commentary Commentary

Commentary: Singapore has a New Deal. We call it the Resilience Budget

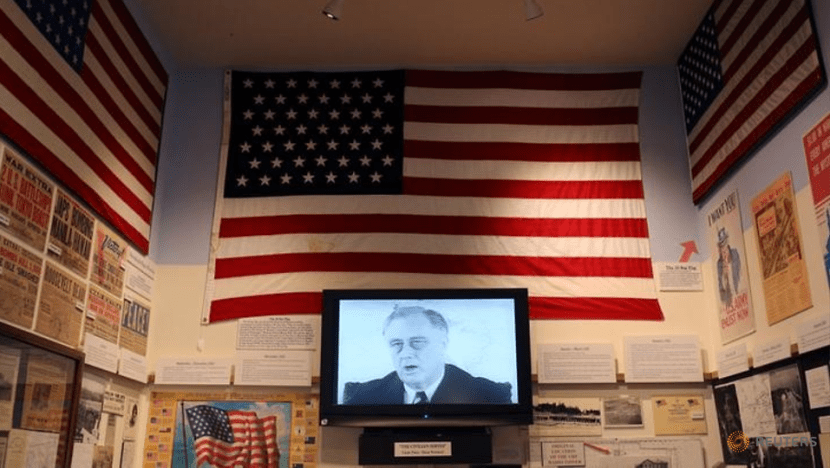

Singapore’s Resilience Budget is almost analogous to American President Franklin D Roosevelt’s New Deal, which lasted from 1933 to 1939, says Lawrence Loh.

Deputy Prime Minister and Finance Minister Heng Swee Keat addresses Parliament detailing additional support measures to help Singaporeans cope amid the COVID-19 pandemic.

SINGAPORE: A grand supplementary government budget, barely a month after the regular annual budget, may be surreally something out of the blue.

But it is absolutely crucial for Singapore caught in a mighty storm amid rapidly deteriorating economic conditions wrought by a global coronavirus pandemic.

It was only back in February that Singapore’s Deputy Prime Minister and Finance Minister Heng Swee Keat rolled out a “Unity Budget” that included expenditures and transfers totaling some S$106 billion for the entire country.

This had a S$6.4 billion Stabilisation and Support package for firms, workers and households to fight the effects of the emerging viral outbreak and hold onto jobs.

This blockbuster move was strongly welcome.

Yet how fast the world has changed.

In just five weeks, Mr Heng is back in Parliament to unveil a supplementary Resilience Budget totalling some S$48.4 billion, almost half of the whole earlier national budget.

Notably, the landmark move will draw S$17 billion from Singapore’s past reserves and, together with the earlier packages, total 11 per cent of Singapore’s gross domestic product.

The new initiative is called a “budget”, not a “package”. This is unlike the response to the global financial crisis during Budget 2009 when the relief effort was labelled a “Resilience Package” and tabled during the regular Budget session.

It is more than the tag – the current parliamentary comeback suggests something even more fundamental.

READ: Commentary: The problem with reusing the 2009 global financial crisis playbook to deal with COVID-19

READ: Commentary: The brewing concern over jobs and salaries as COVID-19 persists

In fact, Singapore’s Resilience Budget is a big deal. It is almost analogous to American President Franklin D Roosevelt’s New Deal, which lasted from 1933 to 1939.

THE NEW DEAL

The New Deal was FDR’s response to the Great Depression, which started earlier with a monumental Wall Street crash in October 1929. The aftermath saw a spectacular nosedive of almost 90 per cent for the Dow Jones Industrial Index within a protracted period of almost three years.

Much as the American stock market crash was a bloodbath, it was a symptom and not the cause of the Great Depression.

A unique confluence at both the demand and supply sides seeded that disaster, including high consumer debt, low producer opportunities and poor financial regulations.

Even if there were debates on the real and root causes of the Great Depression, the effects were undisputable. There were massive job losses, loan defaults, business closures, bank failures and deflation – all the ills of a severe economic downturn.

Beyond the specific economic tribulations, the most drastic consequence of the Great Depression was something of a grander scale – there was a complete breakdown of confidence – social confidence. This sparked widespread tensions, including even racial conflict.

America had been a land of dreams for many immigrants. But with the advent of the Great Depression, many even returned to where they or their forefathers had come from.

President Roosevelt came into office on the heels of the depression. His famed “first 100 days” of his presidency saw a slew of the most radical reforms and reliefs that covered a full spectrum of initiatives ranging from fiscal to monetary policies, from banking to business support, and from city to rural programmes.

READ: Commentary: Imagine holding the US elections during a COVID-19 outbreak

READ: Commentary: What elections in a coronavirus outbreak could look like

Even where the New Deal drew controversy, particularly among political conservatives, the programme was widely recognised as a wild success that revitalised the US and got many engines of growth going again.

THE NEW DEAL, SINGAPORE EDITION

The Resilience Budget – Singapore’s “New Deal” – arrives in a different context from the American analogy but takes place amid a global downturn of possibly epic proportions with flailing business and consumer confidence.

While there might not have been sweeping legislative changes in the same way the New Deal put in place new regulatory building blocks and key federal programmes that underpin much of how the US economy works today, its underlying intent and significance are somewhat similar.

The American New Deal was intended to combat a mammoth economic catastrophe that had gotten out of control. It sought to address what historians put as the three Rs – relief for the people, recovery of the economy, and reform of the financial system.

Singapore’s Resilience Budget – Singapore’s “New Deal” – comes as a timely counteracting stabiliser to the coming upheaval by the global coronavirus pandemic. It has three thrusts: Saving jobs and supporting workers; Supporting enterprises; and Strengthening resilience across the economy and society.

Singapore’s Resilience Budget is purposefully comprehensive – it leaves no stone unturned. It is determined and decisive in terms of breadth and depth.

In breadth, the Budget seeks to save jobs and protect workers. It allocates S$15.1 billion to support more than 1.9 million local employees under the enhanced Jobs Support Scheme. It also provides S$16.2 billion of help to businesses with cash flow, credit and cost with provisions under the enhanced Jobs Support Scheme and Wage Credit Scheme.

While Singapore expects unemployment to grow, the Government has pledged to create 10,000 jobs via a SGUnited Jobs Initiative, with the public sector taking the lead.

Remarkably, there is a huge S$20 billion loan capital arrangement to support companies with strong capabilities.

For households, S$4.6 billion will be given to assist them under the enhanced Care and Support Package.

The expansion of the Government’s role to help families and the unemployed, with the COVID-19 Support fund, the Temporary Relief Fund and more flexibility over ComCare, have been most significant, as new forms of unemployment benefits in all but name.

READ: Commentary: COVID-19 - time for businesses and workers to have the guts to embrace the new normal

READ: Commentary: How prepared are parents for suspension of schools if that happens?

In depth, the most affected sectors, especially those in aviation, tourism and services, will get another round of aid. Specific allocations will be available to help these sectors survive during the crisis and rebound after.

Even the arts and culture sector is not left out. It will have S$55 million to save jobs, upskill and digitalise

Probably the worst-hit, the aviation sector will have S$350 million to fund measures such as rebates on charges and rental reliefs as well as S$400 million to retain workers.

But the most significant move to get Singapore’s aviation through this crisis was one not contained within the Budget, which Mr Heng alluded to: The new role Temasek will play in supporting an embattled Singapore Airlines.

READ: Commentary: COVID-19, the biggest crisis ever for Singapore’s aviation industry and Singapore Airlines

READ: Commentary: Hit hard by COVID-19, Singapore Airlines may need to pursue deeper capacity cuts

A NEXT NEW DEAL?

The Resilience Budget addresses more than the economic and financial concerns. It shores up the social and psychological aspects of society as well, and gives Singaporeans the confidence there is enough ballast to withstand the wild storm ahead.

Indeed, given the surrounding fear and uncertainty many Singaporeans feel facing the pandemic, ensuring Singapore society maintains total cohesion must be the overarching objective, where this also ensures the country can ride out this year-long pandemic.

Like Mr Heng said: “We will take care of our people. We will leave no one behind.”

Mr Heng’s wartime rhetoric is apt. Singapore’s Resilience Budget is more than just a booster shot – it has injected a whole new shock to a system on the cusp of a potentially unprecedented global recession.

Back to Roosevelt’s New Deal – with the magnitude and duration of the Great Depression, it had two major installments – the First New Deal from 1933 to 1934 and the Second New Deal from 1935 to 1936.

There is much uncertainty over how the coronavirus pandemic and its aftermath will play out. If the calamity last longer, will Singapore need another shock – a second New Deal?

Mr Heng certainly doesn’t rule that out. “Should it become necessary, I am prepared to propose to the President further draws on Past Reserves to deal with the situation,” he said.

Lawrence Loh is director of Centre for Governance, Institutions and Organisations at NUS Business School where he is also associate professor of strategy and policy.