HDB resale prices rise 2.3% in first quarter, lowest growth since Q3 2020: Flash estimates

An HDB block in Singapore. (Photo: CNA/Gaya Chandramohan)

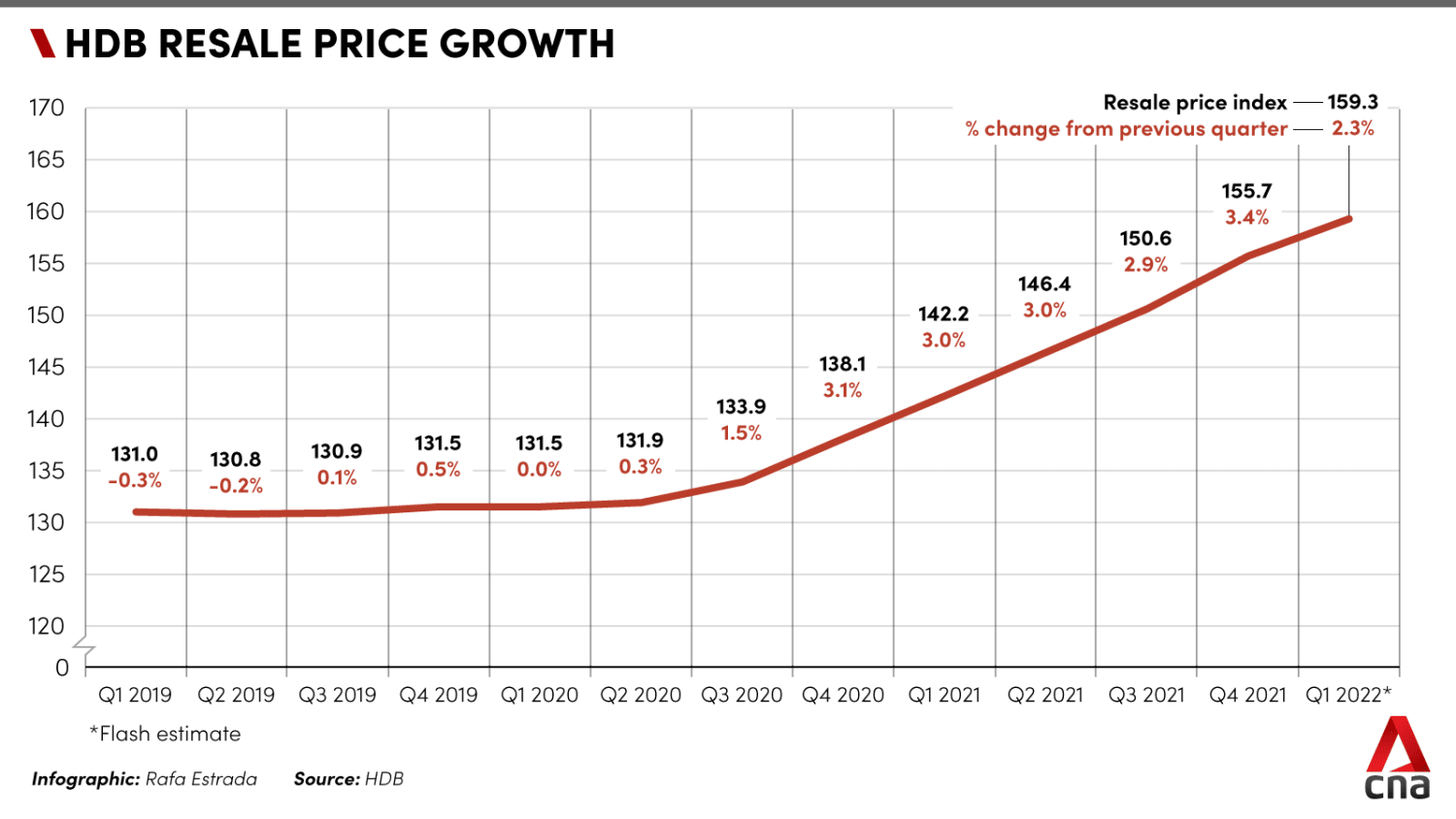

SINGAPORE: Resale flat prices in Singapore rose 2.3 per cent in the first quarter of 2022 - the lowest growth since the third quarter of 2020, according to flash estimates released by the Housing and Development Board (HDB) on Friday (Apr 1).

The resale price index, which provides information on the general price movements in the resale public housing market, rose from 155.7 to 159.3, the estimates showed.

This comes after resale prices in the fourth quarter of 2021 went up by 3.4 per cent.

OrangeTee & Tie's senior vice president of research and analytics Christine Sun said: "This is the lowest price growth since Q3 2020 when prices rose 1.5 per cent."

She added that "price resistance could be setting in" as "prices have already risen for eight consecutive quarters".

Eighty-two flats were sold for at least S$1 million last quarter, which was almost on par with the 85 transactions inked in the preceding quarter, she said.

"Of the million-dollar transactions, more flats breached the S$1.3 million mark and could soon be breaking the S$1.4 million level. Six flats were transacted above S$1.3 million in total, with four such units inked last quarter and another two units transacted in Q4 2021," Ms Sun said.

In an update on upcoming sales launches, HDB said it will offer in May about 5,300 Build-to-Order (BTO) flats in towns and estates such as Bukit Merah, Jurong West, Queenstown, Toa Payoh and Yishun.

In August, about 6,300 to 6,800 BTO flats in places such as Ang Mo Kio, Bukit Merah, Choa Chu Kang, Jurong East, Queenstown and Woodlands will be made available.

"This number is subject to review as more project details will be firmed up closer to the launch date ... HDB will continue to monitor housing demand and adjust the plans where necessary," it said.

Ms Sun said that inflation and rising economic uncertainties may impact buyer sentiment and purchase decisions.

"Should inflation worsen, more people may opt for smaller flats or flats in non-mature estates, which tend to be lower priced. We anticipate that resale prices may continue to rise but at a slower pace of between 5 and 8 per cent this year," she added.