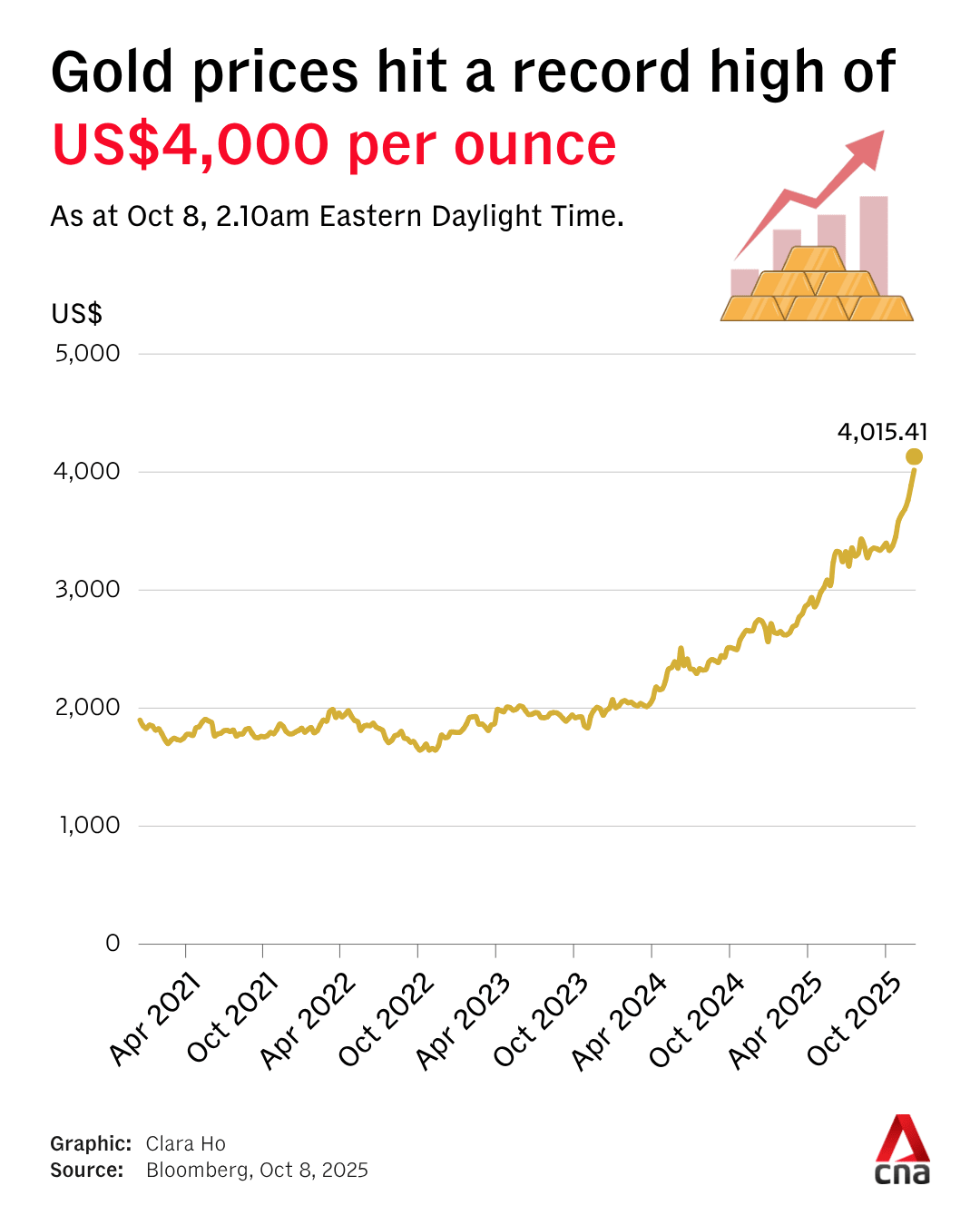

Gold builds on historic rally, soars past US$4,000 an ounce for first time

Gold bars are displayed to be photographed at a bullion house in Mumbai on Dec 3, 2009. (File photo: Reuters/Arko Datta)

Gold pushed through US$4,000 an ounce to hit a record on Wednesday (Oct 8), driven by investors seeking safety from mounting economic and geopolitical uncertainty, alongside expectations of further interest rate cuts by the United States Federal Reserve.

Spot gold was up 0.7 per cent at US$4,011.18 per ounce by 3am GMT. US gold futures for December delivery gained 0.7 per cent to US$4,033.40 per ounce.

Traditionally, gold is seen as a store of value during times of instability. Spot gold is up 53 per cent year to date after rising 27 per cent in 2024.

"There's so much faith in this trade right now that the market will look for the next big round number, which is 5,000, with the Fed likely to continue to lower rates," said Tai Wong, an independent metals trader.

"There will be some bumps in the road, like a lasting truce in the (Middle East) or Ukraine, but the fundamental drivers of the trade, massive and growing debt, reserve diversification and a weaker dollar are unlikely to change in the medium term."

The metal's rally has been driven by a cocktail of factors, including expectations of interest rate cuts, ongoing political and economic uncertainty, solid central bank buying, inflows into gold exchange-traded funds and a weak US dollar.

The US government shutdown entered its seventh day on Tuesday. The shutdown has postponed the release of key economic indicators from the world's biggest economy, forcing investors to rely on secondary, non-government data to gauge the timing and extent of Fed rate cuts.

Investors are now pricing in a 25-basis-point cut at the Fed meeting this month, with an additional 25-basis-point cut anticipated in December.

"Rising uncertainty levels tend to fuel gains in the gold price, and we are seeing this theme play out again," said KCM Trade chief market analyst Tim Waterer.

"Market dynamics of lower US interest rates and the ongoing government shutdown are still working in favour of gold. But the temptation to take profits around the US$4,000 mark (poses) a potential short-term risk."

A "fear of missing out" is also boosting the rally, analysts say.

Additionally, political turmoil in France and Japan has also boosted demand for the safe-haven bullion.

"The latest leg higher has been sparked by the election of Sanae Takaichi over the weekend and the prospect of deeper deficit spending in Japan. That itself ties into a key theme at the moment: the 'run it hot' trade," said Capital.com analyst Kyle Rodda.

Analysts expect strong inflows into exchange-traded funds backed by physical gold, central bank buying and the prospect of lower US interest rates to support gold prices in 2026, prompting Goldman Sachs and UBS to raise their price outlooks.

In other precious metals markets, spot silver rose 1.3 per cent to US$48.42 per ounce, platinum gained 2.5 per cent to US$1,658.40 and palladium climbed 1.8 per cent to US$1,361.89.