New Integrated Shield Plan riders to have higher co-payment cap from April 2026

As part of efforts to rein in rising healthcare costs, new riders will no longer cover minimum deductibles and must set a higher minimum co-payment cap of S$6,000 a year.

A person holds the hand of an elderly patient in a hospital bed. (File photo: iStock)

This audio is generated by an AI tool.

SINGAPORE: Integrated Shield Plan policyholders who buy new riders from next April will see changes to what their coverage includes, as well as a higher minimum co-payment cap.

The Ministry of Health (MOH) announced on Wednesday (Nov 26) that new riders will no longer be allowed to cover the minimum plan deductibles, as part of measures to address rising private healthcare costs.

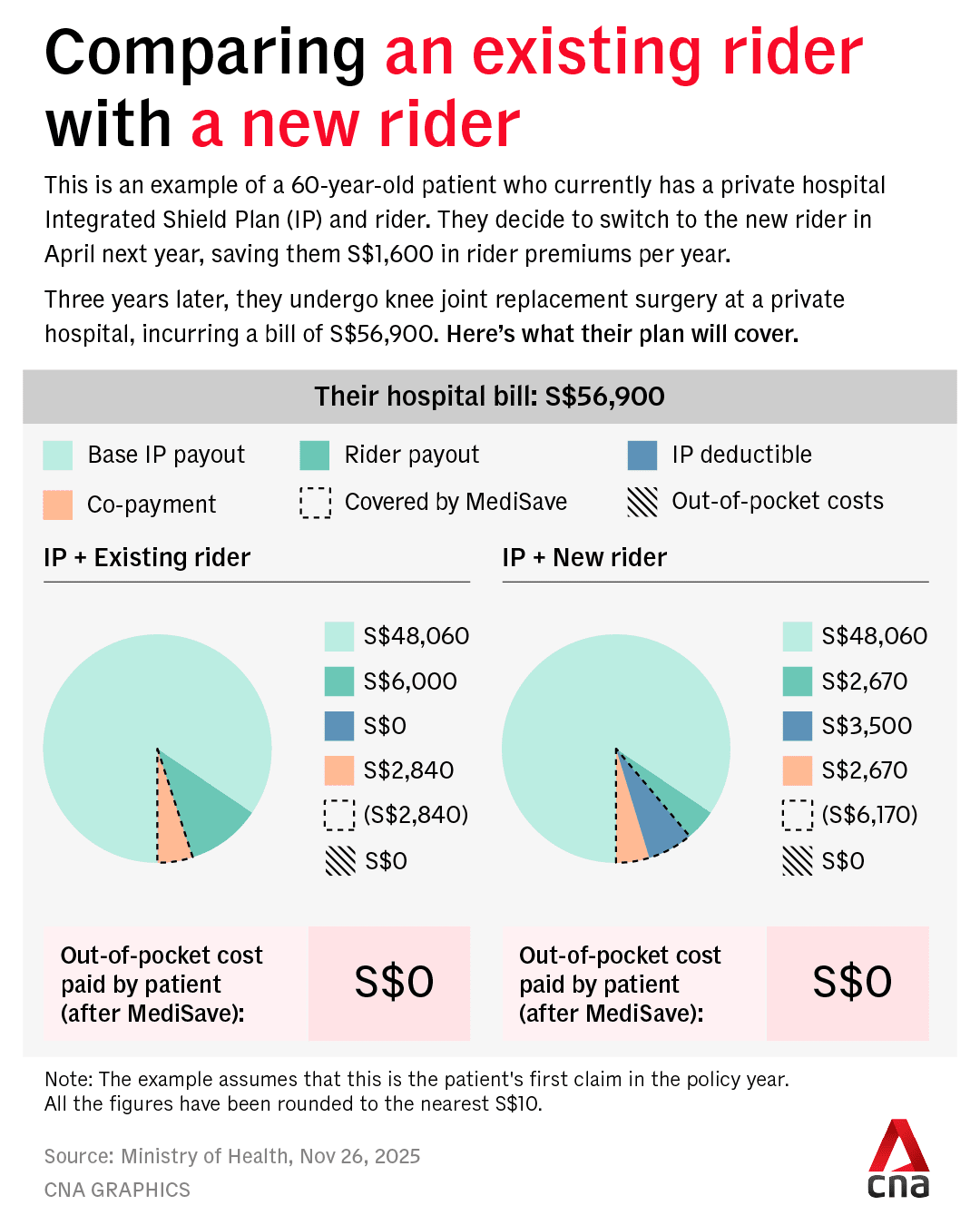

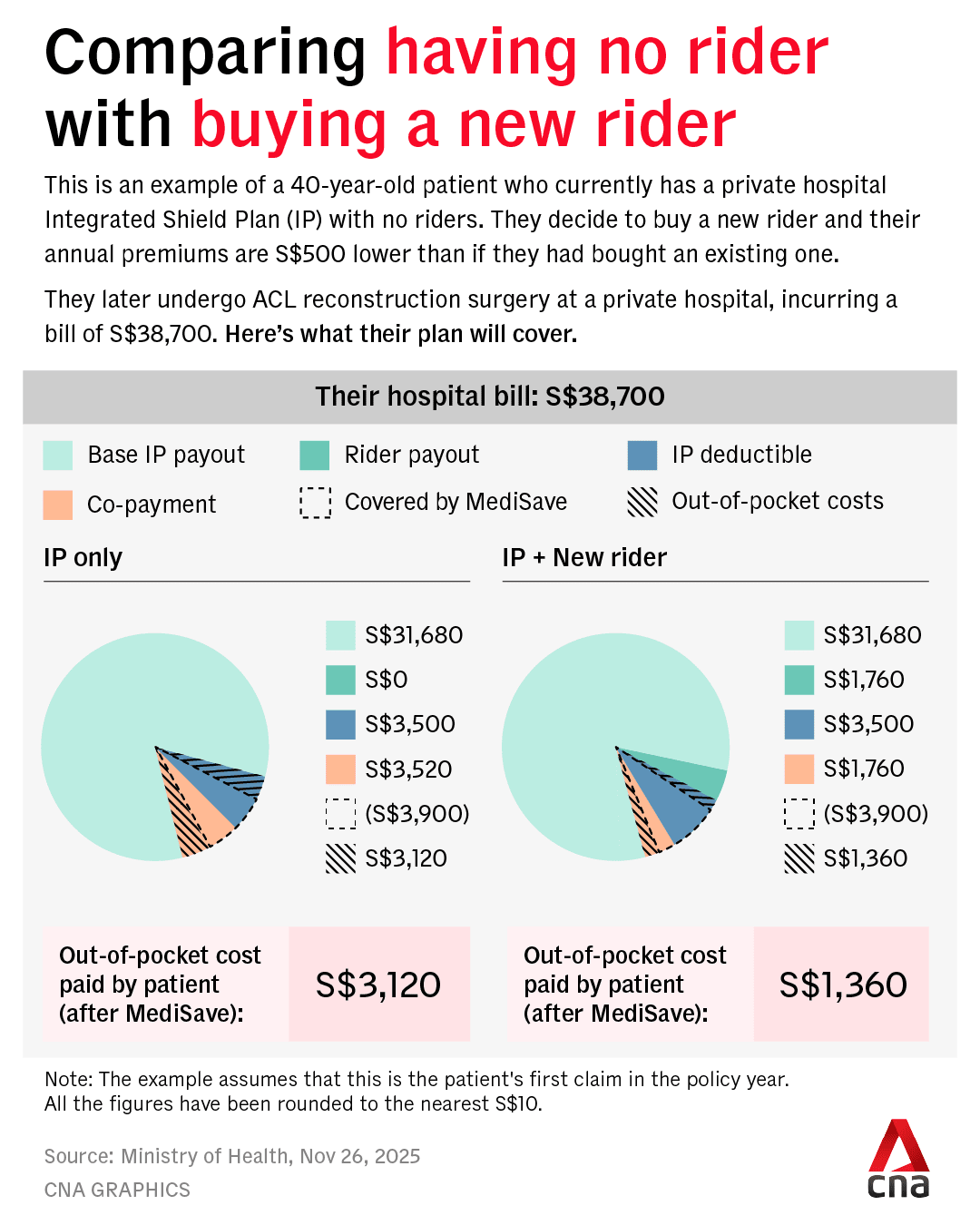

Currently, policyholders with riders must co-pay at least 5 per cent of their bills, with insurers setting a co-payment cap of no less than S$3,000 (US$2,300) per year.

This cap will be raised to a minimum of S$6,000 per year for riders sold from April 2026 to “keep pace with the increase in bill sizes over time”, said MOH. The current minimum 5 per cent co-payment requirement will remain.

An Integrated Shield Plan is a private insurance add-on that complements national health insurance MediShield Life to cover the fees for higher hospital wards or private healthcare. Deductibles are the fixed amounts a policyholder has to pay each year before insurance payouts begin – varied by ward class.

For policyholders with new riders, the S$6,000 cap will apply to co-payments excluding deductibles. MediSave funds can be used to pay both deductibles and co-payments.

A rider is an optional add-on that provides extra coverage beyond the main policy, paid fully in cash. Policyholders often buy riders to reduce their share of hospital bills, particularly for private healthcare.

About 71 per cent of Singapore residents, or around 3 million people, have Integrated Shield Plans, and 67 per cent of these, about 2 million people, have riders, said MOH. Half of Integrated Shield Plan policyholders are on plans for private hospitals, and 80 per cent of them have riders.

TACKLING OVERCONSUMPTION

While very comprehensive coverage that “protects up to almost the last dollar” can “confer absolute peace of mind”, this can be very expensive and drives up healthcare costs, said the Health Ministry.

Minimal co-payments tend to encourage patients to overconsume healthcare services and for providers to overservice them, it added.

In July, Health Minister Ong Ye Kung said that private health insurers and private hospitals have "gotten themselves tied up in a knot, to the detriment of all stakeholders, including patients".

The "knot" came about in big part due to insurance design, he said at the time. "Insurers know that policyholders are worried about incurring an unexpected huge hospital bill, so they launch insurance products that offer generous coverage to win customers and market share."

These products include "as-charged" or no-limit coverage, as well as riders that will cover almost all costs.

In such cases, as insurers are footing almost the entire bill, there is the tendency to "use more than is necessary", said Mr Ong then, calling it "human nature".

According to MOH data, private hospital policyholders with riders are 1.4 times as likely to make a claim as those without riders, and their average claim size is also 1.4 times higher.

Private hospital bills have surged, with the median bill size rising from S$9,100 in 2019 to S$15,700 last year.

Insurers have been raising premiums of private hospital plans and riders significantly to keep up with claims, said the ministry. Despite this, four of the seven insurers offering Integrated Shield Plans reported losses of between 9 and 48 per cent in 2024, while the remaining three “barely broke even”.

“These changes will help to bring health insurance back to its original objective, which is to protect patients against larger healthcare bills,” said MOH. “It will increase cost discipline over minor episodes, and reduce overservicing and overconsumption associated with non-essential hospital admissions or treatments.”

IMPACT ON POLICYHOLDERS

About six in 10 claimants across all ward types will not need to pay for anything in cash, as MediSave limits are enough to cover deductibles and co-payments, said MOH.

About three in 10 claimants will pay less than S$1,000 after MediSave, while the remainder – mostly private hospital patients – may pay more than S$1,000.

Premiums for existing riders have become costlier as policyholders age, prompting many to downgrade or drop them. For example, a 60-year-old policyholder would have to pay an average of S$9,500 per year for a private hospital plan and rider, which includes the cost of MediShield Life. A 40-year-old policyholder would pay S$3,400 per year.

With the changes, new riders are expected to be about 30 per cent cheaper than current ones offering maximum coverage, MOH said.

This translates to annual savings of about S$600 for policyholders with riders for private hospital coverage and S$200 for those with riders that cover public hospitals.

“While the changes entail more co-payment for smaller bills, they should not stop patients from seeking care when it is needed,” the ministry said.

IMPLEMENTATION TIMELINE

Insurers must launch the new riders by Apr 1, 2026, and cease selling those that do not comply with the new requirements on the same day.

Existing riders can continue to be sold until Mar 31, 2026, but buyers must be informed they will move to the new framework by their next policy renewal after Apr 1, 2028.

As for existing rider policies, insurers will “further study” and “determine their own approach”, said MOH. Policyholders who purchased riders before Nov 27 are encouraged to consult their financial advisers on whether the new ones would better suit their needs.

Asked if some insurers may retain existing terms for current policyholders, MOH acknowledged the possibility but said the revised rules would apply to all new riders.

“If they don’t change and only the new rider policyholders are on the new riders … then the impact on cost would have to take a much longer time," MOH said. "Because you would only see the change in behaviour when the new rider holders are actually claiming.”

In response to CNA queries, Prudential Singapore, AIA Singapore, Great Eastern and HSBC Life confirmed that they will introduce the new riders by Apr 1, 2026.

The new measures will encourage conscious and prudent use of healthcare services, and keep premiums affordable and sustainable for all policyholders in the long run, said a Great Eastern spokesperson.

Chief marketing and healthcare officer of AIA Singapore Irma Hadikusuma said that if there are any changes to the coverage for riders, policyholders will be notified at least 31 days in advance to ensure they have ample time to prepare and make informed decisions about their coverage.

While the updates to the rider design could lead to higher out-of-pocket expenses for customers, premiums will be lower, said Dr Sidharth Kachroo, chief health officer of Prudential Singapore, describing it as a "delicate balance to strike" but a "necessary step".

There will be no immediate changes for existing policyholders with riders, he added.

HSBC Life's chief health officer Manu Tandon confirmed that the insurer's policyholders who currently have riders will not see immediate changes.

"We will continue to assess the plan for subsequent policy renewals and will provide existing policyholders with advance notice for any changes that will be made to their policy," he added.

Existing Singlife policyholders will remain covered under their existing clauses and will not be affected by the changes that come into effect from Apr 1, 2026, said its group head of products Helen Shen.

"We will update with more details on coverage, premiums, riders and out-of-pocket costs after careful study of the requirements and the impact they will have on policyholders," she said.