A free trade pact could see strongest economic ties yet for China, Japan and South Korea. Can they make it happen?

Talk of a free trade pact among Japan, South Korea and China resurfaced at their recent summit. Analysts say pragmatism must prevail over ideology to close the deal.

This audio is generated by an AI tool.

SINGAPORE: China, Japan and South Korea will all benefit if they can get a three-way free trade agreement (FTA) across the line, but they will have to overcome serious challenges stemming from geopolitical tensions and other issues, experts say.

Talks for their FTA have stalled since 2019, but the elusive trade deal was cast into the spotlight again last Monday at a trilateral summit attended by Chinese Premier Li Qiang, Japanese Prime Minister Fumio Kishida and South Korean President Yoon Suk Yeol.

At the summit – the first in four years – the three leaders vowed to restart talks on the FTA.

China’s Mr Li called for South Korea and Japan "to deepen economic and trade connectivity, maintain the stability and smoothness of the industrial chain and supply chain, and resume and complete the negotiations of the China-Japan-South Korea FTA as soon as possible".

Three days later on May 30, China’s Ministry of Commerce said it stood ready to speed up negotiations.

The Chinese side attaches great significance to talks on the FTA, which is expected to drive the steady recovery of the regional and even global economy, ministry spokesperson He Yadong said, as reported by state news agency Xinhua.

Korean President Yoon, meanwhile, said the three countries had “decided to create a transparent and predictable environment for trade and investment, and to establish a safe supply chain”.

At a trilateral business meeting held after the summit, business leaders agreed to establish a working group to conduct joint research on economic cooperation in the private sector.

BUILDING ON RCEP

The three countries have economic heft. They make up about 25 per cent of global gross domestic product (GDP) and have a combined yearly trading volume of over US$800 billion.

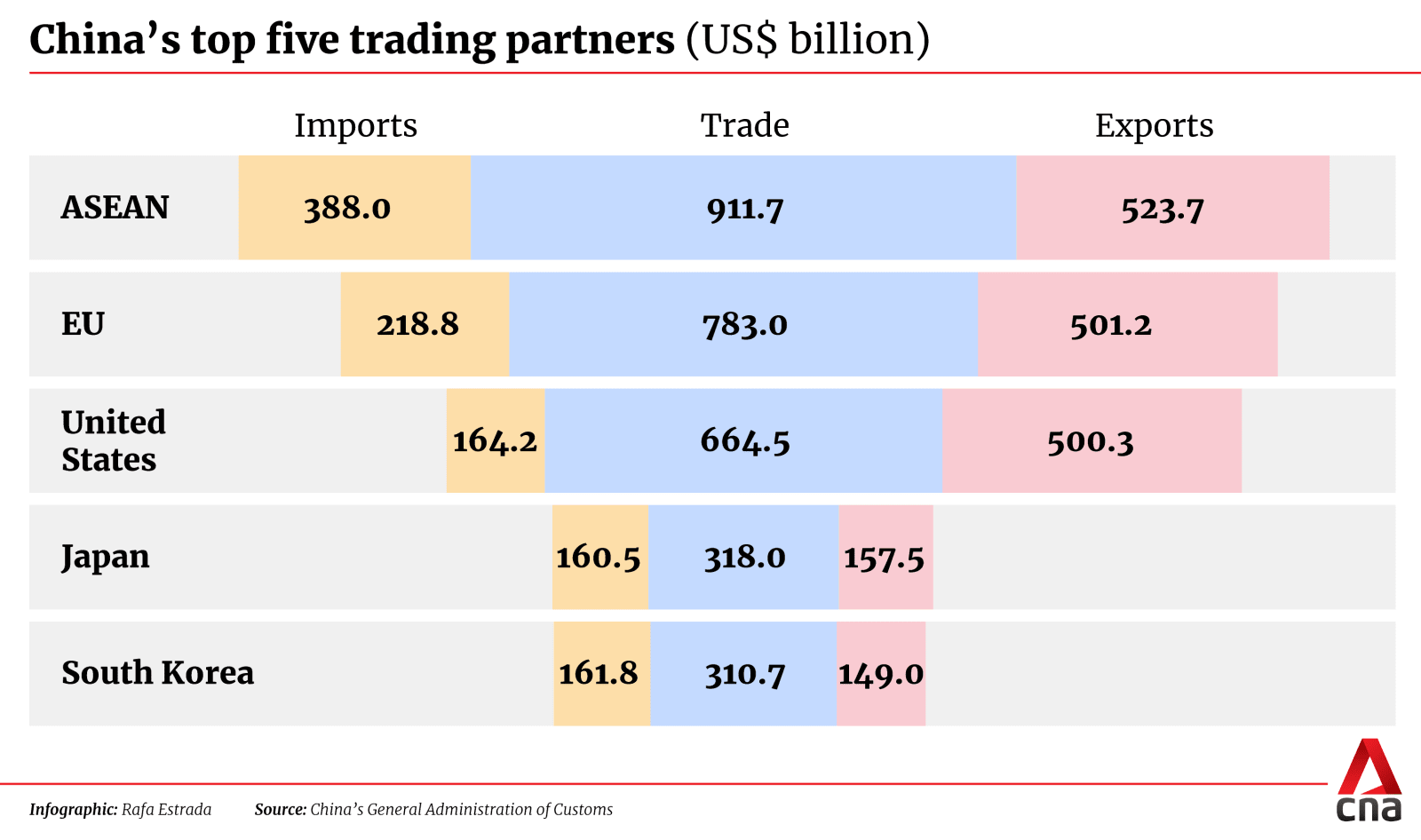

China is the largest trading partner of Japan and South Korea, while Japan and Korea are China’s fourth and fifth largest trading partners, respectively.

In restarting FTA talks, the East Asian neighbours will be building on existing trade pacts to try to deliver one that signals their strongest economic bonds yet, experts note.

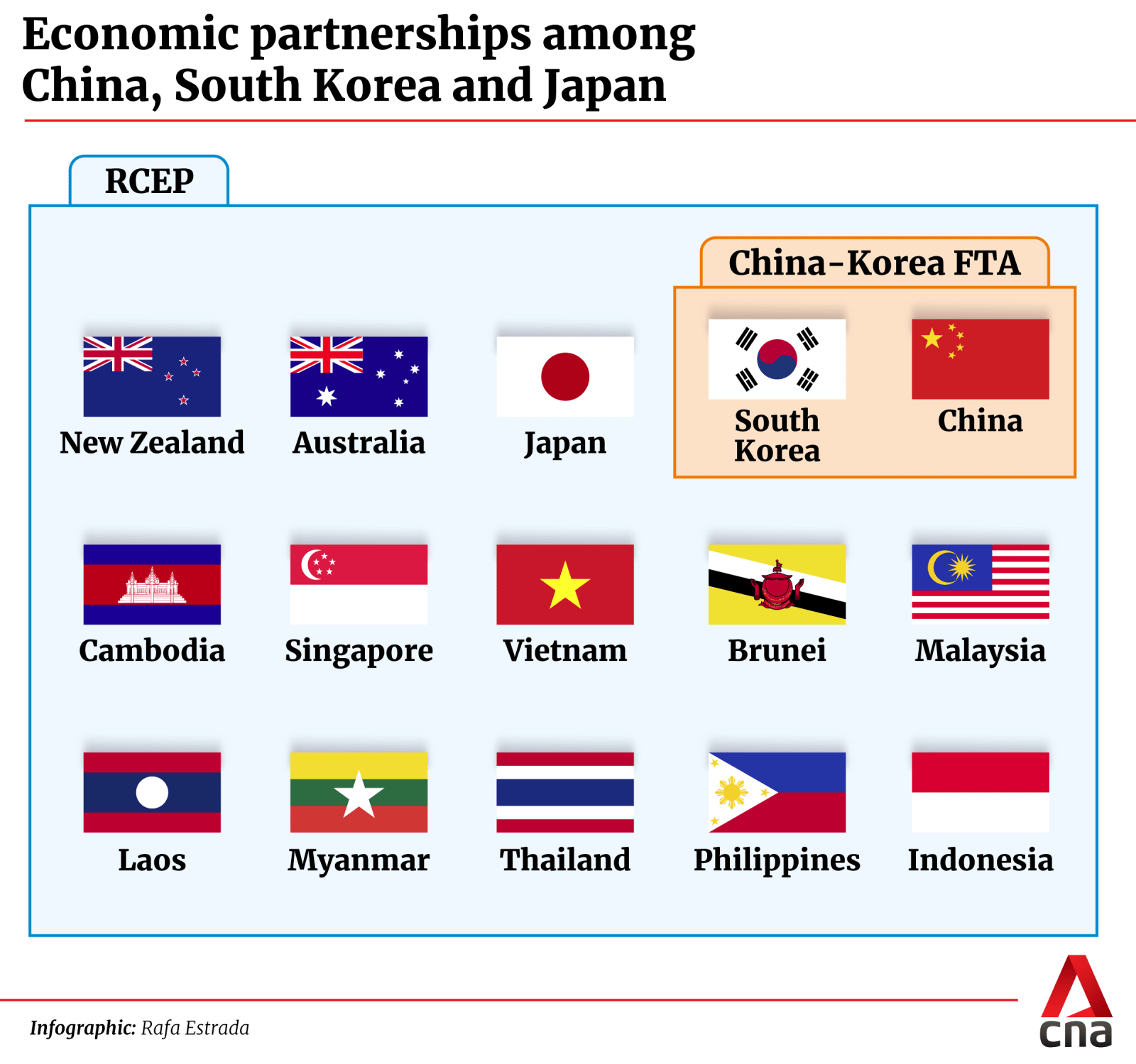

China and South Korea have an FTA signed in 2015.

All three countries are members of the Regional Comprehensive Economic Partnership, which took effect in 2022. The RCEP is an FTA among the 10 member states of the Association of Southeast Asian Nations (ASEAN), Australia, China, Japan, South Korea and New Zealand.

A China-Japan-South Korea FTA will be recognised as “RCEP Plus”, going beyond the RCEP’s level of liberalisation.

For instance, the three countries will aim to fully abolish tariffs on automobiles and auto components, which the RCEP did not, reported news agency Nikkei Asia.

Japan will also seek reductions in industrial subsidies and less preferential treatment for state-owned enterprises, which were left out of the RCEP, Nikkei Asia reported.

Commitments by the three countries to each other under RCEP are “relatively thin”, noted Dr Deborah Elms, head of trade policy at the Hinrich Foundation in Singapore. The foundation works to advance sustainable global trade through research and education.

A three-way FTA will allow them to be more focused, she said. “If there're only three of you in the partnership, you can tailor an agreement often in ways that are more ambitious in some areas, than if you're trying to do it with (15 parties).”

Although China’s commerce ministry spokesperson He said the three countries’ economies are highly complementary and their industrial chains highly interconnected, Dr Elms said they are also competitors in many fields including agriculture, electronics and chemicals.

Finding products for which to remove tariffs will be “a challenge”, she said, citing furniture, raw materials and services as potential areas to be opened up.

(Photo: AFP/Raul ARIANO/Yancheng ETDZ)

WHO’S EAGER FOR TALKS?

While some experts say China is keenest to advance FTA talks due to its economic challenges, others believe an agreement will also serve South Korea and Japan.

China’s eagerness to push for the FTA is not surprising, said Professor Syaru Shirley Lin, chair of the Center for Asia-Pacific Resilience and Innovation and research professor at the University of Virginia in the United States.

“Closer market integration among these countries makes economic sense. Given China's economic challenges, reflected in the real estate slump, weak consumption and private-sector investment, and the pressure of deflation and growing debt, Beijing needs serious measures to boost its growth,” she said.

China’s excess industrial capacity and cheap exports of solar panels, electric vehicles and steel are currently facing pressure from the US, which fears they will hurt its own domestic manufacturing efforts.

The US has increased tariffs on some Chinese imports, including a 100 per cent tax on its electric vehicles, and wants to work with Europe on what it calls China’s overproduction.

Dr Zhu Zhiqun, a professor of political science and international relations at Bucknell University, disagreed that China was more eager than Japan or South Korea. All three countries have a “collective interest” in making progress on trade and supply chain issues, he said.

Summit host South Korea made a notable effort to jumpstart the trilateral summit. Earlier in May, its foreign minister Cho Tae-yul visited his Chinese counterpart Wang Yi in Beijing to pave the way for the summit.

While South Korean President Yoon has sought to strengthen ties with the US and Japan, Mr Cho reportedly stressed that it does not mean South Korea is drifting away from China.

PROCEED WITH CAUTION?

Given the need to balance geographical and market realities with US-China rivalry, the three countries will likely move cautiously if FTA talks resume, analysts note.

The US remains “the most important ally and partner” for both Japan and South Korea, said Dr Zhu.

“Yet, China is right next door and is their largest trading partner. It is not in their interest to have a confrontational relationship with China," he said.

On the other hand, Japan and South Korea “perceive their asymmetric economic interdependence with China as a disadvantage” and this has prompted them to pursue economic diversification, particularly in light of growing US-China strategic competition, noted Prof Lin.

“Consequently, in the negotiation process, Tokyo and Seoul will be more cautious and likely to demand that China address concerns about manufacturing overcapacity, subsidies, and preferential treatment for its state-owned enterprises — issues Beijing has yet to tackle,” she said.

Data shows that both South Korea and Japan have reduced investment in China in recent years.

In 2023, South Korea recorded a trade deficit with China for the first time in 31 years, importing US$18 billion more goods and services than it exported, according to Statistics Korea.

Foreign direct investment by South Korean companies into China also slumped 78.1 per cent to US$1.87 billion in 2023 compared to the previous year, according to South Korea’s Finance Ministry.

Meanwhile, net new money from Japan into China last year fell to its lowest in at least a decade, amounting to 1.31 trillion Japanese yen (US$11.91 billion), according to data from the country's Ministry of Finance.

Half of 1,741 Japanese companies polled expect the Chinese economy to worsen in 2024, an increase from 37 per cent at the end of last year, a recent survey conducted by the Japanese Chamber of Commerce and Industry in China found.

KEEPING UP MOMENTUM

Experts also have mixed views on the likelihood of an FTA happening in the foreseeable future.

Dr Elms does not hold high hopes. “This one’s going to take forever. I mean, a lot of them take forever, just because they're complicated,” she said.

The latest vows by the three leaders will “not make a difference” to companies until the talks move to "a genuine stage" where there are real economic benefits on the table and a deal is "very close to signing", she added.

Dr Zhu is more optimistic. “If the three countries keep the momentum, remove the remaining obstacles, and resist potential external interference, an FTA could be reached before too long,” he said.

“Pragmatism must prevail over ideology or great power politics.”

All sides will certainly have to ramp up efforts if they are serious about the FTA – meeting more frequently and having big teams engaging in discussions with greater intensity, for example, said Dr Elms.

Once-a-year talks “would not bring about much change”, she said.