commentary Commentary

Commentary: How Tencent became world’s most valuable social media company – and then everything changed

Is China’s Tencent the next victim of a technology Cold War? Alex Capri outlines the implications of US policy impacting the tech titan over the past month.

FILE PHOTO: People walk past a Tencent sign at the company headquarters in Shenzhen, Guangdong province, China August 7, 2020. REUTERS/David Kirton

SINGAPORE: Tencent, China’s Shenzhen-based digital platform giant, recently surpassed Facebook as the most valuable social media company in the world – at least, temporarily.

At the end of July, 2020, Tencent reached US$665 billion in market capitalisation to Facebook’s US$656 billion.

To many, this was validation of how China’s massive digital landscape, combined with innovative business models by its BAT (Baidu, Alibaba and Tencent) companies, had produced another world-beating digital platform.

In the run-up to its valuation zenith, Tencent enjoyed a 70 per cent surge in value over a four-month period, in large part, due to China’s COVID-19 lock-down situation, which resulted in skyrocketing revenues from Tencent’s gaming apps, social-commerce and other online apps.

READ: China tech giant Tencent's net profit jumps during pandemic

But that all suddenly changed less than two weeks later.

HOW EVERYTHING CHANGED

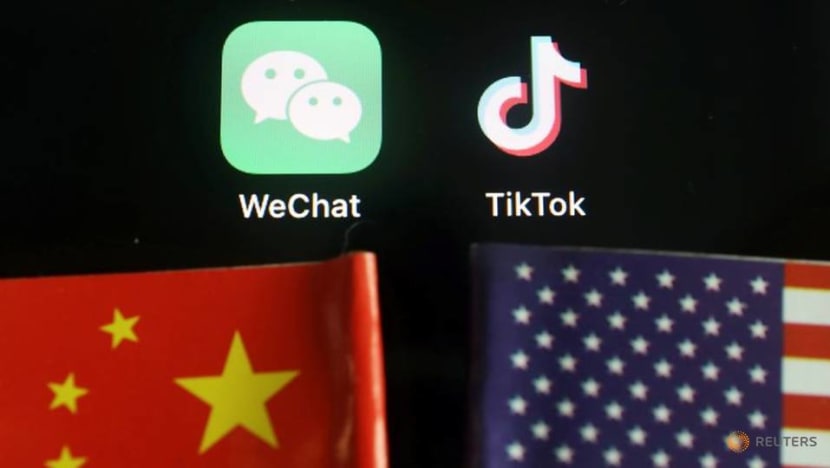

In early August, US president Donald Trump signed an executive order that effectively banned US companies from doing business with WeChat, Tencent’s social messaging platform, which is utilised by more than 1 billion customers.

In a two-day timeframe, Tencent’s market cap lost more than US$66 billion - its worst slide since 2011.

Beyond the financial loss, however, Tencent faces the same long term mega-challenge as other Chinese tech companies: The US-China technology Cold War. As relations continue to deteriorate, this latest development points to a more ominous shift in Sino-US techno-nationalist decoupling.

READ: Commentary: WeChat ban a formidable weapon in US-China trade war

RISING TECHNO-NATIONALISM

A growing trend of techno-nationalism is driving a broader paradigm shift away from the open market, laissez-faire economic model, toward an increasingly state-activist world.

Countries are increasingly viewing tech innovation and capabilities as directly impacting national security, economic prosperity and social stability and taking action to shore up their positions in those areas.

In recent years, Beijing has doubled down on techno-mercantilist initiatives such as the Made in China 2025 initiative, the Digital Belt and Road (BRI) and China Standards 2035, which aims for Chinese companies to set global standards for emerging technologies like 5G and the Internet of Things.

These actions have sparked a race to the bottom – at least, from a free markets perspective- for the world’s free-trading nations. Governments are increasingly intervening in commerce by blocking technology transfers and transactions, as Washington’s recent choking off of vital US semiconductor technology to Huawei demonstrates.

READ: Commentary: 2020 is shaping up to be a rough year for Huawei

The Dutch government continues to withhold critical export licenses for sales to China by ASML, a Dutch semiconductor manufacturing equipment company. Similarly, Germany has blocked the sale of advanced technology to China and recently announced the establishment of a new state-owned investment fund designed to buy stakes in local companies targeted by non-European Union states for strategic tech acquisitions.

The US has rolled out its own version of “chequebook diplomacy,” designed to counter Beijing’s cheap credit programmes that promote the sales of Chinese telecommunications equipment from companies like ZTE and Huawei, along the Digital BRI and beyond.

One of Washington’s recent initiatives has been to allocate US$60 billion to the US International Finance and Development Corporation in 2019, to steer foreign telcos and governments away from Chinese companies.

Australia and EU have rolled out similar countermeasures. The EU signed a deal with Japan to build infrastructure between Europe and Asia in 2019, as a counter to China’s massive BRI investments. Australia, meanwhile, announced a US$1.5 billion Pacific Fund to counter China’s growing infrastructure footprint throughout the Pacific islands in 2018.

READ: Commentary: What's behind China's controversial Health Silk Road efforts

READ: Commentary: Life in China after COVID-19 lockdown gives normal new meaning

TECHNO-NATIONALISM TURBOCHARGED BY THE CLASH OF IDEOLOGIES

The economic dimensions of techno-nationalism will increase but it is the ideological underpinnings of techno-nationalism that has accelerated Sino-US decoupling faster than anything else.

Liberal democratic values associated with safeguarding data privacy and fighting censorship and surveillance are now tethered to export restrictions on hard technologies, such as semiconductors, and, most recently, to the ban on Chinese digital platforms.

The Trump administration justified the recent executive order against WeChat on the basis that WeChat’s collection of data on the activities of overseas Chinese citizens and its propagation of disinformation that advances Beijing’s political narratives are inimical to these sacred values.

Additionally, one of Mr Trump’s recent executive orders cites WeChat as complicit in Beijing’s censorship of alleged human rights violations against the Uighur and other Muslim populations in China’s far Western province of Xinjiang.

Tencent has also come under scrutiny in Washington for the role it allegedly plays in building surveillance technology and related infrastructure for the Chinese Communist Party. Beijing’s imposition of its controversial security law in Hong Kong, for example, has increased the likelihood that Tencent could be held complicit in what Washington describes as Beijing’s denial of basic rights of the people of Hong Kong.

READ: Commentary: To save its markets, Hong Kong needs to rely on China

READ: Trump says looking at pressuring other Chinese companies after Bytedance

DATA AS A STRATEGIC COMMODITY

The reality also is that data has increasingly become a strategic commodity in the techno-nationalist landscape and increasingly linked to national security.

In addition to telecommunication equipment manufacturers such as Huawei, Chinese digital platform companies have come under suspicion regarding data privacy breaches linked to browsing, search and location functions within apps.

Making this a virtual no-win situation for Chinese companies are two Chinese laws: The National Intelligence Law and the Cybersecurity Law, both passed in 2017. Both require Chinese entities to turn over data, encryption codes and any other requested information to the Communist Party when asked.

The implications for Tencent are potentially far-reaching. Should Washington choose to put Tencent on a restricted entity list, it could suffer a fate similar to Huawei.

Like Huawei, Tencent is dependent on US semiconductor technology for microchips – in this case, for its servers and hard infrastructure. And, like Huawei, loss of access to microchips could cripple the company. In both cases, third parties like Taiwan’s TSMC, are restricted from selling microchips made with US manufacturing equipment and intellectual property.

Even if no restrictions on semiconductors are enacted, concerns about data privacy and security could result in a ban on Tencent’s cloud computing services. A similar ban could hit Alibaba.

READ: Commentary: Alibaba makes a whopping US$28 billion bet on its next breakthrough act

READ: Commentary: Multibillion-dollar wizards – how COVID-19 is exposing what’s behind the curtain

THE RING-FENCING OF THE INTERNET

The Trump administration announced two weeks ago it is looking to implement a Clean Networks programme, which would ban any Chinese technology from US telecoms carriers, apps, digital cloud and 5G or 6G networks - effectively ring-fencing the American internet.

Beyond US shores, the US is pressuring its allies and strategic partners to also ban Chinese technology. US techno-nationalist diplomacy has had a global effect whose footprint may only grow in the days ahead. The UK recently banned Huawei from its 5G infrastructure, and India just announced that ZTE and Huawei would not be part of its latest round of national 5G trials.

All of this creates an existential crisis for Chinese tech companies. Even without the challenges of this technology Cold War, Chinese digital companies will face greater scrutiny and suspicion as they venture outside of the protected confines of China‘s digital landscape, which has already been relatively closed to most foreign competitors predating this US-China rivalry.

READ: Commentary: Is national security a good reason to ban TikTok?

READ: Commentary: It's payback time for the way China handled the Internet all these years

A FRAGMENTED FUTURE

Unfortunately, as has been the case with previous US technology bans, sanctioning Tencent may see many American companies become collateral damage.

Blacklisting Huawei has cost the US semiconductor industry billions of dollars in lost revenue. Blacklisting Tencent would affect Apple, which hosts WeChat and its sister app, Weixin, on its iPhones and put in jeopardy its US$44 billion dollar market share in China to local competitors such as Xiaomi, Oppo, Vivo and Huawei.

Tencent has a stake in a number of American companies such as Warner Music, Reddit, Lyft, Snap and a host of American gaming apps. All may have to decouple.

READ: Commentary: US-China rivalry will see a long and bumpy journey

Which begs the question: Can the US and China work out some kind of modus vivendi that would permit trade and collaboration, in general, while strategically decoupling in other areas?

Can there be limits placed, with the recognition that trade and collaboration benefits both sides? Or is the world heading for a broad, accelerating techno-nationalist decoupling?

What happens to Tencent in the coming weeks and months could provide the answer.

Alex Capri is Visiting Senior Fellow with the Department of Analytics & Operations at NUS Business School.