More investors turn to silver even as prices surge, driven by increased industrial demand

Widely dubbed as the "poor man's gold", investors are betting on silver as the metal becomes more precious amid rising industrial use.

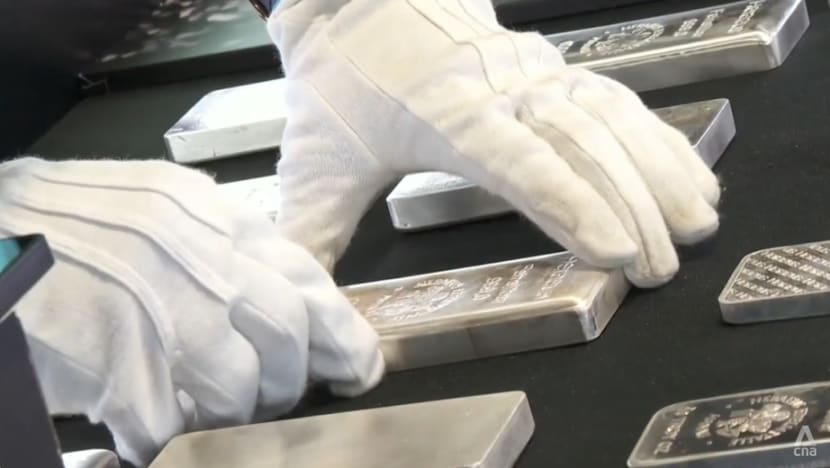

A dealer places silver bullion in a display for sale. Silver, while more volatile than gold, has delivered an approximate price return of 20.3 per cent in the past two years.

This audio is generated by an AI tool.

SINGAPORE: Silver prices have surged 14 per cent so far this year, driven by industrial use in growing sectors like electronics and renewable power.

But investors are also turning to the precious metal as the price of gold soars to record highs on the back of global economic uncertainty.

Already, the Singapore Bullion Market Association (SBMA) said it has seen more investments in silver over the last quarter.

“Allocating gold as an asset class to the portfolio is a norm. But as the price of gold increases … some people are looking at silver as an alternative to be included into their portfolio,” said its CEO Albert Cheng.

Currently, the gold-to-silver ratio is at about 100, meaning one unit of gold is worth 100 units of silver.

“(The ratio) is extremely high, which basically means silver is extremely cheap,” said Mr Gregor Gregersen, founder of The Reserve – a high-capacity vault for the storage of gold and silver in Changi.

“We have had clients buying 30 to 40 tonnes of silver, some coming in by container ... they're holding it long term (to) switch between physical silver and physical gold (in the future).”

He told CNA938 that such investors typically wait for the gold-to-silver ratio to readjust before switching their assets, with gold usually preferred as it is less volatile than silver.

Market watchers expect that the price of silver will keep pace, bringing the ratio closer to the 40-year average of about 70.

SILVER USE IN INDUSTRIES

About 60 per cent of silver in the market is used for industrial production, while 10 to 20 per cent goes to investors. Demand on both sides has been on the rise.

The rest is used in jewellery, silverware and for other purposes.

Considered an excellent conductor of electricity, silver is sought after in sectors such as electric vehicles, semiconductors and artificial intelligence technology.

The rapid growth in such industries with a high usage of silver has fuelled concerns that it could cause a deficit in the precious metal and fuel strong price appreciation.

For instance, silver is an indispensable resource in the production of renewable energy systems like solar panels. It is used in thin wires running down each grid that collect and transport electrons generated by sunlight.

Unlike other metal electrical conductors such as copper, it does not rust and decay – making it the preferred choice.

According to the World Silver Survey, demand from the solar panel industry has surged close to 139 per cent over the past decade.

But supply is struggling to keep up, with mine production down some 7 per cent.

“Silver is used a lot in our busbar. If we (have) a shortage, then this will disrupt the whole solar industry,” said Larry Zhang, senior business development manager at JA Solar.

To mitigate disruptions, the Beijing-headquartered solar development firm said it has secured partnerships with suppliers to ensure a steady flow of material for its panels.

HOW DEMAND COULD BE AFFECTED

While demand for silver is expected to stay strong, a weaker economic outlook could change things for the precious metal.

Dr Tan Kee Wee, an economist at the Singapore Precious Metals Exchange, said that in a downturn, consumers stop purchasing big ticket items like cars or solar panels, driving down demand for the metal and causing prices to fluctuate.

“The health of the global economy affects the price of silver,” he said. “Whereas (for) gold, usually even when the whole world goes into a downturn, the price of gold will not drop (as drastically).”

For investors, silver has delivered an approximate price return of 20.3 per cent in the past two years, despite being more volatile than gold.

But whether silver or gold, market watchers believe investors will continue to flock to safe haven assets as long as instability prevails in the global economy.

“Precious metal is often termed as a crisis commodity because it reacts as a hedge against uncertainty,” said SMBA’s Mr Cheng.

“With the uncertainty in the macro environment and tariff war still ongoing, I would say that gold will continue to perform well in the coming few quarters. With this as a backdrop … silver will continue to behave in the same direction as gold.”