Placing stock in the market: China’s recent rally fuels youth rush for quick gains. How are they faring?

Young investors in China have been piling into the stock market to make bank off a recent rally, but wild swings catch many out. Don’t bank on it to boost spending and consumption, say analysts.

Chinese youths like Li Hao are trying to make bank on China's stock market see-saw. While some have profited, others are facing painful losses. (Photo: Li Hao)

This audio is generated by an AI tool.

SINGAPORE: Graduation might still be eight months away, but accounting major Li Hao from Hunan province in China is already pulling out all the stops to ensure a job is lined up.

From applying for a secondary school teaching certification to sending resumes to banks, the third-year student at Hunan University of Finance and Economics wants to make sure he stays on top of a tough job market.

But even before entering the workforce, the 22-year-old already faces the prospect of losing 30,000 yuan (US$4,214) that he painstakingly saved.

Mr Li recently invested that sum into Chinese stocks as he tried to cash in on a stock market boom in the country, triggered by a stimulus salvo from the government in late September to revitalise the world’s No 2 economy.

What he did not anticipate was the ensuing rollercoaster ride in China’s stock markets as investor optimism waxed and waned following vague signals from policymakers.

In the latest back and forth, Chinese stocks - and wider Asian shares in general - declined on Monday (Nov 11) after a closely-watched legislative meeting last week disappointed investors.

Beijing announced a 10 trillion yuan package last Friday (Nov 8) to help ease local government debt issues, including a six trillion yuan push to clear hidden debt. However, policymakers fell short of announcing any new growth-boosting measures for the stuttering economy.

“I am currently losing money,” Mr Li admitted. Even then, he blames himself, saying: “(It’s because) I’m not picking the leading stock.”

Like Mr Li, there has been a surge in the number of Chinese youths flocking to the stock market - a departure from their usually conservative investment practices as many look to make a quick fortune.

JUMPING ON THE BANDWAGON

While there isn’t an official count of overall Chinese youth investors, data from Sinolink Securities, a Chengdu-based capital markets firm, shows nearly half of its new account holders since early October are under 30 years old.

China-based securities firm Northeast Securities also told Shanghai Securities News, a financial newspaper owned by state-run agency Xinhua, that new accounts opened during the Golden Week holiday period in early October tripled compared to the same period last year, with a “significant increase” in investors aged 18 to 25.

Shenzhen-based securities company Ark of the Times similarly noted an influx of new customers since late September’s policy announcements. Thirty per cent of the newcomers are under 35 years old, according to founder and director Wei Haihong, 57.

He shared that tech stocks, which align with China’s high-tech manufacturing and innovation ambitions, remain the most popular among this group.

What has sparked concern is that some are borrowing money to dabble in the stock market.

A client service manager from a Bank of China branch in Shandong who wanted to be known only as Mr Zhao observed “a surge in loan requests compared to usual times” right before Golden Week.

There have been cases of low-interest consumer loans being used to buy shares amid the market rally, according to local media reports. This has prompted banks to caution customers that this is not sanctioned, and they risk the loans being cancelled.

Analysts say this is in marked contrast to the Chinese youths’ previously conservative investment patterns.

“Younger Chinese, when they do have money, have been putting it into time deposits or buying gold; they've been very conservative,” Mr Shaun Rein, the founder and managing director of strategic market intelligence firm China Market Research Group (CMR), told CNA, adding that focusing on these relatively more secure ventures is not a “bad choice” considering the deflationary pressures and property slump the country is facing.

But he noted that the recent run-up in equities has been drawing them into the stock market, a relatively riskier venture compared to time deposits or buying gold.

China’s central bank unveiled a raft of measures on Sep 24 to shore up a stuttering economy. Offering more funding and interest rate cuts, the broader-than-expected package was the biggest stimulus since the pandemic.

The market reaction was quick and drastic. As small and big investors alike piled in, China stocks experienced their best day in 16 years on Sep 30. Combined turnover on the Shanghai and Shenzhen bourses rose to a record high of 2.6 trillion yuan.

While gains have pared back, the benchmark CSI 300 index is still up more than 20 per cent following the late-September moves.

“All of my three stock-related group chats have been buzzing,” said Mr Wang Mo, 34, an operator for a machinery spare parts supplier in Wenzhou, Zhejiang province who began investing a decade ago.

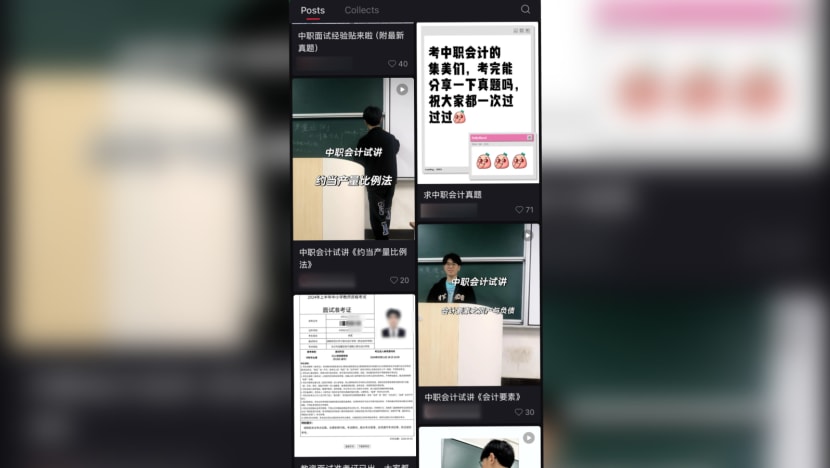

His younger compatriots have also been swept up in the stock market buzz, with many turning to online forums for support. One such platform, Taoguba, features over 170 threads on "post-2000" discussions. Meanwhile, Zhejiang University’s internal online forum is flooded with stock market posts, reflecting the keen interest of varsity students.

Observers warn that these newcomers could be badly burnt, especially those driven by emotion rather than knowledge.

"THIS IS PURELY A GAMBLE"

Mr Wang is all too familiar with risk.

His investing journey began in 2014 when he was a financial manager at a Chinese bank. After a rosy start where he doubled his initial 50,000 yuan investment, by 2016 he had suffered a loss of 100,000 yuan and decided to take a break.

He returned to the market in 2019, investing in equity funds and stock indexes, hoping for another round of gains. “I spent 500,000 yuan in stocks over the past decade, but compared to interest rates, I’m making a loss,” he admitted.

Now, Mr Wang is looking to ride the wave of the latest stock market developments.

But he’s aware that things could go south. Since late September, China’s stock markets have experienced sharp fluctuations. After an initial boost from the stimulus package announcement, stocks have swung heavily between rallies and retreats.

To him, investing in China’s domestic A-shares is not just taking a chance, it’s a “100 per cent gamble”. A-shares are the shares of mainland China-based companies that trade on the Shanghai, Shenzhen and Beijing bourses, and use the renminbi for valuation.

“I am a timid person. If I had seen this situation in the past, I wouldn’t be buying, but this time I’ve prepared 500,000 yuan,” Mr Wang said. “This is purely a gamble, short term.”

The gambling mentality is also something Mr Li, the university undergraduate, has observed among fellow investors as well.

“Chinese investors have lower stock literacy (and have) more of a gambling mindset - they are mostly investing on sentiment,” said Mr Li, who only began investing in late July after being introduced to the stock market through an inter-varsity competition. Organised by a department of the Communist Youth League Central Committee, it ironically aimed to enhance students’ financial literacy.

The market instability has shaken investor confidence, affecting both newcomers and seasoned operators.

A Weibo hashtag, “post-2000 generation’s first tuition fee after entering the stock market,” has garnered over 4.5 million views. The trend was sparked by a youth who entered the stock market on Oct 8 and lost 200,000 yuan in just eight days.

“Fortunes have been made in the last two weeks … but you have to be very cautious because you're playing with fire,” Mr Rein cautioned on Oct 9.

Mr Wei, the securities firm founder, observed that new investors are increasingly focused on short-term gains due to “volatile fluctuations”.

He also noted a growing preference for the Beijing Stock Exchange - founded in 2021 - over the Shanghai and Shenzhen bourses. He believes this is due to its smaller market size, greater flexibility, and the daily 30 per cent limit on share price movements in either direction.

CONTRIBUTING TO CONSUMPTION?

As more Chinese youths embrace the stock market as an extra income source, the question of whether this could help the country’s goal of boosting domestic consumption has also come up.

However, Mr Rein says the reality is that the stock market rally has only helped a “fairly small” percentage of the country’s population.

He expressed concern that with China’s youth unemployment hitting 18.8 per cent in August - the highest so far for the year - and cautious spending patterns, the short-term rise in equities is unlikely to significantly boost consumer confidence and in turn encourage consumption.

“I think you need to have a stabilisation of income. People need to know that every month for the next three to five years, they're going to have a good job … until you get stabilised income levels, you're not going to see people go out and spend,” said Mr Rein.

China has been on an all-out push to fire up its domestic consumption engines as it strives towards economic recovery amid strong headwinds, and meet its full-year growth target of around 5 per cent.

According to China’s market regulator, around 220 million people invest in stocks. That’s less than 20 per cent of the country’s adult population. In contrast, more than 60 per cent of adults in the US, or about 162 million Americans, own stocks, according to American analytics firm Gallup.

Mr Kelvin Tay, chief investment officer for South Asia Pacific at UBS Wealth Management, sees the shift in asset classes as part of a broader trend observed in other countries.

“Traditionally, housing has been the preferred asset class for investments (in China), accounting for as much as 70 per cent of household balance sheets,” he said, drawing parallels to asset shifts in Japan and the US following property market downturns.

“In China, as the bond market doesn’t have the depth and breadth as the US, the only clear asset class that investors can shift to is the equity market. Investing in stocks is also relatively more affordable than the property market, as the financial outlay is much lower.”

However, he noted that stock rallies are unlikely to drive short-term consumption, especially with the property market being a longstanding investment vehicle in China. “White goods (major appliances) and durable goods consumption will only pick up when the property market improves,” he explained.

At the same time, should the stock market turbulence settle and persistent gains emerge, analysts say it could hold much promise.

“(I see) continued sustained upticks in the stock market as an essential piece for China to catalyse the transition into a consumption-driven economy,” said Mr Lee Kok How, an affiliate lecturer at Singapore Management University (SMU) specialising in China's business landscape.

As opposed to short-term speculation, Mr Lee believes that cautious participation by young people in the stock market will contribute to “gradual and sustained upticks”, which could aid the consumption drive as they reap the dividends and potentially spend more.

INVESTING FOR RETIREMENT

Investments have traditionally been closely associated with retirement adequacy, as they’re seen as pivotal in growing one’s nest egg.

In fact, this was a key reason why Mr Li, the university undergraduate, decided to enter the stock market. He initially planned on carrying out value investing, referring to the strategy of investing in undervalued stocks for long-term gains.

But he’s since changed his mind as his stock values fluctuate amid the market instability. “(I’ve been) periodically breaking even and periodically making a loss,” Mr Li conceded.

The former financial manager Mr Wang has ruled out investing in domestic shares long-term for retirement planning purposes.

He shared that he once had confidence in the market but has gradually lost faith over the years due to continued losses brought about by what he alleged are opaque and unfair rules. “(There’s) no future,” he remarked.

Mr Rein from CMR said market stability is sorely needed. “You can't have 8, 9 per cent swings on a daily basis - that just makes everybody scared. And this is more like a casino,” he said.

Mr Lee from SMU predicts it will take some years before China’s stock market stabilises. “A decade, if China’s lucky,” he said. He believes the Chinese government wants a gradual rally in line with market fundamentals.

“The (recent) regulatory tightening of securities rules aims to make the stock market more transparent, robust, and less likely for manipulators to cut chives, for lack of a better term,” Mr Lee said.

In China, the term “cutting chives” or “ge jiu cai” in Chinese, is a metaphor commonly used in economic and financial contexts. It refers to a cyclical process where small investors or ordinary people are exploited for financial gain by corporations, institutions, or wealthy individuals.

UBS’ Mr Tay emphasised the need for better financial literacy. While China has been taking such steps in recent years, like organising financial literacy courses in primary and secondary schools, it’s unclear how effective they have been.

“The main issue is financial education. This is where I think Chinese investors have some way to go,” he said.

For Mr Li the university graduate, the deed is already done. Right now, he just wants to lose as little of his 30,000 yuan stock investment as possible.

He hopes his experience proves a cautionary tale for those looking to enter the market. But he’s also staying positive through it all.

“It’s a small sum in the long run. I’m lucky I didn’t start playing when I had a few million (yuan) - I’d probably lose it all.”