DBS, POSB customers experience 'slowness' when logging into mobile app

The issue persisted for about two hours on Monday (Jun 2) afternoon.

Some customers received an error message on DBS' iBanking mobile app. (Images: Reuters/Edgar Su, CNA)

This audio is generated by an AI tool.

SINGAPORE: DBS and POSB customers experienced "slowness" in accessing the digibank mobile app for around two hours on Monday (Jun 2), starting from about 2.15pm.

In a post on Facebook at 4.01pm, DBS said: "Some customers are experiencing slowness logging into DBS digibank Mobile."

It advised its customers to make payments, check account balances, withdraw cash and place trades on its other channels while it worked to resolve the issue.

In an update at 4.38pm, DBS said that access to its mobile app had "returned to normal" as of 4.08pm.

"We appreciate our customers' patience and are sorry for the inconvenience caused," it said.

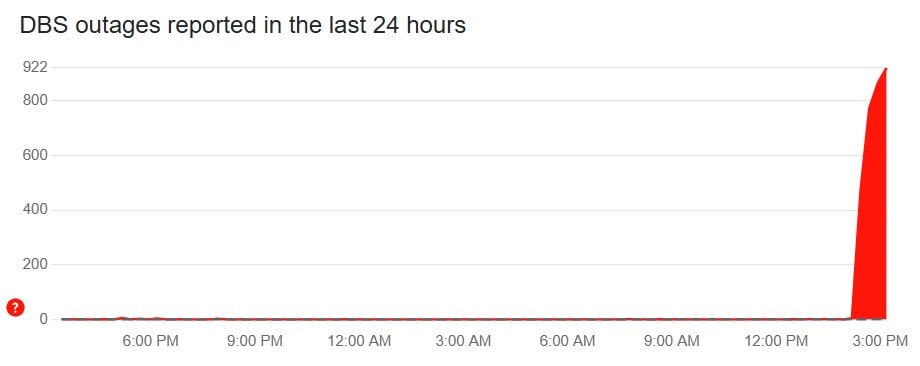

On outage tracking site Downdetector, users began lodging reports at 2.17pm, spiking to 1,060 reports at 3.34pm.

In the comment section of the bank's latest post on Facebook, one user wrote: "Your app is down again."

As of about 3.45pm, about 10 users said they had trouble accessing the app.

"This is becoming increasingly embarrassing," read a comment.

A Facebook user asked why there was no update from the bank, while another noted experiencing slowness when logging into the app from a week ago.

PREVIOUS DISRUPTIONS

In March 2025, DBS' services, including mobile banking, ATMs and NETS were disrupted overnight, with complaints on Mar 8 spiking after midnight and persisting past 9am.

Singapore’s largest lender was also hit by a string of disruptions to its digital banking services in 2023, prompting the Monetary Authority of Singapore to bar the bank from any acquisitions of new business ventures for six months.

The bank was also required to pause non-essential IT changes for six months and was not allowed to reduce the size of its branch and ATM networks in Singapore.

DBS said in November 2023 that it had set aside a special budget of S$80 million to enhance its technology and system resiliency.

The bank’s senior management, including CEO Piyush Gupta, also took cuts to their variable pay to take responsibility for the series of service disruptions in 2023.