Two Chinese yuan remittance firms fined S$5.36 million for sharing information on rates for 6 years

ZGR Global and Hanshan Money Express breached anti-competition rules, receiving the highest penalty that has been meted out for Information Exchange Conduct.

Hanshan Money Express and ZGR Global at People's Park Complex on Dec 19, 2023. (File photos: CNA/Abigail Ng)

This audio is generated by an AI tool.

SINGAPORE: Two remittance companies have been fined S$5.36 million (US$4.14 million) for exchanging information on the Chinese yuan rate to charge customers.

This went on for six years.

In doing so, the companies - ZGR Global and Hanshan Money Express - were less pressured to offer competitive rates to customers, Singapore's competition watchdog said on Thursday (Jul 31).

The case was uncovered after a member of the public noticed that the two shops, located beside each other in People's Park Complex, offered very similar rates and submitted a complaint to the Competition and Consumer Commission of Singapore (CCCS).

The penalty is the highest that has been meted out for Information Exchange Conduct.

ZGR Global, previously known as Zhongguo Remittance, was fined S$2.79 million.

Hanshan Money Express will have to pay S$2.57 million. It received a 10 per cent discount, amounting to around S$285,000, on its penalty because it accepted liability under CCCS' fast track procedure, a streamlined process to resolve cases more efficiently.

This was in addition to a discount given to both companies for cooperating with investigations.

The two companies can appeal against the decision within two months or pay the fine by Oct 1.

CCCS enforces competition and consumer protection laws in Singapore and takes action against unfair trade practices.

Businesses can observe and adapt to their competitors' behaviour, but should not share their pricing strategies or communicate with competitors to influence their conduct, said CCCS chief executive Alvin Koh.

"By colluding together to exchange such information, the parties undermined competition in the market for CNY remittance services, which reduced options for customers," said Mr Koh.

PASSING PAPER SLIPS

ZGR Global and Hanshan Money Express are leading providers of Chinese yuan remittance services in People's Park Complex. They are direct competitors, noted CCCS.

Before they started sharing information in breach of anti-competition rules, they closely monitored each other's rates, such as by having their staff pose as customers.

To overcome this uncertainty, the businesses started informing each other of their respective opening rates at the start of the day, and would update each other whenever they decided to change their rates during the day.

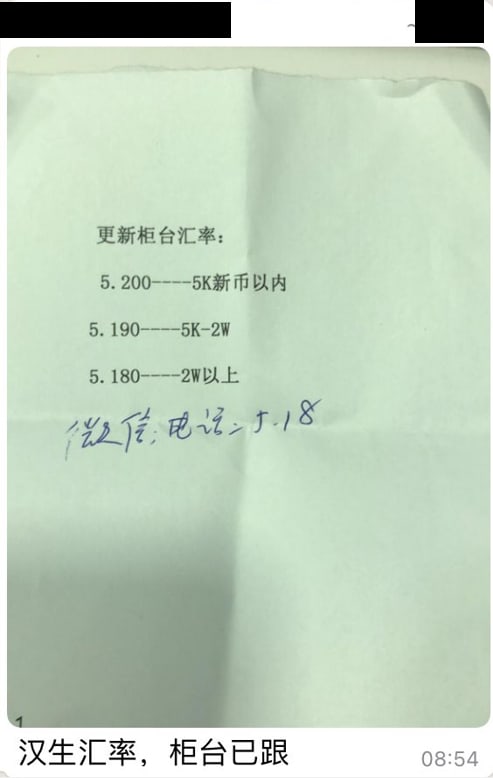

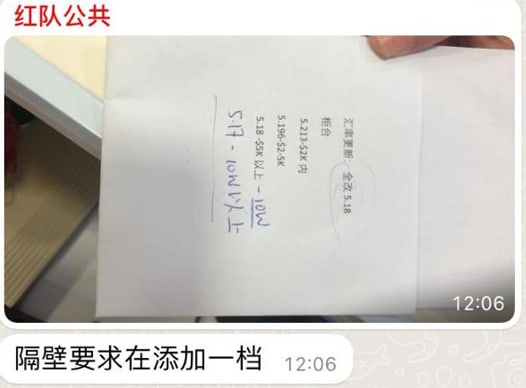

This behaviour began in 2016, and generally occurred daily. They would communicate the rates being used either verbally over the counter, over the phone or by passing paper slips containing the respective rates.

Messages from ZGR Global's internal WhatsApp group showed photos of paper slips, with captions such as "(These are) Hanshan's rates, (which ZGR Global's) counter has already followed".

Another photo came with the caption "Next door requested to add one tier".

Remittance service providers compete based on the remittance rates offered to customers.

"Similar to exchange rates, remittance rates are highly volatile," said Ms Zara Mok, senior assistant director of the legal and enforcement team at CCCS.

"It affects how much money the recipients will receive for the same amount of local currency."

Remittance companies usually use a different rate depending on the amount being remitted.

These rates are not readily available to the public, but the two companies could "instantly access each other's revised rates" by sharing commercially sensitive information, CCCS said.

The information then influenced the setting of each of their rates, undermining the process of competition in the market.

"From the evidence gathered, CCCS observed that the parties had more similar outward CNY remittance rates when the Information Exchange Conduct took place," the agency said.

The commission formally engaged the companies in July 2021, but they only stopped sharing information in February 2022.

CCCS issued a proposed infringement decision to ZGR Global and Hanshan Money Express in November 2024 and a supplementary infringement decision in April this year to give the parties a chance to respond before a final decision was made.

The companies' turnover, the nature and seriousness of the infringement, as well as aggravating or mitigating factors, were considered in deciding on a financial penalty.

Mr Koh said such cases of anti-competitive behaviour are "more prevalent than we like" and are not easy to detect.

This is part of the reason for CCCS's leniency programme, he added, which allows businesses to come forward with information and receive a full waiver or substantially reduced financial penalties.

The commission also has a whistle-blowing scheme with monetary rewards of up to S$120,000.

Commenting on the "significant financial penalties" in the case of the two remittance companies, Mr Koh said: "That signals that we are getting tougher on such activities, including cartel activities in Singapore, and this infringement decision serves as a clear message to all businesses operating in Singapore that anti-competitive practices will not be tolerated."

In response to queries from CNA, ZGR Global said it is carefully reviewing CCCS' decision and considering its options.

"We take our legal obligations very seriously and remain committed to conducting our business with integrity, in full compliance with competition laws and in the best interest of our customers and stakeholders."

CNA has also reached out to Hanshan Money Express for comment.