More banks in Singapore to offer money lock feature, but take-up rate low among young adults

The banks said that while the number of people using the feature to protect their savings is growing, most of them are older customers.

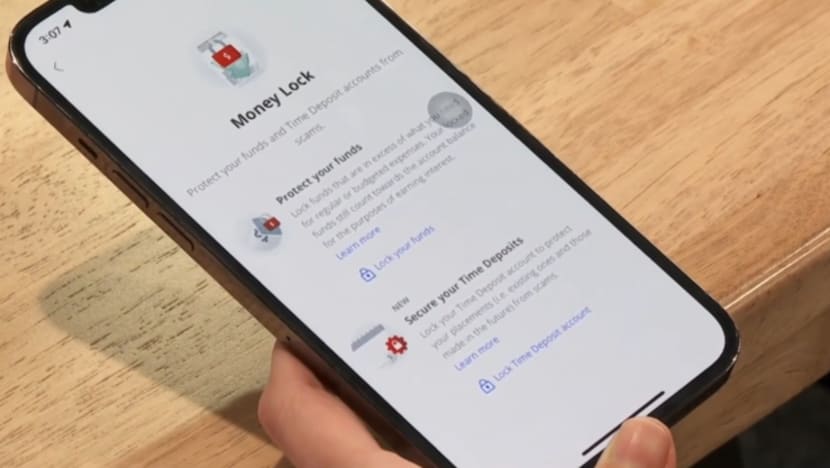

A phone screen showing the "Money Lock" feature on the OCBC mobile app.

This audio is generated by an AI tool.

SINGAPORE: At least three more major banks – HSBC, Maybank and Standard Chartered – are set to offer the “money lock” feature to Singapore customers as early as by the middle of this year.

The anti-scam security feature adds a layer of protection to accounts by allowing users to set aside portions of their funds that cannot be transferred digitally.

The move follows the introduction of the safeguard in November last year by major local banks DBS, OCBC and UOB.

The banks said that while the number of people using the feature to protect their savings is growing, most of them are older customers.

Young adults under 30 make up as little as 15 per cent of such “money lock” users.

MORE USING MONEY LOCK FEATURE

In the three months since the feature launched, over S$5.4 billion (US$4 billion) in savings have been “locked up” in over 61,000 bank accounts across DBS, OCBC and UOB.

Once their money is locked, users can only unlock their funds in person at bank branches or via ATMs, depending on the bank.

UOB said the number of its LockAway accounts and funds deposited in them grew by about 50 per cent from January to February this year.

Similarly, DBS said it is seeing an average of S$5 million being locked up daily in its extended digiVault feature at the beginning of the year.

OCBC said that more than 45,000 accounts and over S$5 billion in savings have been locked by customers.

Among OCBC’s Money Lock users is Mr Alison Liew, who is concerned that bad actors could carry out fraudulent transactions or trick people into transferring their money. He chose to lock away about 70 per cent of his savings.

“Having the assurance that this pool of money is locked away and will be safe from the hands of unscrupulous scammers out there is very comforting,” he said. “Psychologically, having this amount of funds locked up could also help one to be more disciplined in saving.”

Mr Liew said he chose OCBC because the bank allows customers to lock funds in their existing accounts, and in the process retain their interest rates.

Initially, only OCBC offered such a service; customers of the other two banks had to open new, separate accounts to utilise the feature. However, DBS last month also extended its digiVault protection to existing accounts.

At 36 years old, Mr Liew is considered young among the demographic utilising the anti-scam feature.

USERS OF MONEY LOCK ARE OLDER

All three banks currently providing the feature said customers who use “money lock” tend to be older.

UOB said most customers storing their cash in their separate LockAway accounts are 45 years old and above.

OCBC said that among users of its Money Lock feature, those aged 50 and above make up 35 per cent, while those between 30 and 50 years old account for 50 per cent. Those under 30 years of age form just 15 per cent.

Banks said they are reaching out to younger customers on social media to encourage them to keep their money safe by utilising the feature.

“Specifically for the age group 30 years and below, we carry out very targeted communication. It's important that they plan their finances carefully, keeping their funds sufficient for expenses,” said Mr Dennis Lee, head of risk and prevention at OCBC.

“The savings that they build up along the way for emergency use, for maybe their first home or marriage or their dreams, they should periodically lock them away from time to time so that they remain protected on an ongoing basis.”

MORE BANKS UNVEILING FEATURE

Maybank, which is looking at rolling out the security feature in June, said customers will continue to earn the same interest rates whether their funds are locked up or not.

Similar to other banks, customers will be able to lock funds in their current and savings accounts via internet banking and mobile banking.

The feature prevents money from being transferred even if a scammer gains access to a user’s digital account.

Maybank Singapore’s head of community financial services Adam Tan said that while the money lock is an industry-wide scam preventive measure to protect customers, it is just one of many safeguards banks are continuously implementing to stay ahead of bad actors.

“Scams are ever evolving. They will not end just because we have a money lock feature. We have other security features to prevent scammers from targeting victims,” he said.

Other measures include anti-malware control in mobile banking applications, as well as a "kill switch" to immediately freeze accounts and stop internet banking access in instances when accounts are suspected to have been compromised.

HSBC and Standard Chartered said their money lock feature will also be rolled out later this year.