New private home sales in Singapore ‘seem to have stabilised’ after cooling measures: Experts

File photo of private homes in Singapore. (Photo: CNA/Jeremy Long)

SINGAPORE: Sales of new private homes "seem to have stabilised” after cooling measures were implemented at the end of last year, property analysts said.

Excluding executive condominiums (ECs), developers sold 653 units in April, about the same as the 654 units sold in March, data from the Urban Redevelopment Authority (URA) showed on Tuesday (May 17).

Most of these were in the Rest of the Central Region (RCR), where 289 units were sold. A total of 206 units in the Core Central Region (CCR) were sold, while 158 units were transacted in the Outside Central Region (OCR).

Year-on-year, the number of units sold last month fell by about 48 per cent.

The Government had in December announced a package of cooling measures amid record property prices. Since then, monthly numbers of new home sales have stayed in the 600-range, except in February when it dipped below 600.

Number of new home sales

| 2022 | 2021 | |

|---|---|---|

| January | 673 | 1,609 |

| February | 527 | 645 |

| March | 654 | 1,296 |

| April | 653 | 1,262 |

(Source: URA)

“New home sales seem to have stabilised after cooling measures were implemented more than four months ago,” said Ms Christine Sun, senior vice president of research and analytics at OrangeTee & Tie.

Ms Catherine He, head of research at Colliers, agreed and said the residential sector “seems to have stabilised”, and is set for a “stable recovery” on the back of Singapore’s reopening.

Mr Lee Sze Teck, senior director of research at Huttons Asia, said this was the first time in 12 months that sales in the CCR were higher than the OCR.

“The low level of unsold stock in the OCR meant that buyers have increased their budget and traded up to the next tier of private housing in the RCR or CCR,” he added.

The best selling projects include Normanton Park, Riviere and One Pearl Bank, said Ms Sun.

Analysts noted that the number of new sales to foreigners has more than doubled from 25 units in March to 59 units in April after borders reopened.

Only five units sold to foreigners were in the OCR, with 27 units sold each in the CCR and RCR.

“Geopolitical uncertainties may also have a hand in funds flowing to properties in Singapore," said Mr Lee.

Ms He added that the number of sales to foreigners is a “testament to the attractiveness of Singapore’s residential market”, despite the heavier stamp duties.

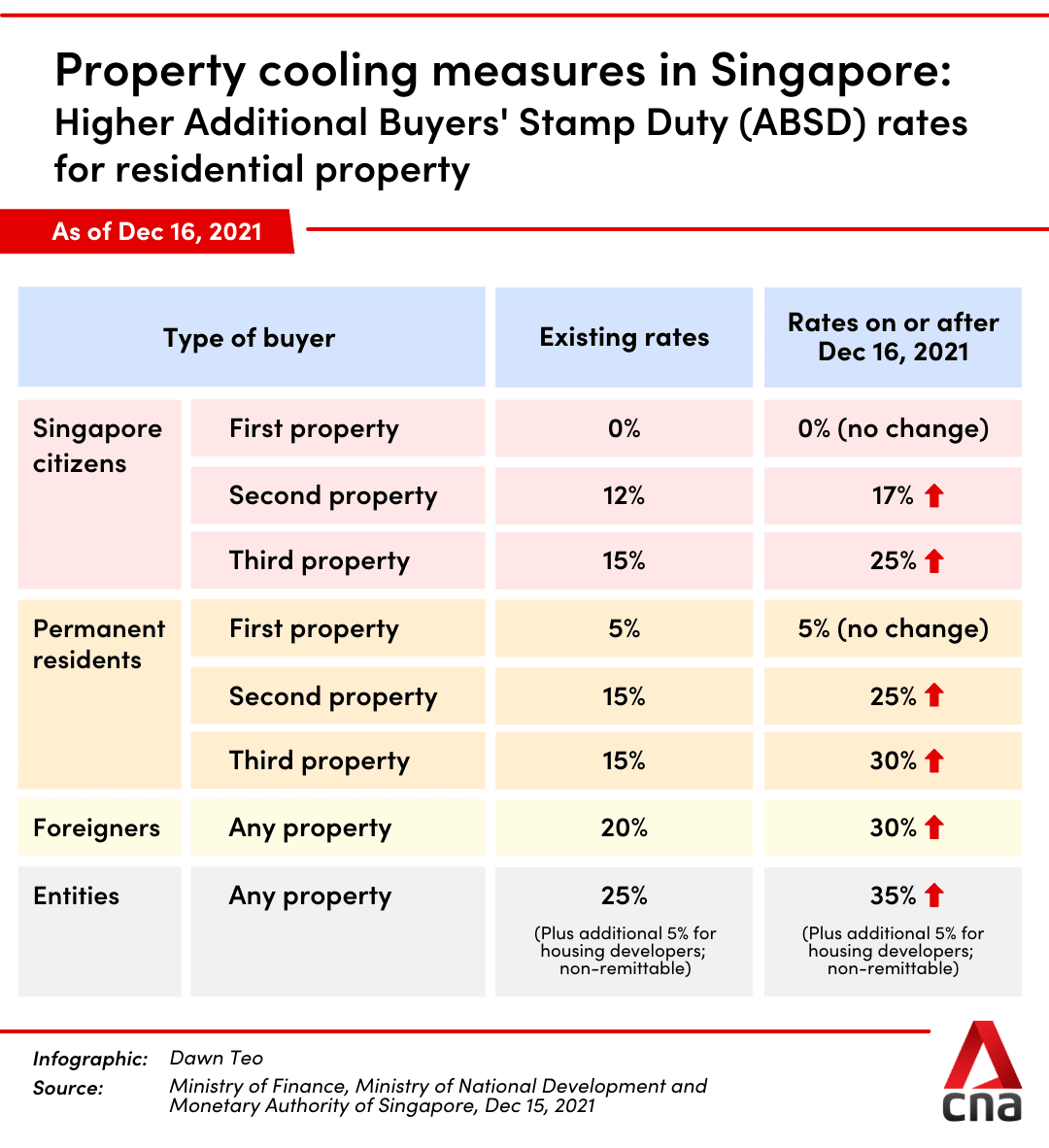

Foreigners buying properties in Singapore are subject to paying 30 per cent additional buyer’s stamp duty (ABSD). Before the cooling measures were implemented in December, foreigners paid 20 per cent ABSD.

OUTLOOK

Ms Sun said the rising number of luxury homes purchased and the growing number of foreign buyers indicate that “well-heeled investors continue to view properties in Singapore favourably” despite the cooling measures.

“We have gained the upper hand against many other countries with the speed of our economic recovery and transition into endemic living. These have boosted investors' confidence to park their funds here for the long run,” she added.

But macroeconomic uncertainties, higher ABSD and rising mortgage rates will weigh on the sentiment of prospective buyers, said Ms He, adding that momentum in private home prices is expected to moderate.