Billion-dollar money laundering case: Luxury handbags and 58 gold bars among items handed to Deloitte for liquidation

The non-cash assets seized during the high-profile case will be sold via various channels, including through auctions.

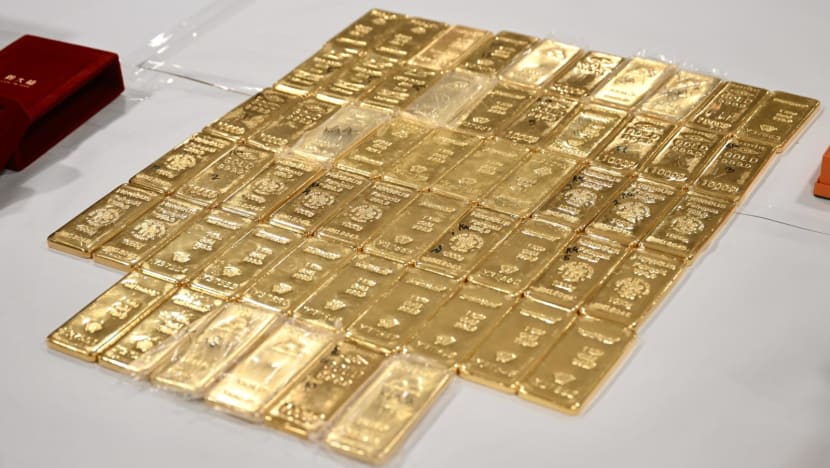

Luxury handbags, watches, jewellery and gold bars were among assets seized during the S$3 billion money laundering case that were handed over by the Singapore police to Deloitte for liquidation on Aug 12, 2025. (Photo: CNA/Marcus Mark Ramos)

This audio is generated by an AI tool.

SINGAPORE: Luxury handbags, watches and gold bars that were seized during the S$3 billion (US$2.33 billion) money laundering case were among the assets handed over by the police to Deloitte for liquidation on Tuesday (Aug 12).

The money laundering case, which came to light following islandwide police raids in August 2023, involved millions of dollars earned over the years from an illicit gambling ring based in Southeast Asia.

The offenders – nine men and one woman – hailed from China and had criminal backgrounds. All have been convicted and were deported after serving their sentences.

On Tuesday, the media were invited to observe how the confiscated assets, which were placed on display at the Police Cantonment Complex, were handed over to staff members from Deloitte by officers from the Commercial Affairs Department (CAD).

In total, 466 luxury goods items and 58 gold bars were handed over across two days. These include about 50 branded bags that appear to be made by Louis Vuitton, Hermes, Dior and Chanel.

Among the handbags are: a Hermes Birkin 25 Togo bag with an estimated value of S$30,000, and a Hermes Kelly Alligator bag that can cost between S$70,000 and S$120,000, according to online listings by brokers such as Sotheby's.

There were also at least 14 luxury watches from brands such as Patek Philippe, Richard Mille, Van Cleef & Arpels, Rolex and Audemars Piguet.

One of the watches seen is a Patek Philippe World Time Chronograph, which has an estimated value of S$120,000. There was also a Richard Mille RM 67, which fetches an estimated value of over S$400,000, according to online marketplace Chrono24.

Also on display were the gold bars, at least 13 cases of jewellery, such as earrings, bracelets, jade necklaces, at least one gold display plate and one luxury belt.

In a statement on Tuesday, the police said it has appointed Deloitte & Touche Financial Advisory Services for the “management and realisation of the non-cash assets seized in relation to the S$3 billion money laundering case”.

To facilitate this, police said they are progressively handing over all remaining non-cash assets, which have yet to be liquidated to Deloitte.

Between Aug 11 and 12, the police handed over 466 luxury items and 58 gold bars to Deloitte.

CNA observed how CAD officers handled the handover of the assets to Deloitte staff members, who then disassembled the luxury bags into their components.

After the parts are photographed, the items are then packaged into brown bags.

For watches, they underwent a brief inspection where staff members wrote some of their details down, before being stored in their case and placed into transparent bags.

The gold bars – each weighing 1kg and valued at around S$139,000 per bar – were likewise inspected by Deloitte staff members and then carefully placed into small transparent bags.

About the case

Investigations into the transnational case date back to 2021, culminating in a widely reported police raid on Aug 2023.

More than 400 officers were involved and 10 people were arrested at condominiums, landed properties as well as Good Class Bungalows. These properties were in prime locations such as Sentosa Cove, Tanglin, Orchard, Holland Village and River Valley.

Singapore police also seized luxury cars, watches, jewellery, designer goods, cryptocurrency and cash. More than 150 properties were also seized, including homes in upmarket neighbourhoods.

About S$1 billion worth of assets linked to the 10 offenders was seized. Of these, the offenders agreed to forfeit between 90 and 100 per cent of the assets – totalling about S$944 million.

WHAT WILL HAPPEN TO THE ITEMS?

Following the handover, Deloitte will securely store the assets and eventually look to sell the items.

Responding to media queries, police said that the proposals for the sale of the assets will be submitted by Deloitte to the police "in due course". The options for sale include auctions and direct selling.

"Deloitte will commence the realisation of the assets, upon the government's approval of the proposals".

The other S$2 billion or so seized assets that make up the S$3 billion figure comes from 17 other suspects on the run and outside of Singapore's jurisdiction.

In February, it was announced that a total of 54 properties, 33 vehicles and 11 country club memberships were liquidated as of December 2024.

Home Affairs Minister and then-Law Minister K Shanmugam said then that about S$1.8 million has been paid into the consolidated fund as of December 2024.

The consolidated fund is similar to a bank account held by the government. According to the Parliament website, Singapore's revenues are paid into this fund and it is also used to fund government spending.

Another S$390 million, which includes proceeds from the liquidation, is pending similar payment into the consolidated fund in the 2024 financial year.

As of December 2024, assets amounting to about S$2.79 billion have been surrendered to the state, said the minister.

Of this, S$1.54 billion was in cash or financial assets, said Mr Shanmugam, adding that the rest were in non-cash assets. These include properties, vehicles and luxury items.

Credit Suisse, UOB and UBS were among nine financial institutions that have been slapped with S$27.45 million in penalties for breaches related to the 2023 money laundering case involving more than S$3 billion in assets. Action has also been taken against 18 individuals involved in managing relationships with suspects in the case. MAS added that this marked the conclusion of its enforcement actions against financial institutions with a “material nexus” to the money laundering case. However, it may take action against “a few remaining individuals” after ongoing court proceedings or investigations conclude.