commentary Singapore

Commentary: The ugly supply-side dynamics that can temper an en bloc frenzy

We are likely to see more successful residential collective sale deals in 2017. But developers beware the nasty disputes that may arise among owners, argues NUS’ Sing Tien Foo.

A view of residential housing in Singapore. (File photo: AFP)

SINGAPORE: The residential en bloc market seems to be picking up steam this year.

With the sale of Serangoon Ville along Serangoon North Avenue 1 for S$499 million, the number of en bloc deals completed this year has increased to six, bringing the total value of such deals in 2017 to S$2.0 billion, a huge jump from the S$1.17 billion in 2016 and S$380 million in 2015.

There are good reasons to believe that this is just the start of another en bloc frenzy, given the number of developments currently on the en bloc market and strong interest from developers.

Yet, supply-side factors, in particular, the collective sale mechanism behind an en bloc negotiation, are essential ingredients for a successful sale. If not managed properly, any arising dispute among a property's owners can scuttle a deal, and go some way to temper confidence in the en bloc market.

COMMON INTERESTS

In an en bloc sale, motivated by common economic interests, owners of either strata units in private non-landed residential developments or houses on contiguous land plots come together to jointly sell redevelopment rights of their land to a shared purchaser.

While the latter case is rare, owners living next to each other in landed developments might find common interest in jointly selling their properties when the price is right.

This was the case for eight owners who sold their terrace houses along Marne Road collectively for S$41.76 million in 2012, at a per square foot (PSF) price of almost $3,000.

Home owners can reap a windfall by selling their properties collectively in these cases, because their existing property can be redeveloped into new, higher density residential developments. In 1995, five bungalows along Walshe Road was sold jointly for a cool $1,520 PSF, double the price of what each would fetch if they were sold individually.

LUCRATIVE AFFAIR

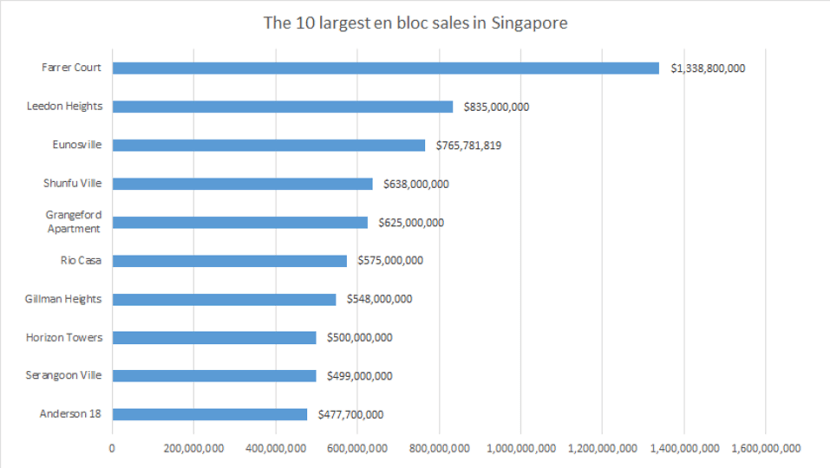

En bloc deals can be a lucrative affair for property developers and home owners in land-scarce Singapore. To date, 6,032 housing units have been involved in en bloc sales, with an aggregate transaction value of more than S$43.34 billion recorded since the first sale in 1994.

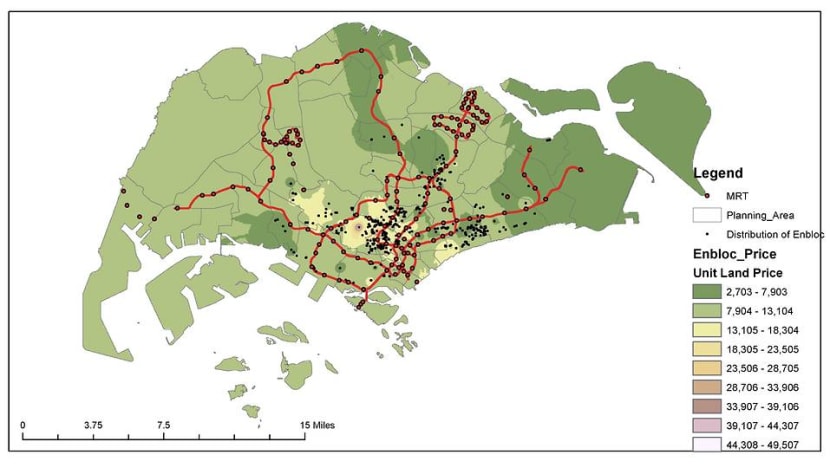

En bloc sales activities have been concentrated in prime residential areas, especially in the city-fringe, where demand for housing is traditionally strong. In these areas, there is also a ready supply of under-developed land with old, low-density buildings and low realised plot ratios, which are potential targets for en bloc redevelopment.

Although some say developers are likely to prefer smaller plots, the data tells us that appetite for large plots of land is growing. Despite the small number of en bloc sales in last three years, these en bloc sales are comparatively larger, both in term of total value and unit size.

The average deal size in this period ranges between S$194.8 million in 2016 and S$380.0 million in 2015, which is significantly larger compared to the en bloc deals during the last peak in the housing market from 2006 to 2007, where the average deal size was around S$90 million.

A few large en bloc deals, which include Raintree Gardens (175 units, S$334 million), Shunfu Ville (358 units, S$638 million), Rio Casa (286 units, S$575 million) and Eunosville (330 units, S$766 million) contribute to this larger average deal size.

BARGAINING, HAGGLING, BRAWLING

Because there is much money to be made, one can also expect a fair amount of bargaining, haggling and even brawling to take place. En bloc sales require the collective support from a majority of owners, who must agree to jointly sell their properties and share the sale proceeds, based on an agreed method of apportionment.

Based on the Singapore Land Title (Strata) Act, an en bloc sale can only proceed if 90 per cent of owners by the total area in a development that is less than 10 years old, or 80 per cent of owners in a development that is 10 years old or older, agree to sell.

This in itself is already an improvement from the previous legislation prior to 2007 that required a unanimous resolution supported by every owner of a strata development to effect an en bloc sale.

This stringent requirement had caused significant tensions between neighbours because minority dissenting owners, who sometimes consisted of just one owner in some cases, could veto an en bloc sale simply by refusing to sell their unit. The 64-unit Eng Kong Mansion was one of the earliest case, where two uncooperative owners of one unit vetoed the en bloc sale decision of the other 63 owners.

Then there is the issue of the sale price. A high reserve price that entices owners to sign onto a collective sale agreement may turn away potential buyers.

On the other hand, a lower reserve price that entices developers to invest time and money to study the profitability of an en bloc sale, can foster competition that drives the sale price up, if owners are sufficiently persuaded to sign on the dotted line.

But often owners have their own price thresholds that must be crossed before they can agree to an en bloc sale.

COMPLEX, CONSENSUS-SEEKING PROCESS

An en bloc sale can be a long-drawn, and sometimes, complex consensus-seeking process. Differences in the en bloc decision, if unresolved, can harm relations among neighbours and create tremendous tensions for people who see each other almost every day and share the same amenities and facilities.

Some owners may harbour acrimony and hatred against others, who they see as standing in their way to realising a huge potential windfall.

For some dissenting owners, many of whom are older residents who may attach great sentiment value to homes that they have lived in for many years, no amount of compensation can make up for the loss of familiar surroundings and the social networks they have established. In old, large developments, this problem can be acute.

In mixed-use developments, commercial property owners can have significant bargaining power vis-à-vis weaker residential property owners. These include owners of big shops or restaurants who own and bear the expenses of commercial facilities in the development such as escalators, loading bays and cargo lifts or have large gross floor areas.

Through their controlling share value, they can have great sway over the details of such en bloc deals, including the method of apportionment and the minimum price.

In navigating these dynamics, some level of behind-the-scenes bargaining by authorised agents and shadowy horse-trading can work but it is often difficult to compensate the losers without taking too much away from the winners’ profit pots or running the risk of agents being accused of acting in bad faith.

Monetary inducement can be an attractive carrot to entice dissenting owner to join an en bloc deal, as was the case in the course of the en bloc negotiations surrounding Harbour View Gardens in 2013.

Yet, even after the sale goes through, some cases can end up embroiled for years in legal dispute and in the case of Gilstead Court, get called off, when dissenting owners who have strong legal grounds to contest the sale file lawsuits.

BUT MORE SUCCESSFUL EN BLOC SALES EXPECTED

In a rapidly urbanised city, en bloc sites provide an alternative source of supply of private residential land for developers and allow for the recycling of land plots populated by dilapidated houses.

More en bloc sales are likely to take place in the coming years, when Singapore’s living areas become more urbanised, and demand for housing in matured housing estates or city-fringe increase. Properties located near MRT stations and public amenities like schools and shopping malls, in particular, are likely to face pressures of being sold en bloc.

We can expect the number of en bloc sales to reach nine to 10 for the full year of 2017, with a total sale value of between S$2.5 and S$4.0 billion, based on the list of hopefuls and their tender exercise periods. Potential en bloc sites that have been put on the market in the past year are aplenty. The list includes Tampines Court, Florence Regency, Villa D’Este, among others.

However, an en bloc sale may take six months to a few years for completion. In the recent Shunfu Ville en bloc case, disputes brought up by a few objecting owners were only resolved by the Court of Appeal four years after the formation of an en bloc committee.

So the success of private en bloc sales is not just dependent on demand-side factors like location and marketing timing. It is also a delicate management of supply-side complications, requiring delicate human intervention to bridge gaps and reach compromises between consenting and dissenting owners.

Such factors are arguably the most important ones that ultimately determine whether a development can clinch an en bloc deal and see through the sale.

Associate Professor Sing Tien Foo is the Dean’s Chair and Director of the Institute of Real Estate Studies at the National University of Singapore.