Heart of the Matter Podcast: Bank outages - Are there gaps in the system?

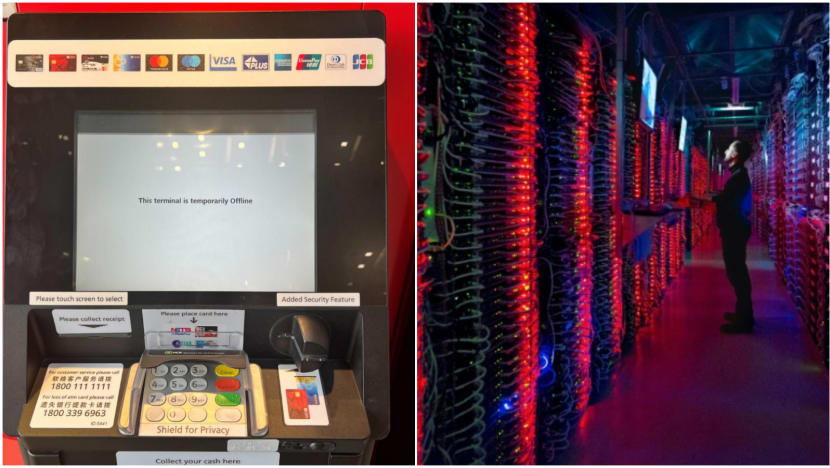

The recent hours-long outage for DBS and Citibank banking and payment services was caused by a technical issue at a data centre. Industry experts weigh in on what happens when critical banking infrastructure goes black.

_1.jpg?itok=ej8yMFTJ)

The recent DBS and Citibank outage in October left many people unable to pay for their transactions and draw money from the ATMs. What goes on when critical banking infrastructure goes black? How are data centres part of this and should we really revert to carrying cash again?

Steven Chia gets answers from Dr Patrick Thng, director of the Master's programme for financial technology and analytics at the Singapore Management University and Ashish Kakar, research director for IDC Financial Insights, Asia Pacific.

What you have to look at is why (aren't) the data centres or the infrastructure resilient? You can't ask people to go back from cards to cash now.

Jump to these key moments:

- 2:10 How interlinked is the entire digital banking infrastructure

- 2:53 Potential solution if there's a bank outage

- 6:42 How are data centres linked to banks

- 11:50 Is it fair to expect a data centre to work flawlessly

- 15:16 What can be done to minimise the risks

- 22:35 Time to review our critical banking infrastructure