HDB resale prices rose 12.5% in 2021, highest annual growth since 2010: Flash estimates

File photo of HDB flats at night. (Photo: CNA/Jeremy Long)

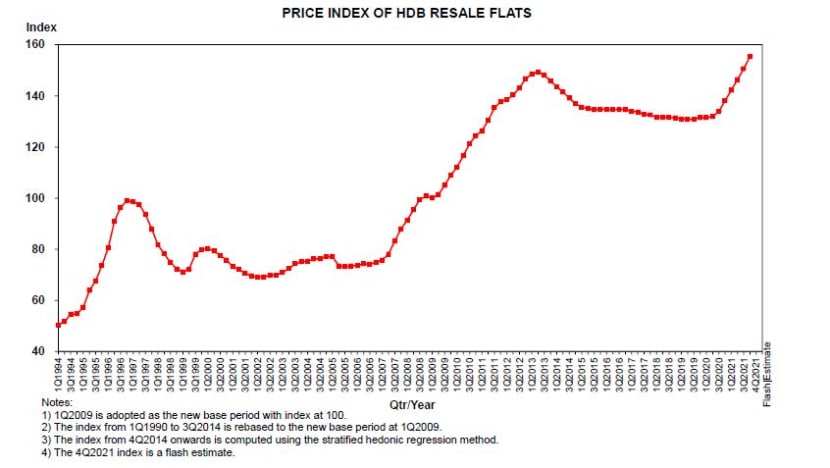

SINGAPORE: Resale flat prices in Singapore rose 12.5 per cent for the whole of 2021, the highest annual growth since 2010, Housing and Development Board (HDB) flash estimates on Monday (Jan 3) showed.

Prices also grew for the seventh straight quarter in the last three months of 2021, rising 3.2 per cent from the preceding quarter.

The resale price index for the fourth quarter was 155.4, extending the record in the previous quarter, the estimates showed.

The index provides information on the general price movements in the resale public housing market.

Last month, the Government announced a package of measures aimed at cooling the property market.

HDB resale price growth

| Quarter | RPI | Price growth |

| Q4 2021 | 155.4 | 12.5% |

| Q4 2020 | 138.1 | 5.0% |

| Q4 2019 | 131.5 | 0.1% |

| Q4 2018 | 131.4 | -0.9% |

| Q4 2017 | 132.6 | -1.5% |

| Q4 2016 | 134.6 | -0.1% |

| Q4 2015 | 134.8 | -1.6% |

| Q4 2014 | 137 | -6.0% |

| Q4 2013 | 145.8 | -0.6% |

| Q4 2012 | 146.7 | 6.5% |

| Q4 2011 | 137.7 | 10.7% |

| Q4 2010 | 124.4 | 14.1% |

| Q4 2009 | 109 | 8.1% |

(Source: HDB)

These include higher Additional Buyer’s Stamp Duties (ABSD), tighter loan-to-value (LTV) limits and lower Total Debt Servicing Ratios (TDSR).

For HDB flats, the LTV limit for housing loans from HDB was tightened from 90 per cent to 85 per cent.

"In addition, the Government will also be significantly increasing the public housing supply for at least the next two years," said HDB on Monday.

HDB added that it plans to launch up to 23,000 flats per year in 2022 and 2023.

"Looking ahead, HDB is prepared to launch up to 100,000 flats in total from 2021 to 2025, if needed, subject to prevailing demand," said the Housing Board.

Ms Christine Sun, senior vice president of research and analytics at OrangeTee and Tie, said the HDB market "exceeded expectations" in terms of price growth and sales volume this year.

Demand continues to outstrip supply in many areas, she said, adding that construction delays and long completion periods of BTO flats may have "driven buyers" to the resale market.

Private homeowners who sold their houses and downgraded to public housing also added to the demand pool.

If delays in the construction industry are not resolved, the planned ramp-up in Build-to-Order (BTO) supply is not going to resolve the demand and supply imbalance in the resale market, said Mr Lee Sze Teck, Huttons Asia’s senior director of research.

"At some point, price resistance will set in in the HDB resale market," he added.

Mr Eugene Lim, ERA's Key Executive Officer, said "bottlenecks" in the construction industry due to COVID-19 have resulted in longer waiting times for owners to take possession of BTO flats.

"The much longer than usual waiting time to take possession of BTO flats remains the critical issue that has pushed and will continue to push buyers who are not willing or able to wait for so long for these new flats to the resale HDB market," said Mr Lim.

As first-time HDB flat buyers are couples planning to get married or start a family, the "more practical" solution would be a resale flat, he added.

"So, unless the HDB can shorten the waiting time for buyers to take possession of their BTO flats, we expect resale HDB flat demand will continue to be driven by first-time buyers (who cannot wait) and those that are not eligible to buy BTO flats," said Mr Lim.

LIMITED IMPACT FROM COOLING MEASURES

Ms Sun said there could be "some limited impact" from the cooling measures introduced by the Government.

"While most buyers may not be adversely affected by the reduced LTV, buyers may generally be more prudent in their home purchases and could even take the opportunity to negotiate for better prices. Some sellers may start adjusting their price expectations as well," she added.

Prices are not expected to fall because demand "is likely to remain robust", and construction of new flats may still be delayed, she said.

Mr Lim said the lowered LTV does not affect those that have a stronger financial ability, such as those with money in their Central Provident Fund or as cash savings.

"Also, many buyers may also be more inclined to take bank loans for their resale HDB flat purchases, as currently, the housing loan interest rates offered by banks are lower and more attractive than HDB’s 2.6 per cent," said Mr Lim.

He added that due to strong demand, increasingly higher resale HDB prices in 2022 can be expected.

NEW LAUNCHES

In February, about 3,900 Build-to-Order (BTO) flats will be offered in towns or estates such as Geylang, Kallang Whampoa, Tengah and Yishun.

In May, HDB will offer "about 5,200 to 5,700" BTO flats in towns or estates such as Bukit Merah, Jurong West, Queenstown, Tampines, Toa Payoh and Yishun.

"This number is subject to review as more project details will be firmed up closer to the launch date," said HDB.

HDB Resale price index for 2020 and 2021

| Quarter | Retail price index | Percentage change from previous quarter |

|---|---|---|

| Q4 2021 | 155.4 | 3.2% |

| Q3 2021 | 150.6 | 2.9% |

| Q2 2021 | 146.4 | 3.0% |

| Q1 2021 | 142.2 | 3.0% |

| Q4 2020 | 138.1 | 3.1% |

| Q3 2020 | 133.9 | 1.5% |

| Q2 2020 | 131.9 | 0.3% |

| Q1 2020 | 131.5 | 0% |

(Source: HDB)