Shares hit record high, oil plummets with market sentiment buoyed by Iran-Israel truce

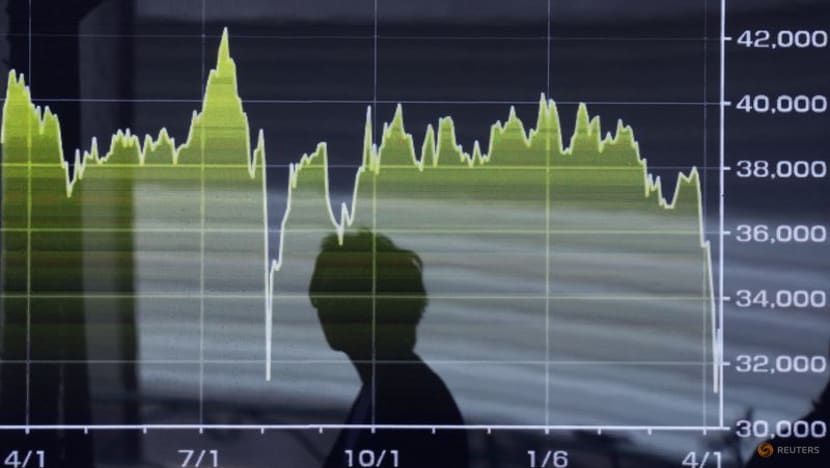

FILE PHOTO: A passerby is reflected on an electronic screen displaying a graph showing recent Japan's Nikkei share average movements outside a brokerage in Tokyo, Japan April 9, 2025. REUTERS/Issei Kato/File Photo

NEW YORK :An index of global shares hit a record high on Tuesday with oil prices plummeting further as market sentiment was lifted by the easing of Middle East tensions, after a shaky ceasefire between Israel and Iran began to take hold.

U.S. President Donald Trump had announced on Monday that Israel and Iran had reached a ceasefire to end their 12-day-old war. But both sides accused each other of violating the truce on Tuesday, sparking an extraordinary outburst from Trump.

Wall Street's main indexes rallied more than 1 per cent, with the benchmark S&P 500 finishing near a record high reached on February 19. The biggest gainers were in financials, technology, communication services, and healthcare stocks. Energy and consumer staples shares were the main drag.

The Nasdaq 100 notched a record high close for the first time since February.

The Dow Jones Industrial Average rose 1.19 per cent to 43,089.02, the S&P 500 rose 1.11 per cent to 6,092.18 and the Nasdaq Composite rose 1.43 per cent to 19,912.53.

European shares finished up 1.11 per cent, hitting a one-week high during the session and notching its biggest single-day jump in over a month.

MSCI's broadest index of Asia-Pacific shares outside Japan jumped 2.4 per cent overnight, closing at its highest level since January 2022. MSCI's gauge of stocks across the globe rose 1.45 per cent to 902.88, hitting its highest level on record.

"Markets are cheering what is looking to be a ceasefire between Iran and Israel, which means no major impact to supply of oil to global markets," said Talley Leger, chief market strategist at the Wealth Consulting Group. "Risk assets, including equities in general and cyclical pro-economy sectors of the market more specifically, have been rallying. Defensives and safe-haven assets have also been ebbing, which is consistent with what we've been saying and what we know historically."

Brent Crude futures settled down 6.1 per cent to $67.14 a barrel. U.S. West Texas Intermediate (WTI) crude fell 6.0 per cent to settle at $64.37. Both contracts had settled down more than 7 per cent in the previous session, having rallied to five-month highs after the U.S. attacked Iran's nuclear facilities over the weekend.

The U.S. dollar declined against major currencies including safe-haven Japanese yen and Swiss franc following the truce. The euro gained.

The dollar weakened 0.88 per cent to 144.80 against the Japanese yen and dropped 0.90 per cent to 0.80515 against the Swiss franc. The euro was up 0.27 per cent at $1.16125.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, fell 0.30 per cent to 97.94.

Federal Reserve Chair Jerome Powell said higher tariffs could begin raising inflation this summer, a period that will be key to Fed considering possible rate cuts. Powell spoke at a hearing before the House Financial Services Committee.

Data showed that U.S. consumer confidence unexpectedly deteriorated in June, signalling softening labor market conditions.

The yield on benchmark U.S. 10-year notes fell 3 basis points to 4.293 per cent. The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 1.2 basis point to 3.817 per cent.

Germany's long-term government bond yields rose after the cabinet passed a draft budget for 2025. The yield on the benchmark German 10-year Bunds rose 0.9 basis points to 2.543 per cent.

Gold prices fell. Spot gold fell 1.34 per cent to $3,323.49 an ounce. U.S. gold futures settled 1.5 per cent lower at $3,298.40.