The Big Read: Finance hub status takes a hit, but the money’s on S’pore bouncing back

Office workers in the financial district. While analysts shared Mr Ravi Menon’s concerns about Singapore’s reputation as a financial hub, some of them pointed out that the moves by the authorities are a testament to the Republic’s no-nonsense approach and set the bar for other jurisdictions. Photo: Reuters

SINGAPORE — The Republic’s status as a financial hub has taken a battering in recent months: Yet another trading outage in its bourse, high-profile insider trading and market manipulation probes, and serious lapses in anti-money laundering processes at several financial institutions that were discovered as a result of investigations into dealings linked to Malaysian state investment fund 1Malaysia Development Berhad (1MDB).

These could not have been more ill-timed for the financial sector amid the subdued global economy.

Bank lending, for example, has declined — mainly due to falling loans to businesss — for nine consecutive months from October last year to June, based on the latest official numbers.

Plagued by technical glitches and low trading volumes, the Singapore Exchange (SGX) will be further hit by the expected delisting of some flagship companies. A Wall Street Journal report recently estimated that almost US$5.5 billion (S$7.4 billion) in market capitalisation could be wiped out from SGX when companies such as Neptune Orient Lines and SMRT delist.

The financial sector, which employs about 200,000 people here and accounts for more than 12 per cent of the gross domestic product, is a key pillar of the Singapore economy. Over the years, the Republic has established itself as one of the top financial centres of the world.

(Click to enlarge)

The latest Global Financial Centres Index — which looks at areas such as business environment factors, financial sector development, and infrastructure factors — released in April ranked Singapore third, behind London (first) and New York (second). Hong Kong and Tokyo were fourth and fifth, respectively. But recent events have affected the Republic’s stellar standing.

The Monetary Authority of Singapore (MAS) has vowed to fix the money laundering lapses, which were found at banks such as DBS, UBS and Standard Chartered Bank (SCB), among others, by installing tougher controls and industry supervision.

The MAS’ managing director, Ravi Menon, cut a disappointed figure when he spoke to reporters at the MAS’ annual report briefing less than a fortnight ago. “There is no doubt that the recent findings have made a dent in our reputation as a clean and trusted financial centre ... What happened is simply unacceptable. We may not be any worse off than other jurisdictions, but that is no consolation. We have not met the high standards we have set for ourselves,” he said.

THE SCOURGE OF MONEY LAUNDERING

In April, Singapore was among the first countries to bring formal charges against an individual arising from the global investigations into 1MDB, when it took action against Yeo Jiawei, a 33-year-old Singaporean who used to work as a wealth planner at the Singapore arm of Swiss private bank BSI.

A month later, the MAS ordered BSI — whose parent bank is facing criminal proceedings by Switzerland authorities — to shut down its operations here, citing serious breaches of anti-money-laundering rules. It was the first time in more than three decades that a merchant banking licence was revoked.

While analysts TODAY interviewed shared Mr Menon’s concerns about Singapore’s reputation, some of them pointed out that the moves by the authorities are a testament to the Republic’s no-nonsense approach and set the bar for other jurisdictions.

ANZ economist Ng Weiwen said: “This is going to be a continued and sustained effort for the central bank in order to keep its position as a global financial centre.”

Apart from setting up a dedicated anti-money-laundering department, the MAS would also be conducting more intrusive inspections of financial institutions identified as facing higher risks. While these moves would go a long way to fix the lapses and restore Singapore’s reputation, analysts stressed the need for the authorities to tread with caution. Over-regulation could adversely affect the financial sector, which is already reeling from the recent disclosures. “Care must be taken, however, if the imposition of stricter anti-money-laundering guidelines raise the cost of compliance while reducing the inherent wiggle room of the risk-based approach,” said Mr Eric Sohn, Dow Jones Risk and Compliance’s director of business product.

He added: “In that case, smaller market participants will be forced out of the market, innovative new solutions will find the barriers to entry in Singapore too high, and illicit funds will be forced underground.”

Senior economist at Mizuho Bank Vishnu Varathan reiterated the need to strike a balance. “The answer to a weaker loans growth environment cannot be the easing of regulatory standards to help banks, as that would be a poor excuse,” he said. “The weak loans problem is a cyclical issue impacted by the slow global economy, while the regulations focus on a long-term, structural effort.”

‘SGX NEEDS TO GET ITS ACT TOGETHER’

With the Singapore authorities committed to weed out money laundering, the lacklustre stock market could be tougher to fix.

The Republic has been knocked off its perch as the premier destination for initial public offerings (IPOs) in South-east Asia. Last year, the SGX had the smallest haul of new share sales among the region’s four largest stock markets. Only 13 IPOs were listed on the SGX last year — just one on the mainboard and the other 12 on Catalist. This compares with the 30 IPOs in 2014, of which 12 were on the mainboard and 18 on the junior board.

So far this year, the SGX has seen 14 IPOs, with the largest being Frasers Logistics and Industrial Trust, which has a market cap of S$1.42 billion.

Market analyst at CMC Markets Singapore Margaret Yang said: “The sizeable IPOs we have seen in the SGX main board this year were mainly real estate investment trusts due to favourable tax treatment and hunting for high yield in today’s low interest rate environment. But the problem is that we are lacking a diversified range of IPOs, such as technology and e-commerce companies.”

To compound the relatively quiet IPO market, the bourse has also been rocked by the plans of major companies to delist. At last month’s press conference on SGX’s full year annual report, its chief executive officer Loh Boon Chye said delistings are “natural occurrences in any well-functioning capital market”. What the SGX has to do is to focus on improving product offerings and on attracting more listings to inject greater vibrancy into the market, he said.

However, IG market strategist Bernard Aw told TODAY: “The increasing number of firms looking to privatise or already delisted is worrying because some of them are quality names, such as NOL, SMRT, Tigerair. If there are more quality companies delisting, we could see a hollowing out of the local stock market, and that will not be positive for already flagging trading interests.”

The SGX’s standing has also taken a hit after several outages. The latest incident — caused by a hard disk failure that was not detected by an application designed to pick up the error — occurred last month and caused trading to be halted for half a day. This came after three breakdowns in 2014 and last year due to various technical issues.

Professor Ho Yew Kee, head of department of accounting at NUS Business School, said: “Trust is a very precious and valuable attribute in the finance industry. We must ensure that the market players do not perceive this as a systematic problem or something that is endemic to Singapore as a financial centre.”

He added: “Singapore has all the right attributes (political stability, certainty in the rule of law, efficiency, transparency, work ethics and culture, etc), and it needs to continue to signal these attributes to the market players to attract them to put their money in Singapore. We need to impress on the market players that such incidents should not happen in the near or distant future.”

The SGX would need to get its house in order, even as the bourse bears the brunt of a sluggish economy. The Straits Times Index — an indicator that tracks the performance of the top 30 companies listed on the SGX — has fallen below 2,900 points, some way off from the healthier levels of 3,300 to 3,400 points a few years ago.

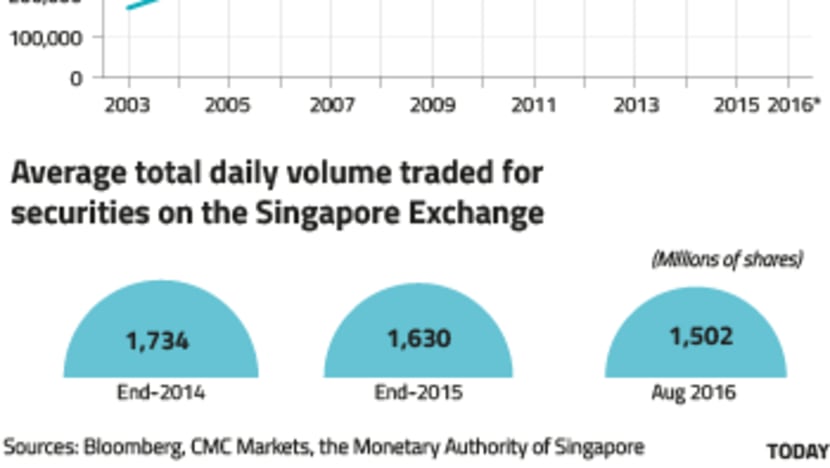

Ms Yang noted that the average total daily volume traded for securities on the SGX has been declining over the past two-and-a-half years. “For listed companies, the shrinking liquidity and depressed valuation are important factors that contributed to a surge in privatisation in the local stock market over the last two years,” she said.

She added: “The relatively low trading volume of shares in the local market will probably continue amid unfavourable market conditions for equities and rising uncertainties surrounding the global economic outlook.”

Amid the weak market conditions, the SGX should look to revive its fortunes by introducing new products, rectifying its technical problems and improving its capabilities in handling trading disruptions. The talk on buying London’s Baltic Exchange is a positive development to reignite investors’ interest, experts said. Ms Yang said: “(The SGX) should continue to bring high-quality IPOs to the local market. Meanwhile, (it should continue to) attract foreign investors — especially institutional investors and funds — to boost liquidity in the securities market.”

In April, the SGX reported nine cases of alleged insider trading and market manipulation in the first three months of this year, after news broke that the central bank and white-collar-crime police are investigating several brokerages and their trading representatives for potential breaches of the securities law. Meanwhile, the authorities are investigating a penny stock crash episode in 2013, which created immense market volatility, wiping out billions in market value. In this instance, the shares of Blumont Group, LionGold and Asiasons Capital surged more than 800 per cent over several months before crashing by more than 90 per cent in an unexplained free fall. Trading rules have been tightened in the aftermath.

Mr Ng lauded the crackdown on the illegal activities: “It underscores the fact that they (the MAS and SGX) are ready to take remedial actions to address any deficiencies in the system.”

S’PORE’S FINANCIAL HUB WOES NOT UNIQUE

Although Singapore’s financial sector is facing its fair share of problems, experts pointed out that these issues are affecting other financial hubs around the world.

Mr Varathan noted that, for example, regulators in the United States and United Kingdom are also tackling the issues of money laundering and countering the financing of terrorism. “Inadvertently, as long as there is a global economy, we can envisage that there will be attempts to whitewash money to put through financial centres,” he said. “Singapore is not facing a greater risk than other major financial centres, it is just responding, arguably as one of the leading financial centres, to step up on these activities ... financial centres need to constantly keep vigilant and be on guard.”

With the weak global economic outlook, the Hong Kong bourse is also facing a surge in large companies seeking to delist. In June, electronics product manufacturer TCL Corporation announced plans to privatise its Hong-Kong-listed smartphone business, in order to “maximise the interest of the shareholders and optimise the company’s business structure”, the South China Morning Post reported. Peak Sport Products, one of China’s largest sports goods manufacturers, also said in May that its controlling shareholder was considering a buyout plan and may delist from the Hong Kong Stock Exchange.

Globally, the weak market conditions have dampened the IPO market. The total capital raised by IPOs globally amounted to US$58.8 billion (S$79.2 billion) in the first half of this year, according to data from CMC Markets. In comparison, IPOs around the world raised US$250 billion and US$200 billion in 2014 and 2015, respectively. “The decline in IPO activities globally in the first half of this year can be attributed to a ‘cooling off’ effect after several years of strong IPO activity across major markets,” said Ms Yang. “This effect is likely to continue in the second half of the year, as heightened economic and political uncertainties surrounding China’s slowing down, Brexit, and commodities slump will continue to undermine IPO sentiment.”

She added: “Going forward, we will need to see a sign of stabilisation in the macro-economic environment before anticipating an improvement of IPO activities globally.”

BRIGHT SPOTS

Meanwhile, Singapore’s asset management industry has been growing steadily: Assets under management stood at S$2.6 trillion last year, up from S$2.4 trillion in 2014 and S$1.8 trillion in 2013. For last year, 80 per cent of the assets were sourced from investors outside of Singapore, while two-thirds were invested into the Asia Pacific, “reflecting Singapore’s role as a regional investment gateway”, the MAS said on its website.

Analysts expect the value of the assets under management to continue to grow. Mr Ng said: “Singapore’s financial hub, in fact, is expected to grow even bigger. With the rise of the middle class in Asia and Asean’s integrated banking system, Singapore is on the top of the shortlist (for investors) ... Singapore’s financial market actually has the depth by international and regional standards.”

He added: “It has many product offerings such as futures, structured notes, bonds and equities, and is also one of the top foreign exchange clearing hubs in the world. That is also another reason why we have the ability to offer products for affluent investors both locally and overseas.”

Many businesses in Asia are still growing, and these companies, which are often family-run, could also provide business opportunities for Singapore as a financial centre. “Asia is still very much family-business-based,” said Prof Ho. “This means that we have plenty of opportunities to turn these family businesses into household names which can be listed. The challenge is to provide these family businesses with reasons to be listed for expansion and growth. In addition, it may also mean that the family businesses are at a stage where their management will have to be professionalised and to move away from management by family members. This provides significant opportunities for (Singapore’s) development and growth.”

As far as the experts are concerned, Singapore has everything going for it as a financial centre — and that also has much to do with how seriously its regulators, such as Mr Menon, take their jobs, including the task of tackling the scourge of money laundering.

“To put things in perspective, Singapore’s regulatory standards are high by international standards, they (the MAS) are just pushing the standards even higher,” Mr Ng said.