ILPs have been in the market for a while, they have undergone significant evolution. Early ILPs were primarily protection-focused, emphasising life insurance coverage and carrying higher charges like mortality and morbidity costs to ensure financial security for loved ones. Today, investment-focused ILPs are gaining traction focusing more on growing investments while still providing essential coverage.

Whether they are investment- or protection-focused, today’s ILPs are designed with flexibility in mind to meet different needs. For example, unlike traditional endowment plans that lock funds for extended periods, ILPs such as Income Insurance’s Invest Flex and Invest Flex Vantage allow up to three charge-free partial withdrawals of up to 10 per cent of the policy value, subject to certain conditions being met, after three years, provided the policyholder has completed the minimum investment period (MIP) — the period during which they have chosen to pay regular premiums. This feature, known as the Life Events Withdrawal Benefit, offers financial agility for significant life events that may occur during the MIP, such as a wedding, starting a family, buying a home, or an unexpected hospital stay.

In addition, you can have the flexibility to take a premium holiday at no charge for up to 120 months from the fifth anniversary of the policy, subject to certain conditions.

A common concern with ILPs is the fees involved. To be transparent to consumers, insurers like Income Insurance offer clear documentation, including a product summary, policy conditions and policy illustration – so they can fully understand their policy and its benefits.

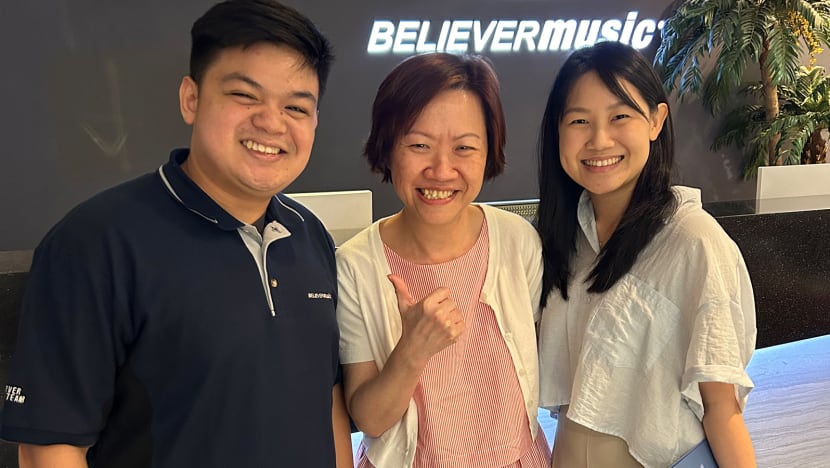

It was this flexibility and transparency that drew Ms Lim to choose Income Insurance’s Invest Flex Vantage plan. After discussing the risks and benefits with her financial advisor representative, Ms Lim felt confident in her decision to invest in the ILP. She also took the time to read the policy’s terms and conditions, ensuring she made an informed choice. “For me, it’s equally important to have investment and coverage,” she added.

PROTECTION AND INVESTMENT ACROSS LIFE STAGES

Income Insurance’s ILPs cater to individuals at every stage of life, from young professionals building their financial foundation to those planning for a secure retirement.

Take Ms Ariel See, 34, for example. A mother of two, the business development manager is exploring ILPs to expand her investment portfolio while ensuring her family’s financial security. With plans like Invest Flex, Ms See can safeguard her children’s future, and simultaneously invest and build her retirement nest egg. “It complements my existing insurance plans by providing investment growth potential alongside life coverage,” she said.

As someone focused on long-term financial planning, she also prefers that professional fund managers handle her investments, rather than placing this responsibility on her family if she were to pass away.

While she already holds other investments and term life insurance, she is interested in ILPs for their flexibility and potential returns. “Initially, I thought ILPs were too expensive, and I was concerned about the fees,” she admitted. “But after learning more, I realised that ILPs offer investment returns that could potentially offset those costs. That changed my perspective.”

For Ms Lim, the focus is on securing a steady income to supplement her retirement savings. The Invest Flex Vantage plan offers her possible dividend payouts with dividend paying funds1 as early as the first policy year, providing a potential income stream to meet her retirement needs.

Beyond investment returns, Ms Lim also required sufficient insurance protection. With Invest Flex Vantage, she has gained coverage for terminal illness and death, ensuring her loved ones are financially supported in case of unexpected events. “Invest Flex Vantage suits my needs,” Ms Lim shared. “I like the dual objectives of ILPs – without both investment growth and protection, it wouldn’t align with my wealth journey.”

MAKING SMART DECISIONS TODAY FOR A SECURE TOMORROW

Both Ms Lim and Ms See are mindful that ILPs require ongoing attention to ensure they’re meeting their financial goals. Ms Lim stays in close contact with her financial advisor representative, regularly reviewing her policy’s performance. “I’ve been reviewing my coverage with my financial advisor representative (on a regular basis),” said Ms Lim. “Retirement planning, disability income protection and coverage for death, terminal illness and hospitalisation are key priorities for me.”

“I prefer to have professional fund managers manage my investments, so I don’t have to worry about it myself. I’ve been enjoying strong returns without the need to monitor my investments every other day. It has been a stress-free experience,” she added.

Meanwhile, Ms See keeps track of her reports from an earlier ILP she bought a decade ago. As her children grow, she is now considering a new ILP to further diversify her investments.

Both women advise investing as a way to accumulate funds for unexpected expenses. “Investing in an ILP is like an instalment plan for my medical bills but with the added benefit of returns, savings and investments. It’s essentially shifting funds from one account to another with potentially higher returns,” said Ms See. “Start saving as early as possible – even if it’s a small amount, it will accumulate into a big amount over time,” she concluded.

TAKE CONTROL OF YOUR FINANCIAL FUTURE TODAY

Explore Income Insurance’s Invest Flex and Invest Flex Vantage plans

to learn how you can balance protection and growth.

FIND OUT MOREImportant notes from Income Insurance:

1 Dividend refers to the distribution of certain funds that have a distribution option that Income Insurance may declare. Distributions are not guaranteed. If the distribution amount for a fund meets the minimum amount Income Insurance tells the policyholder, the policyholder can choose to receive all future distributions from that fund as payouts.

Distributions may be made from the income and/or capital of the sub-fund. Any payout of distributions from the capital of the sub-fund may result in an immediate reduction of the net asset value per share/unit. Please refer to the policy conditions for further details on the declaration of distributions, reinvesting distributions and the applicable terms and conditions.

Disclaimers

This information is not to be construed as an offer, recommendation, solicitation or advice for the subscription, purchase or sale of any investment-linked plan (ILP) sub-fund. The information and descriptions contained in this material are provided solely for general informational purposes and do not constitute any financial advice. It does not have regard to the specific investment objectives, financial situation and particular needs of any person.

Investments are subject to investment risks including the possible loss of the principal amount invested. Before committing to the minimum investment period, you may want to consider how long is your investment expectations or needs and whether you are able to keep up with the premium payment should your financial situation change. Past performance, as well as the prediction, projection or forecast on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of the ILP sub-fund. The performance of the ILP sub-fund is not guaranteed and the value of the units in the ILP sub-fund and the income accruing to the units, if any, may fall or rise. A product summary and product highlights sheet(s) relating to the ILP sub-fund are available and can be obtained from your insurance advisor or online at income.com.sg/funds. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund.

The precise terms, conditions and exclusions of the insurance plans are specified in the policy contracts. All our products are developed to benefit our customers but not all may be suitable for your specific needs. If you are unsure if this plan is suitable for you, we strongly encourage you to speak to a qualified insurance advisor. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. Buying a life insurance plan is a long-term commitment on your part. If you cancel your plan prematurely, the cash value you receive may be zero or less than the premiums you have paid for the plan.

Protected up to specified limits by SDIC.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at February 12, 2025.