Indonesia's exports rise again in June as US-bound shipments jump

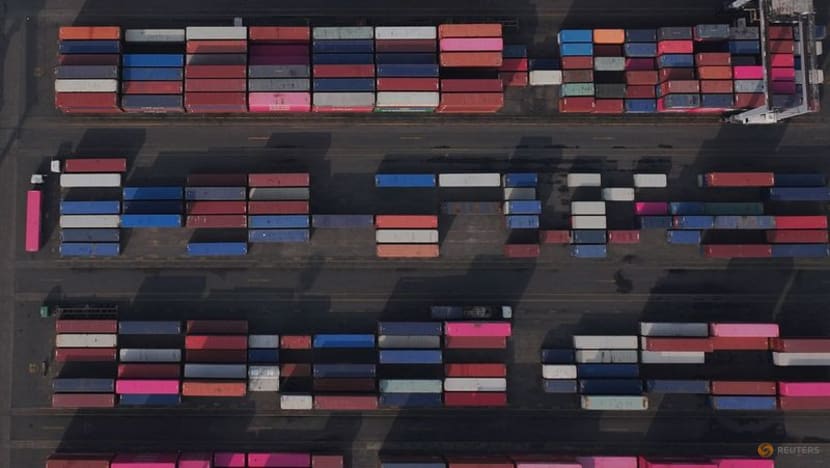

FILE PHOTO: A drone view shows stacks of containers at the Tanjung Priok port in Jakarta, Indonesia, July 10, 2025. REUTERS/Ajeng Dinar Ulfiana/ File Photo

JAKARTA :Indonesia's exports rose in June as exporters sought to beat the U.S. tariff deadline and shipments of palm oil and gold jewellery increased, while inflation accelerated in July, official data showed on Friday.

June shipments from Southeast Asia's biggest economy jumped 11.29 per cent on a yearly basis to $23.44 billion, higher than the 10.41 per cent forecast by economists polled by Reuters. Exports rose 9.68 per cent in May.

Excluding oil and gas, June shipments to the U.S. rose 33.5 per cent on a yearly basis. Top Indonesian products sold to U.S. buyers included electrical machinery, clothing, footwear, palm oil, rubber and seafood.

Shipments of palm oil from the world's biggest producer surged 15.1 per cent in June, while gold and jewellery exports more than doubled from the same month in 2024.

Imports in June rose 4.28 per cent on a yearly basis to $19.33 billion, below the poll's forecast of 6.5 per cent.

The result was a bigger-than-expected trade surplus of $4.11 billion in June, above the poll's expectation of $3.45 billion, but down slightly from May's $4.30 billion.

Indonesian exporters in recent months have brought forward shipments to the United States ahead of President Donald Trump's August 1 deadline for tariff negotiations.

Washington set Indonesia's import tariff at 19 per cent under a deal agreed in July, from threatening a 32 per cent levy earlier, after Jakarta agreed to eliminate most tariffs affecting U.S. industrial and agricultural products and to buy more American goods.

Trump has issued an executive order saying the new tariff rates will be implemented in seven days.

Indonesia's trade surplus may be squeezed as the tariffs take effect, with imports likely to rise and exports affected by lower prices of its top commodities, such as coal, Bank Danamon economist Hosianna Situmorang said.

Meanwhile, Indonesia's July annual inflation accelerated to 2.37 per cent on an annual basis, more than the 2.25 per cent expected by analysts, reflecting higher prices of foods such as shallots, rice, and tomatoes, as well as rising utility and education costs.

Annual core inflation, which strips out government-controlled and volatile food prices, was 2.32 per cent in July, compared with an analyst estimate of 2.37 per cent.

Both rates remained within the central bank's target range of 1.5 per cent to 3.5 per cent. Bank Indonesia has cut interest rates four times since September, citing low inflation and a need to support economic growth.

Josua Pardede, an economist at Bank Permata, said despite the impact of the tariffs on Indonesia's external position, the current account deficit was likely to remain manageable.

"This underpins our call for up to 50 bps BI-rate cuts in 2025," Pardede said.