commentary Commentary

Commentary: When economies reopen for business but families are reluctant to spend

Reopening the economy is no panacea for businesses facing the threat of bankruptcy if adjustment to the ‘new normal’ is not forthcoming, says NUS Business School’s Cai Daolu.

LAPD Officers wear face masks as they patrol Hollywood Blvd during the outbreak of the coronavirus disease (COVID-19), in Los Angeles, California, U.S., May 18, 2020. REUTERS/Mario Anzuoni

SINGAPORE: We’re all itching to get out of our homes to see loved ones and friends but will people return to shops once the relevant restrictions are lifted?

To say that the current state of the global economy is tumultuous is an understatement.

The biggest economy in the world, the US suffered a massive contraction of 4.8 per cent for the first quarter of 2020.

Considering that US lockdowns were only slapped in mid-March, the greater concern is what the second quarter heralds when states continue to be in lockdown, with businesses shuttered and millions of jobs lost.

READ: Commentary: Elon Musk, Tesla’s mad genius, is defying US lockdown - and people love it

LISTEN: Why lifting lockdowns and easing restrictions may be the biggest COVID-19 test facing countries

THE AMERICAN NIGHTMARE

Unemployment numbers in the US went from the American dream to the American nightmare.

In a matter of weeks, it experienced both the lowest and the highest unemployment rate in the past 50 years.

Back in February of this year, the US economy registered a historical low unemployment rate of 3.5 per cent. In mere weeks, it went up to near 15 per cent (a whopping 23 million unemployed people). New jobs created this decade were wiped out in an instant.

Every macroeconomic indicator suggests that the current crisis will be catastrophic, making the global financial crisis of 2008 look like child’s play. Estimates are suggesting it could surpass the Great Depression of 1929.

READ: Commentary: 10 signs a greater depression is coming

FAMILIES ARE TIGHTENING BELTS

Households are not only incredibly cautious with their new habits of personal hygiene, but also extra careful with their spending.

Overall consumer spending in the US, which contributes over two-thirds of GDP, declined over 7 per cent last month.

READ: Commentary: Worried about money? It's not just you

Furthermore, consumer spending on durable goods, items like vehicles, furniture and appliances, dropped by almost 15 per cent, twice as much as the fall observed during the global financial crisis of 2008. Recovery to previous peak levels took almost three years.

All this matters when central banks around the world concur the evolution of consumer spending is a leading indicator of a country’s economic health because the dynamic of consumption reflects household expectations for the economic outlook.

Protests urging the US government to lift lockdowns assume normalcy and businesses can revert to normalcy once those restrictions are eased but nothing can be further from the truth.

READ: Protests, court rulings: Anti-lockdown push turns partisan in US

HEALTH CONCERNS HOLD PEOPLE BACK FROM SPENDING

Using household consumption data from the US, back-of-the-envelope calculation suggests the fear of getting infected is the contributing factor in accounting for the reduction in consumer spending.

Comparison across US states provides a clear picture of why fear is the major factor behind the drop in economic activity, rather than the implementation of movement restrictions.

In states that never implemented any stay-in orders during the COVID-19 health crisis, like the state of South Dakota, consumer spending experienced a similar decline compared to the states that did.

READ: Commentary: In COVID-19 captivity, my urge to splurge is over and won’t be returning soon

This sharp drop in household consumption, regardless of whether a stay-in order has been issued, suggests fear of the virus is the major factor behind the drop in economic activity, rather than the actual implementation of movement restrictions.

Even lifting the stay-in orders, like the state of Georgia, did not bring family back to the businesses and shops. Since Georgia reopened in late April, consumer spending remains low. Not much has changed since the restriction order was lifted.

Fear hurts more the economy than the lockdown measures. Easing restrictions prematurely may not be an effective policy to reactivate the economy – people simply will not spend if they are afraid of subsequent waves of contagion.

The sooner we are able to contain the spread of the virus, locally and globally, the faster we will see a rebound in the economy.

While stay-in measures are costly to the economy, they are not as costly as policy inaction or the inability to control the spread of the virus, which tackle fears people have of coming out.

READ: Commentary: People cannot just be ordered back to work and to spending

EVEN PARTIAL RECOVERY WILL BE CHALLENGING

For the economy to get its engines revving again, consumers need to be confident there is strong containment of the virus and families feel safe returning to work.

Even a partial rebound depends crucially upon effective public health containment policies – especially having in place a mass testing and contact tracing capability.

Recent labour market data from the Bureau of Labor Statistics provides some hope for a speedier recovery in the US and in the world, assuming a vaccine can be found in the next year.

READ: Commentary: COVID-19 vaccine – why is it taking so long to develop one?

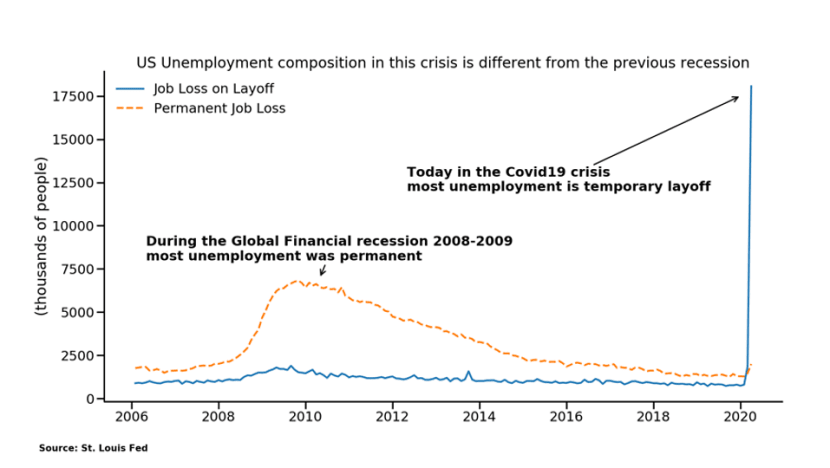

Most unemployment numbers observed in the US in this current crisis is temporary and not permanent, meaning these unemployed workers expect a recall from their firms to be reemployed upon reopening, a vast difference from the global financial crisis.

As long as companies continue to keep workers on the payroll during this difficult time – whether on partial compensation or unpaid leave – rather than lay off workers completely, the chances of a speedy recovery will be higher.

HOPES FOR A FULL RECOVERY

Whether an economy can recover fully will depend on its ability to reallocate manpower, capital and other resources to the new economy post-COVID-19.

There will be inevitable sectoral and structural changes as a consequence of this pandemic. Businesses in tourism, entertainment and recreation industries will have to adapt to survive.

A key challenge faced by all governments in the world is to keep their economic engine running without major disturbances with aggressive and unprecedented monetary and fiscal policies, while ensuring these policies do not ensue another financial crisis further down the road.

READ: Commentary: It is time central banks and governments shoot for negative interest rates

READ: Commentary: Who will bear the costs of COVID-19?

Any prediction on the economic outcome of this pandemic is premature at this stage given the magnitude of the uncertainty we face and the historical infrequency of pandemics.

What we know is this recession will be very different from the previous recessions. Most economic research suggests financial crises take longer to recover because they leave long-lasting unemployment and weaken the financial stability of countries.

Yet in this case, countries have a chance to restore consumer confidence and the economy if they prioritise managing the health risks.

BOOKMARK THIS: Our comprehensive coverage of the coronavirus outbreak and its developments

Download our app or subscribe to our Telegram channel for the latest updates on the coronavirus outbreak: https://cna.asia/telegram

Dr Daolu Cai is visiting senior fellow at the NUS Business School’s Department of Strategy and Policy.