commentary Commentary

Commentary: What is the logic of AirAsia entering Singapore’s food delivery market?

AirAsia’s entry into Singapore’s food delivery market is risky and may not reach profitability in the foreseeable future, says NUS Business School’s Jochen Wirtz.

AirAsia Group CEO Tony Fernandes reacts during an interview in Kuala Lumpur, Malaysia October 8, 2020. REUTERS/Lim Huey Teng

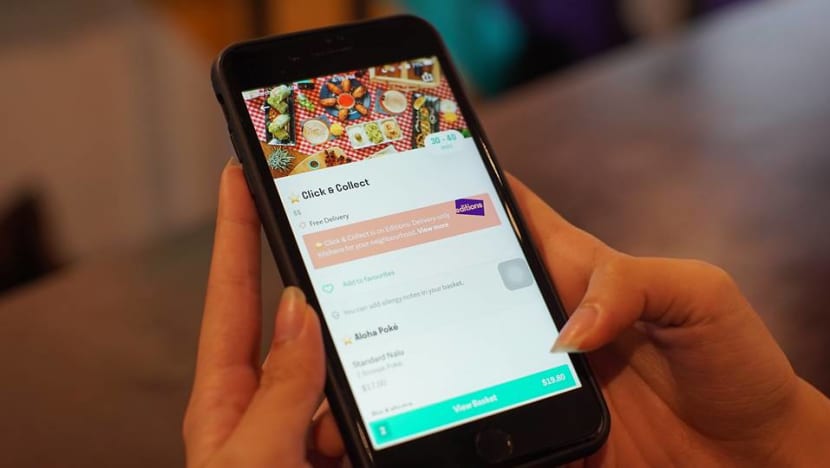

SINGAPORE: The delivery business in food-loving Singapore is a highly competitive market dominated by the likes of GrabFood, Foodpanda and Deliveroo.

Considering the presence of these popular and established players in the market, it was a surprise to hear of AirAsia’s entry into the fray.

Grab is already dominating the food delivery market in Singapore. According to a survey by Rakuten Insight of more than 5,000 consumers in Singapore, as many as 77 per cent of the respondents indicated GrabFood as their most used app for ordering food in 2020.

GrabFood, together with Deliveroo, had reportedly cornered 60 per cent of the food delivery market in Singapore by 2019. That market share would have likely increased likely last year when its food-delivery business grew exponentially during COVID-19.

Given these market conditions, one has to wonder what tricks AirAsia has up its sleeve.

After all, airlines are bleeding cash right now and probably do not have the deep pockets required to survive long periods of negative cash flows of a new business venture. Also, how does it plan to carve out a niche and differentiate itself from the competition?

PLATFORM BUSINESSES REQUIRE A LOT OF CAPITAL

The typical platform model subscribed by food delivery tends to face a “chicken-and-egg” problem.

READ: Commentary: Why a bumper crop of Southeast Asian tech unicorns look set to IPO this year

Restaurants look for platforms with a healthy volume of diners, making set-up and management costs worthwhile, while customers look for platforms with a large variety of restaurants in their vicinity, ideally familial ones or favourites.

To build the required volume, platforms typically run a lot of promotions for both parties. That is, diners and restaurants get discounts as the platform bleeds cash in the name of customer and vendor acquisition.

However, these promotions need to be sustained to build and maintain restaurant and customer volume on the platform. That can take a long time.

On top of that, scaling operations and logistics can be challenging and expensive.

Market observers like Momentum Works have already cautioned food delivery platforms here, highlighting in a report that “companies need to control acquisition and retention costs, and generate ancillary revenue including advertising and financing to achieve profitability and long-term sustainability.”

One year since the pandemic, why do users, riders and restaurants alike still have complaints about food delivery apps? A business professor and a ride-hailing app founder weigh in on CNA's Heart of the Matter podcast:

Therefore, some questions one should ask are: Does AirAsia have sufficiently deep pockets to pull through? If not, is the business model strong enough to mobilise private equity?

Bearing in mind that private equity will look carefully at the business model, its competitive edge, and potential exit strategies such as a trade deal or stock market listing.

DOES AIRASIA HAVE A COMPETITIVE EDGE?

Investing a lot of money into a business only makes sense if the firm has a competitive edge that allows it to enjoy good profits in the future. Competitive edge means either lower costs than the competition, or unique services and features the competition does not have.

READ: Commentary: Asian airlines may never recover without consolidation

READ: Commentary: Southeast Asian airlines are falling from the sky in this COVID-19 storm

Tony Fernandes, AirAsia’s CEO, plans to lower costs by omitting services such as maps where customers and restaurants can see where the driver (and their food) is at any given amount of time.

Unless there are other great ideas, the trouble is there isn’t a lot of fat that can be cut to save costs, especially on the technology front.

Riders and fuel costs have to be paid, and customers need to be supported.

“From payments to restaurant acquisition, updating of detailed information regarding menus and item availability, not to mention marketing costs. These are the fixed costs borne by the platform merchants,” Li Jianggan, CEO of Momentum Works, wrote in a commentary for CNA last year.

In fact, technology will probably favour larger players as they have economies of scale.

Also, users of such apps are used to tracking the status of their orders and may not prefer an app that does not provide such visibility. “Beyond cost structures, a successful food delivery app must mobilise and orchestrate a smooth execution for every order, lest frustration leads consumers to switch loyalties.”

For these reasons, savings on the technology infrastructure are unlikely to help AirAsia truly achieve cost leadership in this market, given especially their small size.

READ: Commentary: Impact of Grab-Gojek merger on consumers and drivers unlikely to be huge

Is its target market unique? AirAsia said they will focus on small restaurants. It appears that the lower commission fees AirAsia is charging – free delivery within 8km until Mar 16 and a 15 per cent commission charge for that service - may entice smaller restaurants to initially sign up.

Charging lower commission than Foodpanda and Deliveroo, for which commission fees stand at 30 per cent to 35 per cent for a delivery of between 2km to 6km, the initial interest for AirAsia seems to be among small to mid-sized restaurants such as Swee Choon Tim Sum Restaurant and the Baoshi F&B Management group’s eateries.

While such a strategy may help AirAsia onboard new and small restaurants, the question is if it is sustainable enough to retain them.

Unless these small restaurants need tailored solutions that differ from what current players already offer, this strategy may not be enough for the long term. For instance, Ernest Ting, owner of Swee Choon, told media that his key concern would be availability of riders and service reliability.

AirAsia is meanwhile keeping operations small. They reportedly have 500 riders signed up, far fewer than the 6,000 riders each for GrabFood and Deliveroo.

CAN AIRASIA BUILD LOYALTY?

After many months of not dining out much, lock-downs and working from home, I would expect customers who order food to already have more than one apps on their phone. If AirAsia attracts them to also try their service, they are simply one additional option for customers and restaurants.

READ: Commentary: A Gojek-Tokopedia merger has ramifications for regional unicorns including Grab and Sea

READ: Commentary: Don’t be too quick to write off the sharing economy, even with COVID-19

When customers have several apps on their phone, they pick the one that offers the cheapest price. Competition is always only one click away. Negligible switching costs make loyalty elusive.

Restaurants are also increasingly working with several delivery platforms and tend to channel the business to their preferred platform, which gives them the best service for commission paid, by offering merchant discounts.

While AirAsia may link its food delivery to the AirAsia loyalty programme that, at the margin, could be a plus, that’s a very small pool of customers.

For consumers and restaurants the extra competition provided by AirAsia’s entrance into the market is overall a good development. Customers benefit through lower prices and restaurants pay less commission.

However, AirAsia’s service offerings are likely to be minimal to keep costs low, just like the no-frills model it employed in air travel years ago.

If consumers and restaurants are ready for that – such as not tracking how far away your rider is with your food, or waiting longer for your food to arrive because there are lesser riders - then Air Asia may stand a chance.

SIGN UP: For CNA’s Commentary newsletter so you get our best offerings each week

Professor Jochen Wirtz is vice dean for MBA programmes and a professor of marketing at National University of Singapore Business School. He is the co-author of the book “Intelligent Automation – Welcome to the World of Hyperautomation”.