commentary Commentary

Commentary: Singapore’s bold bet on seniors and valuable years of life experience

The signal is clear. Raising the retirement and re-employment age is long overdue and the task that lies ahead is for workers and companies to prepare, says retirement expert Patrick Chang.

A senior on her way to work. (Photo: Unsplash)

SINGAPORE: Prime Minister Lee Hsien Loong has announced bold changes to raise the retirement and re-employment ages at the National Day Rally on Sunday (Aug 18).

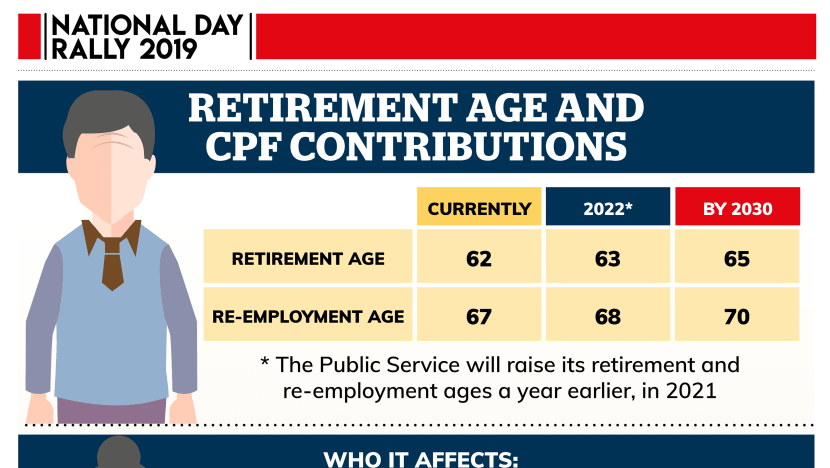

While the retirement age will be raised from age 62 to 63 in 2022, and 65 by 2030, the re-employment age will be raised from 67 to 68 in 2022, and 70 by 2030.

Manpower Minister Josephine Teo moved quickly to announce details of the changes to the Central Provident Fund (CPF) rates for older workers the following day, to help them build up their retirement nest egg.

But the current CPF withdrawal ages remain unchanged. This has been warmly welcomed by most workers who want to continue to have the option of enjoying the fruits of their labour early.

SLOW AND STEADY APPROACH

While the moves were swift and decisive, the overall approach has been gradual and steady, coming on the back of a 15-month consultation with unions and employers.

The Government has also taken a pragmatic approach to spread out the changes over more than a decade, giving sufficient time for both employers and workers to prepare and adjust to the impending changes.

The way the Government has handled this issue is reminiscent of how it took pains to make an early announcement at Budget 2018 a GST hike sometime between 2021 and 2025, so that households can be psychologically prepared.

The overall signal received is very clear: That the shift of the retirement and re-employment age is a necessary, long-term move for a greying population with an ageing workforce.

Singapore will see vast untapped resources if retirement and re-employment ages remain unchanged. A quarter of the total Singapore population will be aged 65 and above by 2030.

This is a reality both employers and workers must adapt to. There is still time, but action must be taken now.

Those aged above 65 may want options for work. A recent study revealed that individuals aged 65 and above require S$1,379 each month to meet basic living needs.

Seniors can depend on CPF Life to meet their financial needs, provided they have the Full Retirement Sum. Currently, based on the default Standard Plan, a senior can expect to receive between $1,350 to S$1,450.

READ: Commentary: Growing old is not a slow march toward obscurity

STRONGER PROTECTION FOR WORKERS

How will the rise in retirement age and re-employment age impact us?

Older employees can be expected to work longer, into their sixties. Under the Employment Act, no employer can dismiss worker without just cause.

This legal framework has been strengthened in April when the Tripartite Alliance for Fair and Progressive Employment Practices issued explicit guidelines stipulating that age, among other reasons, is not fair grounds for dismissal.

These guidelines protect workers from wrongful dismissal before that golden number. It gives workers a greater sense of job security and clarity.

READ: Commentary: People ready to retire later but preparing older workers will require more than reskilling

Workers too can then plan in peace. Knowing that we can be re-employed until age 70, we have a time frame to work on.

We can make the necessary adjustments to our retirement plan, to lead the lifestyle we hope to have beyond 70, barring unforeseen circumstances, such as illnesses, accidents or severe economic downturns that might affect returns on investments.

READ: Reasonable to expect S$3,000 a month for retirement, a commentary

THE JOY OF WORKING

Working for a living aside, the reality also is that most individuals find joy in work. They welcome recognition in the work they do. Their job title is a source of pride that means a lot to them.

Raising the retirement and re-employment ages could have psychological benefits as well.

Those who have left their positions may sometimes experience a sense of loss, and go through flux trying to re-establish their identities. After building and consolidating their capabilities that are relevant to the positions they have held all these years, they feel that they still have more to give.

Practically speaking, Singapore’s only and most precious resource is our people. Early retirement and having such workers exit the workforce can be detrimental to our nation.

In the same way that we should be helping women to stay in the workforce, we must find ways to maximise economic participation.

READ: Commentary: Super mums have one simple request. Don’t hinder them from returning to work

But we have to make a distinction between work and toil, for the last thing we want to encourage is a culture of endless work, where seniors slave away at a job that gives them barely any satisfaction, with little family time, because work is what they are used to.

VALUABLE CONTRIBUTIONS SENIORS CAN MAKE

Here’s another reality to consider: What our seniors have that we do not.

With decades of work experience, seniors have vast expertise, technical know-how, and valued skillsets, and they can make meaningful contribution to the economy and society at large. It would be a great waste not to tap into their strengths.

Most older employees are more than happy to share their experiences and skillsets with youths. In fact, we have seen men who make great mentors, who help younger workers move up their learning curve and master the trade faster.

What these old mentors have, is patience, passion and perspective, which can complement the strengths of young people.

READ: Commentary: Living longer? Here’s what working for 60 years should look like

Older women also show great understanding when it comes to roles that require time and effort, especially childcare. They can be coaches to help younger childcare teachers.

Their maternal instincts can enrich our pre-school sector, where nurturing kids aged 3 to 6 needs composure, confidence and a firm understanding of kids’ motivations and behaviour.

Indeed, old age is a period of time where Singaporeans should be encouraged to pursue their passions, after a pragmatic lifetime of work to save up for their retirement.

HELPING COMPANIES AND WORKERS COPE WITH THIS PARADIGM SHIFT

As the median age for workers is set to rise even further by 2050, we must expect to see more elderly in the workforce in the coming years. This is already happening globally.

In a world of disruption, employers would like seniors to keep up with productivity, and be comfortable with the use of new technologies.

However, this is easier said than done. Many elderly employees may find catching up with the rapid changes in technology overwhelming.

READ: Commentary: Matching older workers to jobs the key manpower challenge for Singapore

What this shift in the retirement and re-employment ages entail is also job redesign that leverages the strengths of older workers. But the roles in most companies have been created with youth in mind.

Where PM Lee had said more initiatives to aid companies to deal with this shift will be announced at Budget 2020, it would be interesting to see what measures to nudge companies towards job redesign will be announced by DPM Heng Swee Keat.

Overall, there are benefits to raising both the retirement and re-employment ages, with valid concerns, including the rising business costs of employing older workers.

But the irreversible trend of an ageing workforce and longer lifespans makes doing so the way to go.

The Government has placed a bold bet on seniors and wagered that they can bring value to the table for their companies. The more important task that lies ahead is for companies and workers to get ready.

Patrick Chang is a Certified Financial Planner and author of the book The A To Z Guide to Retirement Planning.