Singapore introduces property cooling measures, with stricter borrowing criteria and tighter limits for HDB loans

Private home owners will now have to wait 15 months after they sell their property before they can buy an HDB resale flat.

Build-to-Order HDB flats in Singapore. (File photo: CNA/Calvin Oh)

SINGAPORE: The Government unveiled a slew of property cooling measures on Thursday (Sep 29), aimed at moderating demand and ensuring prudent borrowing amid rising interest rates.

The measures, which come into effect from Sep 30, include tightening the maximum loan quantum limits. For HDB loans, the loan-to-value (LTV) limit has been lowered from 85 per cent to 80 per cent.

To moderate demand in the HDB resale market, there is now a 15-month wait-out period for private home owners buying HDB resale flats.

"It is a temporary measure which will be reviewed in future depending on overall market conditions and housing demand," said HDB, the Monetary Authority of Singapore (MAS) and the Ministry of National Development (MND) in a joint press release issued slightly after 11.40pm on Thursday.

LOAN LIMITS

Minister for National Development Desmond Lee said on Friday that Singapore enjoyed "exceptionally low interest rates" from 2013 to 2021, especially from private financial institutions, with introductory rates for new housing loans hovering around 2 per cent.

However, he added that there has been an increase in market interest rates over the last year.

"This will increase borrowing costs for those who are buying a home, and for those who are servicing existing home loans that are pegged to floating rates," he said.

The mortgage interest rates are expected to rise further in future, along with US interest rates, Mr Lee added.

To ensure prudent borrowing and avoid future difficulties in servicing home loans, the Government will tighten the maximum loan quantum limits for housing loans, the authorities said on Thursday.

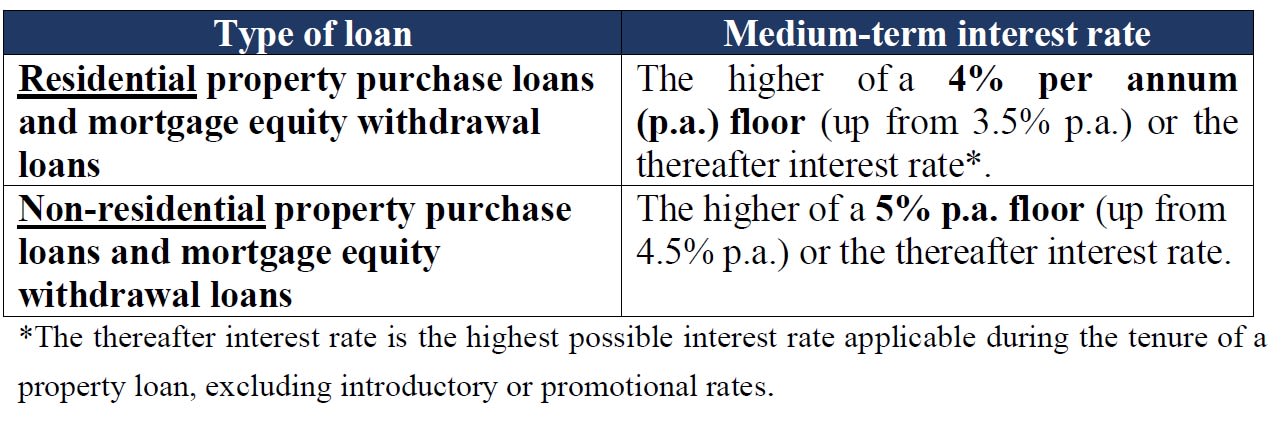

For property loans from private financial institutions, the medium-term interest rate floor - which is used to compute the total debt servicing ratio (TDSR) and the mortgage servicing ratio (MSR) - has been raised by 0.5 percentage point.

TDSR refers to the portion of a borrower’s gross monthly income that goes towards repaying the monthly debt obligations - including the loan being applied for - while MSR is applicable to loans for HDB flats.

By raising the medium-term interest rate floor, authorities are tightening the criteria to assess a borrower's ability to repay the loan.

This will apply to property loans where the option to purchase (OTP) is granted on or after Sep 30. If there is no option to purchase, it will apply when the date of sale and purchase agreement is on or after that date.

The actual interest rates charged for mortgages will continue to be determined by the private financial institutions.

For loans granted by HDB, the agency will introduce an interest rate floor of 3 per cent for computing the eligible loan amount.

This means the interest rate used to determine the eligible amount of HDB's concessionary housing loan will be 3 per cent per annum or 0.1 percentage point above the prevailing CPF Ordinary Account interest rate - whichever is higher.

The new interest rate floor will apply to fresh applications for an HDB loan eligibility letter received on or after midnight on Sep 30.

There will be no impact on existing applications received by HDB before this time. It will also not affect the actual HDB concessionary interest rate, which remains at 2.6 per cent per annum.

LOAN-TO-VALUE LIMIT FOR HDB LOANS

Meanwhile, the loan-to-value (LTV) limit for HDB loans will be lowered from 85 per cent to 80 per cent.

This reduces the maximum amount home buyers can borrow from HDB. But the revised limit will not apply to loans granted by financial institutions, which will remain at 75 per cent.

"The lower LTV limit will apply to new flat applications for sales exercises launched and complete resale applications which are received by HDB on or after Sep 30, 2022," authorities said.

They added that they do not expect this move to affect first-time and lower-income flat buyers significantly, as these potential home owners still receive housing grants of up to S$80,000 when buying a subsidised flat directly from HDB, or up to S$160,000 when buying a resale flat.

"They can also tap on their CPF savings to pay for the flat purchase, thereby reducing the loan amount they may need to take," authorities added.

NEW 15-MONTH WAIT-OUT PERIOD

The latest round of measures comes about nine months after the previous package of measures introduced in December last year.

Since then, the HDB Resale Price Index has increased by more than 5 per cent as at the end of the second quarter of 2022, authorities noted.

Given the "clear upward momentum in HDB resale prices" and to moderate demand, the Government has imposed a 15-month wait-out period for private home owners before they can purchase a non-subsidised HDB resale flat.

This will kick in after they have sold their property.

The new rule will also apply to those who sold their private property prior to submitting an application to buy a resale flat.

Previously, such property owners were allowed to buy an HDB resale flat on the open market if they sold their private properties within six months of purchasing the HDB unit.

The new 15-month wait-out period will not apply to seniors aged 55 and above who are moving from their private property to a four-room or smaller resale flat, the authorities said.

The wait-out period for private home owners who are first-timers and wish to apply for the CPF Housing Grant and Enhanced CPF Housing Grant for their resale flat purchase also remains unchanged at 30 months.

The new 15-month wait-out period is a temporary measure which will be reviewed.

Regarding the wait-out period, Mr Lee said on Friday that private residential property owners “generally have more means to buy resale flats”, compared to first-time home buyers or existing HDB flat owners.

“Some may not even need to take loans to complete their purchase,” he said.

“They therefore tend to pay higher amounts of cash-over-valuation when they buy resale flats.”

He also reiterated that this will moderate demand for HDB resale flats and keep them affordable, especially for first-time home buyers who “may have more pressing housing needs”.

"The Government remains committed to keep public housing inclusive, affordable and accessible to Singaporeans. We will continue to monitor the property market and adjust our policies to ensure that they remain relevant," the authorities assured on Thursday in their statement.

"We urge households to exercise prudence before taking up any new loans, and be sure of their debt-servicing ability before making long-term financial commitments."

In December, the Government announced a set of measures to cool the private residential and HDB resale markets.

This included raising Additional Buyer’s Stamp Duty (ABSD) rates, tightening the total debt servicing ratio threshold and lowering the LTV limit for loans.

ABSD rates for Singapore citizens and permanent residents purchasing their first residential property remained unchanged at 0 per cent and 5 per cent respectively. However, it was increased for those buying a second or a third and subsequent residential property.

The Government also tightened the total debt servicing ratio threshold from 60 per cent to 55 per cent, which means new mortgages cannot cause borrowers' total monthly loan repayments to exceed 55 per cent of their monthly income.

It had also earlier cut the LTV limit for HDB loans, from 90 per cent to 85 per cent.