IN FOCUS: Why are some retail tenants up against their landlords and can the relationship be mended?

A road crossing along Orchard Road, which has many shopping malls. Many people were spotted along the famous shopping district in the afternoon on Jun 19, 2020. (Photo: Rachel Phua)

SINGAPORE: In February, as bustling shopping malls in Singapore began to empty out due to the spread of a then little-known novel coronavirus, a small group of worried retailers got together on WhatsApp.

Some had seen sales tumble by more than one-third and, as small businesses operating on thin profit margins, they were starting to fret over tightening cash reserves. Rent – one of their biggest costs – was top of their concerns.

“We realised that this was going to be a real disaster,” said Terence Yow, whose company Enviably Me is the official distributor of Melissa shoes in Singapore.

As the calls for help grew, some members like Mr Yow suggested coming together as a group to appeal to their landlords, most of which are large property developers. “We can keep complaining and get nowhere or try presenting a case to the landlords coherently and collectively,” he said.

Several others agreed and the Singapore Tenants United for Fairness (SGTUFF) was formed.

READ: Tenants need ‘unprecedented’ rent relief amid COVID-19 outbreak, say retail and F&B groups

By then, the Restaurant Association of Singapore (RAS) was already asking mall operators for rent cuts and at one point, locked horns with those it deemed as dragging their feet. SGTUFF, which had ballooned to represent more than 300 retailers by early-March, joined in the call.

This rally for rental reliefs continued as the COVID-19 fallout deepened with a “circuit breaker” that shut down non-essential businesses like retail and made dine-ins off limits for food and beverage (F&B) operators. Some landlords announced relief packages in various forms, but renters fired back saying these were too little and too slow amid heightened restrictions.

Eventually, the Government stepped in with a new law in April, mandating landlords to pass on their property tax rebates in full to tenants. Last month, policymakers followed up with another rule that required landlords to waive up to two months of rent for tenants.

READ: Amended COVID-19 laws passed requiring landlords to give SME tenants more rental waivers

AN OLD PROBLEM RESURFACES

Alongside the tussle for rent breaks, SGTUFF also wanted something else: A relook at the Fair Tenancy Framework.

This framework was a set of voluntary guidelines drawn up by a workgroup under the Singapore Business Federation (SBF) in 2015 after firms reported continuous increases in rents.

At the launch, then-SBF chairman Teo Siong Seng described such increases as “unsustainable” and that many businesses were “subjected to one-sided lease terms” that only protected the landlords’ interests.

The framework aimed to foster data transparency and fairer negotiations between landlords and tenants, but made little headway with a lack of support from the private landlords. Five years since it was launched, only Jurong Town Corporation endorsed the guidelines.

“Even though we are very concerned about the immediate problems, we know that if we all want to remain in business for a long time, having a strong fair tenancy framework is becoming more critical,” said Mr Yow.

By early-March, SGTUFF had met and shared its idea with various trade associations and government agencies. The following month, it joined hands with four other business associations – the Singapore Business Federation SME Committee, Association of Small and Medium Enterprises (ASME), Singapore Retail Association and RAS – to start work on a proposal.

The business groups, which called themselves the Fair Tenancy Framework Industry Committee (FTFIC), put up a 64-page position paper to the Government on May 21, in which it laid out 15 recommendations for fair tenancy law and a new commission for enforcement and dispute resolutions.

READ: Businesses call for fair tenancy law to solve ‘growing’ imbalance in landlord-tenant relationship amid COVID-19 outbreak

For FTFIC chairman Kurt Wee, the tug of war for rental relief has shown off “the ugly head of the landlords”. And the fact that the Government made a rare move to step in is telling of a longstanding problem – an increasingly lopsided relationship between tenants and their landlords, he said.

“As early as 2014, I had called out institutional landlords for behaving like a cartel with aggressive leasing behaviour and for me to have done that then means it had been going on for years prior to that,” said Mr Wee, who is also ASME president and chairman of the SBF SME committee.

“There’s a clear and growing lopsidedness, and a need for fair tenancy regulations. If we don’t act, businesses won’t be able to survive.”

POWER DISPARITY – WHO’S TO BLAME?

One might ask: What are the reasons behind this perceived power imbalance between landlords and tenants?

The emergence of real estate investment trusts (REITs) in Singapore 18 years ago is one answer that has been tossed up in many discussions.

REITs are funds that invest in real estate assets such as offices, shopping malls and hotels. They make money off these assets, largely from rental income, and distribute them to investors on a regular basis.

The first REIT to be listed on the Singapore Exchange (SGX) is CapitaLand Mall Trust in 2002. Since then, Singapore has grown into a major REIT market with more than 40 REITs. Of these, 11 are retail REITs. CapitaLand Mall Trust, whose portfolio includes 15 malls in Singapore, is the biggest REIT by market capitalisation.

According to a report by SGX Research last month, Singapore-listed REITs boast an average dividend yield of 7.2 per cent, outperforming other asset classes. The yields of retail REITs averaged at 7.4 per cent, second highest among the seven categories of REITs.

These steady returns have made REITs a long-time investor favourite but retail tenants said this has come at their expense.

“The landlord-tenant relationship by nature is a lopsided one … but the imbalance started to tilt even more towards the landlords when the concept of REITs first started in Singapore,” said Mr Yow who started his company in 2009.

“With the onset of REITs, which is very focused on payouts to unitholders, it was a clear swing to rental extraction as the key principle for landlords. You could very quickly see the contracts start becoming more heavily weighted towards them.”

These, according to other tenants that CNA spoke to, include shorter leases and steep rental increments during renewals, as well as the popularisation of gross turnover (GTO) rent where rent is based off a percentage of store sales.

The latter is now a common fixture in tenancy agreements for malls, where monthly rent is defined as a base rent plus a small percentage of GTO or a percentage of GTO only, whichever is higher. Savills Singapore’s executive director for research and consultancy Alan Cheong described this as a “win-win situation” that ensured landlords with steady rent incomes in both good and bad times.

To be sure, REIT-owned malls have raised the bar for mall management with frequent asset enhancements and changes to tenant mix, as well as marketing and promotional activities to keep shoppers coming, said National University of Singapore (NUS) Associate Professor Sing Tien Foo, who noted that these moves incur costs.

He cited a 2014 report by the Ministry of Trade and Industry (MTI) on whether REITs were driving up rents. That study found that better locations and enhancement works, instead of ownership, were the reasons behind higher rental costs at REIT-owned malls.

With better footfall comes higher demand from businesses for shop spaces, which likely played a bigger role in driving up rents, said Assoc Prof Sing.

READ: The Big Read: It’s survival of the fittest, as retail household names shrink or disappear

Even so, industry players pointed out that landlords often take reference from one another’s business practices.

Noting that the “aggressive rent-seeking behaviour” has since been picked up by other institutional landlords, Mr Wee said: “We often find the same lawyers drafting (leases) for the smaller landlords as well so the aggressive rent-seeking behavior has become very proliferated.”

In 2014, when asked by then-Workers’ Party Non-Constituency Member of Parliament Yee Jenn Jong if the Government agreed with MTI’s report, then-Minister of State for Trade and Industry Teo Ser Luck said REITs may have a “signalling effect” on other landlords in its vicinity, according to a TODAY report.

When contacted, the REIT Association of Singapore (REITAS) said the REIT model has benefited both tenants and investors in Singapore.

Retail landlords make “significant long-term investments” and take on “very significant financing risk” when it comes to owning and running quality malls, while at the same time ensuring mall concepts stay fresh, it said in an emailed response.

This has contributed to a vibrant retail and F&B scene in Singapore, while investors, with many being Singaporeans, have benefited from the REITs’ regular stable distributions, REITAS added.

Other factors also contributed to the dynamics of the relationships between landlords and tenants.

Mr Cheong, who described the commercial property market as a “semi-competitive oligopoly”, said years of slow land supply have seen many of the shopping malls here, excluding strata-titled ones, coming under the hands of a few property firms.

“A control of land supply prevents rents from falling through but on the other hand, you strengthen the holding power of the landlords," he said.

Meanwhile, a lack of resources to comb through tenancy contracts also means that some smaller tenants have put their names on the dotted lines “without understanding the terms or negotiating”.

“As a result, the lopsidedness became bigger and bigger,” Mr Wee said. “Pricing mechanisms became more complex and clauses became more onerous – all done to ensure fewer risks for landlords and more responsibilities on tenants, both in good times and bad times.”

THE ISSUE OF RENT

CNA spoke to several tenants in retail and F&B about how this has affected them. Rising rents were a common concern.

For one retailer, while sales have fallen by an average of about 8 per cent every year since 2015, rent for his store located in a prime mall along Orchard Road has gone in the opposite direction.

Even when the lease was up for renewal in 2018, falling sales did not get him out of the yearly step-up in base rent. That lease structure continued, albeit at a smaller increment of S$0.50 per square foot (psf) every year from the previous S$1 psf after he negotiated.

His rent is now S$52 psf per month. Inclusive of a small percentage of sales rung up at the tills and other marketing charges by the mall, his monthly rent adds up to slightly over S$20,000.

In a good month for business, he pays more as the clause on GTO rent - where rent is based off a percentage of store sales - kicks in. This can go up to as much as S$36,000 in the month of December.

“Just when you think you are earning more, you pay more to the landlord,” said the retailer who requested for his identity and store location to be kept anonymous due to “broad” confidentiality clauses in his tenancy agreement.

Taken altogether, nearly one-fifth of his total sales in 2019 went to his landlord, up from about 15 per cent in 2015.

"People will ask do you choose to renew the lease? You can choose not to, but you need to reinstate the space and renovate a new space," said the retailer.

"It's also not so easy to leave because in one locale, there may just be one supplier of grade-A shopping malls so the question is how much of a choice do tenants really have?"

Tenants have charged that the inclusion of GTO in rental contracts has forced them to give up sales data through the use of the mall’s point-of-sale systems.

“They know we’d want to stay on because there’s so much pain involved in moving. And when they know your monthly sales, it’s not too difficult to work out your P&L (profit and loss statement) and how much they can extract out of you before you’d say no,” said Mr Yow.

Landlords, on the other hand, provide little to no information on footfall or how the mall is performing, he added. “When they know everything about you but you know nothing about them, every negotiation we lose.”

This is why the group lobbying for fair tenancy law is calling for the base rent to be calculated using objective metrics of a landlord’s actual cost for running the premises and for the component based on gross sales to be negotiable.

The FTFIC is also asking for a public rental information database to be set up, as well as for landlords to provide mall-level productivity and performance data to level the playing field during negotiations.

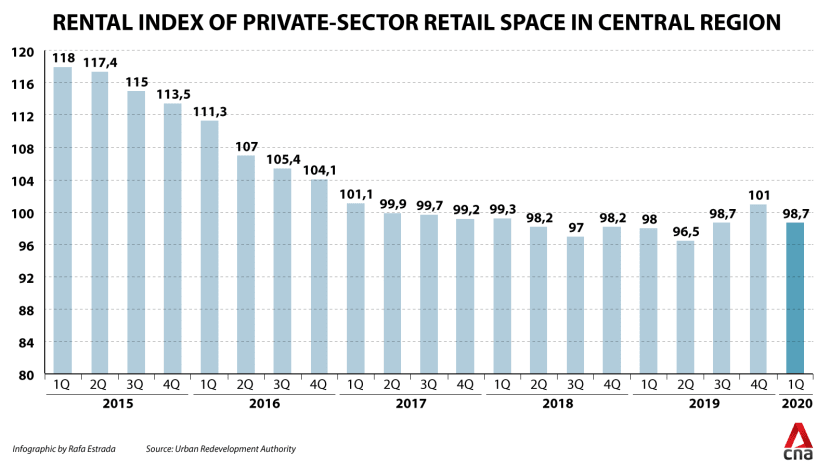

As it stands, there is official data on retail rents although it has been showing a different trend from the concerns on the ground.

The Urban Redevelopment Authority (URA) publishes a quarterly index tracking rentals of retail space. This has seen a general decline since the first quarter of 2015, although it picked up towards the last two quarters of 2019. For the first quarter of this year, it eased 2.3 per cent.

To put things into perspective, the index only covers Singapore’s central region and includes a broad swathe of private retail spaces including strata malls. This is why tenants told CNA that the index is too generic to help them with rent matters.

The index being an average of all private retail spaces may not also accurately reflect rents at shopping malls, which are “very sensitive” to location, said Mr Cheong from Savills Singapore. “Even within malls, which level you are located matters.”

He added: “Retail rents are going down for (the) strata-unit type but when it comes to the malls, it’s very hard to ascertain what’s going up or down. Reason being that landlords don’t share the information across the board. It’s all on a negotiation basis,” he said, adding that this has subjected retail tenants to a “prisoners’ dilemma”.

And even with a less-than-rosy outlook ahead, rent hikes for individual businesses seem to be continuing.

When lease renewal talks began in March for Edward Lim’s pizza restaurant located at myVillage mall in Serangoon Garden, he was informed by his landlord that rent would be going up from S$16 psf to S$18 psf. Mr Lim and his co-owners tried negotiating for a reduction but failed.

After considering their sunk costs – S$70,000 on renovations that were done just a year ago – and a reinstatement bill that could come up to S$14,000 if they did not renew their lease, the owners decided it was perhaps better to accept the terms and stay put.

“After thinking about all the costs, we decided to stay but with a last try on negotiations … We asked if we could pay S$17 for the first year and S$18 in the second year given the uncertainties of COVID-19.”

That was rejected by the mall and the pizza restaurant, The Peel 1889, shifted out last week when its lease ended.

When contacted, myVillage’s senior marketing manager Kenneth Lim said the mall was “returning to the original rental rates prior to the lease” given that it did not re-negotiate terms when The Peel 1889 took over the lease from a previous tenant.

As part of its guiding principles, the mall has a “consultative manner when it comes to leases” and has also done its best to help by offering solutions for online orders and deliveries while passing on government-granted tax rebates.

The rebates, according to restaurant owner Mr Lim when he spoke to CNA in June, were dispersed in three tranches that totalled up to about S$4,600. He pays about S$7,000 for rent every month.

On this, the mall said it is giving out the property tax rebates in tranches and has “shifted a significant portion” of that ahead of the year-end deadline to help tenants with rental costs. It is waiting for additional guidelines on rental waivers from the authorities and “will work quickly” once those are made clear.

THE UNFAIR CLAUSES

Lease agreements at malls have also been populated with “harsh” terms and conditions, tenants said.

One main gripe is how landlords can terminate leases for any reason without compensation even before the lease is up. Tenants, however, are unable to do the same and will have to pay up the rent amount remaining on their leases.

Landlords also do not have to compensate the tenant if they decide to redevelop the building and relocate the latter.

In recent years, tenants said they have also been made to bear other costs, such as the legal fees of drafting lease agreements, stamp duty fees and “administrative charges to the mall’s leasing department”.

“If you’re in the leasing business, wouldn’t this be part of your normal operations?” asked the retailer with a store in Orchard Road, who noted that these administrative charges can come up to about S$800.

Echoing that, Mr Wee said: "The rent-seeking behaviour has gone beyond just the dual-pricing rent model and into generating revenue off the tenants from other sources."

Mr Desmond Sim, who heads research for Singapore and Southeast Asia at CBRE, offered a perspective from the landlords: “A landlord’s biggest fear is a sudden vacancy … You can have vacancies in an office building and nobody will know, but in a mall, it will be obvious. So these are protective clauses as landlords also want to protect their business.”

Unfortunately, these clauses “are usually seen as more harsh” for the small and medium-sized enterprises (SMEs), he added.

READ: Landlords and tenants need to see each other as long-term partners, share both pain and benefits: Chan Chun Sing

All these have made it hard for retail tenants to save up for rainy days or invest in their business and employees.

“The current situation should highlight that retailers and F&B operators have so little ability to retain earnings that they cannot deal with a crisis. It is time for policymakers to ask themselves: Is this the business condition they want to have in Singapore?” the retailer said.

The retailer said he attended the launch of the SBF’s Fair Tenancy Framework in 2015. Held in a hotel’s ballroom, it had seemed a grand affair and he remembered feeling “very hopeful”.

“But if you read all the articles now and compare it with what was said in 2015, you’d know that nothing has changed.”

ROOM TO IMPROVE LEASING FRAMEWORK: REITAS

But sentiment among private landlords may be finally changing, at least according to Cynthia Phua who led the committee behind the 2015 framework.

During the FTFIC’s press conference in May, she said a representative from CapitaLand had sat in for one of the meetings earlier this year.

When contacted for this story in June, a spokesperson said CapitaLand has “kept and will continue to keep (its) channels of communication open” as part of its commitment towards building a sustainable retail ecosystem in Singapore with all stakeholders.

The property giant did not answer other questions pertaining to this article and referred CNA to a previous press statement.

In that statement dated Jun 8, it said it would further waive and potentially defer rent for qualifying SME tenants as required by the COVID-19 laws, but doing so will have an “adverse impact” on its earnings this year.

"We therefore maintain our conviction that the impact of the regulatory intervention be applied objectively, transparently and proportionally, as a shared responsibility across all stakeholders,” said chief financial officer Andrew Lim.

Seven other mall operators that CNA reached out to for this article in June declined comment or did not respond. The Real Estate Developers' Association of Singapore (REDAS) also did not reply to queries.

REITAS reiterated its stance that there is a “long-term symbiotic business partnership” between landlords and tenants.

“Despite news reports of some landlords not passing on rent rebates to tenants until the Government stepped in to mandate the same, to the best of our knowledge, most or all of REITAS’ REIT members had already been helping tenants during this trying period,” it said.

“Notwithstanding this, we believe that there is room to improve the existing leasing framework and together with other commercial landlords, we are committed to engaging our tenants in good faith to do so.”

It added that a self-regulating framework with a code of conduct that is “mutually conceived and updated over time together with tenants” will present a “more flexible and invested approach, rather than having to rely on legislation”.

THE WAY FORWARD?

A new attempt to deal with this issue is now under way.

A committee made up of landlords, tenants and industry watchers has been set up under SBF with the aim of developing a framework to deal with ongoing problems, as well as establish industry norms on tenancy practices and terms.

There will also be mechanisms to ensure compliance with the framework, and allow parties to seek recourse and resolve disputes, the SBF said. The committee aims to complete its deliberations by the end of the year before drawing up an implementation timeline.

READ: Committee with landlords, tenants formed to develop framework for tenancy issues

The FTFIC said in the Jun 26 press release that it is hopeful that common ground can be found so as “to rectify imbalances … in a timely fashion”. Representatives of REDAS and REITAS said it is a “timely opportunity” for key stakeholders to address industry disruptions “by looking for ways to improve existing landlord-tenant practices”.

Among those that CNA spoke to, the appropriate way forward has drawn differing views. Some like NUS Assoc Prof Sing said legislation may be a “blunt” tool and preferred the set-up of a committee to first “bridge potential gaps” between parties.

Mr Sim also called for more conversations. "I’m sure landlords, under the threat of occupancy, will be very open. They themselves know if they don’t show a bit more flexibility, it will affect their occupancy no matter what.”

Mr Cheong, on the other hand, preferred legislation as institutional landlords will need more nudging. That said, he acknowledged that mall operators are not immune to the economic toll of COVID-19.

As a first step, he said landlords could consider offering rent based on GTO until the crisis is over, noting that there have been instances of landlords experimenting with this model prior to the pandemic.

WATCH: Smaller landlords call on Government for more support | Video

Meanwhile, concerns have emerged that smaller individual landlords are being left out of the discussions.

Already, these landlords who “are as SME as the tenants”, are reeling from the requirement of having to provide additional rental waivers, said Victor Ng who owns two retail units at Bugis Cube.

Mr Ng, who is also vice-chairman of the management corporation strata title (MCST) committee at the commercial property, said smaller landlords are unlike large corporates with deep pockets to withstand economic downturns.

These are often individuals who have through their own savings manage to invest in property, such as small commercial shophouses, as a form of retirement income. Many still have mortgages to service and deferment programmes offered by banks are not much of a relief due to “steep” additional interests.

These landlords also charge much lower rent and do not collect extra marketing or maintenance fees, added Mr Ng who said smaller landlords “definitely need representation in the committee”.

Henry Mok, who is chairman of the Bugis Cube MCST committee, has started a petition calling for the Government to recognise this disparity and “accord a fairer set of rules” for smaller landlords.

“It is discriminating to have the smaller landlords compared and treated like big landlords for the Fair Tenancy Framework,” said the petition, which has garnered more than 300 signatures.

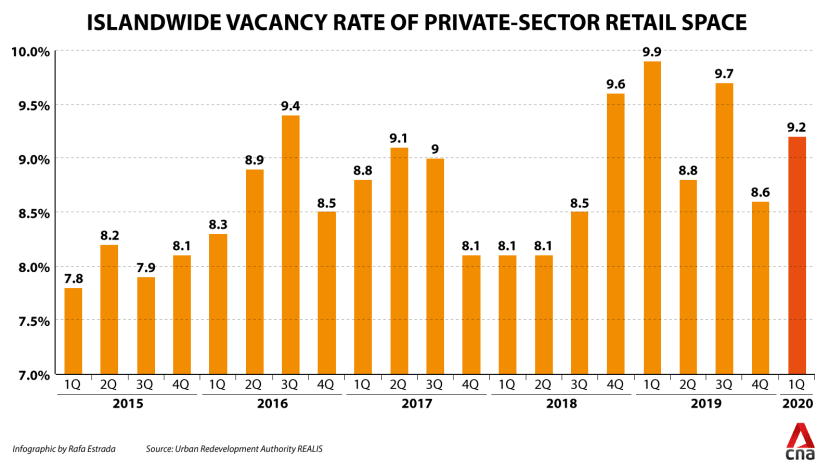

Resolving this fractured relationship between tenants and their landlords here will come as the retail industry braces for more pain ahead, given that impact from the COVID-19 pandemic is likely to be prolonged.

For instance, malls in Orchard Road could be in the doldrums for a while longer as tourists may not return so quickly, said Mr Sim.

Beyond COVID-19, ongoing structural changes could gain steam. More people could turn to online shopping, meaning more pain for already-battered brick-and-mortar retailers while shopping malls will also need to evolve to stay relevant.

Given this grim outlook that could see higher mall vacancy rates, landlords and tenants will need to come together, industry watchers said.

“What’s at stake is not just businesses and jobs, but Singapore’s reputation on the retail front,” said Mr Cheong.

Mr Yow, the representative of SGTUFF, agrees: “The landlord-tenant relationship has reached a break point given the systemic shifts of COVID-19 but I think what we all want is something that can benefit all stakeholders – landlords, tenants and Singapore.”

BOOKMARK THIS: Our comprehensive coverage of the coronavirus outbreak and its developments

Download our app or subscribe to our Telegram channel for the latest updates on the coronavirus outbreak: https://cna.asia/telegram